Summary:

- Meta Platforms, Inc. has seen a significant shift in its business model, and we continue to question their allocation of capital.

- The company’s losses in its Reality Labs division continue to be a drag, despite some improvements in other areas of the business.

- But advertisers have returned to Meta’s core Facebook and Instagram platforms, and the tough comps are well behind them.

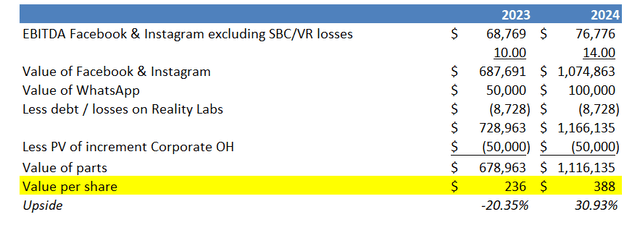

- Below we do a deep dive on the sum of the parts of the business. Our math suggests a range of $220-400, but likely to improve over time.

- We suggest a small 1% position and like the AI optionality. Meta Platforms trades at a~16x forward core earnings (ex-Reality Lab losses).

Kira-Yan

Background

We wrote up Facebook, now Meta Platforms, Inc. (NASDAQ:META), back in September 2019 here and recommended it as a solid Compounder and cash flow generator. When the business model had inflected dramatically (for the worse owing to iOS changes and capital allocation decisions), we sold our shares.

At the time, not only had CEO Mark Zuckerberg seemingly lost all sense with respect to the potential of the metaverse/virtual reality, but also Apple (AAPL) dealt a serious blow to the company’s ability to track user activity online. That pressured advertising, while at the same time Zuckerberg announced plans to spend some $10 billion a year on his pet project, Reality Labs (i.e., the metaverse). They even changed the name of the company to reflect his vision.

We got out and missed any material downside, but with 20/20 hindsight, clearly missed buying it back at the bottom in late 2022. META fell below $100 at one point in 2022 and has just in a few months ripped back to almost $300. The speed at which names in this market can change is incredible today.

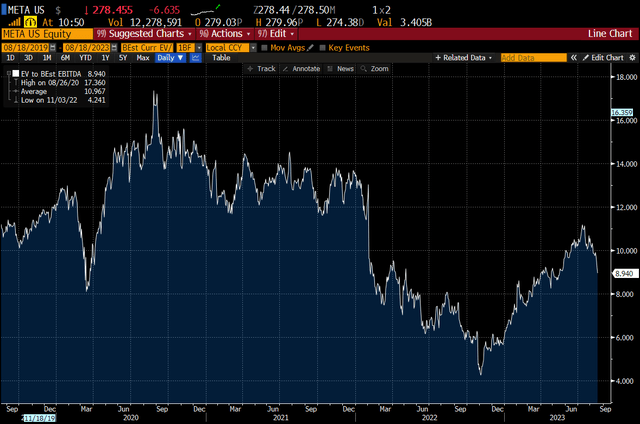

Below is META on a forward EV/EBITDA basis.

Bloomberg

The stock de-rated from 13x EBITDA to 6x in just a matter of 9 months. Then it bounced back to 11x before pulling back again to 9x today. (Note that Street EBITDA numbers above exclude stock-based comp (SBC), but Street analyst EPS estimates include SBC.)

2022 was Zuckerberg’s so-called Year of Efficiency (which began last summer actually). The company cut its employee base from a peak of 87,000 last September to 71,500 as of June 2023. Hiring will begin probably in 2024 per the company, but at a slow pace.

That has helped consolidated earnings by quite a bit.

Advertising Recovery

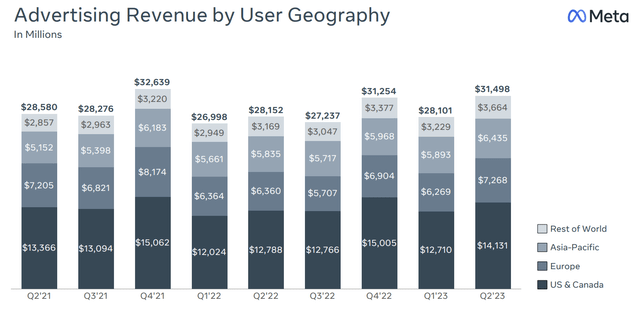

With comps now fully lapped for the new iOS changes in early 2022 (which hit advertising), growth has finally resumed in ad revenue on a year-over-year basis.

One contact with “millions” in his budget said that advertising budgets are coming back to Facebook and Instagram as Meta has spent “billions investing in their ad products.” Their machine learnings (which help advertisers target audiences) and upgrades have simplified the process for marketers. Interestingly too, while Meta click through rates are lower still, ad ROIs are still high. That means that some marketers are spending more money on the platform to get results that mirror the results of pre-iOS changes.

To summarize, we continue to think that Zuck is young, eager and as smart as they come. META’s track record has blemishes now, but the setup for 2024 could be a good one. Marketing budgets have returned to META after disruption last year. Plus, election years are good for advertising, and so far, the economy shows few signs of slowing.

On META stock, our sum of the parts math suggests a fair range of $230 to $400 give or take baring a macro hit to advertising budgets. Their core Family of Apps business will do almost $18 in EPS this year (offset by Reality Labs losses of course). But in a world where the average Nasdaq stock trades at ~30x forward, META looks like a high quality business at a bargain (16x 2023 Family of Apps earnings, excluding losses in Reality Labs).

With META working on their Llama AI product and the possibility that Llama Code could have large cost implications for the company (improving programmer efficiency), there is a good chance that Meta can continue to improve margins.

Given the large move this year to date, there is no “fat pitch” in buying META stock today. But the valuation is compelling. So, we recommend a starter 0.5%-1.0% position in the $290s, hoping to buy more a bit cheaper (our next add price of $270 give or take).

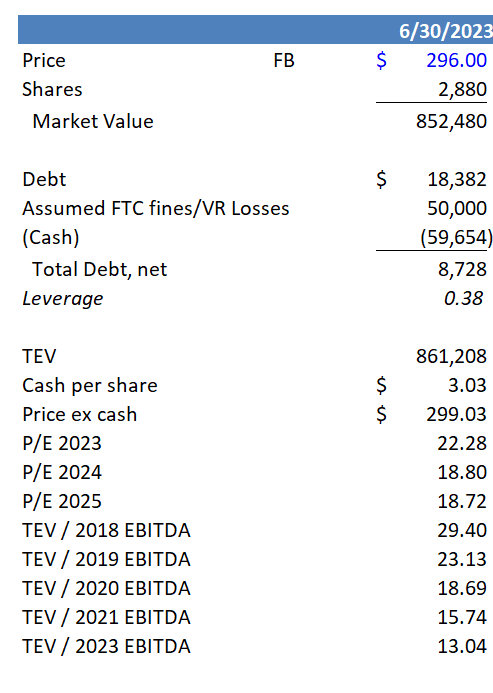

Updated Capitalization

Capitalization (Author Spreadsheet, company financials)

Note that above we assumed that the current run-rate of ~$13 billion in annual Reality Labs losses continue and so imply a $50 billion NPV net loss figure for shareholders. It could be worse, perhaps by another 5 years or $50 billion (or $17 per share) as the company shows no indication of slowing this spending.

June 2023 Quarter Review

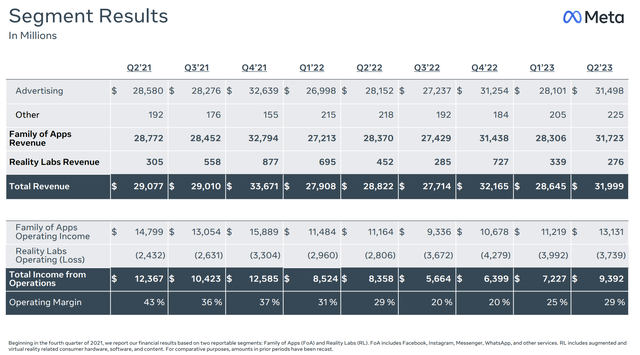

Meta’s revenue grew 12% ex-currency in the June quarter. EPS grew to $3.09 excluding a restructuring charge and using a more normalized 20% tax rate. That beat estimates of $2.92 and was 25% higher than the June 2022 quarter.

Cutting their employee count and monetizing Reels on Facebook and Instagram were key drivers to EPS growth. That said, comps were easy and so EPS grew off of a very low base. EPS excluding Reality Labs in the quarter was $4.23, down 15% from the June 2021 quarter (2 years ago).

The core Family of Apps business put up solid numbers, growing ad revenue 13% YoY on a constant currency basis in the quarter. There are legitimate concerns however that ad pricing has been falling rapidly as they fell 16% per ad YoY. Fortunately, ad volumes were up 34%.

One digital advertiser I spoke with said “There is no other game in town besides Google and Facebook still.”

Another from our expert network said:

“I have seen the advertising budgets coming back, even speaking anecdotally to other marketers and agencies and networking groups I’m in. People have started to spend a lot more on Facebook. I will say what they have done in terms of the limitations from the browser-based pixel, they have really encouraged marketers to set up the CAPI which is [Conversion API] tracker.”

This is a bit more advertiser-intensive to set up, but now lets Facebook basically helps track users off the platform (which is what impacted them last year as users opted out of being tracked in early 2022).

As for online comps, LinkedIn ads are the most expensive in terms of click rates; TikTok is not as easy but is growing; Snapchat is bringing up the rear (the latter two have the youngest audiences). Google appears strong still in digital advertising, of course.

Below, we can see revenue by geography and quarterly totals.

META IR

As for Reality Labs, we are less optimistic. Below are the segment results. Note how Reality Labs’ revenue is still not even a drop in the bucket at META.

META IR

The company launched Threads, a competitive product to X (the company fka Twitter) and downloads began impressively but have now tapered off. While Reels monetization is well underway, WhatsApp continues to have billions of users and has significant upside potential. Ad clicks on WhatsApp was up 80% YoY (and still off a low base, we guess).

On the negative side, Reality Labs’ losses appear to be getting worse. Revenue was down 39% YoY, to a minuscule figure of $276 million. With spending at $4 billion per quarter, this remains a disaster and warrants caution. All we can say on the positive side is that losses perhaps have peaked with a new Meta Quest 3 headset due to launch in the fall. Losses were as high as $4.3 billion in Q4 2022. Still, quarterly losses in June of $3.7 billion speak to strong odds of a large negative drag on capital. Perhaps for years to come. But I think we can measure this and bake future losses fairly easily into our model.

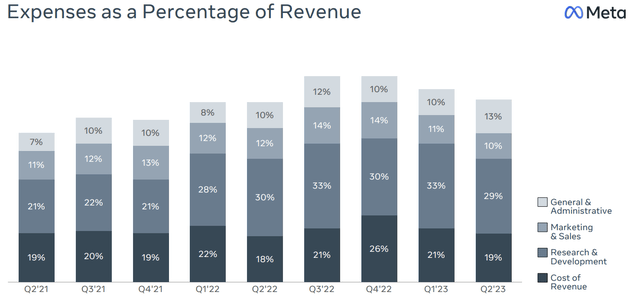

Below illustrates the improvement in costs at Meta as the employee count fell starting last Q3.

Expense chart (META IR)

There still seems some work to do here, but on the quarterly call, Meta made it clear that some hiring will resume in 2024, albeit at a slow pace.

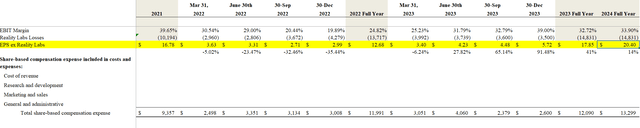

Given the losses in Reality Labs, we backed out of what EPS looks like for the core businesses (Family of Apps).

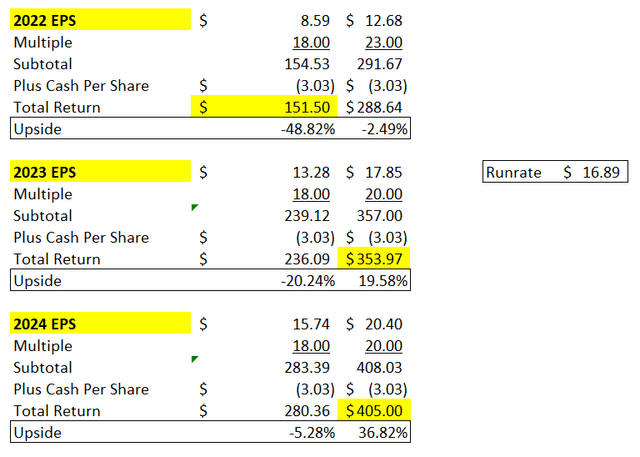

While we model $13.28 in EPS this year, that includes Reality Labs losses. Excluding Zuckerberg’s VR losses EPS should be almost $18 per share ($17.85) at a 20% tax rate.

As for their artificial intelligence (AI) plans, META has partnered with Microsoft (MSFT) on an open-source large language model called Llama-2 (love the name). While we are not sure how Meta monetizes Llama-2, we have heard that it is good, and we do think there is a good chance they can use AI to help the company become more efficient at programming (ultimately impacting productivity and margins).

Meta has just announced a new product called Code Llama to assist computer engineers. It is free now but has potential.

Model

We took cost guidance for the year and revenue guidance for Q3 and with that can triangulate pretty closely what EPS will be in 2023. In 2024, management talked only generally about costs increasing, with D&A costs increasing faster than usual. Meta will continue to invest in AI/VR and servers / more infrastructure.

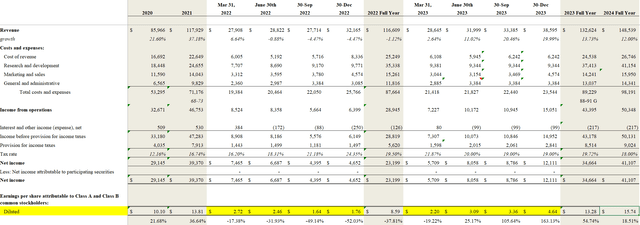

Below is our model with EPS and EPS excluding RL losses too.

Income Statement (META IR)

Street estimates are $13.45 this year (close to our $13.28 estimates) and $17.17 in 2024. We are more conservative at $15.74 in EPS in 2024. As an election year, growth could be higher than normal only to moderate in 2025.

Below are EPS figures excluding the RL losses. Note that in a hard landing scenario, these figures could be much lower as ad spending is often the first cost companies cut when times are tough.

Author spreadsheet, company financials

Valuation

Apart from Google (GOOG), there are few good peers. TikTok, Pinterest (PINS), and Snap (SNAP) offer online social media apps with advertising as their means of monetization. But TikTok is private, Pinterest a mess, and SNAP even worse. The latter trades at 21x and 59x forward EBITDA.

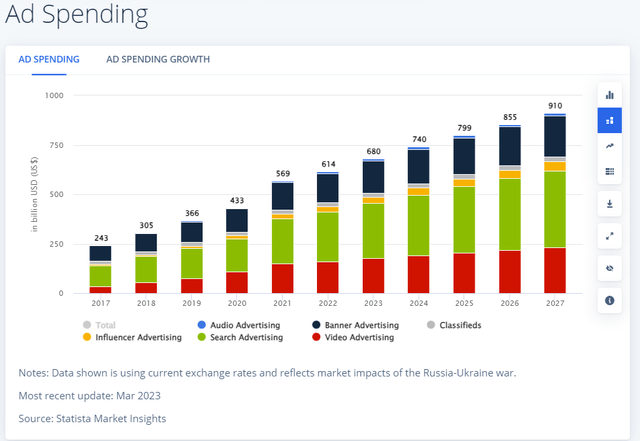

We think META is probably worth a premium to the S&P 500’s (SP500) multiple and continue to like the long-term digital advertising potential.

Below is one macro estimate (from Statistica) of Digital advertising growth.

Statistica Market Insights

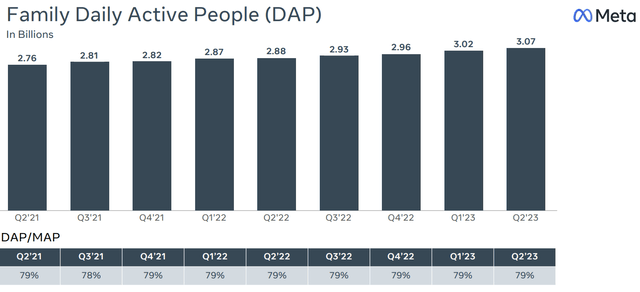

And below is the number of daily users, up 6.5% YoY.

META IR

Below are some simple P/E valuations. We assumed for the record that the company burns its cash stash in the pursuit of the company’s metaverse projects. But as mentioned, worst case there probably is only $17 more in cash burn that could come from another 5 years of losses at RL.

The range of EPS figures is below. In the left column, we adjusted EPS and included RL losses. EPS in the right column excludes RL losses.

Author Spreadsheet and estimates, Company Financials

On 2023 and 2024 estimates, this suggests a broad range of $236-405 on the stock. The $151 price level assumes trough earnings again; that seems less likely given cost cuts to date.

Our simple story is that the company will do roughly $20 in EPS next year excluding RL losses. That should be worth 18-20x, or $360-400 on META shares. The losses in excess of cash on the balance sheet pose say $17 of negative value, implying a fair value of $343-383. Any AI or Threads upside could be additive to the valuation of META.

Here is our math using EBITDA estimates on a sum-of-the-parts basis. We did back out stock-based comp in our EBITDA estimates, but generally, the valuation is in a similar range.

Author Spreadsheet

Big picture, we cannot see how Facebook and Instagram would be worth less than 10x EBITDA, especially as advertisers have returned to their platforms. WhatsApp is harder to assess, but based on users could easily be worth $50-100 billion. SNAP is trading at a $15 billion TEV and has 397 million users ($38 per user in value). WhatsApp has 2.7 billion users so it seems easily worth a range of $19-37 per user (as our math above implies).

It appears that the bad news with respect to Meta’s advertising businesses is mostly behind them. They have adapted to the new iOS changes, and growth has resumed. Omnicom (OMC) is a creative advertising business and trades at 7.6x 2023 and 7.2x 2024 EBITDA. Also, Google trades at 12x forward 12-month blended EBITDA.

So, Family of Apps should be worth a premium to OMC which is why we chose 10x as a lower end valuation range.

Conclusion

The easy money has certainly been made for those who bought META shares in the back half of 2021. Despite all the volatility, Meta Platforms stock is about where it traded two years ago.

The run up in the shares as the business has improved gives us some caution. I am no chartist, but this one does look scary. It could consolidate in the 200-250 range (we just don’t know). With less cost-cutting going forward, beating earnings estimates may be harder, too, looking forward.

Meanwhile, Reality Labs / VR losses are also continuing. Threads probably won’t move the needle, and we see little in the way of monetization of their AI initiatives near term, regardless of how well they are built. While I do not pretend to have any edge with respect to AI, we quickly counted 20 various companies building AI products. Competition will be high and moats not be that wide.

At $298 (give or take), META seems cheap to fair value, but not a slam dunk. We would put a broad range of $220 to $400 on the stock in the next 2 years. We did not model a recession scenario here and that could add headwinds to growth as we know that advertising is a cyclical business.

However, owning Meta Platforms, Inc. stock heading into an election year with iOS problems behind them, should we not have a recession in 2024, could be a good setup for solid/continued gains.

We recommend a starter ~1.0% position for Meta Platforms, Inc. with a goal to add more lower.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Long GOOG, OMC

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thanks for reading! We look for high quality stocks trading at attractive valuations in our Marketplace service entitled Cash Flow Compounders: The Best Stocks in the World. Our focus is high return on equity, high free cash flow stocks with a proven track record in compounding earnings at higher than market rates. There we provide in depth research, with 2-4 new, high quality ideas per month. My picks going back to 2011 have produced just under 30% annual returns, putting me well within the top 1% of bloggers (TipRanks). Sign up for a free 2 week trial to get my latest ideas!