Summary:

- The Guyana partnership will give up roughly 1.32 million acres as the agreement with Guyana states.

- The partners will, of course, keep the priority acreage.

- The original acreage is 6.6 million acres, which is equivalent to roughly 1150 Gulf of Mexico blocks.

- Exxon Mobil actually handles three huge FPSO projects from the development stage to the beginning of production at one time.

- As more partnerships have commercial discoveries worth developing, there is a good possibility of more than one FPSO in Guyana and Suriname.

HeliRy/E+ via Getty Images

(Note: This article was in the newsletter on March 12, 2023.)

Exxon Mobil Corporation (NYSE:XOM) formed a partnership with Hess Corporation (HES) and CNOOC Limited (CEO) to explore the Guyana basin. The partnership (and others) formed back in the 1990s and soon received some giant leases to explore. Exxon Mobil, the operator, has a 45% interest in the Stabroek, Hess has a 30% interest, and the remainder is the interest of CNOOC. Most of the current interest is on the 6.6 million acres of Stabroek because commercial production has begun there. But Exxon Mobil has formed partnerships for each of the other leases it has interests in as well that may or may not become important down the road.

The market misunderstands the “give up” for some of the acreage. This is a contracted situation, as John Hess will explain, and is referenced later. Actually, it is more like 1.32 million acres that the partnership is contractually obligated to give up in Guyana. According to John Hess, CEO of Hess, the partnership long ago signed an agreement to give up 20% and the time to do that is approaching. Since the original Stabroek block in Guyana had 6.6 million acres (which he equates to about 1150 Gulf of Mexico sections), there is still going to be plenty left over for the partnership.

John Hess noted there is a lot of misunderstanding about this floating around the public. It is actually a fairly standard provision that I have seen elsewhere many times that over time, the uninteresting parts of these leases get returned. Mr. Hess further stated they are keeping the production and the potential parts of the lease that needs to be explored. That should really surprise no one. So, it’s really 5.3 (roughly) million reasons to remain in Guyana and keep developing the discoveries that the partnership has.

The other thing Mr. Hess mentioned is that at any time Exxon Mobil, the operating partner, is juggling three FPSO projects. At the current time, the ship which is the latest FPSO has left port and is on its way to Guyana. Therefore, the first oil from this latest FPSO will definitely happen before year-end.

The second FPSO (that is a current project that Exxon Mobil is dealing with) is the latest project to have been approved by the Guyana government. It is actually the fourth FPSO approved by the government. So that one has now moved from the planning stage to the building stage. In the meantime, the partnership now has drill ships drilling development wells that investors rarely hear about and installing connecting pipelines as needed (or can be done) so that when an FPSO arrives, the connections can be made efficiently to begin production.

The third FPSO project is actually the potentially fifth FPSO and is the one before the government to approve (and the partnership makes sure to have one before the government at all times). Mr. Hess marveled at how Exxon Mobil, the operators can do all of that at one time. These projects are each potentially in the ten billion to twenty billion dollar range (give or take a lot until they are approved and running). Therefore, in practical terms, the partnership is likely to do one of these per year for the time being.

John Hess also mentioned that the joint venture is now cash flow positive. This is true despite the need to Fund FPSO projects and drill expensive development and exploration wells while generating that cash flow. That is an incredible accomplishment.

Last but not least, the government has assured the partners that they will honor all contracts. However, the prime minister was anticipating that some of the Stabroek block would soon be turned back over and likely would be auctioned off to someone else to explore.

In the meantime, Exxon Mobil has interests in more blocks and is evaluating the situation in those blocks, both in Guyana and Suriname. So even though this partnership is likely to do one FPSO per year, future discoveries elsewhere that prove to be significant enough to be commercially viable will require FPSOs as well. Such a situation of more than one FPSO per year starting up would become significant to a company the size of Exxon Mobil.

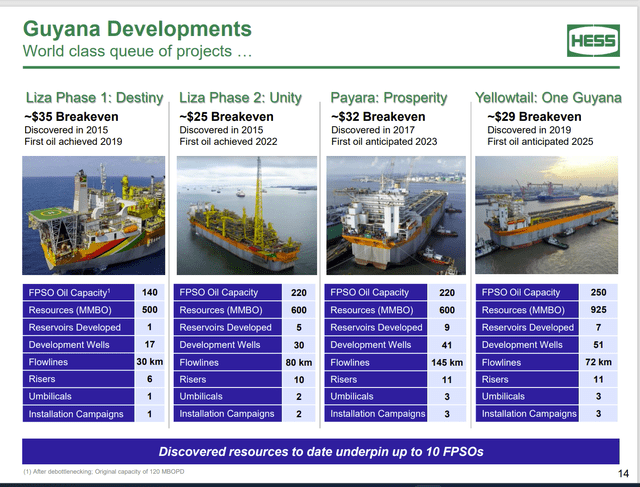

Hess Description Of Approved FPSO Projects Along With Initial Scheduled Production Dates (Hess Corporate Presentation March 2023)

The sheer number of partnership FPSO projects that are justified along with the Exxon Mobil having a goal of having six of these produced by sometime in 2027 is a major production boost. Each FPSO can produce at least 200,000 BOED. For Exxon Mobil, 40% of 6 of those would range in the 500,000 BOD range in 2027 (if that goal is reached). That is just one block and one partnership.

As more blocks and partnerships report commercial discoveries, the upside potential in this area alone is mind-blowing.

LNG

Exxon Mobil is one of the largest LNG producers in the world.

” Key projects include the Coral South floating LNG development in Mozambique, the Golden Pass export facility on the U.S. Gulf Coast, and future developments in Papua New Guinea and Mozambique”

Source: Exxon Mobil 2021 Annual Report

Every one of these projects is every bit as large as the Guyana project right now, even though the Guyana (and Suriname) partnerships have the potential to be the largest in company history.

Exxon Mobil is not currently dependent upon any one large project to grow production. Production did in fact grow a little bit, despite the fact that management sold some non-core assets that were probably high cost. That may well signify the beginning of a period of significant production growth that had eluded the company for quite some time. If that is the case, then the future of the stock price will be very different from the past.

Sample Of Future Possibilities

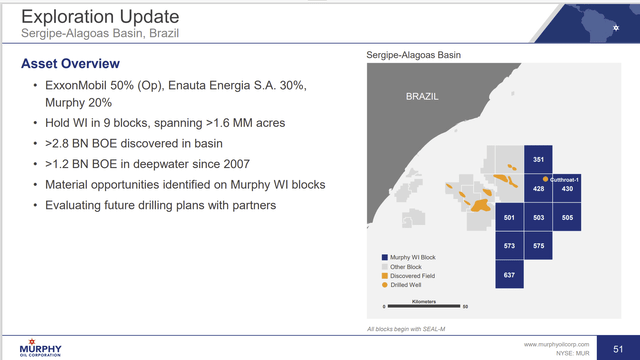

Exxon Mobil has a partnership with Murphy Oil Corporation (MUR). Now, the first well as reported by Murphy management was a dry hole. That is often the case, as many times it takes years (like it took in Guyana) until a commercial discovery is reported. It then takes still more years after that to get the commercial discovery to production.

Murphy Oil Description Of Exxon Mobil Partnership Possibilities (Murphy Oil Fourth Quarter 2022 Corporate Presentation)

This is one of several worldwide projects that can potentially add to the production growth potential Exxon Mobil already has on its plate.

The Future

Exxon Mobil management is busy adding a lot of new low-cost production to the portfolio. Management long ago announced a plan to drop the company’s breakeven. The way that is done is to add low-cost production. The Guyana FPSOs shown above have world-class breakeven points. You don’t see many projects of any kind that come in with the breakeven points reported for the Guyana FSPOs.

So, all those comments focused upon lower oil prices forget one big item.

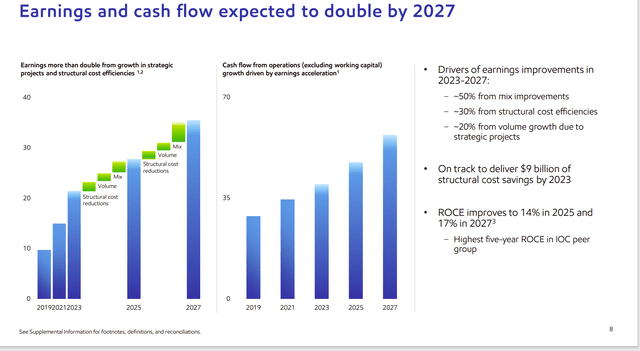

Exxon Mobil Corporate Plan To Increase Earnings (Exxon Mobil Corporate Plan Update)

Companies like this one tend to take a year like fiscal 2022 and use it to speed up the process to get where they are going. In fact, the ending point is likely to be raised over time to keep the company growing. The company is moving to a growth and income model when a plan like this is presented. That means that periods of commodity price weakness are likely entry points for investors to consider.

The company could be materially larger by the time the next pricing rally begins. That would make Exxon Mobil Corporation a strong buy as an income and growth consideration based upon the Guyana partnership progress. Besides, this industry has such low visibility that a predicted time of weak commodity prices may not happen (or it could be unexpectedly short). For the buy and hold group of investors, this is probably a stock to consider buying because growth and income propositions with this level of safety are rare.

The whole group is out of favor, as shown by historically low price-earnings ratios. Most executives in the conference call mention how cheap the industry is. The time to sell is when many of those executives sell the company. Right now, most are doing exactly what Exxon Mobil is doing, and that is investing in the industry one way or another. It is just a matter of time now before those investments become apparent to investors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have a beneficial long position in the shares of XOM, HES, MUR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation for the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits its own investment qualifications.

I analyze oil and gas companies like Exxon Mobil and related companies in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies – the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.