Summary:

- Etsy’s Q1’24 earnings report disappointed due to a year-over-year drop in gross merchandise sales.

- Etsy, however, has a strong and profitable e-Commerce business with potential for a GMS recovery, especially in a lower-inflation world.

- Low earnings expectations and cheap valuation calculate to a favorable risk profile.

grinvalds

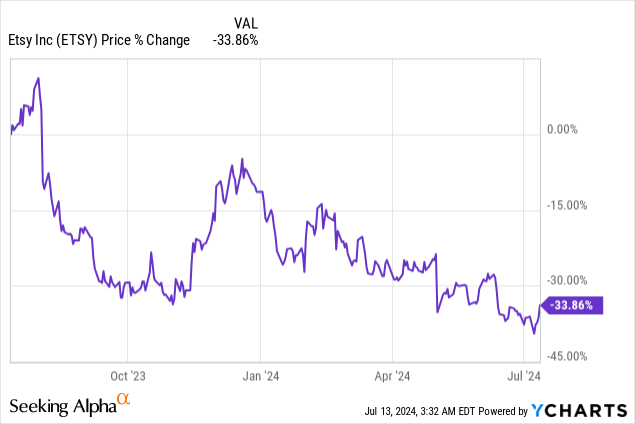

E-commerce platform Etsy (NASDAQ:ETSY) could be a potential out-performance candidate in an environment of easing inflation and a speculative buy before the company releases its second fiscal quarter earnings on July 24, 2024. Etsy disappointed in the first-quarter with a weak gross merchandise sales number — a key metric for e-Commerce companies that measures the amount of total revenues generated on an e-Commerce platform — causing shares to drop. This has created a situation in which investors have low expectations for the upcoming quarter. Since inflation also continued to ease throughout the second-quarter, I believe ETSY is potentially set for a strong earnings sheet which could act as a catalyst for an upside breakout!

Previous rating

I rated shares of Etsy a buy in July 2021 due to favorable marketplace economics and strong growth in its customer base. Another reason why I liked shares of Etsy was that gross merchandise sales (essentially platform revenues) soared during the pandemic. Etsy’s shares have declined approximately 70% since, however, in large part because the end of the COVID-19 pandemic also brought an end to the e-Commerce boom. However, Etsy is widely profitable, has a committed user base and sees growth in its average revenue per customer.

Solid e-Commerce business, GMS set to recover

Etsy is an artsy e-Commerce company that has specialized in the promotion and sales of hand-made and vintage products. The Etsy platform is essentially a social media company with an attached e-Commerce platform that has a very committed, female-dominated user base. Etsy had approximately 92M active buyers on its platform with about 60% of these buyers being located in the U.S. Since 2019, Etsy’s buyer count has approximately doubled and the average buyer on the platform has increased spending, on a TTM basis, by 22% to $126.

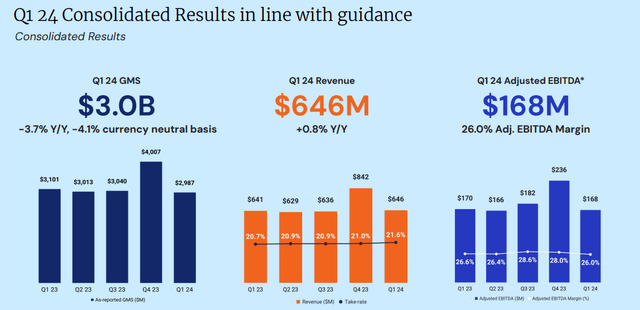

A key problem for Etsy has been its slowing top line growth which has weighed on the company’s valuation. In the first-quarter, Etsy saw a steep decline in its revenues on a quarter over quarter basis which is typical for e-Commerce companies: customers tend to ramp up their spending during the holiday season in Q4, leading then to a sequential drop-off in revenues and GMS in Q1’24. Etsy’s first-quarter GMS — the amount of revenue generated on an e-Commerce platform — totaled $3.0B, showing a drop of 25% Q/Q and a 4% decline year over year. Revenues totaled $646M, showing only 0.8% year over year growth.

While there is a seasonal factor explaining the decline of Etsy’s revenues and GMS in Q1, high inflation also weighed on the e-Commerce platforms growth lately. Since inflation now seems much of a threat now than at the beginning of the year, I believe Etsy has potential to surprise to the upside in Q2’24: as per the newest inflation update, June inflation eased to 3.0%, showing a 0.3 PP decline compared to May and inflation beat the estimate of 3.1%. With inflation moderating consistently throughout the second-quarter, I believe consumers are feeling at least some relief and a headwind for Etsy’s financial performance may be removed here.

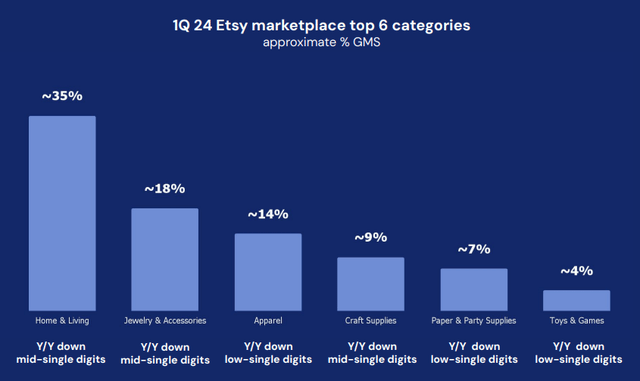

Etsy generates the majority of its revenue from just a small number of core categories such as Home & Living, Jewelry & Accessories and Apparel. The company has stated that its core business has been affected by a challenging macro environment (inflation) which “impacted consumer discretionary product spending.” With inflation easing, I believe Etsy could return to a stronger revenue profile and potentially also beat low earnings expectations for Q2’24.

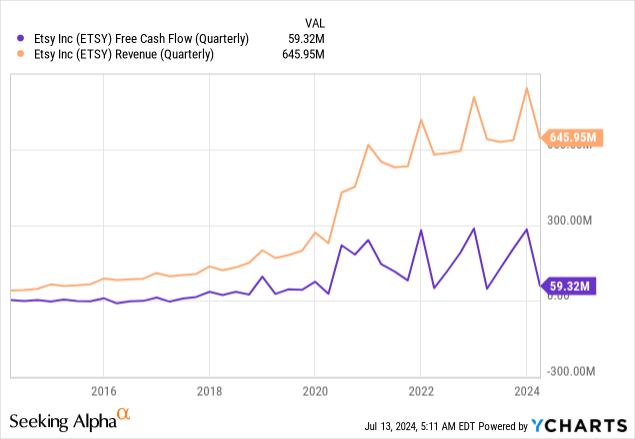

Strong free cash flows

Etsy, while struggling a bit on the top line, is already widely profitable on both an EBITDA and free cash flow basis. In the first-quarter, Etsy generated free cash flow of $59.3M which calculates to a free cash flow margin of 9.2%. This free cash flow growth is mainly driven by an engaged and growing user base as well as higher average transaction values over time.

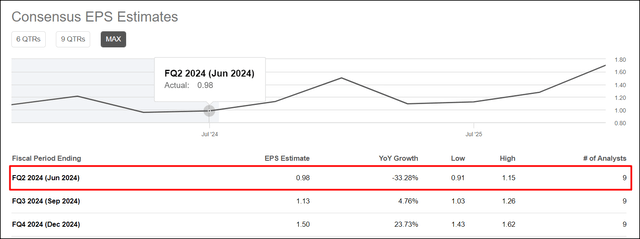

Earnings expectations are very low

Etsy’s earnings expectations heading into the second-quarter are very low which creates out-performance potential. Analysts currently expect the e-Commerce platform to generate only $0.98 per-share in earnings in Q2 which implies a year over year decline of 33%. In the last 90 days, analysts submitted 16 EPS downward revisions compared to just 2 upside revisions. With inflation becoming less of an issue for Etsy, I believe the odds of an earnings beat in Q2 as well as for accelerating top line growth in the remainder of FY 2024 are favorable.

Etsy’s valuation

Etsy’s shares are very cheap and with the second-quarter earnings report potentially supplying a catalyst for a share price revaluation to the upside, I believe the risk profile here is favorable as well.

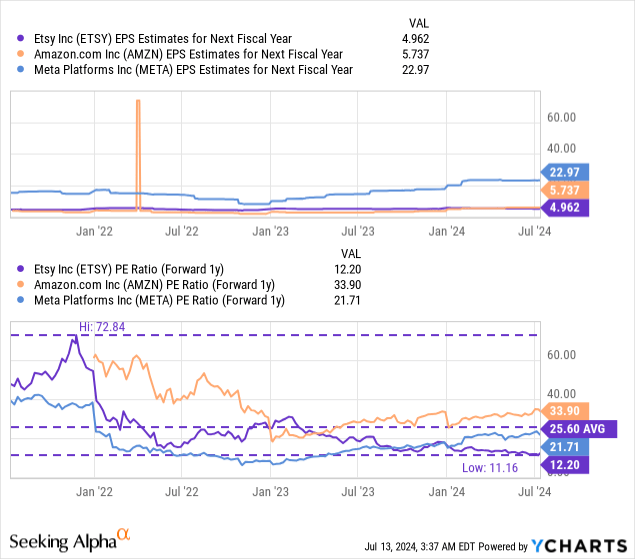

Etsy is currently valued at a price-to-revenue ratio of 12.2X which reflects a massive 52% discount to Etsy’s 3-year average P/E ratio. Etsy can be compared to other large e-Commerce platforms like Amazon (AMZN) and Meta Platforms (META) which obviously are also super profitable, but are seeing stronger top line growth as they appeal to a broader audience.

Amazon is trading at a P/E ratio of 33.9X which makes it the most expensive e-Commerce platform investors can buy into right now. Amazon has also seen a major rebound in e-Commerce volumes on its platform which I called a major narrative shift earlier this year. Meta Platforms, whose shares had a massive run in the last year, trades at 21.7X and I continue to recommend the social media platform for growth investors: I Am Aggressively Buying The Drop.

In my opinion, Etsy, if it returns to positive top line and GMS growth in the coming quarters, could be fairly priced at 20.0X forward earnings. The industry group P/E ratio as of right now is about 22.6X, but the ratio is skewed upwards before of Amazon’s high P/E ratio which is at least in part driven by its fast-growing AWS business. A 20.0X P/E ratio is hardly a stretch for Etsy, considering that the platform is free cash flow profitable and has a very lucrative niche audience. A 20X earnings multiplier implies a fair value of $99 and upside revaluation potential of 64%.

Risks with Etsy

The biggest risk for Etsy, as I see it, relates to the platform’s GMS trajectory and consumer spending. If Etsy’s GMS does not rebound and grow in the coming quarters, the e-Commerce platform may fail to generate an important catalyst to initiate a share revaluation. What would change my mind about Etsy is if the company were to see negative top line growth or falling free cash flow (margins).

Final thoughts

Etsy’s first-quarter earnings report was not great, largely due to headwinds in the e-Commerce business that were tied to inflation and consumer spending. However, price pressures in the market are easing and the company could be set to see a growth rebound in its core product categories. Since earnings expectations seem to be quite low after the Q1 GMS and revenue disappointment, I believe the backdrop of lower inflation could result in a strong Q2 earnings report for Etsy later this month. With shares being priced at a very low 12.2X P/E ratio, the risk profile is quite favorable as well, in my opinion!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ETSY, AMZN, SHOP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.