Summary:

- Fuel prices continue to fall, which should help Southwest improve margins.

- Domestic travel continues to grow at a rapid pace.

- Southwest continues to invest in its business.

Alex Wong

Southwest Airlines (NYSE:LUV) is set to report earnings on April 27th. The company previously posted a Q4 loss based on flight cancellations which resulted in an impairment of $800 million. Such impairment costs are unlikely to repeat in future quarters. Furthermore, hedges should roll over which should help improve the bottom line for Southwest.

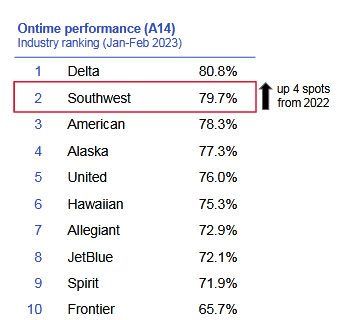

Despite the hiccups from the previous quarters, mainly Southwest’s computer glitch, which led to cancellations, Southwest has been able to improve its industry on-time performance significantly during the recent months (see image below, from Southwest’s investors presentation), increasing its ability to arrive on time to around 80%, putting it just behind Delta. This will significantly improve the image of Southwest after a computer glitch caused the company some dysfunction, and should see the airline return back to profitability soon.

Investor Presentation (Southwest)

Customers have also been returning to the airline, with data showing that 50% of customers who were affected by the glitch have now booked with Southwest again. Adding to the positives, management continues to see strong feedback from customers, and improving sentiment since December.

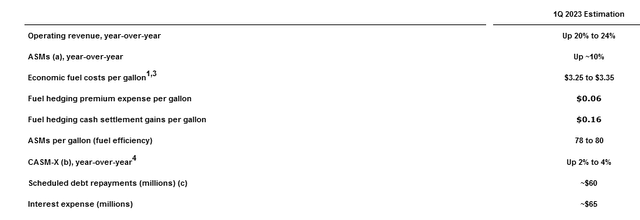

Southwest’s first quarter should be impressive, as domestic tailwinds continue to take hold. The company’s management has been quite bullish on the 1Q according to their 1Q estimates from their investor presentation, with their estimates for operating revenue expected to increase by 20%-24%, and average seat miles, is expected to increase by 10%. Meanwhile, the cost of fuel is expected to come in at $3.25. But a look at recent statistics suggest that things might be even rosier.

Southwest Investor Presentation (Southwest)

Fuel prices

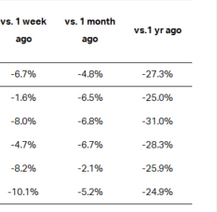

Jet Fuel prices have been falling throughout the past few months and this should be reflected in the upcoming earnings. North American fuel is down significantly YoY, as of 17th March, and down over 8% over the previous year. A reduction of 8%, average and projection along with a reduction in 27%, should see fuel prices decline to around $2.8-$2.9 for the current quarter, which will allow for a reasonable increase in profitability, especially since fuel prices are historically around 30%, of revenue, and play a significant role, in operational costs, and quite often determine whether or not a company is successful or not.

IATA Fuel Prices As of March 17th (IATA)

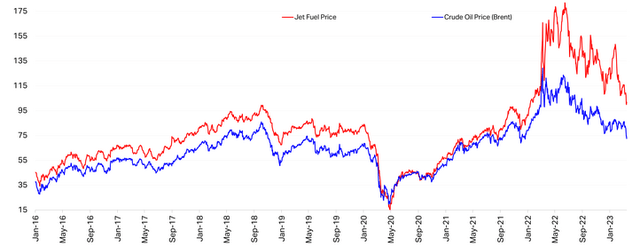

Admittedly jet fuel prices are still up significantly from the previous years, especially going back to 2016 when energy prices were much lower. But the prices have started to moderate, and it remains to be seen whether Southwest in turn reduces the cost of its flights. Management has indicated that for 2023, the total fuel costs per gallon price could fall to $2.65-$2.75, and this will likely help to push the company towards increased profitability later this year. Regardless, fuel costs of around $3.00 would still benefit the company significantly.

IATA Fuel Price History (IATA)

Airline traffic continues to recover well

Although Southwest continues to operate below 2019 capacity, strong demand in the North American domestic routes should result in significant growth increases. North American traffic continued to increase by 84%, on international routes, and domestic routes saw a 27% increase, with capacity increasing by 12%. This increase in capacity combined with an increase in traffic could see revenue come in slightly higher around 30%, YoY, and ASM could increase by 12%. Traffic on the domestic routes has not been affected by rising interest rates, and recovery is expected to continue through 2023, even though I expect to see a slight slowdown in the latter half of the year, stemming from weakness in the economy.

Capacity and Traffic (Business Travel News)

Meanwhile, the CASM or cost per average seat mile, which is expected to increase by 2-4% according to management’s outlook (see image above), could come in around +1 or +2%, as both operating costs start to become steadier, due to lower oil prices, and due to the base effect of inflation reducing operational costs such as labor costs. This, in turn, should help the company as it looks to get back to profitability. Operating costs should reduce, as the base effects of inflation moderate, although inflation continues to remain hot in recent times, coming in at around 6%, which is still far above where it has been the last decade. This has been affecting many industries including air travel and could further affect air travel as we head into the year.

Where are valuations and earnings headed?

I expect Southwest to see a significant increase in revenue, forecasting +35% YoY. This equates to ~$6.3-$6.4 billion, putting the company on track for $27-28 billion for the current fiscal year, as both capacity and seats filled increases. Furthermore, the bottom line should come in around 8%-10% in terms of net profit for the year, with the latest quarter witnessing around $500-600 million in profit, and total profit for the year coming in around $2.0-2.5 billion, with estimates based on projections for cost, based on current trends.

Cash flow might be slightly affected as the company continues to invest in its business, including a $1 billion injection into the backend, to overhual the company’s aging IT system, and improve the overall efficiency and reliability of its IT system, and thereby not incur the losses that it did, when the glitch in recent months caused multiple flight cancellations, and a $800 million in losses.

Regardless, expect the current quarter to show better-than-expected results, as Southwest continues to see strong improvements throughout the year. I believe that the forward P/E could push higher anywhere between 7x-9x, considering for the potential variables during the year including fuel prices.

Conclusion

Southwest Airlines should continue to see a strong year, the company is poised to see improving capacity and improving demand, as more people take to the skies. But issues remain with inflation, which has been affecting real incomes. Airline ticket prices remain quite high, and it remains to be seen how customers will react should inflation continue. But, the stock could see investors come back in force, as Southwest’s prospects improve, making it a buy over the course of the year.

In conclusion, I believe Southwest’s upcoming quarterly results will show higher than projected revenue, and improving margins. The effects of the factors mentioned in the article such as improving demand, capacity, and lower costs results in better than expected top and bottom line make the risk-reward for Southwest towards look appealing.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.