Summary:

- The EV transition is not going as smoothly as expected, with challenges in expanding beyond early adopters.

- Ford’s focus on its legacy business and hybrids has positioned it for success as the EV trend loses momentum.

- Ford’s commitment to profitability, cash returns, and dividends makes it an attractive option for investors in the evolving automotive market.

Justin Sullivan/Getty Images News

Introduction

It’s time to talk about EVs!

The EV transition is not going nearly as smoothly as one might have expected when the Net-Zero transition went into overdrive after the pandemic.

For example, in November, The Verge focused on the weakening EV trend despite skyrocketing EV sales, a wider variety of EV models to pick from, and an improving infrastructure.

The Verge

The problem is moving beyond the early adopters stage.

We’re now at a stage where it is increasingly tough to expand in a market that desperately requires mass adoption to grow margins and justify investments.

I added emphasis to the quote below:

“EV adoption is looking to move into its next phase — requiring much more mass-market interest — and this larger cohort has to be sold on EVs since they aren’t as enthusiastic and willing as early adopters,” she said.

This will be much more challenging for dealers: converting a whole cohort of more trepidatious, price-sensitive shoppers to an entirely new technology. Buying an EV isn’t just about bigger screens, faux grilles, or light bars; it’s an entirely new lifestyle, full of range considerations and charging anxieties and home equipment installations. – The Verge

This was confirmed by a Twitter/X account named Car Dealership Guy, which is run by an expert industry insider who noted that EVs don’t even sell after a steep discount.

Electric vehicle prices are down, but they may not be down enough. With prices slashed as much as 50% in some cases, EVs are by far the best “deal” in the market. But inventory days’ supply is still high. If sales don’t rebound even after such steep discounts, most car manufacturers (and dealers) will deal with even bigger losses. Via Twitter/X

All of this is fantastic news for a car manufacturer I have covered a few times in the past. A car company that has bet on EVs without neglecting its legacy business.

That company is the Ford Motor Company (NYSE:F).

My most recent article on the company was written on April 3, 2023, when I went with the title “Don’t Buy Ford, Buy Lear Instead.“

Since then, Ford’s stock price has fallen 2%. Lear’s (LEA) stock price has risen by 4%.

Back then, I made the case that buying suppliers is (often) a better move than buying car manufacturers.

While I won’t change my mind on that, this article is dedicated to Ford, which made the right move by sticking to its legacy business.

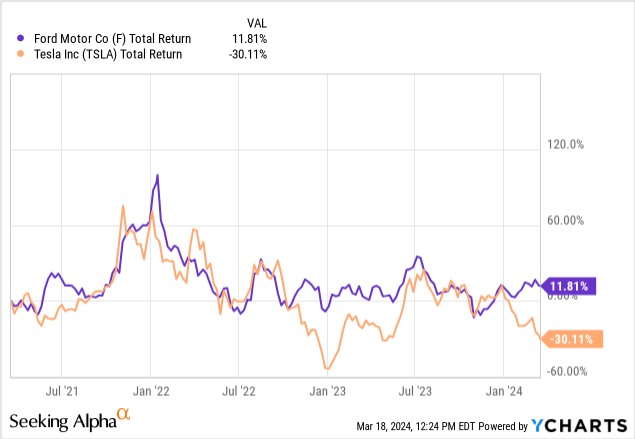

Now, it could reap the rewards, as the EV trend has derailed, which allowed Ford to outperform the North American EV giant Tesla (TSLA) by more than 40 points over the past three years.

With that said, let’s dive into the details!

Ford Made The Right Decisions

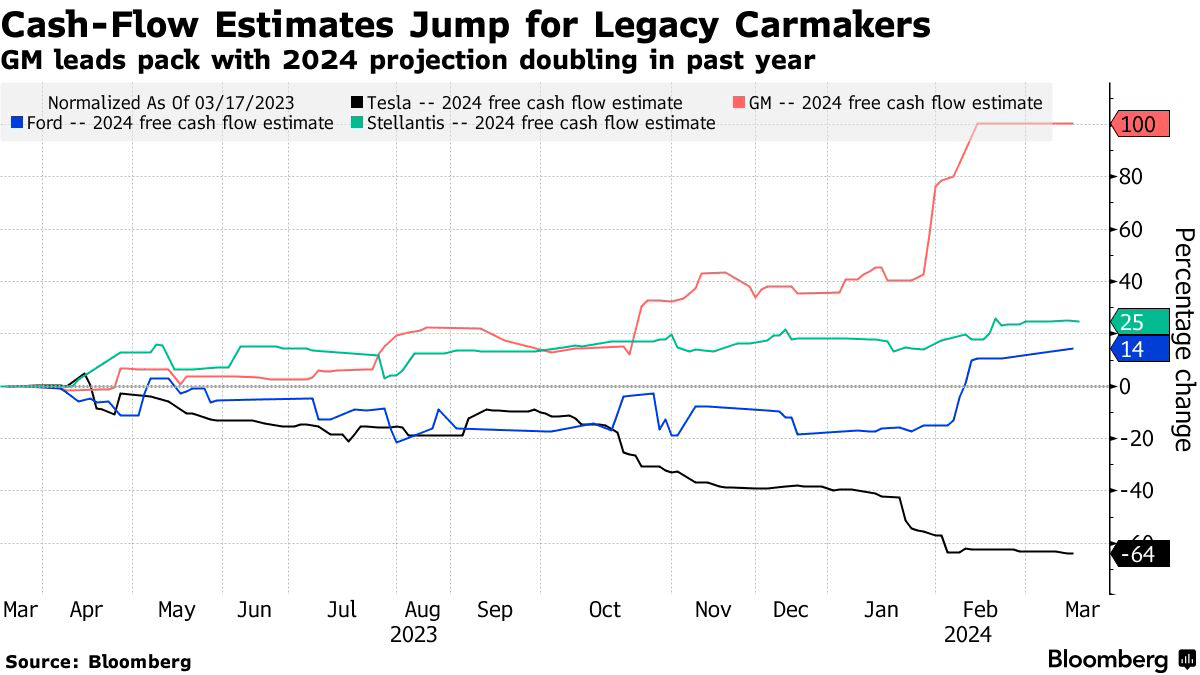

On March 18, Bloomberg reported something highly interesting in an article titled “Old-Guard Car Stocks Are Hot Again As EV Revolution Sputters.”

According to the article, traditional car manufacturers like General Motors (GM), Ford, and Stellantis (STLA) are gaining as the profitability of gasoline-powered cars and hybrids remains strong.

Essentially, investors like the steady profits of the internal combustion engine, which also has lower risks than EVs, as only incremental innovation is needed to improve these engines.

As we can see below, cash flow estimates have been hiked consistently over the past few months for these producers. The opposite has happened in the case of Tesla.

Bloomberg

In the traditional car segment, Ford stands out.

According to the same article:

Jonas picked Ford as his top choice among US auto stocks, saying that after years of spending heavily on EVs and self-driving cars, these companies are now focusing on giving cash back to shareholders.

“In a world of scarce capital and changing strategic priorities, we believe capital efficiency and cash return will be deterministic in driving share price performance for 2024,” he wrote.- Bloomberg

In other words, not only do Ford and its major peers have more consistent margins, but they also benefit from their ability to reward investors.

After all, while Ford invested in e-mobility through the F-150 Lightning and other models, it always stuck with Ford Blue, which is its legacy business. This business segment includes the mighty Mustang, which apparently can be boosted to more than 800 horsepower with a $10,000 upgrade.

Ford Motor Company

Furthermore, during the most recent Wolfe Research Global 2024 Auto and Auto Tech Conference, the company noted that it has a focus on hybrids and plug-in hybrids, allowing it to leverage existing strengths while preparing for an eventual transition.

This is what the Japanese producers have done for a long time. Companies like Toyota Motor (TM) mainly stuck with hybrids instead of pledging to go all-in on electric mobility.

U.S. sales of hybrids jumped 50% in the first two months of the year. That surge outpaced EV sales, which grew 13%, in both growth and volume. Hybrids flew off dealer lots in 25 days on average, nearly three times faster than EVs and twice as fast as gas-powered cars, according to research site Edmunds. – Wall Street Journal

Roughly a fifth of Ford’s flagship model, the F-150, are now hybrid models. Total F-150 hybrid sales are expected to double!

Moreover, roughly half of its Maverick models are sold with a hybrid system.

It now has the #1 and #2 bestselling trucks in the U.S.

Ford Motor Company

Last year, total hybrid sales were up 20%. This year, growth is expected to double to 40%.

Hence, it is no surprise that Ford makes the case that the market potential for hybrid vehicles remains robust, fueled by increasing environmental awareness, regulatory pressures, and advancements in hybrid technology.

It also sees cost advantages that customers understand.

[…] the mainstream customers can do the math on hybrid. We see that every day at Ford. We’re now number three and probably number two this year on hybrid in the U.S. And the customers don’t have to change their habit on hybrid and they can immediately do the math on the efficiency of the fuel economy.

[…] And as far as our future business plan, we have now, since the middle of last year have assumed that we have to basically sell a EV at a hybrid premium. There is no more money for customers than that. $3,000 to $5,000 that’s it and I think that is the right way to approach it.

[…] We got to think about this. I’m not going to launch any vehicle if I can’t make money on it. In the first 12 months, that required a lot of change. – Wolfe Conference

While Ford is still innovating in the EV space, it is a big player in the hybrid section, as it benefits from a large existing platform, a massive customer base, and pricing advantages over companies that did go into EVs more aggressively.

I like the company’s view on not selling any experimental vehicles but sticking to what works (making money).

During its 4Q23 earnings call, the company noted that its next Gen 2 products will be profitable within 12 months of their launch.

All of this is good news for shareholders.

Shareholders & Valuation

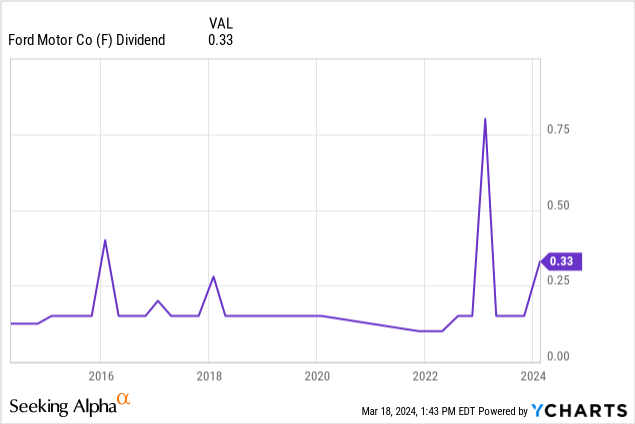

Last year, the company paid a quarterly dividend of $0.15 per share in addition to a special dividend of $0.18 per share.

It now has a regular dividend yield of 4.9%.

The dividend decision brought the payout ratio to roughly 50% in 2023. This aligns with the company’s target of consistently returning 40-50% of free cash flow to shareholders.

In the 2024-2026 period, the company is expected to generate roughly $6.1 billion in average free cash flow per year. That’s 12.7% of its current market cap.

Half of that is 6.4%.

This is great news for its dividend – excluding potential recessions or other headwinds.

It also bodes well that Ford isn’t going to experiment with EVs (anymore). The company is very clear about its plans and is in a fantastic spot to maintain elevated dividend payments.

The company, which has an investment-grade credit rating of BBB- also has a good valuation.

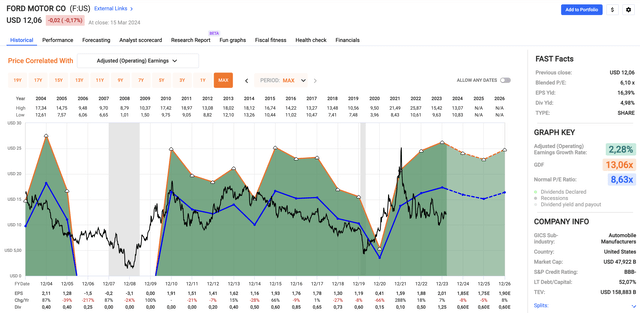

Although the company’s earnings per share are not expected to see meaningful growth, as analysts expect EPS to average $1.83 in the 2024-2026 period, the stock is trading at a blended P/E ratio of just 6.1x EPS. That’s way below its long-term normalized P/E ratio of 8.6x.

This implies a fair price target of $15.50, which is 28% above the current price.

Please note that these numbers are seen in the chart below.

FAST Graphs

While I agree with subdued EPS growth expectations, given that elevated rates and sticky inflation are a horrible combination for consumers, I do believe that Ford is trading below its fair price, especially if investors move more money from pure-play EV stocks to companies like Ford.

The current consensus price target is $13.50, which is below my fair price estimate of $15.50.

All things considered, while I cannot make the case that this is a great environment to buy car companies, I like the longer-term risk/reward for Ford, as it focuses on money-makers in the conventional and hybrid space.

It is also getting industry tailwinds as the EV trend is fading.

On top of that, management has decided to get serious about dividends, which should bode well for (special) dividends.

Takeaway

In an environment where the electric vehicle revolution faces tough headwinds, traditional car manufacturers like Ford are gaining ground.

By prioritizing their legacy business and investing in hybrids, Ford stands out as a smart choice for investors.

With a focus on profitability and returning cash to shareholders, Ford’s steady performance and commitment to dividends make it an attractive option in the evolving automotive market.

As the EV trend loses momentum, Ford’s strategic decisions position it for long-term success, offering investors a promising risk/reward proposition.

Pros & Cons

Pros:

- EV Uncertainty: Ford’s emphasis on its legacy business and hybrid models provides stability in a volatile market where the EV trend is facing challenges.

- Profitability and Cash Returns: Ford’s commitment to profitability and returning cash to shareholders through dividends shows a shareholder-friendly approach.

- Industry Tailwinds: With the EV trend fading, Ford benefits from industry tailwinds favoring traditional car manufacturers.

Cons:

- Limited Growth Potential: While Ford’s focus on hybrids and traditional models ensures stability, it won’t change the fact that the consumer is in a tough spot right now.

- Evolving Market Dynamics & Competition: Nobody knows what the auto industry will look like 10-15 years from now. Innovation will remain key, which comes with competition risks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.