Summary:

- Exxon Mobil stock has provided zero return since November 6, 2023, while the S&P 500 grew by 15%.

- Exxon’s latest quarterly earnings missed estimates, with revenue declining by 12% and adjusted EPS shrinking.

- XOM is currently around 22% overvalued according to the dividend discount model analysis.

Bloomberg/Bloomberg via Getty Images

Investment thesis

My previous bullish thesis about Exxon Mobil (NYSE:XOM) did not age well since the stock provided zero return since November 6, 2023. At the same time, the S&P 500 grew by about 15%. After analyzing recent development and their anticipated impact on energy commodity markets, I must concede that my earlier assessments were completely off the mark. I have overestimated the positive influence of geopolitical uncertainty and OPEC’s ability to sway oil prices. It appears that the oil supply will remain resilient, and major economies are unlikely to deliver positive surprises in 2024. At the same time, XOM is traded with a substantial premium, which I consider unjustified given the current trends. All in all, I downgrade XOM to “Sell”.

Recent developments

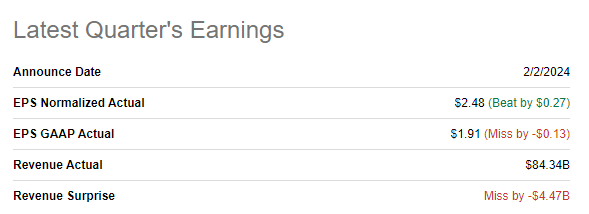

Exxon released its latest quarterly earnings on February 2, when the company missed consensus estimates. Revenue declined by about 12% YoY, and the adjusted EPS shrank from $3.40 to $2.48. The decline in financial performance was a mix of decreased volumes and prices, which aligns with the soft energy commodity markets in recent months. For the full year, XOM recorded a 16% revenue decline and a 35% decrease in net income. The weakening financial performance in 2023 is unsurprising, given oil and gas price spikes in 2022 after the Russia-Ukraine war started on February 24, 2022.

Seeking Alpha

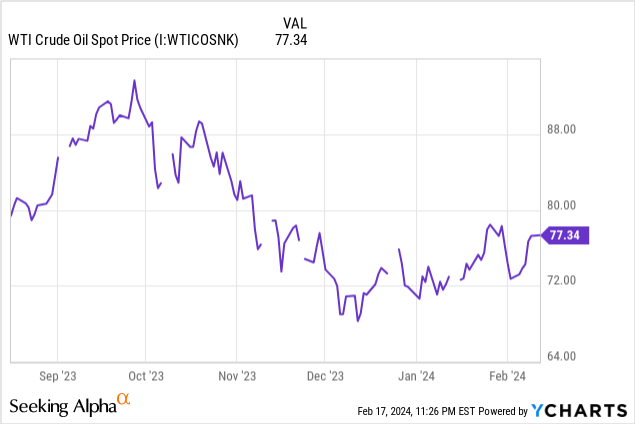

Reflecting on the unfolding dynamics within the energy commodity market in recent quarters, I realize that my prior assessment may have been overly optimistic regarding the positive catalysts at play. Just a half year ago, many factors appeared very favorable for energy commodities in my eyes. I anticipated that the significant geopolitical uncertainties, coupled with OPEC’s willingness to adjust production levels in case of the softening macro environment and the necessity for the U.S. to replenish its strategic petroleum reserves, would synergize into a firm mix of catalysts pushing oil prices towards closer to triple-digits. However, these expectations proved erroneous, as shown below by the sustained downtrend in crude oil prices over the past six months.

If we look forward, the foreseeable future is also unlikely to be favorable for energy commodities. First, the Fed is determined to continue fighting inflation, as Jerome Powell highlighted in November 2023 that the mission to return inflation to its 2 percent target has a “long way to go.” That said, the Fed’s rate cuts in 2024 are very unlikely to be sharp and aggressive, especially considering the recent negative surprise from the U.S. inflation data. Therefore, the monetary policy over the next several quarters is unlikely to help to heat up the energy commodity markets.

Second, it appears that the global commodities supply hasn’t actually experienced a loss of Russian oil; instead, there has been a redirection of Russian oil flows. Russia has adeptly navigated around Western sanctions, effectively sidestepping them, thereby avoiding any significant disruption to the global supply-demand equilibrium. As the war in Ukraine approaches to start its third year and shows no signs of ending soon, it appears highly unlikely that any imposed sanctions will have the capability to disrupt Russia’s oil supply. Consequently, the likelihood of disruptions to the global supply, which could result in a surge in oil prices, appears very low. Moreover, it is important to emphasize that the world’s largest energy consumer, the U.S. is likely to continue breaking new oil production records in 2024. The fact that the U.S. becomes less depending from imported oil is also a negative catalyst for oil prices.

Third, it is also crucial to understand the prospects for the demand side of my analysis. The world’s largest economy is expected to demonstrate a notable growth deceleration in 2024 compared to 2023. The reasons are on the surface: the tight monetary policy and the softening labor market. The world’s second-largest economy, China, is struggling and demonstrated much slower growth in 2023 than economists expected after the pandemic-related headwinds of 2021-2022. According to Nikkei, the growth pace will continue cooling down in 2024. Japan has lost its third place in the world’s top economies after slipping into recession recently. The outlook for the Eurozone’s economic prospects is also cautious. That said, I also see no big positive catalysts for the demand side.

Valuation update

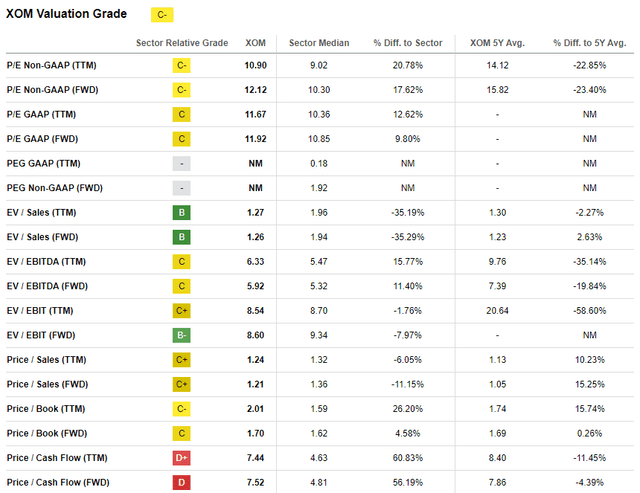

XOM declined by about 10% over the last twelve months, substantially lagging behind the broader U.S. market. The start of 2024 was quite positive, though, with a 4% YTD rally. Seeking Alpha Quant assigns XOM an average “C-” valuation grade, meaning the stock is around fairly valued. Indeed, valuation ratios are mostly in line with the sector median and XOM’s historical averages.

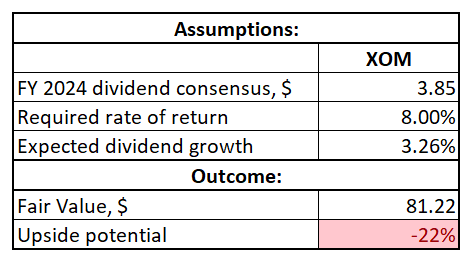

I want to proceed with my analysis of the dividend discount model [DDM]. The model will be discounted using an 8% WACC. I expect a 3.26% dividend growth, which is the average of the XOM’s past decade and the last five years’ CAGR. I use the consensus $3.85 dividend estimate for FY 2024 as my base year dividend assumption.

Author’s calculations

According to my DDM analysis, the stock’s fair share price is $81. This price level is approximately in line with the levels demonstrated by the stock before the commencement of the Russia-Ukraine war. That said, it looks like XOM is around 22% overvalued.

Risks to my bearish thesis

Movements in oil and gas company stock prices closely correlate with abrupt shifts in energy prices. A sudden surge in crude oil prices automatically translates to increased revenue and profitability for industry giants like Exxon Mobil. Such spikes in oil prices often occur in response to significant global disruptions. Take, for instance, the recent black swan event in the energy markets triggered by the Russian invasion of Ukraine, resulting in the economic isolation of one of the largest crude oil exporters. This geopolitical turmoil has the potential to impact the global oil supply significantly. Moreover, with ongoing military conflicts near major oil basins, the possibility of oil and gas facilities becoming targets of missile attacks cannot be dismissed. While the likelihood of such an event remains relatively low, the potential ramifications could be immense. Any global oil supply disruption would likely lead to a short-term surge in crude oil prices, thereby driving up the stock price of companies like XOM.

Let us also not forget that the tight monetary policy in the U.S. played a crucial role in controlling oil prices. There is still a substantial level of uncertainty regarding the Fed’s future steps regarding interest rates. At the end of 2023, Mr. Powell announced that three rate cuts will likely be in 2024. At the same time, the latest press conference was less dovish, which took place a couple of weeks ago. This uncertainty surrounding monetary policy also translates into uncertainty for the oil and gas markets, as the base rate plays a crucial role in influencing economic activity, including the consumption of energy commodities. Considering this, a sudden and more aggressive easing of monetary policy could spur a new wave of economic activity and increased demand for energy commodities. This scenario would highly likely serve as a significant positive catalyst for XOM.

Bottom line

To conclude, XOM looks like a “Sell”, especially with the current generous valuation. As oil and gas companies’ financial performance and valuations are closely tied to crude oil prices, I see no positive catalysts in the near term. Despite the imposition of unprecedented sanctions on Russian oil, the supply remains robust, and the prospects of significant shifts that could sharply increase global demand seem highly improbable.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.