Summary:

- Exxon Mobil is set to benefit from higher crude oil prices and expanding production, particularly from its recent Permian asset acquisition.

- The stock has strong momentum, breaking above key moving averages, and is expected to announce a dividend increase soon.

- The U.S. economy’s solid labor market and moderating inflation further support XOM’s bullish outlook.

- Despite recent gains, the stock remains sensibly valued, making it an attractive buy for passive income investors.

JHVEPhoto

Exxon Mobil Corp. (NYSE:XOM) is poised to profit from higher crude oil prices and a growing production base related to its Permian asset acquisition.

The latest upside price retracement and a strong labor market report strong tilt the odds in favor of further upside for the energy behemoth, in my view.

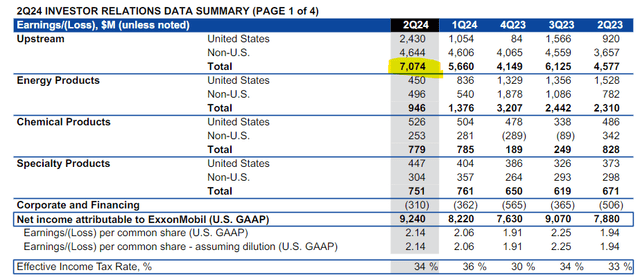

Exxon Mobil Corp.’s production is expanding, creating volume upside in the critical upstream segment. The upstream segment produced 77% of the company’s profits in the second quarter.

In addition, Exxon Mobil Corp. is poised to announce a new dividend at the end of the month and the stock is sensibly valued.

My Rating History

My last stock classification for Exxon Mobil Corp. was Strong Buy in light of the Organization of the Petroleum Exporting Countries removing price uncertainty in June. Crude oil prices rebounded lately, causing an upside breakout for Exxon Mobil’s stock.

Since crude oil prices have recovered to $76/barrel, the energy company, in my view, is poised for a solid earnings release next month and could surprise in terms of upstream profits.

Investors Should Continue To Expect Robust Upstream Results

Exxon Mobil Corp. is a Houston-based, multinational oil and gas company with a diversified portfolio of energy assets. The company owns a big upstream business, which includes its production and exploration activities, refineries as well as chemicals and specialty product segments.

By far the most dominant is the upstream segment which accounts of the majority of Exxon Mobil Corp’s earnings. To strengthen its upstream operations, the oil and gas company acquired Pioneer Natural Resources for almost $60 billion in November 2023 and Exxon Mobil Corp. is seeing some respectable momentum here.

Exxon Mobil Corp. is doing very well for itself in the upstream business which is buoyed by high crude oil prices. In the second quarter, Exxon Mobil Corp. realized an average crude oil price of $79.00/barrel, up 5.4% QoQ, in the United States. Outside of the U.S., the average realized price for crude oil rose 7.8% QoQ to $77.60/barrel.

Exxon Mobil Corp.’s oil-equivalent production in the second quarter amounted to 4,358 Koebd, up 15.2% QoQ, thanks to Exxon Mobil Corp.’s prior acquisition of Pioneer. The Pioneer acquisition, which was completed only in May 2024, had a focus on Permian assets which are poised to double Exxon Mobil Corp’s Permian output to 2 Moebd by 2027.

Including Pioneer, Exxon Mobil Corp. extracted a record 1.2 Moebd out of the ground and chances are the company will see growth in upstream volumes in the third quarter as well. As a consequence, the energy company, thanks to high crude oil prices, is slated to report strong earnings for its third quarter.

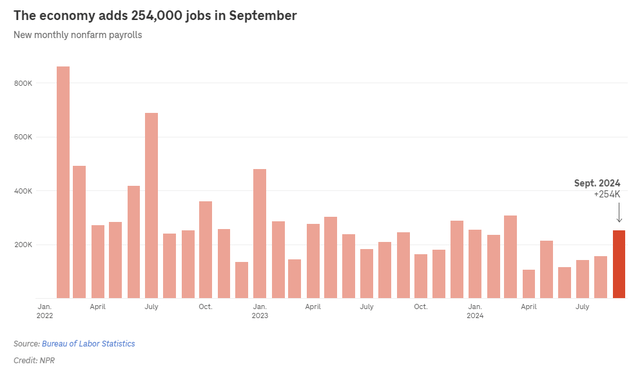

What supports an investment in Exxon Mobil Corp. here is that the U.S. economy appears to be in reasonably good shape: Inflation has been moderating as of late, which forced the central bank into action, and the latest jobs report was much stronger than anticipated as well.

U.S. employers generated 254,000 jobs in the month of September which beat the consensus of 150,000. Solid labor market conditions, job gains and receding inflation are good news for the U.S. economy and could further lend support to the upside retracement of crude oil prices.

New Monthly Non-Farm Payrolls (NPR)

Technical Chart Setup

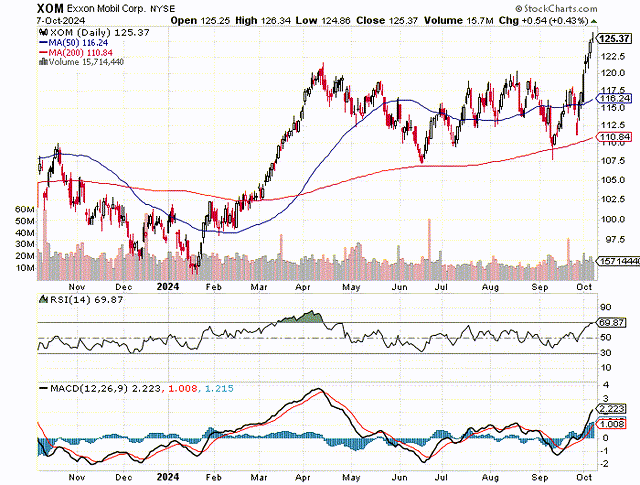

Exxon Mobil Corp.’s stock just broke out above the crucial 50 day-moving average line, a short-term trend indicator that reveals bullish or bearish sentiment.

By that same token, Exxon Mobil Corp. also broke out above the 200-day moving average line in September, so both the short- and the long-term momentum rend are very bullish here. With oil prices also recovering to $76/barrel, up 7% in the last week, I think that the short-term profit outlook for Exxon Mobil Corp. is extremely bullish.

The Relative Strength Index has pushed up to a value of 69.87 which puts the stock at risk of an overheating in the short term, but with oil prices rising and Exxon Mobil Corp. growing its production, I don’t think this rally has seen its end yet.

Moving Averages (Stockcharts.com)

Dividend Announcement Imminent

Exxon Mobil Corp. is poised to increase its dividend at the end of the month. In recent years, the energy company made its dividend announcement in late October and I anticipate a dividend increase to $1.00 per share per quarter, up from $0.95 per share today.

High Margin Of Safety For Passive Income Investors

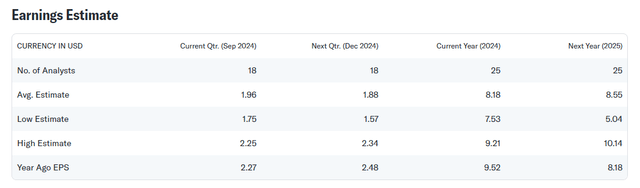

Exxon Mobil Corp., despite its breakout above the 50-day moving average line, is not expensive yet. The stock is selling for $125.37, but with profit estimates for this year anchored at $8.18, the energy company’s stock is still rather cheap, I’d say.

Next year, Exxon Mobil Corp. is anticipated to see 5% profit growth YoY whereas this year profits are expected to decrease 14%. In case Exxon Mobil Corp. managed to scale up production of its newly acquired Pioneer assets in the Permian I think the company could put up very robust results in its important upstream segment. Based on these stats, Exxon Mobil Corp. is selling for a profit multiple 15.3x based on this year’s estimated profits.

Chevron Corp. (CVX) is selling for 13.9x this year’s anticipated profits. Exxon Mobil Corp.’s Pioneer acquisition, however, has a strong production upside catalyst and the new dividend is poised to immediately boost passive income investors’ dividends from the stock.

Earnings Estimate (Yahoo Finance)

Why The Investment Thesis Might Prove To Be Faulty

A possible wild card for Exxon Mobil Corp. is the possibility that the U.S. economy could slump into a recession, the odds of which are presently, in my view, not that high. The last labor market report was very strong and does not suggest that the U.S. economy is in any trouble.

With that said, a downturn would most certainly affect as much money Exxon Mobil Corp. would be able to sell its crude oil for. Should the Pioneer acquisition fail to delivery substantial production growth moving forward, the stock may be poised for a correction.

My Conclusion

Exxon Mobil Corp.’s stock is seeing solid momentum following the breakout above its 50-day moving average line. Despite the breakout, however, the stock is still very sensibly valued when taking into account just how much money Exxon Mobil Corp. makes with its energy operations and that its production is poised to grow thanks to Pioneer, particularly in the competitive and promising Permian.

The present geopolitical situation with multiple wars going on benefits Exxon Mobil’s strategic position as well.

I think that Exxon Mobil is poised to deliver durable dividend growth moving forward, and the stock remains a buy for passive income investors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.