Summary:

- Exxon Mobil Corporation first quarter earnings were better than expected.

- Cash flow was likewise very strong.

- Growth and declining cost levels largely offset lower commodity prices.

- Mark to market derivative losses hid more earnings power.

- The price-earnings ratio should expand as this becomes more of a growth and income play.

zhengzaishuru

Exxon Mobil Corporation (NYSE:XOM) posted an unexpectedly good quarter. A lot of analysts and articles correctly predicted that oil and gas prices would be lower this year than was the case in the second and third quarters of fiscal year 2022. However, management has been growing low-cost production while selling (and shutting down) high-cost production and operations. That enabled a better-than-expected quarter. With more growth on the way, eventually that growth will outweigh the current forecast of lower commodity prices for the next couple of years.

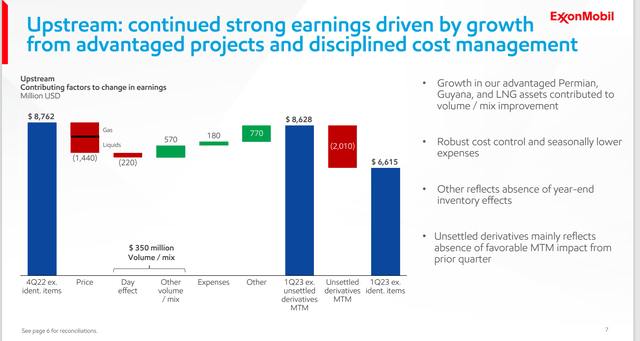

Exxon Mobil Reconciliation of Current Earnings To Fourth Quarter 2022. (Exxon Mobil First Quarter 2023, Earnings Conference Call Presentation)

Interestingly, some of the earnings potential was hidden by the mark to market derivative losses shown above. So, there is still more progress that can be made in the future just from this issue.

The slide also demonstrates how management actions have worked to mitigate the pricing issue. As the presentation demonstrates, management nearly offset the pricing issue before the derivatives. That is actually quite an impressive performance.

But there are more difficult comparisons to follow.

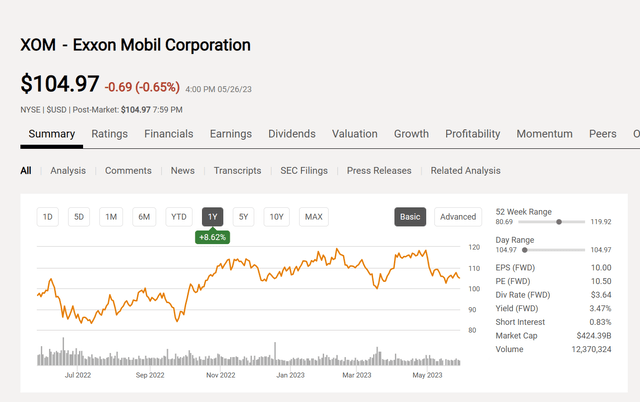

Exxon Mobil Stock Price History And Key Valuation Measures (Seeking Alpha Website May 29, 2023)

But the other thing to note is that anyone betting on a stock price decline is in the position of claiming that a relatively low price-earnings ratio will remain low or even contract. But history suggests that price-earnings ratios expand in cyclical industries as commodity prices weaken.

This has lately been a bear market, and the stock has come off its recent high prices. But the whole cost cutting theme and growth-from-low-cost new projects makes this probably a buying opportunity. I follow a lot of companies and most insiders are either buying or trying to “get in on the action.” As long as that is the case, long-term shareholders (or potential shareholders) may want to consider hanging on to a company like this until a lot of new oil and gas companies go public or a lot of insiders sell their companies.

Clearly, growth prospects are improving at this company when compared to the past decade. Management listed several growth and expansion projects. More future projects were also listed. That would suggest a higher average price-earnings ratio going forward.

A company the size of Exxon Mobil is not going to grow at the pace of some of the smaller companies that I follow. But higher single digit growth (maybe even 10% a year) combined with a growing dividend that growth enables would suggest a comfortable long-term (total) return for investors in the teens.

Of course, the company was cheaper back in fiscal year 2020. But so was much of the stock market. The difference now is that the plans management put in place some years back are now becoming apparent to the market. A large company like this one takes considerable time to actually put plans into action. But those actions are now bearing fruit.

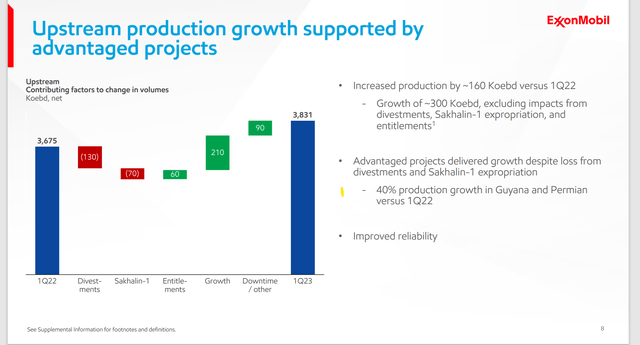

Exxon Mobil Upstream Net Growth (Exxon Mobil First Quarter 2023, Earnings Conference Call Slides)

Investors can probably assume that the growth will continue at the 10% level. But eventually, the deductions due to sales or expropriation will eventually decrease.

More to the point, many of the deductions are a net plus to cash flow because they were high cost. The growth is in low-cost projects with low breakeven points.

What is going on with upstream happens similarly in the other divisions. Management is always getting rid of products or projects that no longer “pull their weight” while finding new, more profitable ways to make money for shareholders.

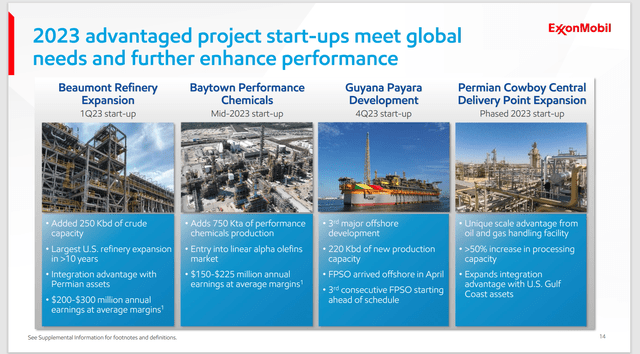

Refining is another area where there is a cycle of high-cost capacity being shut down while lower cost new capacity comes online. Management added some lower cost refining capacity to handle the growing Permian production.

Typically, Exxon Mobil finds production and then decides whether or not to add downstream and other capabilities. Investors can expect a review of the Guyana situation for a possible downstream expansion in the future as that project continues to build volume. This is something that the company has done for years. That means there are more growth prospects in the long-term future of the company than management currently states is “on its plate.”

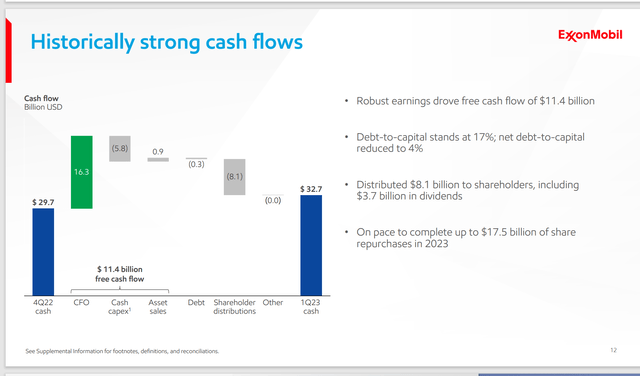

Exxon Mobil Cash Uses First Quarter 2023 And Ending Cash Balance (Exxon Mobil First Quarter 2023, Earnings Conference Call Slides)

The net result of all of this was very strong cash flow in the first quarter. Management has clearly met its goal of $30 billion cash balance and the debt is at a level management is comfortable with.

Therefore, the stock repurchase program can continue, and dividends are likely to rise faster than earnings as a result. Management noted they are well on their way to achieving the cost savings that were originally envisioned.

What is likely to happen after this is another cost savings campaign as technology continues to move forward. In this day and age, companies can no longer “sit still” as they will lose their competitive position very fast. This management appears to (finally) recognize that reality.

The Future

Management is now continually searching for new projects that will continue the growth program that has really just begun to become apparent to shareholders.

Exxon Mobil Presentation Of Material New Project Completions (Exxon Mobil First Quarter 2023, Earnings Conference Call Slides)

Clearly, more growth projects will come online to add to the increased revenue and lower cost structure of the projects already complete. Some will be a one-time event. Others, like Guyana, are likely to repeat several times well into the future.

Since this slide was made, the Guyana Partnership has approved Uaru for the fifth FPSO development in Guyana and the fourth FPSO has arrived to begin the hookup process. First oil for the fourth FPSO is on target for the fourth quarter.

Now one FPSO is not nearly as significant for Exxon Mobil as it is for the smallest partner Hess Corporation (HES). However, Exxon Mobil has another discovery elsewhere in a different partnership that is being evaluated. The possibility of two or more future projects in Guyana and Suriname could potentially add a lot of upside production potential in the future that very much would be significant. For now, Guyana is world-class-low-cost production that is replacing aging high-cost production (and that may be very significant to earnings).

But the key here is that management has changed direction in a material way from the company of the last decade or so. Therefore, the stock price is likely to have a very different history in the future than the price history of the past.

The market likes a growth story. For the first time in quite a while, a growth story is becoming apparent to the market. Investors can expect that story to become more apparent to the market as the future unfolds.

The continuing cost reductions that occur with this company and really throughout the industry may well usher in a period of relatively cheap gasoline and other oil-based products. We as a country appear to have a lot more unconventional reserves than we ever had conventional reserves. The goal has to be to produce those reserves at an economic cost. Unconventional is a very young industry with a lot of frontiers yet to be conquered. Exxon Mobil appears to be in the forefront of that and offshore.

Even though the Exxon Mobil Corporation stock price is up considerably from 2020, it likely has a lot more to go now that the company is heading towards an income and growth strategy. This stock is a consideration for anyone looking for a long-term return in the teens with the relatively low risk of a diversified (oil and gas) company like this one. Oil and gas will be needed for a very long time well into the future. So, Exxon Mobil Corporation has a very long time before there is a future to worry about.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HES XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I analyze oil and gas companies like Exxon Mobil and related companies in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies — the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.