Summary:

- Etsy is struggling with increased competition from platforms like Temu, resulting in potential brand dilution and alienation of core customers.

- Elliott Management has acquired a significant stake in ETSY, reflecting investor concerns and potential for increased pressure on management to improve efficiency.

- Etsy’s revenue growth has stalled, market share is declining, and recent acquisitions have not met expectations, casting doubt on the company’s strategy and long-term competitiveness.

Kenneth Cheung

Last year we downgraded our rating of Etsy (NASDAQ:ETSY) because it was clear that growth was stalling, and the company did not have a coherent strategy to reignite revenue expansion. In hindsight, we should have been even more aggressive. While directionally we were correct, we should have been more aggressive with a double downgrade to “Sell”. Not only was keeping the gains from the Covid period no longer enough, but the competitive landscape was already starting to shift in an unfavorable way for the company. Since then, it has become clear that competitive pressures from the likes of Temu (PDD) are making life much harder for Etsy, and the company has made some unforced errors as well. In our opinion, by trying to compete on all fronts for customers, it has diluted its brand and alienated some of its core buyers and sellers.

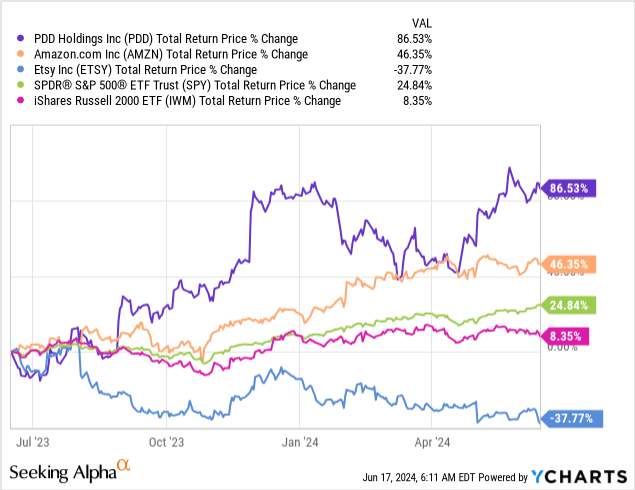

It is, therefore, not surprising that Etsy has underperformed both the S&P 500 index (SPY) and the broader iShares Russell 2000 ETF (IWM), while competitors like PDD and Amazon (AMZN) have actually outperformed these indices over the past year.

Activist Investor Involvement

We believe Etsy made several mistakes which led to an activist investor coming onto the scene. At the start of February, it was reported that Elliot Management had accumulated a roughly 13% stake in the company, making it the largest shareholder. When the news was reported, the share price received a significant boost, but now these gains have mostly reverted.

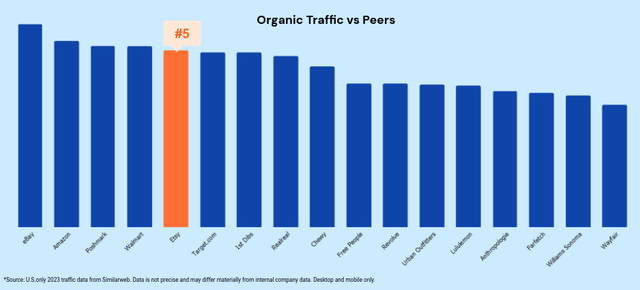

We can understand the attraction towards Etsy, as we were fans of the business model too. Its platform benefits from network effects, it can scale rapidly given its asset-light business model, and its strong brand meant that it received significant visits from organic search. In fact, the company boasted in a recent investor presentation that roughly 80% of its visits come either directly or through organic search. While this is impressive, it is down from ~85% in 2019, which means the company is increasingly reliant on digital ads. Another differentiator is the high percentage of items that can be customized, with the company sharing that approximately 30% of Etsy’s inventory is customizable. Still, we are no longer sure these positives are enough to make Etsy competitive in an increasingly ruthless e-commerce environment.

Competitive Landscape

To say that the competitive landscape has recently shifted is probably an understatement, as there has been a tectonic shift in the e-commerce sector with extremely aggressive behavior from some participants. Perhaps there is no better example than PDD’s Temu platform, which has been spending eye-watering sums of money. It has spent billions on advertising, and it is allegedly losing money, on average, on every order sent to the U.S. Temu is not the only Chinese platform using gamification, cheap prices, and aggressive marketing to take market share. Etsy is also facing threats from Shein, AliExpress (BABA), and also traditional retailers like Walmart (WMT) and Target (TGT) that are expanding their e-commerce offerings, while Amazon also remains an aggressive competitor.

During the most recent earnings call, CEO Josh Silverman was asked about the impact of Chinese competition, and while he acknowledged it is having some negative effect, he downplayed the threat too much in our opinion.

[…] I think what we’ve been saying all along is that we think that the Chinese competitors are more symptoms than a root cause. I think what we’re observing again and again, both at Etsy and what we read in the commentary from so many others in our space, is that consumers feel really pressured in spite of what we’re seeing about a generally healthy economy, consumers feel really pressured and so they are seeking value in deep discounts and deep promotions.

And so yes, the Chinese competitors are offering that, but Amazon and Walmart are, too. And it looks like the people that are driving most of the growth in e-commerce are people that are able to offer everyday essentials at very low prices. And there’s probably some trip consolidation that’s happening there, too. While you go into Walmart to buy your groceries at a cheaper price, you may pick up some other items as well while you’re there.

So I think that the Chinese competitors are a competitive headwind, no doubt. They’ve been a headwind to us and to everyone else in e-commerce. It would be great to see them not investing so aggressively in marketing. But I think the root cause of consumers feeling a ton of pressure and, therefore, seeking deep discounts will remain regardless of what the Chinese players do.

Our focus in that is not to chase them to the bottom, is not to try to be the very cheapest place to buy things. It’s to make Etsy more Etsy. It’s to lean into what makes Etsy different and special. And we talked a lot about that on the call. I’m incredibly excited about the — all the initiatives we have going to really elevate the very best of Etsy, suppress the things that are not the best of Etsy and make the aisles easier to shop so people can see the wonderful products that we have on offer and the more that they find really, really cheap and really disposable things. I think the more they will crave an alternative to that and we’re bound and determined to use this moment to get even stronger as that alternative.

Brand Deterioration

While management is saying that they will not “chase them to the bottom”, when talking about the Chinese competition, there appear to be several complaints that the quality of the products on Etsy’s platform have deteriorated. It has even been reported that AI-generated items and other low-quality products have made their way to the platform. While Etsy’s management tried to reassure investors during the earnings call that they are stepping up their “take-downs”, with CFO Rachel Glaser even saying they have “gotten successively better at it”, we believe this remains a big issue.

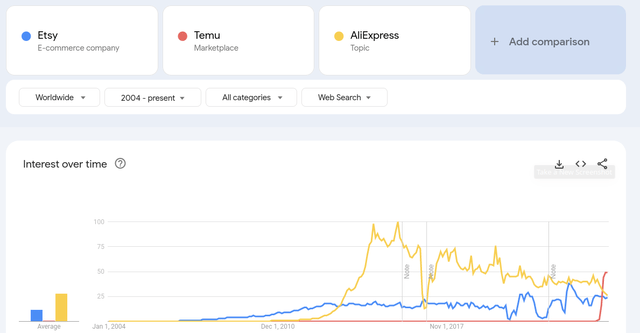

In any case, it is clear that consumer interest in Etsy is stalling at a time when rivals like Temu are seeing interest in their marketplaces skyrocket. It is incredible that in a matter of months, Temu has surpassed Etsy and AliExpress in worldwide search interest.

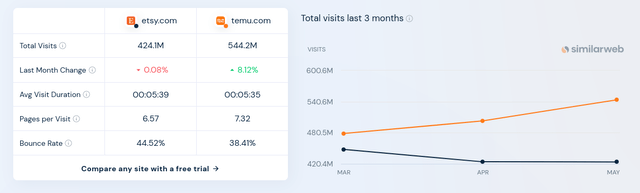

This is also reflected when we look at website visits, which according to SimilarWeb have decreased for Etsy, while they have grown for Temu. A few months ago they had similar visitor levels, but the gap is quickly widening.

Financial Results

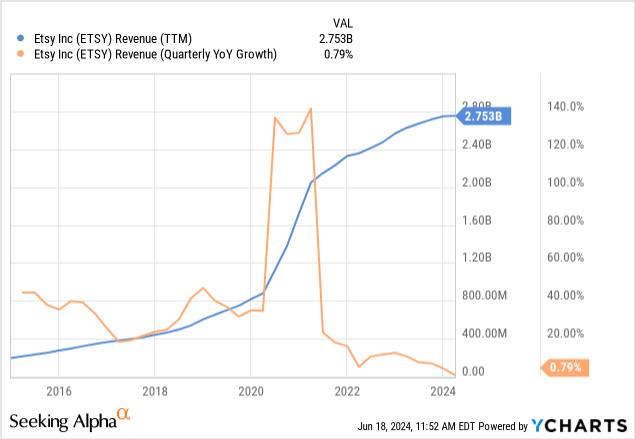

While revenue growth was impressive in the pandemic years, it has since clearly stalled, with recent quarterly revenue growth numbers below the inflation rate. This is despite the company increasing its take rate from sellers, through direct commission increases, and from increasing use of advertising on its platform. In other words, gross merchandise volume (GMV), which is a critical figure to determine the health of the platform, is at this point decreasing, and there is a limit as to how high the company can push the take-rate.

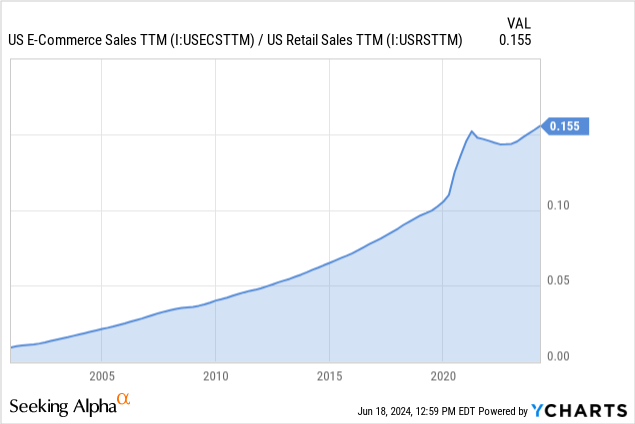

Since e-commerce is once again growing as a percentage of retail sales, this clearly means that Etsy is losing market share. While there was a “normalization” period for e-commerce, it appears to be over and it is now close to its previous growth trend.

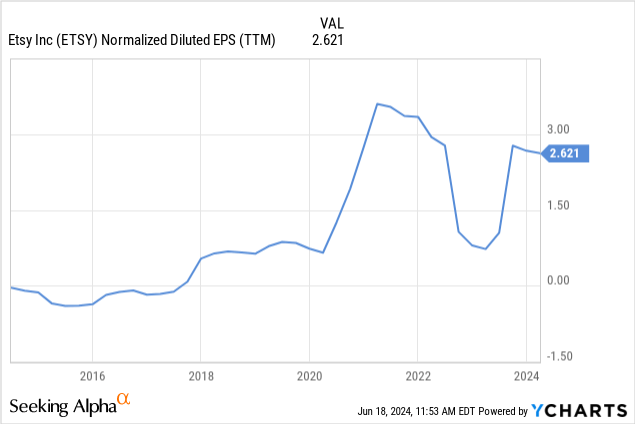

As the company has made investments trying to reignite growth, this has affected profitability. While revenue growth has been stagnant in recent quarters, it is not in decline. The same cannot be said about earnings per share, since efforts to reignite growth have reduced margins, resulting in earnings per share considerably below their historical peak.

M&A

It is not only the main Etsy marketplace that is experiencing growth challenges. According to a recent company presentation, Reverb’s gross merchandise sales were $942 million in 2023, basically flat year-over-year. Reverb is an online marketplace dedicated to buying and selling musical instruments, which was growing rapidly when the company acquired it in 2019.

Depop’s gross merchandise sales were $600 million in 2023, 9% up year-over-year. However, this is down from the $650 million the company generated in 2020, before Etsy acquired it for $1.6 billion in 2021. Depop is a popular marketplace to resell clothes, which was growing quickly and was particularly popular with younger users. However, it does seem the company overpaid significantly, considering it was making only about $70 million at the time of acquisition, meaning Etsy paid an over 20x sales multiple.

Another acquisition failure in our view was Elo7, which some consider the “Brazilian Etsy”, and which the company purchased and then sold only two years later, with CEO Josh Silverman explaining that Etsy, “has not seen the performance it anticipated when it made the acquisition decision two years ago”.

In our opinion, the company’s “house of brands” strategy has been rather disappointing, and shows that a “roll-up” strategy will probably not be the answer to Etsy’s issues.

Future Outlook

In our opinion, management did not sound very confident when giving guidance during the most recent earnings call, with CFO Rachel Glaser saying during her prepared remarks that, “… our current view suggests a modest acceleration in year-over-year consolidated GMS in the second half. You know, we’d like to call it like we see it, and it’s just really tough for us to call it right now.” This seems to have left some analysts confused, and they tried during the Q&A session to get a clearer picture. We share her response to an analyst that asked for clarification regarding the guidance that was provided:

So the guide we gave said that we the range of the guide was that we could be slightly positive, slightly better than Q2, not positive, slightly better than Q2 or slightly worse than Q2, which I know is not very helpful. Our current forecast sees that our current view is that we see some acceleration as we go through the year. But the cushion, the margin of error has gotten a lot narrower, which is why we very cautiously giving you some giving you some perspective on what we are seeing.

In any case, beyond what happens in the next couple of quarters, our belief is that Etsy will experience increased competitive pressures and will probably continue to lose market share to rivals. Our best guess is that Elliot Management will push the company to become more efficient, probably resulting in even more layoffs, and to automate or move jobs to lower-cost countries. This might boost earnings in the short term, but we do not think this will prove a long-term solution to the issues it is facing. As such, we see Etsy as a much more speculative investment.

Valuation

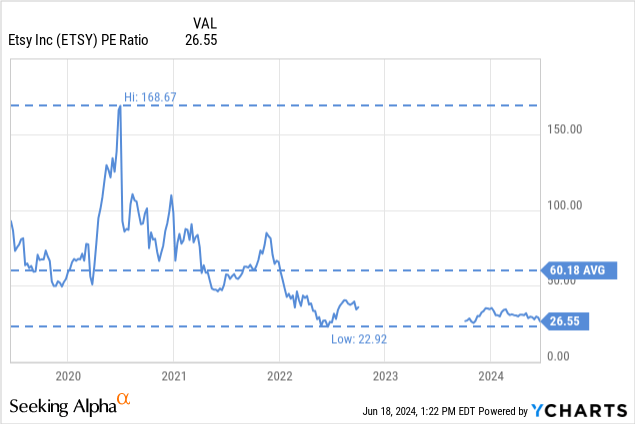

It can be argued that the valuation is close to the lowest it has ever been when measured by its Price/Earnings ratio. While it is currently at less than half its ten-year average, we think a 26x multiple is not cheap for a company that is no longer delivering revenue and profit growth.

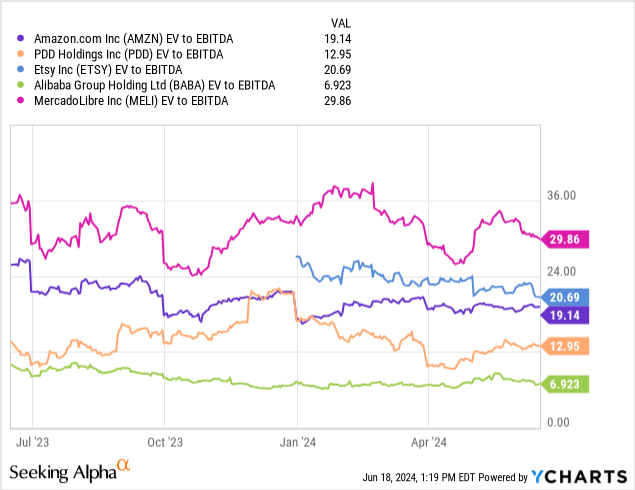

It also looks expensive compared to many of its rivals, including PDD, Amazon, Alibaba, and MercadoLibre (MELI). From this group, the only one currently having a higher EV/EBITDA multiple is MercadoLibre, and the company has much better growth prospects.

Risks

We see several important risks to Etsy shares, including extremely aggressive competition, inflation eroding consumer discretionary spending, and retail spending trending down. In addition, we see fee hikes and other issues in relation to sellers, eroding their goodwill towards the platform. Finally, we see a big risk in the brand losing value if the company deviates from its original focus on hand-made quality products.

To be clear, we do not think Etsy is a particularly attractive short idea, and there is some turnaround potential. What we are trying to say is that we see the competitive landscape getting significantly more complicated for the company, with rivals employing aggressive tactics and showing a willingness to lose money in order to gain market share.

The company appears to be losing market share, as e-commerce has resumed its upward trajectory, but Etsy is seeing its marketplace stagnate. Put together, we believe Etsy has become a significantly more speculative investment. While we still like its asset-light marketplace business model, we do not see a clear strategy from the company on how to overcome the multiple challenges it is facing.

What would make us reevaluate our thesis is if management comes with a credible plan to refocus on hand-made quality products, establishes a strategy to really differentiate the platform and the brand, improves relations with sellers, and makes it clear that they are not going to just be a slightly more expensive version of Amazon, or some of the other e-commerce platforms. We think this is possible, as Howard Shultz demonstrated a few years ago when he managed to turn around Starbucks (SBUX) after it had lost its focus by growing at all costs. Shultz worked on significantly improving the customer experience and addressing the issues he described as, “watering down of the Starbucks experience” and a “commoditization of our brand.”

Conclusion

The competitive landscape has become significantly more complicated for Etsy, and the company does not appear to have a good strategy to overcome these challenges, in our view. As such, it is losing market share to aggressive rivals like Temu that are gamifying the shopping experience and seemingly willing to lose money in order to gain market share. We believe a turnaround is possible, as the company still has a respected brand and significant organic search visits, but it will become more difficult if the company does not adapt quickly to the changed environment. Etsy clearly needs a bold new strategy, and so far, we are not seeing anything convincing from management.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling shares, you should do your own research and reach your own conclusion, or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.