Summary:

- The recent pullback of oil prices has made the energy sector the most attractive market sector.

- Peering into the future, I do not see oil prices stuck at the current $75 level.

- Instead, I foresee several immediate catalysts to propel the price upward, including record-low strategic petroleum reserves and oil stocks.

- Investors can of course use a sector fund to express this bullish view.

- Here, I will go a step further to argue why I see Exxon Mobil as a superior option.

marketlan/iStock via Getty Images

Thesis

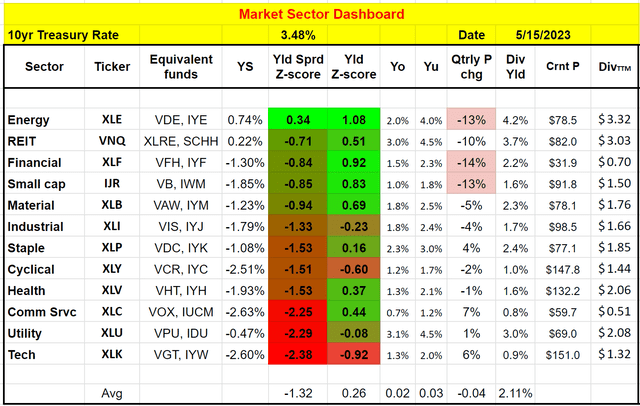

The energy sector, approximated by the Energy Select Sector SPDR Fund (XLE), is the most attractive market sector as shown by our market dashboard (downloadable via this link: Market Sector Dashboard). The sector was made attractive due to a combination of A) price corrections and B) improved fundamentals. The price corrections are in turn caused by oil price pullbacks from a peak of $120 a year ago to the current level of around $75. And an excellent indicator of the improved fundamentals involves the robust growth of the dividend from the sector. To wit, as of the March quarter (the most recent quarter for its dividend raises), XLE raised its quarterly dividend by 32% YoY, the highest YoY rise among all the sector funds tracked by our dashboard.

Under this background, the core thesis of this article is twofold:

- I do not anticipate oil prices to stabilize around the current $75 level. Instead, I see multiple strong catalysts that could drive the prices up substantially. And I will elaborate on a few of these catalysts in this article, including the need to replenish our strategic petroleum reserve, record-low crude oil stocks, and persisting inflation.

- As such, potential investors who share this bullish view could bet on it via a sector fund (like any one of those listed in our dashboard). But I will go a step further to explain why Exxon Mobil (NYSE:XOM) is a better choice to express this view.

Record-low strategic petroleum reserve

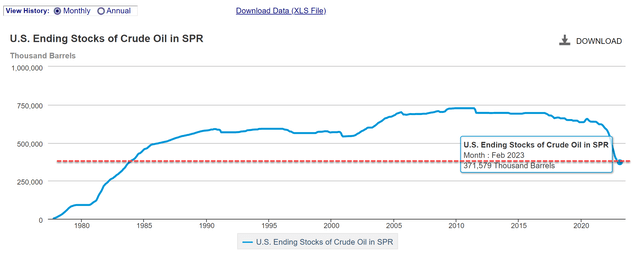

Let me start by explaining the first reason why I do not see oil prices stuck at $75: the record-low Strategic petroleum reserve (“SPR”).

If you recall, back in March 2022, President Biden ordered the release of one million barrels of crude oil per day for a duration of six months from the SPR in order to combat the rising energy prices. Currently, the last weekly SPR data shows a reserve of only stands at the current level of 371 million barrels. To provide some context, this represents the lowest level since 1984. My take is that the release of the SPR is at best a temporary fix. Now, as we sit on a record low SPR, I do not see the United States having any other option but to reverse course and begin replenishing the reserve.

However, replenishment under the current circumstances won’t be easy. Refilling the SPR can only be done through two sources as I see it: domestic production or imports. And next, I will explain why either route would likely drive up oil prices.

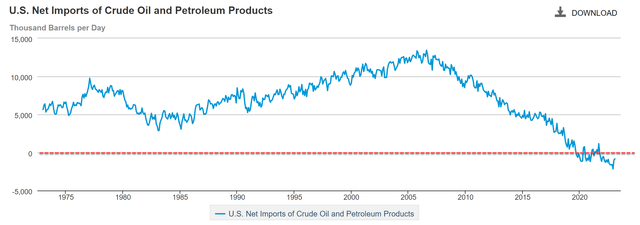

Negative net imports and record-low stocks

Our net imports are simply negative as seen from the chart below. Instead of the import surplus which we’ve been used to historically, the U.S. net imports of crude oil and petroleum products have been in the negative territory since early 2020. With the Russian/Ukraine situation dragging on and the European countries in dire need of energy suppliers, I do not see an import surplus any time soon.

That leaves us one option only the way I see it – replenishing via domestic production. This approach will simply add one more larger buyer to the already imbalanced supply-demand relationship. As emphasized in my previous articles, the U.S. is now experiencing an energy shortage caused by a structural imbalance accumulated over multiple years.

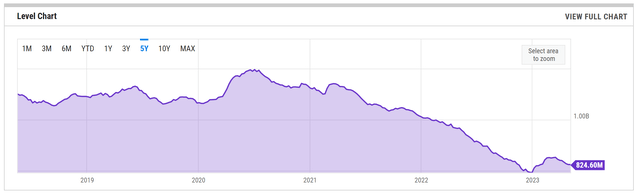

The next chart provides a good indicator of the symptoms and the magnitude of this imbalance. The chart depicts the weekly U.S. domestic crude oil inventory. As you can see, prior to 2021, the inventory remained quite stable above ~1 billion barrels. The inventory level started a sharp and consistent decline in 2021. Currently, the US Crude Oil inventory sits at 824 million barrels, the lowest level observed during this period of time.

As a result, refilling the SPR tank would add an additional significant buyer to the demand side, further exacerbating the existing imbalance. The domestic oil players (such as those included in the XLE fund) will be the go-to suppliers for this refilling, and very unlikely under favorable pricing environments.

And next, I will explain why XOM is better poised for this catalyst than the rest sector average.

Why XOM is better than sector average?

As aforementioned, the catalysts explained above apply to the whole energy sector. However, I see XOM better positioned than the sector average for many reasons. And top 2 reasons are:

- First and foremost, scale and supply contracts. Refilling the SPR requires long-term supply contracts, and XOM is well-positioned to secure such contracts due to its size, reputation, and financial stability. Being one of the largest energy companies globally, XOM provides substantial financial resources, production capabilities, and infrastructure to match the scale and timeframe of large contracts. Its scale allows it to handle large-scale supply contracts and effectively meet the demands of SPR refilling.

- Second, strategic partnerships. XOM has established partnerships with various governments and entities worldwide. These partnerships can provide the company with privileged access to strategic resources and opportunities, further enhancing its ability to benefit from SPR refilling.

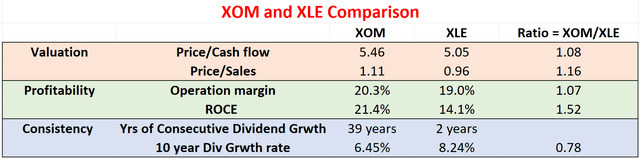

Despite these strategic advantages, XOM’s valuation is on par with the energy sector as shown in the chart below. Note the data used in the table was compiled from Yahoo Finance, Seeking Alpha, and also the XLE’s fund descriptions as of May 15, 2022. These could change a bit by the time this article is published. To wit, XOM is for sale at 5.46x of its cash flow, only about 8% above XLE. Its price/sales ratio hovers around 1.11x, about 16% higher than XLE. However, bear in mind that its margins and return on capital employed (“ROCE”) are superior to the sector average. Hence, the valuation premium (if there is any) is even smaller than on the surface.

Author based on data from Yahoo, Seeking Alpha, and also XLE’s fund descriptions

Risks, expected returns, and final thoughts

Both XOM and the energy sector face many risks ranging from environmental concerns, lawsuits, government policies, et al. These risks have been repeatedly discussed by many other SA authors and we won’t further add on. Here, I will point out a few risks specific to the thesis of this article. The rate at which the SPR is replenished is a crucial factor to the thesis and is ultimately uncertain. Delays or disruptions in the refilling process, such as logistical challenges or regulatory constraints, could prolong the period of low SPR levels. Decisions regarding the timeframe and pace of the SPR refilling can be influenced by policy considerations and geopolitical factors. Changes in government priorities, international relations, or shifts in energy policies may impact the timing and extent of SPR refilling efforts. Political debates and negotiations can introduce uncertainties into the process. Such geopolitical factors are ultimately unpredictable.

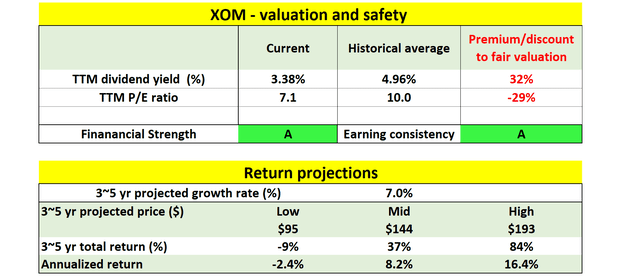

In conclusion, I see more upside than downside potential for oil prices under current conditions. And I see XOM better positioned for the upside catalysts than the sector average. There are some downside risks as mentioned above. These downside risks could lead to a negative return as shown in my analysis below. But overall, I see a very asymmetric return profile.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.