Summary:

- Exxon Mobil Corporation’s weak Q2 results highlight the earnings risk when oil prices fall.

- OPEC+ has an estimated spare oil capacity matching the peak levels since at least 2000.

- The stock trades at ~13x ’24 EPS targets, and the risk is lower earnings when oil ultimately rolls over.

William_Potter

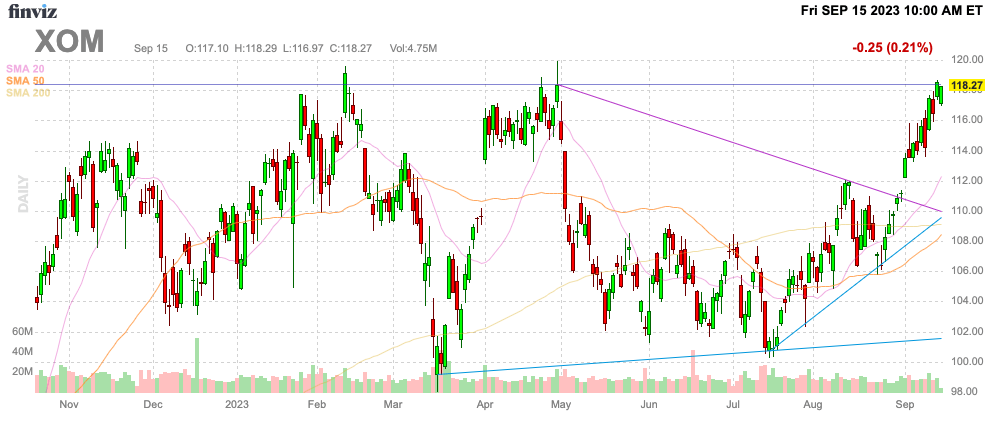

As Exxon Mobil Corporation (NYSE:XOM) takes on the all-time highs from earlier this year, investors need to remember that oil is at far lower prices now and the world has plenty of supply. The energy giant just printed a weak quarter, highlighting the earnings risk when oil ultimately heads lower again due to the space capacity. My investment thesis is now ultra Bearish on the stock with the double top.

Finviz

Unsustainable Prices

WTI crude (CL1.COM) spent most of Q2 trading in the mid-$70 range. When looking at the 5-year chart, oil is trading far above the levels prior to the Russian invasion in early 2022.

The Saudis have led an OPEC charge this year to raise prices by cutting oil production. The country just announced plans to keep the voluntary cut of 1 million barrels per day until year-end.

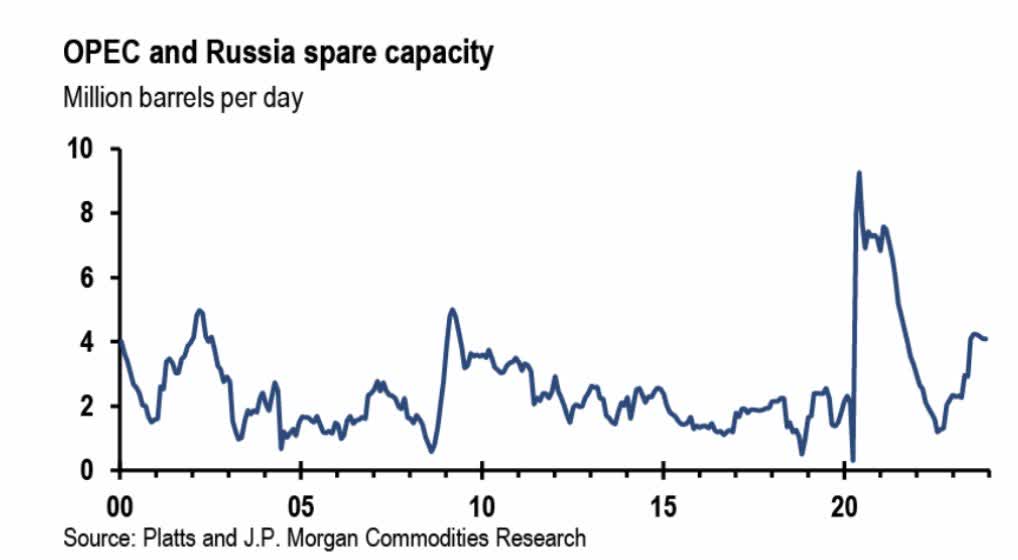

This cut was on top of additional cuts of 1.66 million barrels per day by OPEC members. According to research from Platts and J.P. Morgan, the current spare oil capacity from OPEC+ countries tops 4 million barrels per day and nearly matches the highest levels since at least 2000 outside of the initial Covid demand dip in 2020.

Platts/J.P. Morgan

With Brent back to $94, our view is that oil prices have an upside to possibly $100. At a triple-digit price, the Saudis are likely pressured back onto the market after publicly stating a need for only $85/b in order to fund the government.

As the above chart highlighted, the world doesn’t lack spare capacity. Oil prices are only surging due to OPEC+ keeping supply artificially low.

Key Q2 Insights

Exxon Mobil reported Q2’23 results just over a month ago, providing investors key insights to what normalized earnings look like now after the Russian invasion of Ukraine no longer impacts prices. In addition, the energy giant has cost cuts amounting to an estimated $9 billion since 2019.

The company only earned $1.94 per share during the June quarter. The EPS missed analyst estimates by $0.08 and was nearly $1 per share below the prior quarter’s level of $2.83 and far below the peak profits.

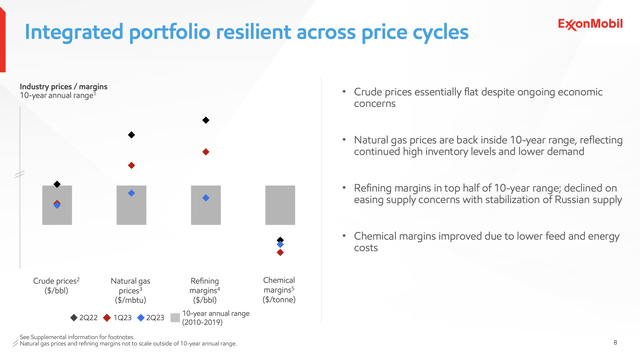

Exxon Mobil provides this handy chart highlighting how Q2 margins were more within the norm of the 10-year average margins, especially for crucial crude and natural gas prices and refining margins. The only segment with below historically normal margins is the Chemical segment.

Exxon Mobil Q2’23 presentation

The key dilemma is how to value the stock going forward. Exxon Mobil has an annualized EPS below $8 per share, making a $120 stock price very expensive at over 15x earnings run rate.

Analysts have a 2024 EPS target at nearly $9 for a forward P/E multiple of 13x. This EPS target appears more in line with current market prices for oil and natural gas.

The real risk to investors is that oil prices have been elevated for 18 months now. The risk is for a cycle of lower oil prices, similar to natural gas now.

Considering the spare capacity, oil prices could fall below $70/b and into at least the low $60/b similar to back in 2019. Exxon Mobil would start reporting even lower earnings, knowing the 2019 EPS was only $2 per share.

The company has ~4 billion shares outstanding, suggesting the $9 billion in cost savings would in theory add another $2 to EPS potential from the 2019 EPS level. Exxon Mobil would have a $4 earning potential based on 2019 energy prices, assuming all of the cost cuts weren’t replaced by additional spending in other categories.

Takeaway

The key investor takeaway is that $120 appears the peak price for Exxon Mobil Corporation. The stock is fully valued for elevated oil prices and the risk is now to the downside knowing that oil ultimately ends up at much lower prices over the next cycle.

Investors should cash out at current levels and look for a better entry level when OPEC+ no longer has the ability to freely cut output to push oil prices higher.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.