Summary:

- Acadia’s new drug, Daybue, shows promising initial sales, but pimavanserin failed in schizophrenia trials, impacting stock value.

- Nuplazid’s patent protection may shield it from generic competition until at least 2030, with steady sales growth reported.

- Daybue faces challenges with patient retention due to side effects, yet remains the only FDA-approved treatment for Rett syndrome.

- I am maintaining my Buy rating on Acadia stock due to Daybue’s potential, despite risks from generic competition and macroeconomic factors.

GeorgePeters

Acadia Pharmaceuticals: From Sky-High to Grounded Realities

My last look at Acadia Pharmaceuticals (NASDAQ:ACAD) followed the development of their new drug, Daybue, for the treatment of Rett syndrome. Daybue posted a strong entry with $90 million of revenue in its first six months on the market. Back then, retention was 81% four months after drug initiation. I noted that Daybue was forecast by some analysts to do as much as $1 billion in peak annual revenue. The stock shot up nearly 50% immediately following my Buy recommendation in December, but has since dropped back to earth following another quarterly earnings report and schizophrenia data for pimavanserin, which is FDA-approved as Nuplazid for the treatment of Alzheimer’s disease psychosis. At the time of writing, Acadia’s stock is down 20% due to the clinical trial failure, and the following article reassesses Acadia in light of these developments.

Treating the negative symptoms (e.g., social withdrawal and apathy) of schizophrenia is a formidable task, so it’s no real surprise that pimavanserin didn’t succeed. The market for schizophrenia, already a multibillion dollar market, is expected to reach $10 billion in the coming years. The company’s lead revenue generator, Nuplazid, is already facing the threat of generic competition in psychosis. Management shed some light on this issue on the last earnings call.

As you recall, we have two patents, two families of patents that protect pimavanserin. One is our composition of matter patent. We won at the Toronto Court Level on that in the fall. We submitted two arguments. We only needed to win on one. We won on both arguments. That is being appealed as we fully expected it would be. The schedule I anticipate there is we’ll probably go through a series of briefings in the second quarter of this year, and then we expect oral arguments to be probably in the third quarter of this year, and the decision would likely come probably in the first half of next year.

Judging from the transcript, the company anticipates Nuplazid’s “composition of matter” patents shielding the drug from generic entrants until at least 2030. These will be important developments moving forward, as Nuplazid generated $549 million in sales in 2023 (up 6% year over year) and is guided to achieve between $560 million and $590 million this year.

Success in schizophrenia would have provided a solid boost for Nuplazid’s prospects, so a 20% drop in valuation doesn’t scream inefficient to me.

Moving onto Daybue, the drug showed some weakness in patient numbers, which the company attributed to “seasonal.”

(…) we had just over 800 patients at the end of the third quarter. When we closed 2023, we had close to 900 patients on therapy. And just to give a little further context, as we described, we had a seasonal decline in January, and as a consequence fewer patients initiated therapy. And then in February, we saw a significant rebound in new patient starts and together with improvements in conversion and refill rates. And today we have — taking that all together, we have approximately 860 patients on therapy.

Recall that Daybue is the only treatment FDA-approved for Rett syndrome. However, in clinical trials, over 80% of patients experienced diarrhea (mostly mild-to-moderate cases). This contributed to a discontinuation rate of 18%. For the quarter, sales for Daybue totaled $87 million and the company projects between $370 million and $420 million in 2024. This is, in my experience, a wider projected variance than usual, hinting at some uncertainty.

Looking at the income statement for the three months ended December 31, Acadia reported a net income of $45.797 million, a notable improvement compared to a net loss of $41.725 million the previous year. This was mainly attributed to total revenues blossoming from $136.490 million to $231.041 million. Meanwhile, SG&A costs only inched forward, from $104.402 million to $111.465 million. This suggests that marketing Daybue hasn’t been associated with a lot of costs. Also, I’m sure it helps that Acadia has an existing marketing team established with Nuplazid.

Overall, I like how the quarter looks. Investors were a bit spooked by the drop in Daybue patient numbers, but I don’t see any red flags here. Rett syndrome is a very serious disorder, and Daybue is the first and only disease-modifying drug available, so I don’t anticipate tolerability issues leading to an uncontrollable amount of discontinuations, especially as diarrhea can be, somewhat, mitigated via dose-titrations, diet, and anti-diarrheal agents.

Financial Health

According to Acadia’s balance sheet, as of December 31, the company had $188 million in cash and cash equivalents and $250 million in investment securities. Current assets totaled $616 million, while total liabilities equaled $317 million. Their current ratio, therefore, is over 2.0. This indicates Acadia is in a good position to cover its short-term liabilities.

Net cash provided by operating activities was $16 million for 2023. This points to profitability. Assuming no changes, I cannot calculate a cash runway as Acadia is not burning cash anymore due to robust revenue growth.

Market Sentiment

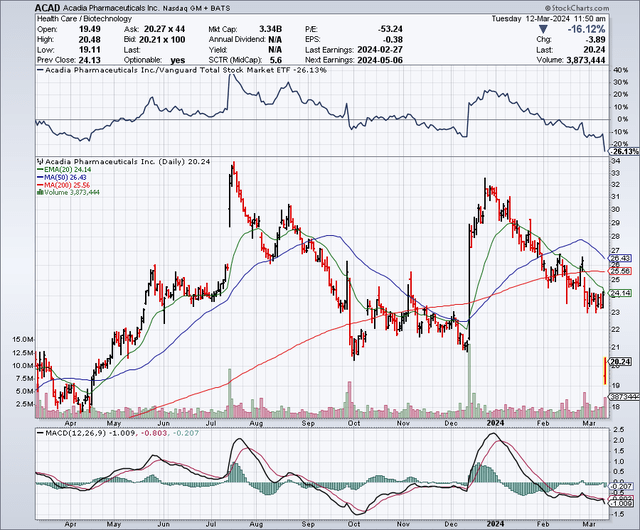

According to Seeking Alpha, Acadia sports a market capitalization of $3.98 billion and analysts are projecting $967 million in sales this year. This figure is expected to reach $1.28 billion in 2026. Acadia’s stock has underperformed the broader market (SP500) over the past six and twelve months.

StockCharts.com

Per Fintel, short interest makes up 9% of Acadia’s float, signaling some doubt among market participants. Over the past year, insider trading has seen a net addition of 574,325 shares. Per Nasdaq, institutional ownership is high at 97%, with 162 holders increasing their position versus 104 decreasing. Key holders include Baker Bros., State Street, Ecor1 Capital, and Vanguard.

Given the above information, I’d classify Acadia’s market sentiment as “mixed.” It seems like individual investors are weary, but insiders and institutional investors remain confident.

My Analysis and Recommendation

In conclusion, from my porch, not much has changed in Acadia’s prospects since my last look. I personally didn’t anticipate high odds of success in schizophrenia, so Tuesday’s news comes as no surprise. The company is doing a fine job protecting Nuplazid from generic entry, but legal outcomes are difficult to predict. The main story here, in my view, remains Daybue, and judging by its past performance and future projections, things look bright. Acadia seems reasonably valued, near a $4 billion market capitalization, with some upside depending on how Daybue trends on the Rett market. For now, I remain confident in its prospects and support maintaining a Buy in Acadia stock. Risks include underwhelming revenue for either Daybue or Nuplazid, generic entry greatly diminishing Nuplazid revenue in the short term, and macroeconomic headwinds that impact the biotechnology sector. Investors should watch closely for continued updates regarding both Nuplazid and Daybue.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article aims to offer informational content and is not meant to be a comprehensive analysis of the company. It should not be interpreted as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. The predictions and opinions expressed herein about clinical, regulatory, and market outcomes are those of the author and are rooted in probabilities rather than certainties. While efforts are made to ensure the accuracy of the information, there might be inadvertent errors. Therefore, readers are encouraged to independently verify the information. Investing in biotech comes with inherent volatility, risk, and speculation. Before making any investment decisions, readers should undertake their own research and evaluate their financial position. The author disclaims any liability for financial losses stemming from the use or reliance on the content of this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.