Summary:

- Exxon Mobil is in growth mode for the next few years, aiming to take production from 3.7 mm BOEPD to 4.3 mm BOEPD.

- It has the infrastructure in place to do it.

- A robust bull case for the stock is presented at current levels.

Igor-Kardasov/iStock via Getty Images

Note – this article appeared in the Daily Drilling Report, December, 27th 2022.

Introduction

The problem with writing about Exxon Mobil (NYSE:XOM) is that it is such a colossus, there is no way to really do it justice in the 1,500-2,000 words Seeking Alpha articles usually run. You have to pick a few topics and run with them. There’s also the fact that XOM is heavily covered on this platform, with 2-3 articles dropping daily at times. So there are a lot of opinions out there about the company. Some authors are telling you to buy XOM, some others are using the same fact set to encourage you to sell or hold.

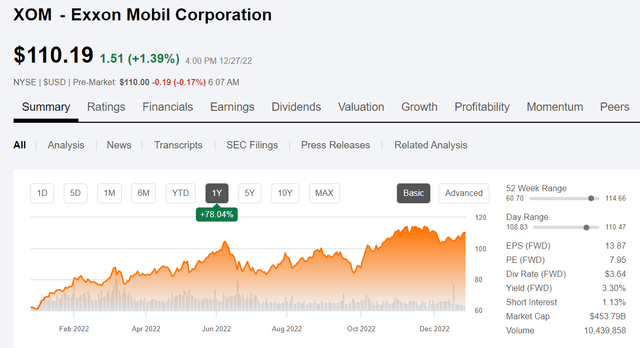

XOM Price Chart (Seeking Alpha)

Here’s my view – XOM is a buy. Even with the run up since October, it is still a buy. The company is buying back shares, with an authorization of $50 bn that can be executed over the next several years. There is some controversy around this plan that I really don’t understand. So that will be one thing we discuss.

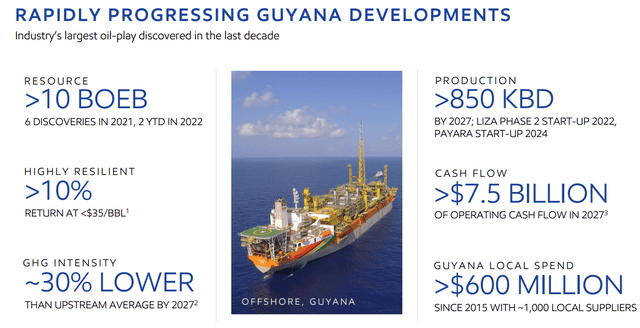

The next topics will be the three engines of prosperity for XOM for at least the next decade. The Permian and Guyana will throw off cash at an increasing rate through 2027 at least in the case of the Permian. In the case of Guyana, we haven’t really seen an upper limit. By 2025 XOM will be producing >800K BOEPD from Guyana, and has a number of discoveries now under FID review.

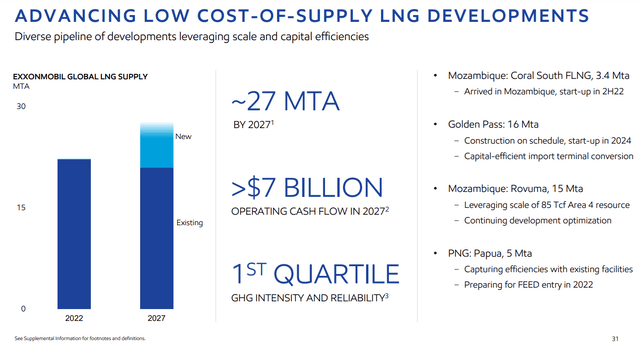

XOM also has a solid footprint in LNG and is on track to deliver 27 mtpa in 2027 from 4-key projects sprinkled around the world. This capacity advantages their Permian production and the African and PNG projects are favorably located for European and Asian demand.

If you’re looking for a fixer upper, XOM’s not it. It is easily the best house on the block.

Thesis for XOM

XOM is the largest of the integrated American oil companies, exceeding Chevron’s (CVX) market cap by ~40 bn or so. It is primarily a producer of oil and gas, as well as petrochemicals. XOM has demonstrated almost unmatched fidelity toward its shareholders, with an unbroken record of dividend payments that goes back to 1995. It kept faith with shareholders in 2020, fully funding its dividend at the cost of around $20 bn in borrowings. (This at a time when the world was collapsing!) XOM is generating the cash to fund its just raised and currently 3.3% yielding dividend, and will continue to generate enough cash to maintain it in any oil price scenario we consider likely. It is also returning cash through stock repurchases, paying down debt and internally funding growth capex. There is nothing not to like about this company that is selling now for less than 5X TTM.

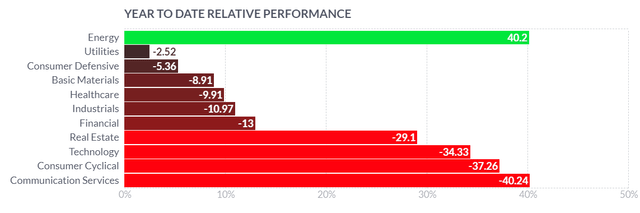

There is also the “Best House On A Bad Street” argument to be made for XOM, and the entire petro-energy sector, for that matter. The chart illustrates that there was one safe haven in the broad market in 2022, Energy. I will posit that the chart for 2023 will look much the same given the turbulent state of the macro economy.

Market sector graph (Barchart)

XOM has outperformed the broader energy sector, beginning 2023 near the top of its 2022 range, and gaining $197 bn in market cap since the beginning of the year. The catalysts that drove this performance, largely higher energy prices this year, are still in place for 2023. Most analysts are predicting oil prices at or above $100 for the year, which will improve realizations from Q-4 2022 on, if this pans out.

Finally, I am impressed with Darren Woods who, unlike some other oil company CEOs, has decided to publicly and firmly push back against the anti-oil crowd. I wish more oil CEO’s would engage in truth-telling of this kind. Having the courage to buck the trend toward climate change blather is exemplary. History tells us that appeasing tyrants doesn’t end well, and it’s time the industry became more vocal about the contributions we make to energy security.

The stock buyback

The company has a three-year window to execute this $50 bn authorization. XOM stock as recently October has dipped into the low $80’s, before rebounding into the mid-$115’s. A point close to where it sits now. The low volatility of the stock is encouraging.

In regard to the buyback. This will reduce the float by as much as 13-15% using a range of $80-100 per share. This will relieve the company of as much as ~$2.275 bn in annual dividend payments when it is fully executed, and adding still further to the safety of the remaining dividends for the long term.

Let’s face it, the company could do other things with the cash. It could buy a competitor. Perhaps Devon Energy (DVN), but why? XOM is already the biggest cat in the jungle, and they have a history of overpaying for acquisitions-think XTO. Add to that, they are a smaller company than a few years ago, and there is only so much they can manage successfully. Paying out this money as a special dividend might be an option, but that’s a one-time sugar high, that might actually punish the stock in the following quarter when they revert to the fixed dividend, as happened to DVN. Heck… it could buy Twitter (now private) off Elon Musk. I bet the Chief Twit would make them a deal. XOM has done dumber stuff with money. Anyone remember the (Mobil) purchase of Monkey Wards? It wasn’t long before they wished they’d bought back stock.

I suppose as a final point, the prevalence of the stock buyback in the industry is comforting. “They’re all doing it.” I know, I know… your momma used say rhetorically when you said this to her, “Well, if everybody was jumping off a bridge, would you…?”

The point remains, can everybody in the industry be wrong? Perhaps, but there is comfort in following a trend. It suggests that other managers of capital are looking at the market and coming to the same conclusion as XOM. That being, there is no time like the present to pump up the balance sheet.

Sure, if the oil price collapses, stock buys in this range may not look good in a historical context. I get it. The fact will remain permanent costs have been reduced and in a “fortress-like” strategic move the company is upgrading its balance sheet to withstand the lean times that inevitably come in this business. Times like a couple of years ago.

Catalysts for continued growth

XOM has a bunch of low hanging fruit to pick over the next few years. This list isn’t complete by any stretch, but its illustrative.

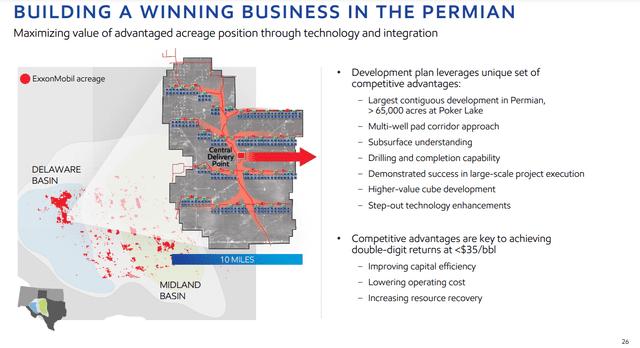

The Permian

With over a million acres under lease, XOM has one of the largest footprints in this region. It enables the factory-like production technique that has the company “stamping” out wells in high style, with a 2027 target of 800K BOEPD. Drilling 15K foot horizontals is well within the company’s scope. Some Sakhalin wells had HZ legs close to 40K feet.

Guyana

This country is just the gift that keeps giving. With a string of 20 or so successful finds over the last 7 years, it is the global exploration success of post-2010. There is nothing to match it.

XOM has already FID’d four FPSO projects and forecasts pumping ~850K BOEPD of mid-range crude, by 2027, with several more FIDs in the pipeline. Exploration drilling continues, so the ultimate upside in terms of production isn’t really known. One thing I can tell you, is that traditionally you find oil… where you’ve already found oil. So in a historical context, the prospects for future discoveries are good.

LNG

LNG is a story that should pretty well tell itself by now. The world is eager for energy and reducing the carbon footprint of energy supply. LNG ticks both boxes and XOM will be a major player in this needed resource.

Financials

XOM’s financials are pristine, certainly as compared with what they were a short time ago. They say money doesn’t cure everything, but it sure eases the pain. With TTM cash flow of $76 bn and the prospect of similar returns next year, the company can easily afford its capex of ~$16 bn, dividend of $15 bn, and debt reduction, stock buybacks, interest and other incidentals. For the first time in nearly a decade, money is one problem the company doesn’t have.

Risks

Well those other guys could be right. Oil prices could tank. The wind could start blowing over in the EU and UK. Heck our intrepid Secretary of Energy just announced a breakthrough in fusion energy that will put mini-reactors in people’s backyards in a few years. Lots of stuff could happen.

In the event any of what I’ve mentioned does come to pass, shares of XOM might suffer.

Your takeaway

XOM is conservatively priced. I wrote last year that a share price of $130 didn’t seem excessive to me. That number was based on a cash flow multiple slightly higher than the current 6X. A 7X would get them to that $130 level. For reference, Chevron trades at a 7.5X. It doesn’t seem unreasonable for the market to award XOM a 7X. That projects modest growth from current levels, so the company can be bought at present levels. But, as always, watch for your own entry points and for heaven’s sake… layer in. No one is suggesting that you go out and buy a full position at the current price!

Should the oil price rebound as I am suggesting it will, higher run rate cash flow, ~$100 bn, might deliver that higher multiple. Analyst estimates for the stock range from $90-$138, with the average being $119. So my call isn’t too far-fetched.

I’ll close by saying that XOM should be in everyone’s portfolio for growth and income. I wish it was in mine, and when I can shift some money around I will pick an entry in the current range.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in XOM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not advice to buy or sell this stock or ETF in spite of the particular rating I am forced to select in the SA template. I am not an accountant or CPA or CFA. This article is intended to provide information to interested parties and is in no way a recommendation to buy or sell the securities mentioned. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to do their own due diligence before investing their hard-earned cash.