Summary:

- Microsoft has maintained a strong competitive moat through its popular Windows and Office software, significant investment in cloud infrastructure with Azure, and successful expansion into gaming.

- Despite Microsoft’s impressive revenue growth and high operating margins, the current stock price significantly exceeds historical growth trends, driven largely by AI hype, suggesting an overvaluation in the market.

- Microsoft has a varied track record with acquisitions like Skype and LinkedIn, and while some investments like in OpenAI appear promising on paper, their long-term financial returns are still uncertain.

InnaFelker

There is no question Microsoft (NASDAQ:MSFT) has a very strong competitive moat that is reflected in superior financial performance. A very large percentage of office workers are used to its Windows and Office software, and reluctant to spend the time learning how to use alternative options, giving the company switching costs advantages. Perhaps more importantly, it invested heavily in the cloud infrastructure business at the right time with a solid strategy, making its Azure offering the number two player only behind Amazon’s AWS, and with a solid lead over Google Cloud (GOOGL). It has also shown that it can successfully develop products in other software segments such as gaming, where Xbox’s only important competitor is Sony’s PlayStation (SONY) .

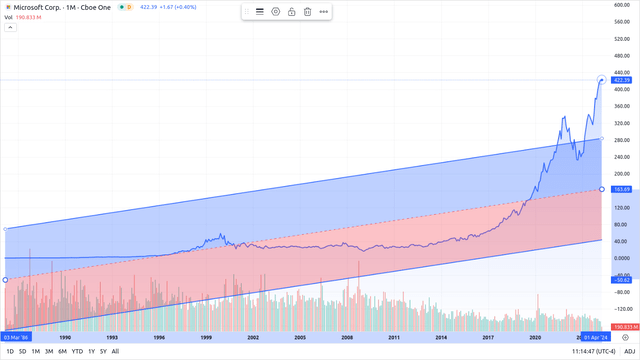

It is therefore not surprising that the company has been able to compound retained earnings at a high rate, which has resulted in a rapidly appreciating share price. Still, investors now appear to be pricing growth above its historical average, given that the share price is more than twice what its regression trend would suggest. We attribute much of the current overvaluation to AI hype. While we recognize AI will likely prove a solid tailwind for the cloud and data center business the next few years, we think investors are extrapolating the benefit too far into the future.

Financials

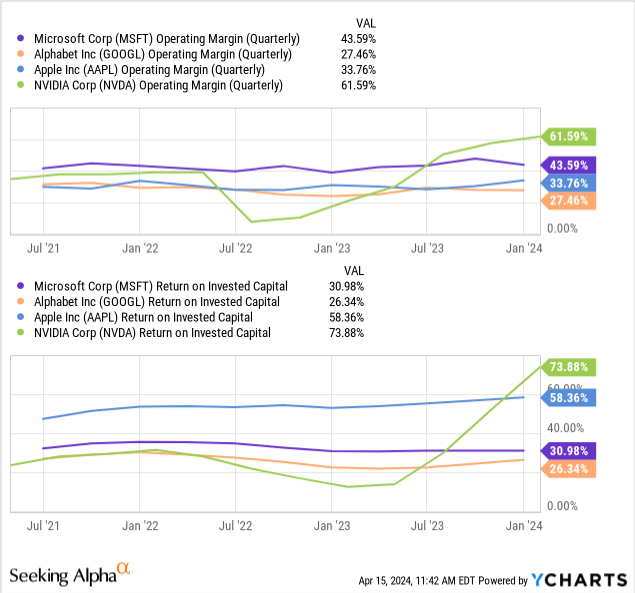

Evidence of the company’s competitive moat can be found in its elevated operating margins, which are multiples higher than the average, and which few companies are able to match. Its operating margin is even higher than that of Alphabet and Apple (AAPL), and only recently has NVIDIA (NVDA) surpassed them. Still, Apple’s and NVIDIA’s capital-light business models do deliver higher returns on invested capital.

Revenue Growth

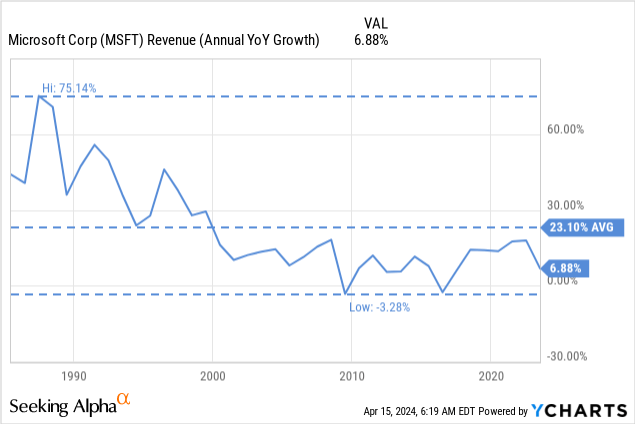

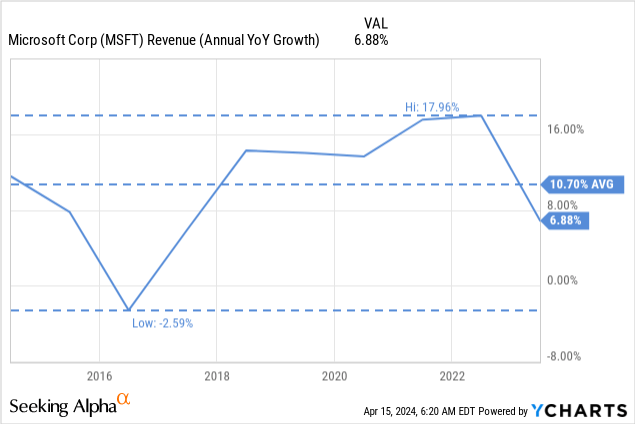

Microsoft has been a public company for several decades, and its revenue growth track record is certainly impressive. Growing revenue at a ~23% compounded annual growth rate for over three decades is quite an accomplishment. It is clear, however, that the hyper growth era the company saw in its early days is probably over. Its recent 6.8% annual revenue growth reflects its reality as a relatively mature corporation, even if it ticks up briefly given the tailwinds currently exciting investors.

In fact, if we look at the average revenue growth over the past ten years, we see that the average has been less than half, at less than 11% per year. Earnings have been growing faster, but we believe there is a limit to how high profit margins can be, and eventually earnings will tend to grow at a similar rate to revenue growth.

Acquisitions and Investments

Microsoft has a mixed history with acquisitions, so we would not really count on M&A as a significant positive for shareholders. In some cases, even when it was right about the potential of a business, it failed with the execution.

One example is Skype, which had an enormous lead over competitors, yet Zoom Video Communications (ZM) not only caught up with it, but surpassed it in importance. There are many articles and videos online explaining what went wrong, but at the end of the day, it was an acquisition that was not managed correctly.

Similarly, while LinkedIn has probably been a financial success, it speaks more to the durability of the “network effects” moat, than any innovation or improvements Microsoft has added to the platform. The engineering team has been busy trying to move to Azure, but after three years decided to abandon the plan. At the same time, Microsoft is cutting jobs at LinkedIn, further reducing resources to improve the platform.

Perhaps one of the worst acquisitions the company has made was Nokia, where it went on to lose more than $8 billion. Some of its internal investments look like losers, even if it is more difficult to quantify the amounts. Despite significant investments, Microsoft’s Bing search engine remains a very small player. Its OpenAI investment looks great on paper, but it remains to be seen what return it will actually deliver. At least it retains some of its independence, even if it is also being pressured to use Azure cloud services. It is also too soon to tell if the ~$69 billion deal for Activision Blizzard will deliver a good financial return, but it certainly appears expensive, considering the game developer generated only $7.5 billion in revenue in its last fiscal year.

Balance Sheet

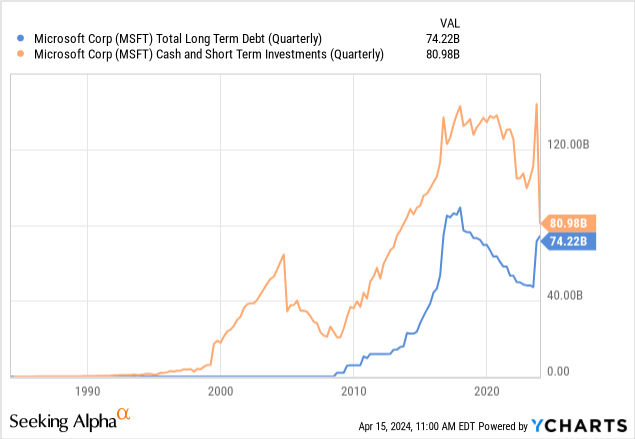

At least one thing Microsoft investors do not need to worry too much about is the balance sheet. With more cash and short-term investments than long-term debt, the company has a very solid financial position that enables it to use its cash flow for investments, acquisitions, share buybacks, or dividends.

Valuation

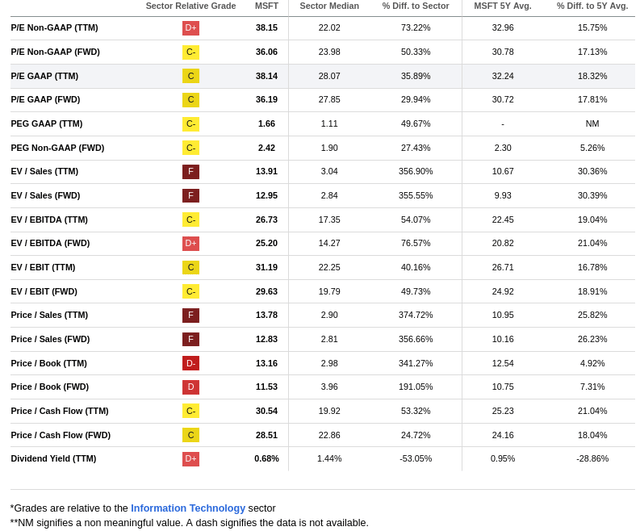

Unfortunately, investors are being asked to pay a very high price for the strong financials and solid franchises the company owns. The company looks expensive even compared with its own history, despite the trend of slowing revenue growth.

Its trailing twelve months GAAP Price/Earnings multiple of 38x, is roughly 18% higher compared to its 5-year average, and more than 35% compared to information technology sector. Its forward P/E multiple is similarly about 17% higher than its 5-year average, and more than 50% higher when compared to its sector median.

Based on our future earnings estimates, we calculate a net present value of $295 per share, which would mean that shares are currently about 43% overvalued.

Alternatively, we have to lower the discount rate to ~6% to get a net present value close to where shares are currently trading, which is very low considering that it is currently possible to get yields above 5% with high-quality short-term bonds.

| EPS | Discounted @ 10% | |

| FY 24E | 11.7 | 10.64 |

| FY 25E | 13.34 | 11.02 |

| FY 26E | 15.63 | 11.74 |

| FY 27E | 18.37 | 12.55 |

| FY 28E | 20.52 | 12.74 |

| FY 29E | 22.78 | 12.86 |

| FY 30E | 25.28 | 12.97 |

| FY 31E | 28.06 | 13.09 |

| FY 32E | 31.15 | 13.21 |

| FY 33E | 34.58 | 13.33 |

| FY 34E | 38.38 | 13.45 |

| Terminal Value @ 3% terminal growth | 493.96 | 157.39 |

| NPV | $295.00 |

Risks

The biggest risk we see with an investment in Microsoft at current prices is the extremely high valuation. Investors are betting AI will turbo-charge the business, and that recent acquisitions will be a success. However, when zooming out, the trend has been for revenue growth to decelerate as the company has matured, and the company has a mixed track record with its acquisitions at best.

Conclusion

Microsoft is a very strong company, with enviable financial performance and very high profit margins that reflect businesses with strong competitive moats. Still, the current valuation appears excessive, with investors clearly betting that AI will deliver a step change to its rate of growth. However, even when using relatively optimistic earnings growth assumptions, we find shares significantly overvalued.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling shares, you should do your own research and reach your own conclusion, or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.