Summary:

- I see natural gas as a more immediate catalyst (i.e., compared to oil prices) for Exxon Mobil and Chevron in the incoming months.

- Natural gas is currently too compressed to last.

- It is near the lowest level since 1998 and also below my estimate of the break-even production price.

- I also expect the supply-demand imbalance to worsen this summer due to above-average cooling demand and production/storage limitations.

- I expect these catalysts to drive natural gas prices at least to the historical average of $4~$4.5, translating into ~20% projected returns for Exxon and Chevron stocks.

Torsten Asmus

Thesis

The title of this article was inspired by (or you could say stolen from) Game of Thrones. The inspiration came to me from two directions. The obvious one is that summer is here. And the second one is the main theme of this article. Most investors for big oil stocks like Exxon Mobil (NYSE:XOM) and Chevron (NYSE:CVX) are mostly concerned about oil prices and their impact on XOM and CVX’s profits. It is a bit similar to the situation in the HBO show where most people are concerned about who gets to be on the throne, yet the true issue is the upcoming long winter and the undead army it brings.

In this article, I will explain why I see natural gas prices as a main near-term catalyst for XOM and CVX’s profits this summer. Furthermore, when most people think of natural gas, probably the first instinct is that it is a fuel we burn for heating purposes. This may be true in winter. But in summer times, the situation is kind of the opposite. Natural gas is the most-used fuel for electricity generation, which was consumed by our air conditioning units to keep us cool. And guess what, the 2023 summer is expected to be a pretty hot summer.

And in the remainder of this article, I will argue that natural gas price is a key positive catalyst for XOM and CVX in the next few quarters. Just to be perfectly clear, I am not saying that oil is not important for their profits. What I am going to argue is that natural gas will be the more important and immediate catalyst in the near term both due to its currently compressed price, its price volatility, and also the supply-demand imbalance. To limit the length of the article, I will focus my arguments on the following three aspects:

- The current natural gas price is near the lowest point in more than two decades. I do not see such a low price being sustained given the supply disruption caused by the Russian/Ukraine situation and the electricity demand.

- I will then analyze XOM and CVX’s role in the natural gas sector and also the role of natural gas in their income streams.

- And finally, I will assess the profitability impacts of natural gas prices on their profits. Based on the assessment, I will form a projection of their return potential.

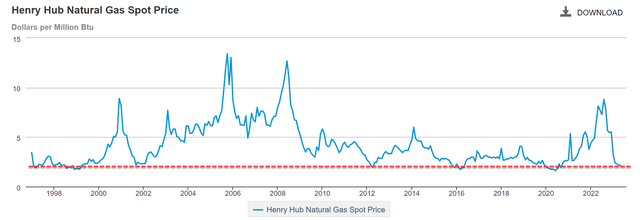

Natural gas price at a historical low

The current natural gas prices are near a historically low level. The Henry Hub Natural Gas Spot Price (Dollars per Million Btu) currently hovers around $2.15. And as seen in the following chart, it is near the lowest level since 1998. Natural gas is notorious for its volatility, which you can easily see by just eyeballing the data in the chart. The price almost reached $8/MMBtu in the summer of 2022. The average Henry Hub spot price (averaged on a monthly basis) is about $4. And the current price is far below this average.

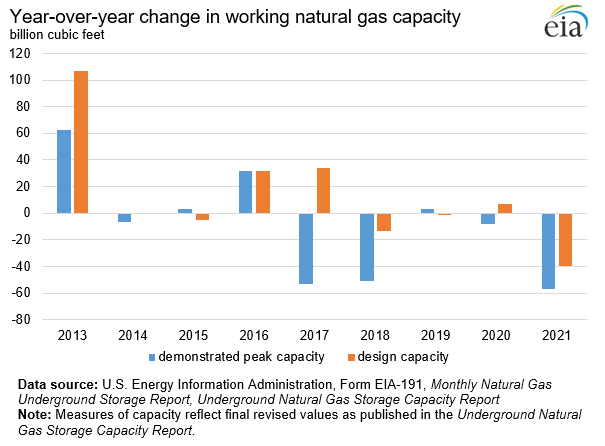

Looking ahead, I don’t see natural gas prices remaining at such a low level for several reasons. First, the supply end of the equation is quite restricted due to both the Russian/Ukraine war and also the result of years of underinvestment in our energy infrastructure. As you can see from the next chart below, the demonstrated capacity of underground working natural gas storage in the U.S. has been largely in decline since 2017. Note that EIA (the U.S. Energy Information Administration) will publish its next update on the storage capacity in June 2023.

On the demand side, as aforementioned, natural gas is the most important source for electricity generation. In the United States, according to EIA data, natural gas is the most-used fuel for electricity generation, accounting for 39.8% of total utility-scale electricity generation in 2022. This is followed by coal (19.5%), nuclear (18.9%), renewables (20.1%), and petroleum (0.6%). Moreover, the electric power sector had practical limitations with natural gas-to-coal switching and hence is unlikely to find an alternative supplement in the near term. Also as aforementioned, the 2023 summer is expected to be a hot summer and has high electricity demand as a result. NOAA (National Oceanic and Atmospheric Administration) has recently released its 2023 summer outlook for the United States, and it predicts that temperatures will be above average for much of the country. The outlook also predicts that there is a higher-than-normal chance of drought in the Southwest and the Southeast.

With this macroscopic picture, next, I will analyze the role of natural gas in XOM and CVX’s income streams.

Source: EIA.gov

Role of natural gas in XOM and CVX businesses

It is a good time to clarify that the thesis does not imply that oil is not important for XOM and CVX’s income. Oil-related revenues still form the bulk of their current income. Based on data provided in XOM’s 2022 annual report, my estimate is that XOM generated about 63% of its revenue from oil-related business (i.e., about two-thirds) and 37% of its revenue from natural gas business (i.e., a bit more than one-third). The picture for CVX is very similar, again based on data from its 2022 annual report, my estimate is that CVX generated about 64% of its revenue from oil-related business and 36% from natural gas business.

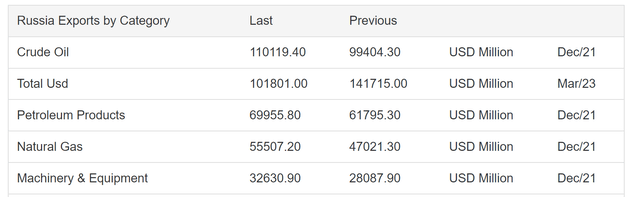

The takeaway here is that natural gas-related revenues are not the major revenue source, but they are a significant part of both companies. And my thesis is not to argue oil price is not important. It is to argue that natural gas price and demand will be a more immediate catalyst in the next few quarters. In the section above, I analyzed the price and supply-demand imbalance in a more macroscopic fashion. Here, I want to zoom in and focus on a specific aspect to further illustrate the immediacy. The next chart below shows the exports from Russian as of Dec. 2021, i.e., before the war broke out. As seen, natural gas is Russia’s third largest export, with a total trading value in the range of $47 to $55 billion. And probably some natural gas-related exports get counted in the petroleum products category as well. Now with the Russian/Ukraine war dragging on (and potentially escalating), many countries/regions have been imposing sanctions on Russian exports. These sanctions create a $47 to $55B hole in the nature gas universe that will have to be filled. Global leaders like XOM and CVX are the best candidates to fill this hole in my view thanks to their scale, reach, and compatibility of their political and legal systems to many regions that used to rely on Russian exports (e.g., the European Union).

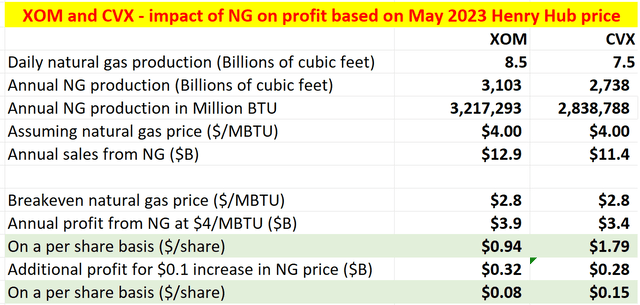

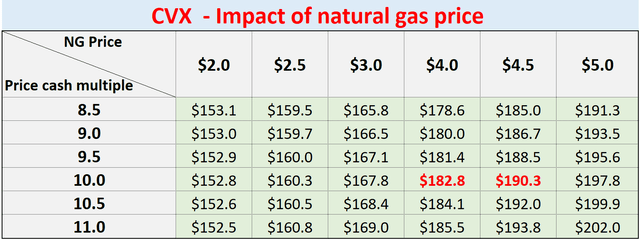

The table below provides a more detailed projection of the financial impact of natural gas demand and prices on XOM and CVX. Discussion of natural gas always involves a bit more math than oil (that is probably one key reason why it is less often talked about). The unit conversion alone (cubic feet, MBTU, et al) can be off putting to start with. Our earlier article provides a more detailed explanation if you are interested. In case you trust my math, the table below shows the end results.

These projections were based on a few assumptions, which are all conservative the way I see things. Notably, I assumed a $2.80/MBTU breakeven price for natural gas production based on this McKinsey report. In other words, the current Henry Hub price of $2.15 is far below this breakeven point, another reason why I do not see the current natural gas price as sustainable. I also assumed the level of their production to be around the historical average in recent years and the target natural gas price to be $4/MBTU (which is the long-term average price as aforementioned).

Based on these assumptions, if natural gas prices rise by $0.1/MBTU, XOM and CVX would generate an additional $0.08 and $0.15 of earnings per share, respectively.

And the next section will elaborate on the return potential created by such an EPS boost.

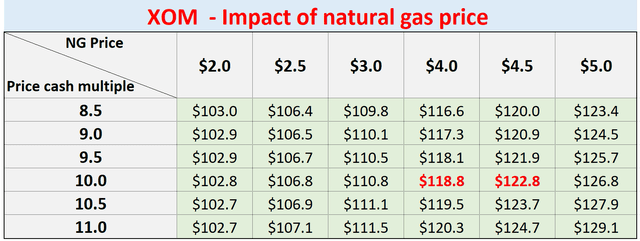

Projected prices and returns

The next two tables illustrate my projected share prices and expected returns for XOM and CVX due to impacts from natural gas as analyzed above. As seen, assuming a valuation multiple of 10x cash flow, I expect XOM’s stock price to reach about $119 if the natural gas price returns to the $4 historical average. Given the supply-demand imbalance and above-average summer cooling needs ahead, I expect a natural gas price above the historical average. And as seen, XOM’s price is projected to reach $123 if natural gas prices climb to $4.5, a return potential of almost 20% compared to its current price of ~$104. In CVX’s case, the projected price would be $182 to $190 for a natural gas price in the range of $4 to $5, again translating into a return potential of up to about 20% too. And finally, do not forget that both stocks are paying relatively high cash dividends (and both are dividend champions).

Final thoughts and risks

There are risks/uncertainties associated with both XOM and CVX. The long-term risks (policy uncertainties, transition to a low-carbon economy, et al) have been thoroughly discussed by many other SA authors so I won’t further add here. Here, I will instead focus more on the risks specific to the thesis – the drivers for natural gas demand/price this coming summer. First, weather forecasting always involves a degree of uncertainty. The summer could turn out to be cooler than what NOAA projected and thus the cooling demands turn out lower. There are also many uncertainties associated with the supply disruptions caused by the Russian/Ukraine war. The duration of the war, the specific sanctions, and the eventual outcome of the war are all unpredictable. However, the global energy and logistical network is so complicated that even if the war ends today, it will still take some time for the demand-supply imbalance to ease. It will take time for Russia to recover its production and for the logistics to work out.

To conclude, my bull thesis for XOM and CVX is based on natural gas price/demand in the near term. I am not arguing that oil prices are not important. Oil-related revenues still represent the majority of their income. The point I am making is that natural gas will serve as a more immediate catalyst for XOM and CVX due to the severe compression of current prices, my anticipation of above-average cooling demand this summer, and also the supply-demand imbalance in the sector.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.