Summary:

- XOM is trading at multi-year highs and is ripe for a pullback with Q1’s earnings release.

- We think this will create a buying opportunity investors should not ignore.

- Current investors should protect profits while monitoring for a lower buy-in point.

- XOM has also had discussions with Pioneer Natural Resources regarding a merger. We offer a brief look at the drivers for this deal.

- If we do see a pullback post earnings, investors should be ready to pounce. XOM is a sell at current prices.

XOM and PXD hunh? Hmm. Got any carrots? Gimme a carrot and I’ll give ya the low down. GlobalP/iStock via Getty Images

Introduction

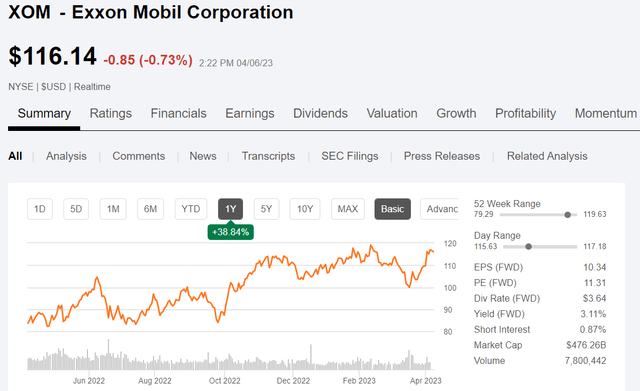

Since last summer Exxon Mobil (NYSE:XOM) has rocketed higher, gaining about 30% over this period. 30% growth in essentially 8 months is very unusual for a big-cap, value stock like XOM. Admittedly a good bit of this has come in the last couple of weeks, and the company is trading at 11X earnings on a forward basis. Caution at this point is probably well-advised over the short term.

XOM Price chart (Seeking Alpha)

Analyst earnings forecasts have come down over the last three months and currently sit at $2.65 per share for Q1. That’s a step down from Q4 2022’s $3.07, and full year $13.26. Price estimates vary from $110 to $148, with a median of $127. I honestly think that the $148 figure is unrealistic with oil prices below $100 per barrel.

On a forward basis, the company is on track to earn ~$10.50 per share in 2023, although that will probably be boosted in the second half thanks to higher oil prices. In any scenario, I believe it’s probably a safe bet that XOM shares are going to sell off a bit when earnings are released – unless they beat substantially.

I think that could lead to some Q2 softness that will create an excellent entry point in the mid-$80s for this oilfield titan. Long term, XOM is a company you want to own, and I will tell you why in the rest of this article.

The future of oil

There’s a lot of malarky being tossed around about an “energy transition.” I recently had an expository tantrum on another site regarding this silliness. When an old mud engineer pitches a hissy-fit, you don’t want to be around. I will be more restrained here, taking heed of the standards of decorum around Seeking Alpha.

There is no energy transition! Period, full-stop, end of story. Stop this 2030, 2040, and 2050 silliness, none of these deadlines are going to happen. There is energy “addition,” in form of wind, solar, biofuels, and H2. These sources will share the global energy load along with petroleum sources as long as there is a need for individual transportation and travel, we retain an industrial economy, and we like to eat regularly.

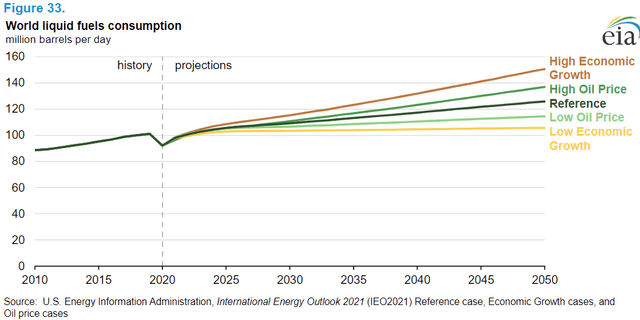

Below is an EIA graphic, a data source to which we regularly turn to in this blog, forecasting liquid fuels consumption through 2050. It might as well be 2100, it won’t matter. Your grandchildren will be pulling up to a gas pump somewhere in the distant future to fill the family jalopy, same as you did. That is, if they’re not pounding rocks in a cave due to the collapse of modern civilization. Let’s not be morbid, I have full confidence the world will alter its present course in time for the former scenario to come to fruition.

This graphic is instructive. It tells you that the good scientists and statisticians at the Energy Information Agency (EIA) have concluded, contrarily to the stated aims of the current Executive branch of government, that oil and gas have a bright future as far as the eye can see. In no case do we ever use less oil than we are using now, and in most cases, quite a bit more will be needed.

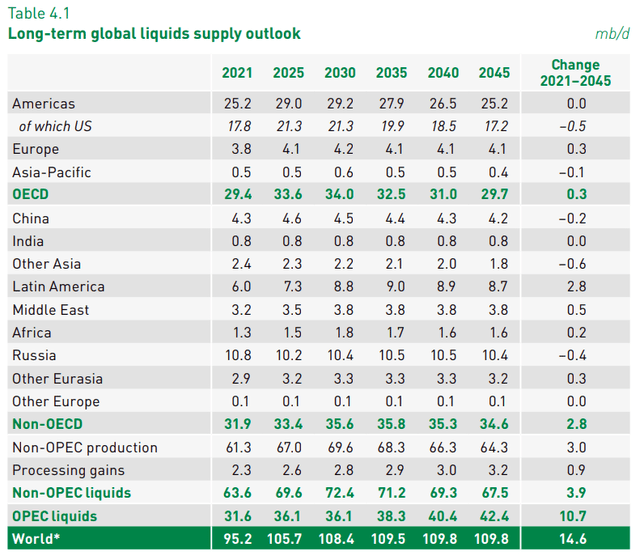

Let’s also be generous and allow that the good sheikhs who run OPEC know a thing or two about the future of fuels. Below is their estimate through 2045 which seems even more conservative than the EIA estimate above.

OPEC liquid fuels forecast (OPEC)

Ok, this is turning into a rant and I will stop here. I hope I’ve made a case that oil and gas will be relevant for a long, long time.

Reasons why XOM will throw off a ton of cash for the foreseeable future

The Permian

XOM is one of the kings of the Permian, with over a million acres owned in fee and under lease. I discussed their footprint in my last article “Best House on a Bad Street,” and I will commend you to that for more detail. They were trading there at $110 and I gave them a buy, so thanks to the rally of the last couple of weeks, I can claim a win. Sort of. Nothing to brag about, but at least it’s not down!

One point I will make is technology matters in driving down cost, and no one knows the various aspects of driving cost out of an operation like XOM. I’ve worked for these guys in my past, and the focus on cost is relentless. When XOM tells you they are going to be the low-cost producer, you can believe it. The 750 or so rigs now working can stay ahead of natural decline rates, but there is a tipping point below where we would see a sharp drop off.

XOM plans to be producing a million barrels a day out of the Permian by 2027. At today’s current level of 600K, that requires a 12% CAGR and gets you comfortably through that million on schedule. To get there they have to replace ~128K BOEPD of decline and add about ~80K BOEPD of new production in 2023, and then the Law of Large Numbers really kicks in. For 2023 XOM will need to drill several hundred wells in the Permian to achieve this result. They have about $4 bn budgeted for the Permian this year, and that should deliver those 350 or so wells, figuring $10-12 mm per well.

The payoff will be the $20 bn or so of EBITDA this production will put on the balance sheet then, and of course incrementally in between now and then.

Before we leave the Permian, let’s have a quick chat about the potential of a merger between XOM and Pioneer Natural Resources (PXD). This was bound to happen as the smaller players have mostly been gobbled up by companies the size of PXD, and it takes a bit to move the needle for XOM. PXD would move the needle for XOM in a big way. Doubling their production to ~1.3 mm BOEPD, adding $11 bn of EBITDA – at $80.00 per bbl, and adding 2.2 bn bbls of 2P reserves in one fell swoop, if they can pull it off, it’s a no-brainer.

A no-brainer for a price, right? PXD trades at 5X EBITDA and $80 per flowing bbl, so the metrics are right. But, Scott Sheffield is a horse trader from the old school – he buys cheap, and that likely means when he has this one chance to ring the brass bell, he sells dear. We’ll see.

There’s a lot of synergies here for XOM. Their Midland basin acreage is spotty and most of it isn’t really conducive to the 15K foot laterals the industry is fixated upon now. PXD would solve a lot of problems for XOM and I expect Sheffield knows it. If the deal goes it will be at a pretty good premium to today’s prices in my estimation.

I will have a longer article out soon with my more detailed take on this deal.

Guyana

XOM drilled into a “river” of oil offshore Guyana. More properly, I should call this the main channel of the fluvial outflow of an ancient river or antediluvian tidal plain that settled into the deep basin between Guyana and Suriname. 19 discoveries and 11 bn of booked reserves later, XOM has the prospect of flowing a ~million barrels a day from subsea wells by 2027. There is no question that XOM is in the sweet spot of this bonanza.

Competitors APA Corp. (APA) and Big Daddy TotalEnergies (TTE) are unable to declare an FID sanction on their finds in Block 53, offshore Suriname, despite a string of high-quality discoveries since 2020. Recent disappointments have put a damper on Suriname’s prospects of offshore riches. That’s why they call it “exploration,” I guess.

Guyana will be the gift that keeps on giving to XOM shareholders for decades to come.

LNG

The case for LNG as an alternate fuel, mostly displacing coal in third-world countries has been made over and over again, and I won’t bore you with further repetition. XOM with LNG projects at Golden Pass, USA, Rovuma, Mozambique, Gorgon, Australia, PNG LNG, Papua New Guinea, Qatar North Field, Qatar, and a few places I am sure I’ve left out, is on track to be one of the top global producers of this fuel as the projects come on line in the next few years.

Refining

Oil companies got into the refining business early in the last century to provide retail distribution for the crude oil they were producing. There are fat and lean years in refining and over time many of these companies have exited the business or sold off their operations. Many of the top refiners today were formerly part of what used to be called an integrated oil company. XOM has retained this capacity internally, and recently expanded their massive Baytown complex, adding 250K BOPD to bring their total to 630K BOPD. With the loss of over a million barrels of refining capacity in this country, this is good news for drivers hoping to fuel up. It’s good news for shareholders of XOM as well. Refiners are doing quite well with most of the larger ones Valero (VLO), Marathon (MPC), and Phillips (PSX) enjoying record profits and margins, and share prices in recent times.

Carbon Capture

XOM is on track to begin printing cash in the CCUS sector with their Houston Ship Channel site. With a recently signed contract with Linde (LIN) to store 2.2 mmpta of CO2, beginning in 2025. I am on record as saying this is pure silliness – nature has provided us with two perfect carbon capture mechanisms called oceans and trees. But I’ve never said it won’t make money! Thanks to the ironically named Inflation Reduction Act (it kills me SA won’t let me put emojis in their template) this practice will pay two ways.

Rystad thinks this will be a $55 bn USD business by 2050. Who am I to disagree? Using their figure of $100 per ton for the “deadly gas,” XOM will see gross billings of a couple of hundred million from this contract alone. If you’ve never been, the Houston Ship Channel is a target-rich environment with probably the largest concentration of industrial sites in the world.

Risks

XOM’s biggest risk is a fall in oil prices. It is the recent fall that I am postulating that will create an attractive entry point for new investors. Crude realizations are likely to be in the $70s for Q1, 2023 and compress cash flow and EBITDA. Another big rout – which can’t be discounted could weaken shares prices, but only temporarily in my view. We saw this in 2020 when XOM fell into the middle $30s and provided a historic buying opportunity for bottom-fishing investors. You never say never in this business, and should that scenario arise, back the truck up.

XOM also faces climate litigation risk that can’t be quantified at present. They are a fat target and may one day face the prospect of being held liable for Anthropogenic Global Warming-AGW. In my view, this will create another buying opportunity similar to what’s happened with cigarette companies. I actually wrote an article postulating this a while back. Give it a read. Exxon Mobil: The Making Of A ‘Sin’ Stock.

Your takeaway – Oil is worth something

I titled this article the way I did for a reason. Something that often gets lost in discussions is XOM’s product has intrinsic value. It’s worth something. The value rises and falls according to market conditions, but at the end of the day, we can’t do without it. I bring this up because some authors are pointing to XOM’s fairly paltry yield and recommending Treasuries at current rates. That case can be made, but do Treasuries have intrinsic value? Meaning can you put a T-bill in your gas tank and roll on down the road? Uh-huh!

Ask yourself, at a time of high inflation what asset better holds its value? Oil or T-bills? I will guarantee you it’s not T-bills at 4-5%. The money supply has been vastly increased recently creating inflation, and then there is that pesky little problem of the trillions of dollars held by other countries if King Dollar is dethroned as the world’s reserve currency. Uh-huh! The answer, of course, is real gold and black gold. XOM has a lot of it with over 17 bn bbl of proved reserves. That’s a lot. At the company’s projected daily rate of 4.2 mm BOEPD, it’s ten years of production, if they never found (or bought) another barrel.

There is a temptation to revert to Discounted Cash Flow analysis to put a value on this trove. XOM does just that in their 2022 10-K, putting the consolidated value of all cash flows from oil and gas at $190 bn. Great. What impresses me more is the likelihood that XOM will produce 3,650,000,000 bn barrels of oil over the next 10 years, or just over 1% of global demand. And, has the very real prospect of producing at those levels for decades to come. Real, tangible goods that the world desperately needs. Keep your eye on what matters.

If XOM were to fall into the $80s post-earnings, I would rate them again, a strong buy. At today’s price, they trade at 4.75X EV/EBITDA and $128K per flowing barrel. Not in the bargain bin on either figure. At $85 those figures would be ~3.3X and ~$90K respectively. Much more competitive with other oil producers, and present a solid entry point for a high oil price scenario, where a run toward those higher analyst estimates might be realistic. Not to mention a yield on cost of 4.2%, giving those T-bills a “Run for the Roses” so to speak.

XOM is somewhat overvalued at present and investors should make their own asset allocation decisions with that in mind. Long term, and particularly if the PXD deal goes forward, XOM is a company you want to own for steady growth in a higher-priced oil environment, and a modest income. I would remind dividend investors that XOM kept faith in lean times and actually borrowed money to pay their dividend obligations in 2020. I’ve said before that’s character, and character is worth something.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is not advice to buy or sell this stock or ETF in spite of the particular rating I am forced to select in the SA template. I am not an accountant or CPA or CFA. This article is intended to provide information to interested parties and is in no way a recommendation to buy or sell the securities mentioned. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to do their own due diligence before investing their hard-earned cash.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.