Summary:

- Exxon Mobil’s stock continues to underperform the market, and investors should have expected that.

- Short-term headwinds for the stock remain, and we might see better entry points in the next 12-month period.

- Exxon, however, remains well-positioned in the long run, which makes the stock a solid hold for the time being.

THEGIFT777/E+ via Getty Images

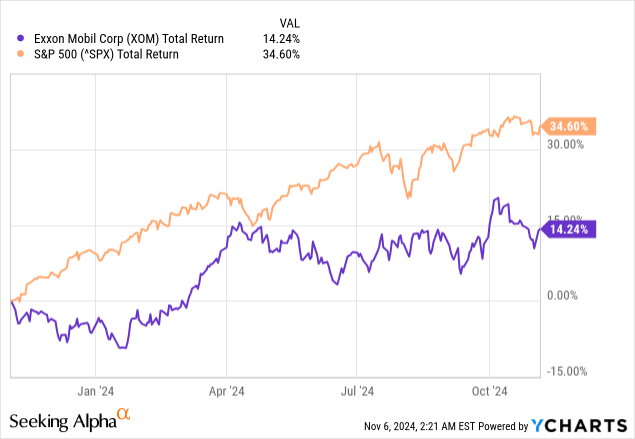

As expected, the past 12-month period has been a challenging one for Exxon Mobil (NYSE:XOM) shareholders.

The stock’s total return stands at roughly 14%, which is not a bad result on an absolute basis. Relative to the broader equity market, however, XOM has significantly underperformed the S&P 500.

The reason why I say that this performance was mostly expected is because last November I outlined certain short-term risks that were likely to continue to weigh on the share price. At the same time, the stock was fairly priced at the time and that significantly limited any potential upside.

Thus, the total return over the past year was almost entirely driven by the strong equity market and to an extent by XOM’s dividend yield of around 3%. If it wasn’t for the strong performance of the S&P 500, XOM would have been deeply into negative territory over the period and this now poses the question: – is the stock once again in buy territory or is there more pain ahead?

Short-term Headwinds

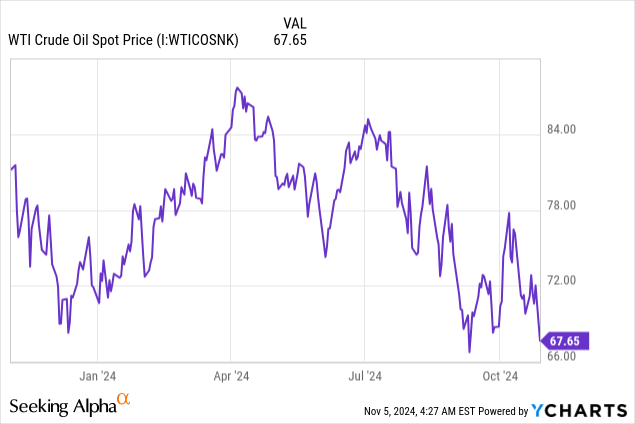

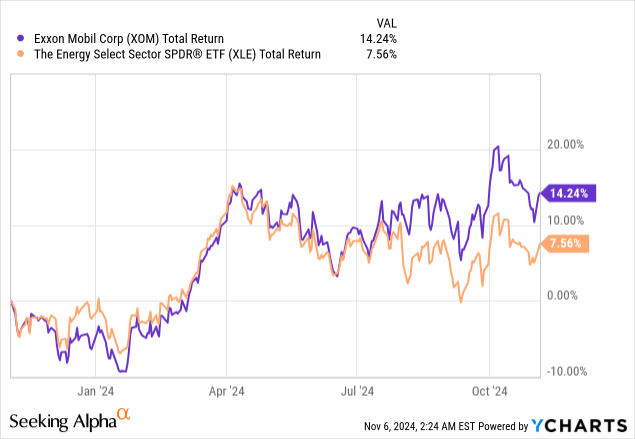

The past 12-month period was quite challenging not only for XOM, but also for energy companies more broadly as crude oil prices fell sharply and demand remained weak.

Nonetheless, XOM outperformed the Energy Select Sector SPDR® Fund ETF (XLE) by a wide margin (see the graph below). This highlights the importance of selecting the winners within each industry due to their lower downside risk when times are bad and significant upside potential when industry tailwinds are present.

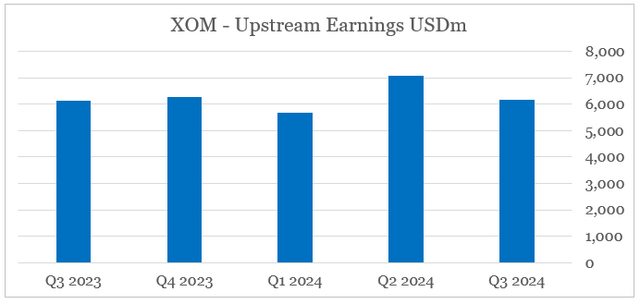

Although oil prices fell significantly over the past year, Exxon’s upstream earnings remained relatively stable. Of course, we should keep in mind that the third quarter of this year was the first full quarter with Pioneer results included.

prepared by the author, using data from SEC Filings

By focusing on high-value projects and reducing costs, XOM’s management has managed to improve efficiency, and the unit earnings on an oil-equivalent barrel have now nearly doubled since 2019.

On a constant price basis, our 2019 unit earnings were about $5 per oil-equivalent barrel. Year-to-date in 2024, excluding Pioneer, we’ve doubled that to $10 per barrel.

Source: XOM Q3 2024 Earnings Transcript

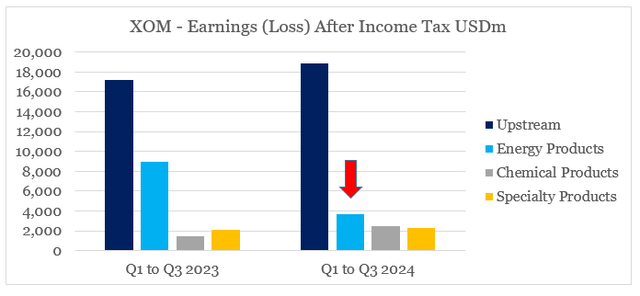

In spite of the significant progress being made in the upstream business, the poor performance in Energy Products was the main headwind for Exxon’s share price. For the first nine months of 2024 we saw earnings in the segment falling by nearly 60% – from $8.9bn in 2023 to $3.6bn.

prepared by the author, using data from SEC Filings

Once again this was related to outside factors as refining margins collapsed in 2024 to their lowest levels since 2020. According to the U.S. Energy Information Administration, the reason for that is relatively weak demand of petroleum products and in particular – distillate fuel oil.

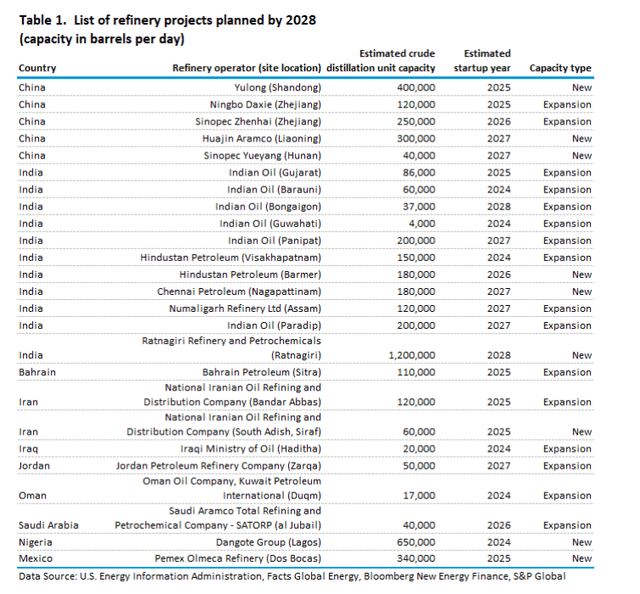

Declining margins are the result of relatively weak demand for petroleum products even as global refining capacity increases.

Source: EIA

EIA

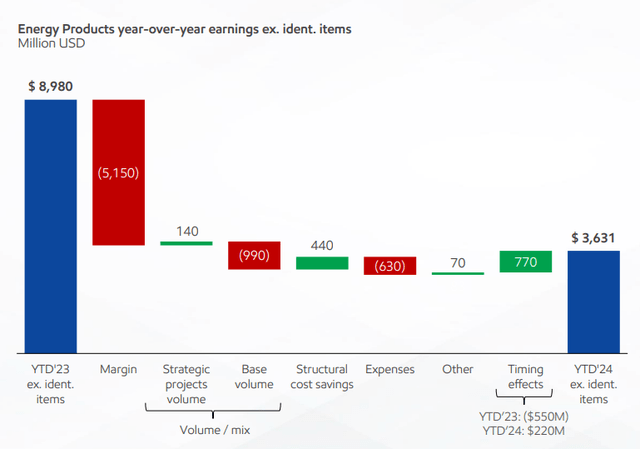

This led to Exxon’s Energy Products earnings falling almost entirely as a result of lower margins, with certain divestments and higher planned maintenance also having an impact on the division’s base volumes.

Exxon Mobil Investor Presentation

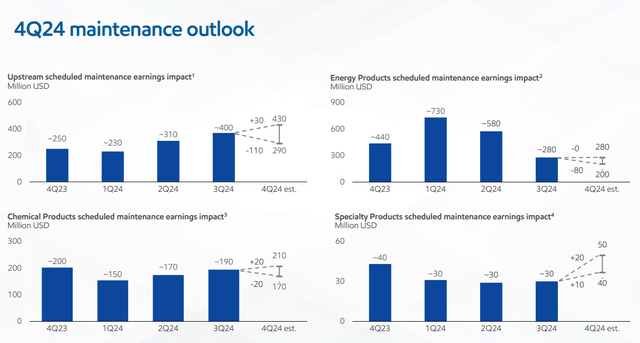

Although maintenance earnings impact in Q4 2024 could be smaller in the Energy Products division, the overall impact across the company will remain high and as refining margins remain low I would not expect a change in Exxon’s share price trajectory in the near term.

Exxon Mobil Investor Presentation

Looking beyond the short term, however, we see refining capacity expanding predominantly in Asia and the Middle East, which puts U.S. based companies like Exxon and Chevron (CVX) in a good spot to expand margins. On top of that, with all the geopolitical events in mind, Europe is becoming increasingly dependent on LNG imports, which is yet another long-term tailwind for XOM and CVX.

Fairly Priced

In addition to the short-term headwinds for XOM’s profitability, the stock is also priced more in-line with its business fundamentals. Unlike late 2020, Exxon’s investors cannot count on any mean-reversion of the stock’s valuation, which in my view makes XOM a solid Hold.

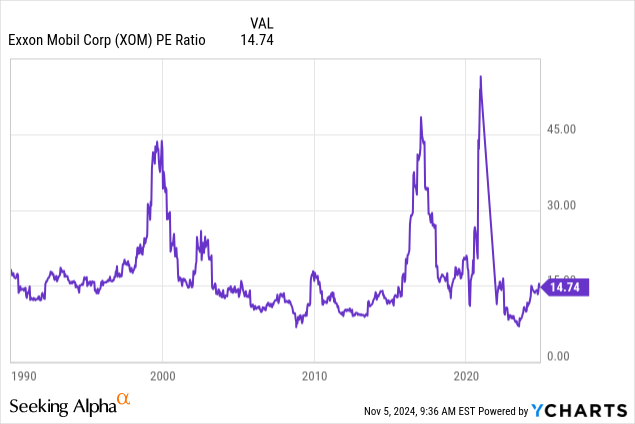

Although the earnings multiple might seem low within the context of other equities, it is roughly in-line with the long-term average for the stock if we exclude the periods of time when earnings collapsed and the P/E ratio skyrocketed temporarily.

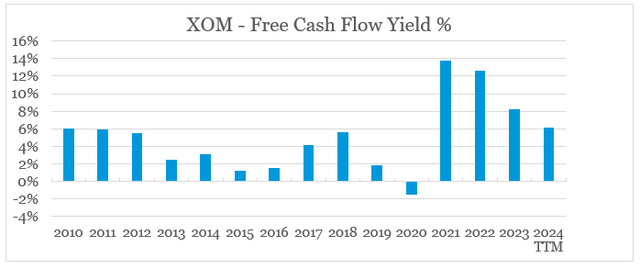

On a free cash flow basis, XOM is also priced at more normal levels, with the current free cash flow yield of 6% no longer looking attractive in historical context. On top of all that, we have the yield on 10-year Treasuries at their highest levels since 2007 which favors a more cautious approach to cyclical equities.

prepared by the author, using data from Seeking Alpha SEC Filings

We should also take into account the current capex cycle and Exxon’s need to reinvest higher amounts into the business going forward. For comparison, the company’s capex in FY 2023 stood at around $22bn, which is expected to increase to $25bn in FY 2024. As I have said before, this is good news for long-term shareholders, but will continue to put pressure on the share price in the near term.

So, the one other thing I just want to take the opportunity to mention is we have been guiding to CapEx and exploration expense. We had said for this year that’s going to be $28 billion. That’s what we still think it’s going to be. That’s $25 billion for Exxon Mobil and about $3 billion for Pioneer.

Source: XOM Q3 2024 Earnings Transcript

Conclusion

Exxon Mobil’s poor performance over the past year has been expected as certain tailwinds subside. Looking ahead, I expect the share price to remain under pressure and to continue to underperform the broader equity market. This, however, does not make XOM a sell and the stock remains attractive for anyone with a long investment horizon.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CVX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for similarly well-positioned high quality businesses in the energy space?

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.