Summary:

- Exxon Mobil’s third quarter report is expected to be strong due to the increase in oil prices and margin expansion.

- OPEC’s production cuts are causing an increase in heavy oil prices and a decrease in the discount. This threatens the profitability of the US refining industry.

- The completion of the Trans Mountain pipeline in Canada may permanently change the relationship between heavy oil and light oil, impacting the refining industry’s profits.

- The Beaumont Refinery expansion will handle Permian light oil production. This could begin a refining industry trend.

- The third quarter also will benefit from new low cost production and the sales of high cost production.

Jeremy Poland

Exxon Mobil (NYSE:XOM) has long been a leader in accommodating market changes. Some changes are obvious like the increase in the price of oil that should lead to a very good third quarter report as well as a darn good start to the fourth quarter. In facts, profits could be heading towards second quarter, 2022 levels (even though they are clearly not there yet). Less obvious is the change in the relationship of heavy oil to light oil that may decrease a profit source that has made money for the company and the whole United States refining industry for some time.

Narrowing The Pricing Gap

The decrease in the gap between heavy oil and light oil prices is currently happening because OPEC (primarily Saudi Arabia when it comes to heavy oil) is cutting back on production as are other heavy oil suppliers.

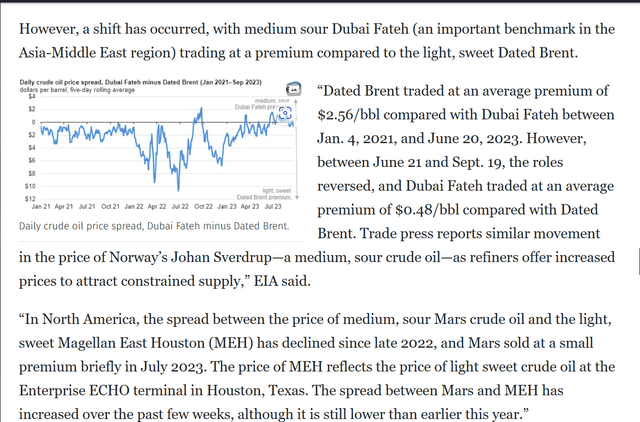

Oil & Gas Journal Article Noting the Change In Relation Between Heavy Oil And Light Oil (Oil & Gas Journal Article September 25, 2023)

This movement of oil prices threatens a long-standing US refining industry profit making strategy. For a very long time, the United States has mostly exported the light crude produced by the unconventional wells while importing the heavy oil (even heavy oil with sulfur). The industry then made an “extra” profit by upgrading the heavy oil into the same products that were made with light oil while capturing the extra revenue of the discount to the finished product.

But when that discount no longer exists, then the industry does not make an extra profit that justifies the assets needed for the extra refining processes. If this was a temporary phenomenon, then investors could put it down to just the usual volatility in pricing that will soon fix itself.

Trans Mountain Pipeline

But the Canadian completion of the Trans Mountain pipeline. Threatens to change this relationship permanently. This long-delayed project is now over 80% complete. Even with an expected reroute in some places, the pipeline should be in operation within the next couple of years (no guarantees, of course).

This will allow a significant amount of Canadian production that was available to the United States with the usual heavy oil discount, to be exported. The volume carried through the pipeline will likely be significant enough to enable the discount between heavy oil and light oil to narrow. It may narrow to the point that the profit the United States has long made on importing heavy oil while exporting light oil will decrease or maybe even disappear.

Should that prove to be the case, the refining industry will be in for at least a period of lower profits during cyclical high points.

The Exxon Mobil Answer

Exxon Mobil normally integrates where it has a decent upstream business. As a general rule, the company builds the upstream business first and then adds other divisions as a value-added way to grow for that particular upstream business.

In the case of the Permian, the company may have inadvertently begun a refining trend.

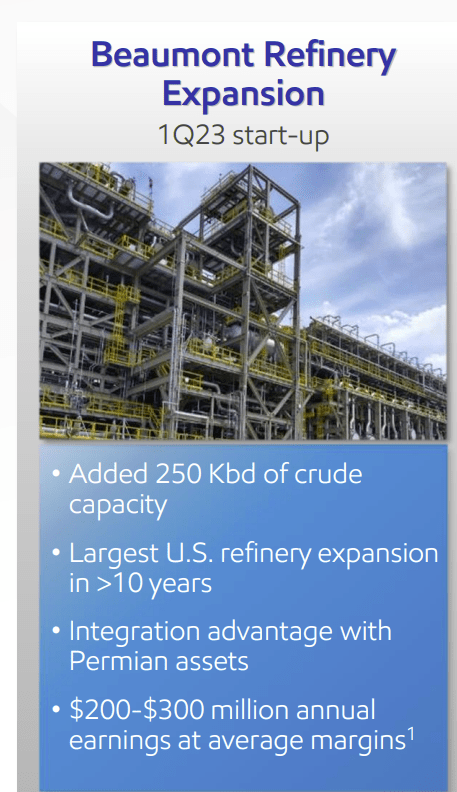

Exxon Mobil Announcement Of Refinery Expansion Completion (Exxon Mobil First Quarter 2023, Earnings Conference Call Slides)

This Beaumont refinery expansion is actually the size of most middle-sized refineries (standalone). So, while many talk about the lack of new refineries, the industry is working around that by expanding existing refineries to make up for the lack of new refineries. It gets the industry to the same point as building new refineries.

What’s even more interesting is that this refinery will handle the light crude that the company produces in the Permian. This is a variance from the industry strategy noted above of exporting the light crude while importing the heavy crude to make a profit on that spread. It could mean that the spread will not be worth the effort in the future. What we will have to see is how many more expansion projects happen with the idea of handling light crude.

The Third Quarter

The third quarter itself is going to benefit from some of the best oil pricing so far in the current fiscal year. Most investors remember that prices peaked roughly in the second quarter of fiscal year 2022 and it was downhill after that. This year began with a fair amount of pessimism about oil prices despite the fact that the industry by and large, made decent profits at those prices.

I have been reporting for some time that well breakeven points have been dropping. That should of course lead to lower corporate breakeven points and a more profitable industry at various oil prices.

Exxon Mobil not only benefits from higher prices, but it also benefits from a drive to lower costs. This project has been aided by previously mentioned sales of high-cost production replaced by low-cost Permian production (that the new refinery expansion project will serve.

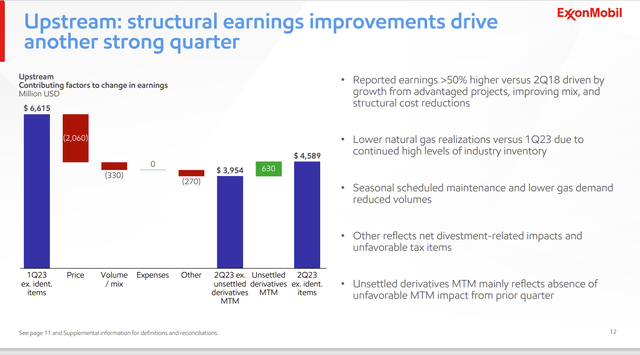

Exxon Mobil Second Quarter 2023, Earnings Comparison To Second Quarter 2022 (Exxon Mobil Second Quarter 2023, Earnings Conference Call Slides)

Management mentioned in the next slide that Guyana and the Permian business were growing at roughly a 20% rate. What that is likely to do is begin to slowly turn the expenses (now at zero) favorable in the future.

The other thing likely to happen is that unfavorable price effect shown above will likely disappear in the third quarter (or at the very least it won’t be as bad as the comparison above which was against the peak pricing last fiscal year).

Since oil prices remained relatively weak towards the end of the fiscal year, the comparisons should become easier on the pricing front. In the meantime, management keeps adding new low-cost production while periodically selling the higher-cost production. That is going to widen the company margin even if oil prices veer slightly from expected levels as commodity prices often do.

This would include the world-class low breakeven (on Brent pricing) of Guyana:

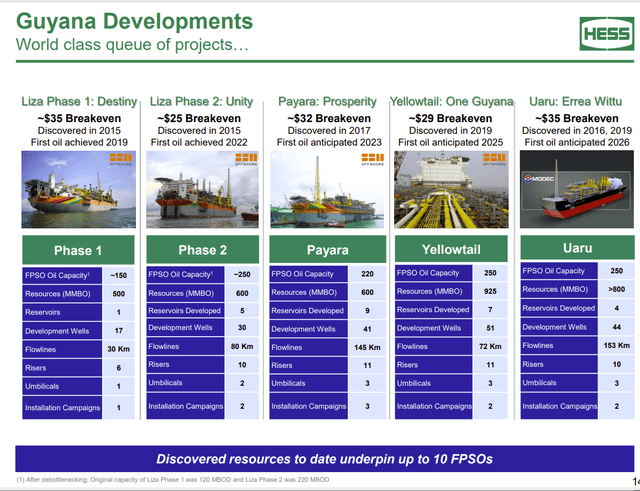

Hess Presentation Of Approved FPSO Projects (Hess Presentation At Barclays CEO Energy-Power Conference September 2023)

Exxon Mobil is the operator of the partnership with Hess (HES) and is the one that is bringing all the projects shown above online. The startup of the Payara FPSO will begin in the fourth quarter. This year benefitted from the first two projects shown above with the Lisa Phase 2 reaching its full potential about six months after startup.

Exxon Mobil immediately began to work on debottlenecking projects to allow (eventually) all three FPSO’s to process production above the nameplate amounts shown above. Exxon Mobil has also rearranged the production strategy in an attempt to hold down that breakeven point by holding down costs.

The production from the numbers above is 620 BOD (as natural gas is reinjected). But that production should grow a good 10% above that and possibly more. In round numbers Exxon Mobil would get 45% of 700,000 BOD which is significant even for a company the size of Exxon Mobil. That number will increase when the next FPSO begins operations in 2025.

John Hess also mentioned in the latest conference that the partners have an extra year to make up for fiscal year 2020. The advantage is that they have six ships operating whereas in 2020 they had three ships. This is important because the more acreage that moves into “developed” territory, the less acreage remaining will be part of the negotiated giveback to Guyana next year.

The expected robust pricing environment may well mean that the partnership would add yet another ship or two depending upon the partners view of oil prices. (The same thing happens with the Permian as higher prices would mean more money to drill.)

Cost Advantages

Exxon Mobil was one of the few companies to drill right through the pandemic when it could. This allowed the company to take advantage of rock bottom prices offshore and on shore. The cost advantages achieved by such a strategy are the same as a competitive moat as those advantages last the life of the well. Offshore, that is one very long life. Onshore is close to the same.

Exxon Mobil could be doing the same thing with the refinery expansion as it is adding refinery capacity that can handle light oil at a time when really no many are even thinking about that. Generally, the costs for at least some of the equipment will be low. Exxon Mobil will be done long before the “mad rush” to add additional capacity to handle light oil begins.

Key Ideas

Exxon Mobil will clearly benefit from rising oil prices just like the rest of the industry. But it will also benefit from replacing high cost production with low cost production.

In addition, management may be thinking ahead to a time when it no longer benefits the refining industry to handle heavy oil (with or without sulfur). The latest refinery expansion projects will process Permian light oil.

The last benefit comes from the fact that in Guyana all potential emissions are reinjected into the reservoir which leads to an industry leading low emissions project. This likewise puts the company in the front of the industry with low emissions that are actually common with offshore projects.

Commodity markets change all the time. This is one company that appears to be in front of the changes. That is a very good sign for the future.

The company is likely a strong buy consideration in that profits will likely outperform expectations as the cost structure continues to decline. Management has noted in the past that meeting the original goal means that the goals change to accommodate such an accomplishment. So, cost cutting is here to stay for a very long time to come. This company is becoming a growth and income vehicle.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM HES either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation for the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits its own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Long Player believes oil and gas is a boom-bust, cyclical industry. It takes patience, and it certainly helps to have experience. He has been focusing on this industry for years. He is a retired CPA, and holds an MBA and MA. He leads the investing group Oil & Gas Value Research. He looks for under-followed oil companies and out-of-favor midstream companies that offer compelling opportunities. The group includes an active chat room in which Oil & Gas investors discuss recent information and share ideas. Learn more.