Summary:

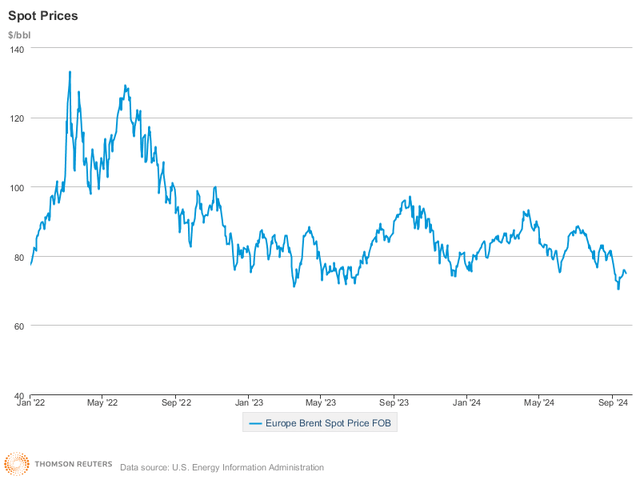

- Recent Brent weakness likely to continue as OPEC is reportedly considering output raises to “protect” market share and non-OPEC supply continues to expand.

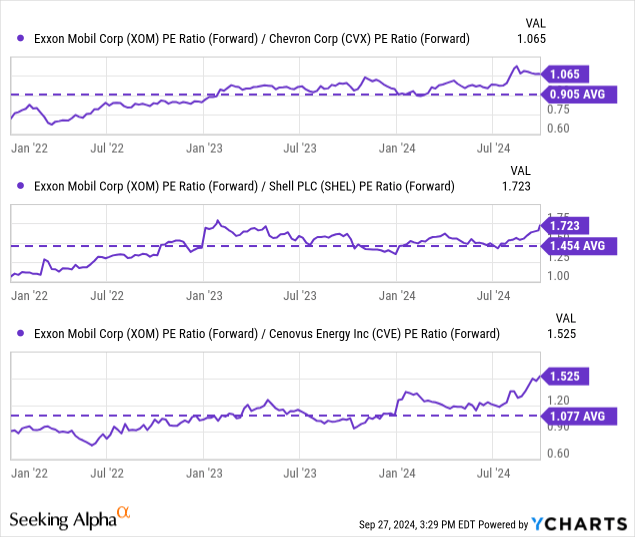

- Exxon shares have outperformed significantly YTD, bringing relative multiples to their highest in years and eliminating any valuation upside, in our view.

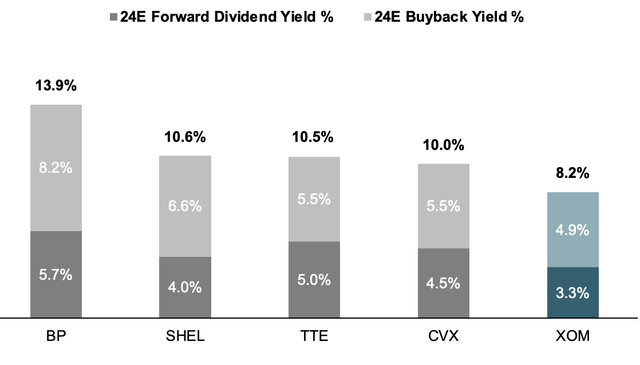

- We see upside potential further limited by a weak 8% yield (divs+buybacks), sitting significantly below the sector average.

- While we continue to view Exxon’s portfolio and mgmt as best-in-class, we believe near term risk/reward looks increasingly unfavorable and downgrade shares to Underweight (new PT $120/sh).

Bruce Bennett

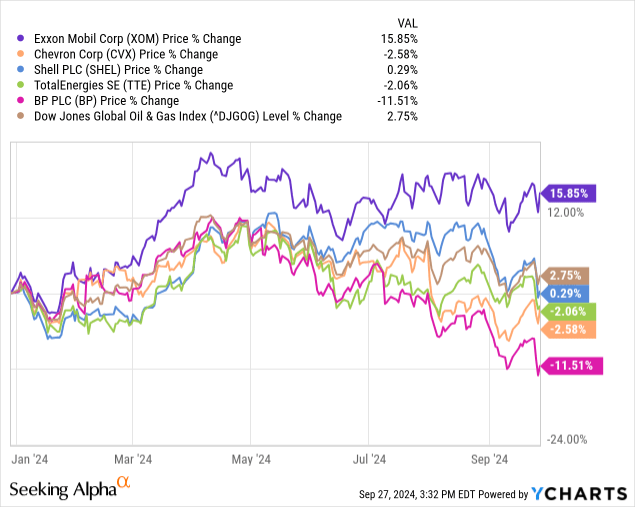

Exxon (NYSE:XOM) has outperformed peers since we last covered the company in June when we found its premium valuation justified given mgmt’s ambitious targets to grow midterm EPS in the double digits. And while we remain confident in mgmt’s ability to deliver on that, we find the valuation gap with peers having grown too excessive. This is especially as peers have pulled back sharply in recent weeks, following continued weakness in oil prices and a weakening outlook, last but not least driven by Saudi Arabia reportedly slashing its unofficial $100 Brent target in order to protect its market share.

As of Sep 27, Exxon is the only global major whose shares are up materially YTD with Shell only marginally positive and the others in the red while the Dow Jones Global O&G index is also just marginally green. This reinforces our key thesis that shares have gotten ahead of itself and might be due for a correction as the industry enters a temporary downturn (we note that Exxon makes up a sizeable portion of the index).

At currently just ~8% in consensus expected 2024 dividends and buybacks, Exxon shares yield significantly less than global integrated peers. Adding that to a shaky oil market outlook and record high multiples relative to peers, near term risk/reward for Exxon has turned increasingly unfavorable and downside risk now well outweighs upside potential, in our view.

[Note: Supermajor peers include Chevron (CVX), Shell (SHEL), Total (TTE) and BP (BP). Other global majors include Eni (E), Equinor (EQNR), Repsol (OTCQX:REPYY), Cenovus (CVE), Suncor (SU) and Imperial (IMO).]

Brent to remain pressured as KSA aims to protect market share, putting Q3 results at risk. Following the initial spike post Russia’s invasion of Ukraine, oil prices have traded largely rangebound since late 2022. This put global majors in a very comfortable position as prices around $80 present a good mix of strong cash generation and lower political scrutiny.

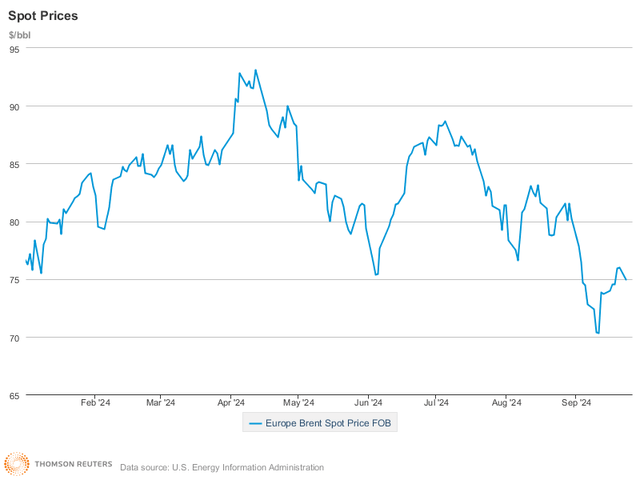

Coming into 2024, this ~$75-90 range continued to hold as continued weakness in China and shaky economic outlooks for Europe and the US were more than offset by OPEC limiting supply and conflict in the Middle East. During Q3, however, the fundamental supply/demand outlook weakened significantly, with Brent briefly dropping below $70 on Sep10 for the first time since 2021.

While OPEC output cuts formally remain in place through December (pushed backwards from October), oil analysts expect the restarted volumes alongside ample non-OPEC growth, primarily in the Americas, to tip global crude markets into a surplus for 2025. According to BofA Global Research, oil production in just the four countries of Brazil, Guyana, Canada and the US will contribute an additional ~1.2Mboed in volumes next year which should create a supply overhang of ~730Kboed, similar to the ~700Kboed projected by GS and Morgan Stanley.

Price forecasts have also been slashed across the board at both private banks and state agencies with most recent forecasts around ~$7 below June projections as per biz intelligence firm Argus. Trafigura, one of the largest global commodity trading houses, also recently made news when head of oil Luckock announced Brent would “probably going to go into the $60s some time relatively soon” at an industry conference. While commodity price forecasts are notoriously hard and should usually be taken with some grain of salt, we do find it providing a good overall picture of the markets which we believe turned increasingly bearish during 2024, likely setting up a significantly weaker 2025.

This is further reinforced by some of the most extreme negative investor positioning with shorts on Brent exceeding longs for the first time on record during last week. Overall fund positioning in commodities has also dropped to the lowest since seven years, according to a BofA survey.

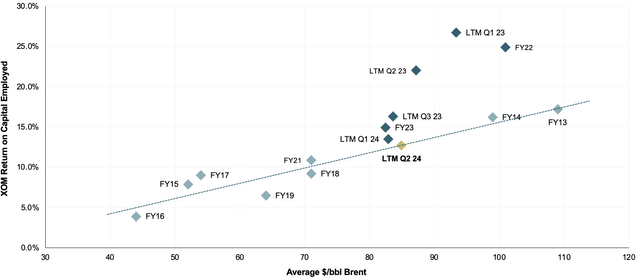

LTM ROCE dropped below pre-Covid average for the first time since 2022. During our initiation note on Exxon (see here), we introduced our ROCE tracker, plotting annual and LTM realized returns on capital employed (calculated as per Exxon methodology) vs average Brent price during the period. Back then we found evidence for a company that has become significantly more efficient going out of Covid with actual ROCEs up to 90% higher than those predicted on a pre-Covid regression. This trend, however, slowly cooled over the recent quarters with Q2’s LTM ROCE below the pre-Covid trendline for the first time since FY22. While likely not a sufficient data point to establish any persistent weakness, we do turn somewhat cautious on H2 24 ROCE, especially as Q2 was the first quarter newly acquired Pioneer was fully accounted for.

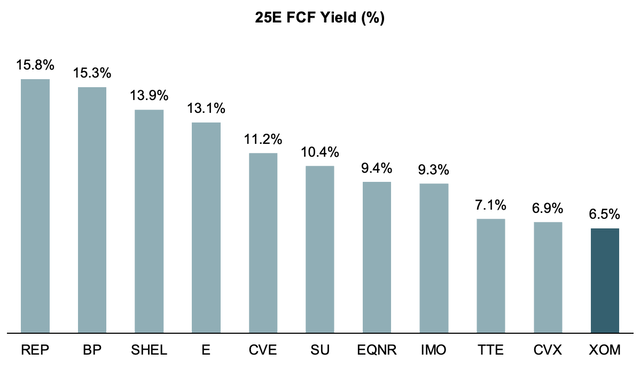

Current multiples leave no margin for error and depress relative distribution yield. While a weakening oil macro is likely to affect the entire industry, we find Exxon’s valuation levels leaving it with more relative downside. Using forward 25E P/E ratios, we find shares trading at their highest relative premium to peers since more than 2 years.

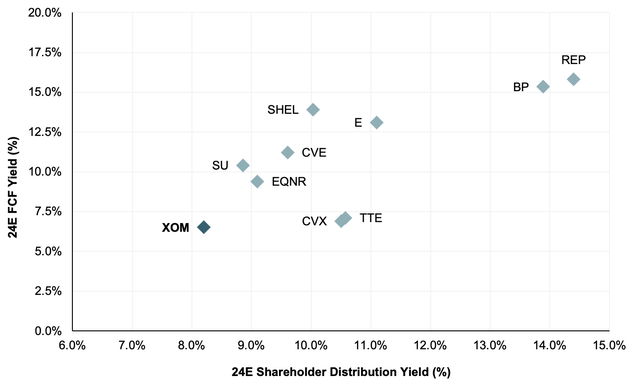

And while we acknowledge both Exxon’s portfolio and mgmt as industry leading and capable of trading at a sizeable premium vs both other Supermajors and smaller Tier 2 globals, with a likely weaker oil environment in 2025 we see investors increasingly pivoting to value. As of Sep 24, Exxon shares trade at a ~6.5% yield on 25E FCF or roughly 0.6x global majors average, down from ~0.8x earlier this year, in our view highlighting the YTD valuation dispersion.

With the highest valuation, relative shareholder yields at Exxon look significantly less generous than peers. While all other supermajors are expected to distribute >10% of their market cap to shareholders this year, we see Exxon at ~8.2%, coming from a ~3.3% fwd dividend and assuming ~$25B in buybacks.

Mapping out FCF yields vs total shareholder yields, we further find Exxon sitting at a significantly disadvantaged position relative to global major peers, highlighting a weak risk/reward, in our view.

Valuation Update

Downwards adjusting forecasts for crude & NGL and incorporating next year estimates for downstream, we reduce our price target to $120/sh, implying just ~4% price upside.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.