Summary:

- Etsy has fallen sharply after posting weak Q2 results, primarily owing to declining gross merchandise sales (GMS).

- The company has also shifted its FY24 outlook language again, no longer citing confidence in the ability to accelerate GMS in the second half of FY24.

- The company’s weak growth is also coinciding with higher marketing spend, indicating ineffective advertising plays.

- Though cheap at <10x adjusted EBITDA, Etsy remains a value trap to be avoided.

vgajic/E+ via Getty Images

Across industries, one of the broad themes that dominated the Q2 earnings season was the likelihood of a pending U.S. recession. And unfortunately for companies that were already struggling with maintaining growth heading into potential macro turbulence, the path might get even rougher.

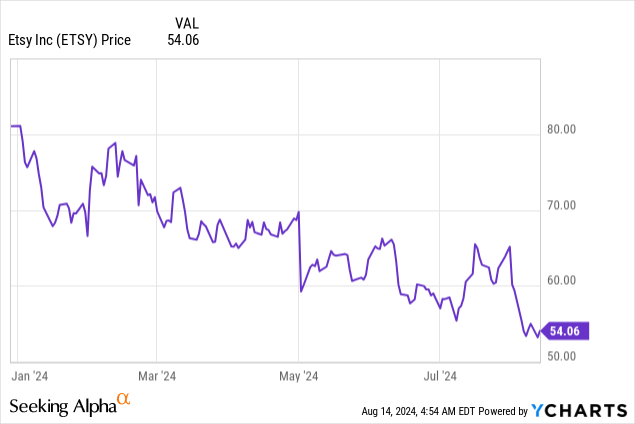

Such is the case for Etsy (NASDAQ:ETSY), the crafts and collectibles marketplace that experienced a brief resurgence in demand during the pandemic. Since then, however, gross merchandise sales have dropped off and growth has been tepid, despite numerous initiatives by the company to revive it. After posting weak results in Q2, shares of Etsy collapsed further, bringing year-to-date losses to over 30%. My take: don’t expect Etsy to recover anytime soon, if even at all.

Amid lackluster growth initiatives, Etsy is still a sell

I last wrote a bearish opinion on Etsy in May, when the stock was still trading in the mid-$60s. After digesting the company’s Q2 results, however, I’ve turned incrementally more bearish on the company, and I am reiterating my sell rating on the stock.

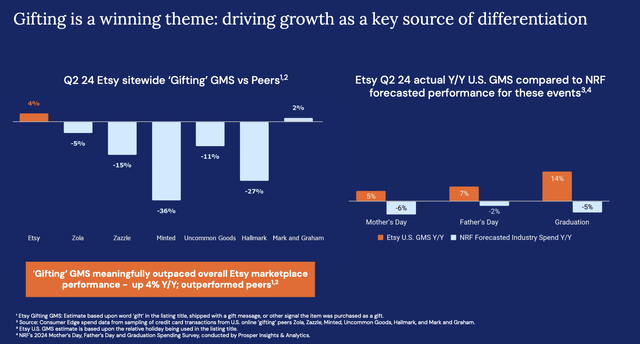

Amid weaker growth, the company has only a handful of growth initiatives up its sleeve. The first of these is improvements to the Gifting experience on Etsy, which the company noted was a major driver of Q2 purchases, which is chock-full of gifting occasions (Mother’s and Father’s Day, graduations). The company notes that gifting-related purchases saw 4% GMS growth, versus a -2% decline for the overall company.

Etsy gifting (Etsy Q2 shareholder deck)

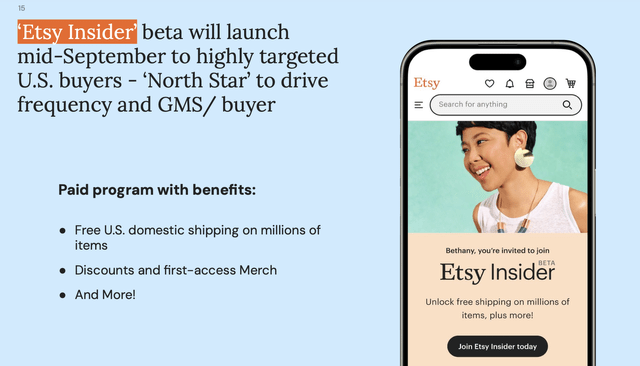

The second is not yet in market, and will launch in September at the tail end of Q3. “Etsy Insider” is meant to be a targeted program that is aimed at Etsy’s habitual drivers, as both a subscription offering and an additional advertising plug that is hoping to drive greater buyer frequency:

Etsy Insider (Etsy Q2 shareholder deck)

But in my view, these are weaker growth stunts that aren’t capable of reversing multiple quarters of GMS decline (and arguably, if we’re heading into a recession, the second half will be worse than the first). 4% growth in Gifting for a small portion of the company’s GMS base isn’t quite enough to turn the ship around. And though we haven’t seen the impact of Etsy Insider yet, this is essentially another marketing push that aims to open a subscription base from Etsy’s most loyal customer base. Subscription revenue is most likely to be a de minimis contribution to overall revenue; and unfortunately, even though Etsy is spending more dollars on advertising, it’s still suffering through GMS declines (more on this in the next section).

All in all, I continue to see Etsy as a company that is struggling to maintain its relevance, and amid darkening macro clouds in the U.S., Etsy’s prospects are likely to get even tougher. Continue to steer clear here and invest elsewhere.

Q2 highlights

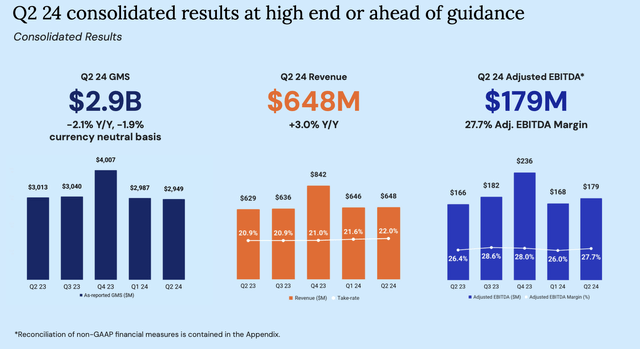

Etsy’s Q2 results, which have sparked a ~15% selloff since the earnings release, did little to assuage investors that a near-term rebound was incoming. Take a look at the highlights below:

Etsy Q2 highlights (Etsy Q2 shareholder deck)

Etsy’s GMS, its most-watched metric, declined -1.9% y/y (on a constant currency basis) to $2.9 billion. The company did tout its acceleration in GMS on a constant-currency basis versus a -4.1% decline in Q1, but all in all, the business is still shrinking.

Two factors make this worse. First is the fact that Etsy has gradually and subtly shifted its full-year GMS outlook language as the year goes on.

- In Q4, before the year started, the company said: “We currently expect the first quarter to be our low point in year-over-year growth in GMS and revenue, as we begin to see the expected benefits of our Etsy marketplace product and marketing investments kicking in starting in the second quarter.”

- In Q1, after noting that Q2 should accelerate, it also said about the rest of the year: “With a range of potential outcomes for the full year, our current view suggests a modest acceleration in year-over-year GMS in the second half.”

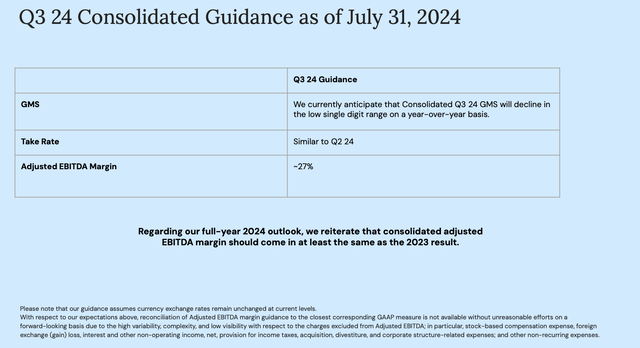

What you can see in the Q2 guidance statement below, meanwhile, is that the company has actually withdrawn all commentary on GMS improving for the second half of FY24, only stating that Q3 will decline in the low single digits while holding on to its full-year adjusted EBITDA margin target of at least flat to FY23, or 27%.

Etsy outlook (Etsy Q2 highlights)

A “low single digit decline” could be interpreted as anywhere between a -1% to -4% decline, which effectively means Q3 performance will be similar to Q2: and not an acceleration. And given potential macro concerns, there’s definitely a possibility that the second half (and/or FY25) could come in even weaker than current results.

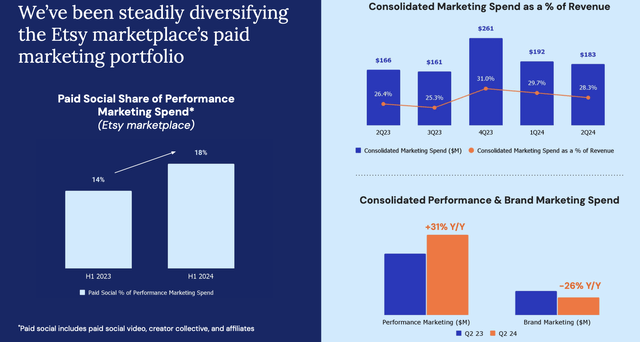

What makes this even more disappointing is the fact that Etsy has been spending more of its revenue on advertising and marketing. In Q2, marketing spend in nominal terms increased 10% y/y to $183 million, or 28.3% of revenue: 190bps more than the prior-year quarter.

Etsy marketing spend (Etsy Q2 highlights)

The good news in the quarter: revenue growth outpaced GMS declines (as the company promised), up 3% y/y with the spread primarily being driven by ad revenue strength. And despite the increased spend on marketing, adjusted EBITDA margins still expanded 130bps y/y to 27.7% in Q2, helped by a slightly stronger gross margin (also driven by ad success) and reductions in product development spend.

Still, in the long run, Etsy’s ability to increase its take rates from fees and ads will be more limited, and its growth will ultimately depend on its GMS: which has been declining relentlessly.

Valuation and key takeaways

As a stock, Etsy’s chief merit is that its declines have rendered it cheap. At current share prices near $54, Etsy trades at a $6.20 billion market cap; and after netting off the $1.14 billion of cash and investments against $2.29 billion of debt on its latest balance sheet, Etsy’s resulting enterprise value is $7.35 billion.

Meanwhile, for the current fiscal year FY24, Wall Street analysts are expecting Etsy to generate $2.81 billion in revenue, or 2.4% y/y top-line growth (roughly in line with first-half actual growth of 1.9% y/y, which could spell risk for the remainder of the year if GMS results do weaken). Applying a 27.4% margin (flat to FY23, in keeping with the company’s outlook statement) against this revenue yields adjusted EBITDA of $770 million, putting Etsy’s valuation multiple at 9.5x EV/FY24 adjusted EBITDA.

When the S&P 500 is still trading at a high-teens forward P/E multiple, Etsy’s sub-10x adjusted EBITDA multiple looks enticing. But we do have to recognize that this company is no longer growing, despite a number of growth initiatives and more generous marketing spend. As such, it’s a value trap to be avoided.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.