Summary:

- Last October, Exxon Mobil rewarded shareholders with its 41st consecutive annual dividend raise.

- The company’s results were better than the steep declines in Q3 revenue and profits indicated.

- Exxon Mobil boasts an AA- credit rating on a stable outlook from S&P.

- Shares of the energy giant look to be trading 21% below fair value.

- Exxon Mobil could be poised to beat the S&P 500 in the next 10 years.

Customers fill their gas tanks at an Exxon-branded gas station. hapabapa/iStock Editorial via Getty Images

Dividend growth isn’t always a cut-and-dry-positive. It probably sounds strange that I would say this as a dividend growth investor, but that’s because growing the dividend for the sake of growing it isn’t sustainable. Ideally, before growing a dividend, a company’s board of directors must ask the following questions:

- Can we afford to send more cash to shareholders?

- Does it economically make sense for us to do so?

As one can imagine, the first question is straightforward. It boils down to whether a business is generating the earnings and free cash flow necessary to service debt and adequately cover its dividend.

The second question also shouldn’t be too difficult to answer. The answer to this question should hinge on whether a company has invested enough cash into all viable avenues of future growth.

As I will discuss, for good reason, Exxon Mobil’s (NYSE:XOM) Board of Directors implicitly answered in the affirmative to both of these hypothetical questions. Last October, the company extended its dividend growth streak to 41 consecutive years, upping the quarterly dividend per share by 4.4% to $0.95.

For the first time since May 2019, I will cover why I remain bullish on Exxon Mobil.

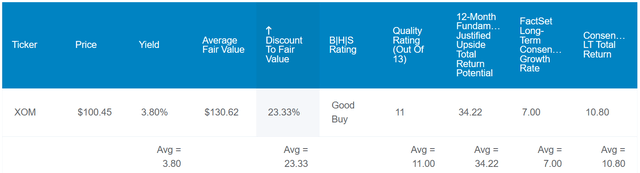

Dividend Kings Zen Research Terminal

Exxon Mobil’s 3.7% dividend yield is quite attractive versus the 1.5% yield of the S&P 500 index (SP500). Now, I know that most high-yield savings accounts are paying over 4% right now. Aside from an ample emergency fund, I do appreciate the benefits of a small cash reserve set aside when the broader market gets overstretched, as it appears to be now. But beyond a certain point, excess cash endlessly sitting on the sidelines is a surefire way to fall victim to the inflation monster.

Exxon Mobil’s 28% EPS payout ratio is significantly below the 40% EPS payout ratio that rating agencies view as sustainable for the industry. Also, the company’s 17% debt-to-capital ratio clocks in at roughly half of the 30% that rating agencies like to see from the oil and gas industry.

Thus, it shouldn’t be a shock to learn that Exxon Mobil enjoys an AA- credit rating from S&P on a stable outlook. That signifies that the company’s probability of going bankrupt in the next 30 years is just 0.55%. Put another way, Exxon Mobil will remain in business in 181 out of 182 scenarios over that time.

For these reasons, the chance of the company cutting its dividend in the next average recession is subdued at 1%. Even in the next severe recession, Exxon Mobil’s risk of decreasing its dividend is just 2.1%.

Dividend Kings Zen Research Terminal

Shares of the oil and gas giant also appear to be trading at an enticing value. Using the historical P/E ratio and dividend yield as a guide, Exxon Mobil’s shares may be worth $131 each. That would mean the company is priced 21% under its fair value.

If Exxon Mobil were to revert to fair value and match the analyst growth consensus, here are the annual total returns that could lie ahead over the coming 10 years:

- 3.7% yield + 7% FactSet Research annual growth consensus + a 2.4% annual valuation multiple boost = 13.1% annual total return potential or a 242% 10-year cumulative total return versus the 8.6% annual total return potential of the S&P or a 128% 10-year cumulative total return

A Cyclical Heading In The Right Direction

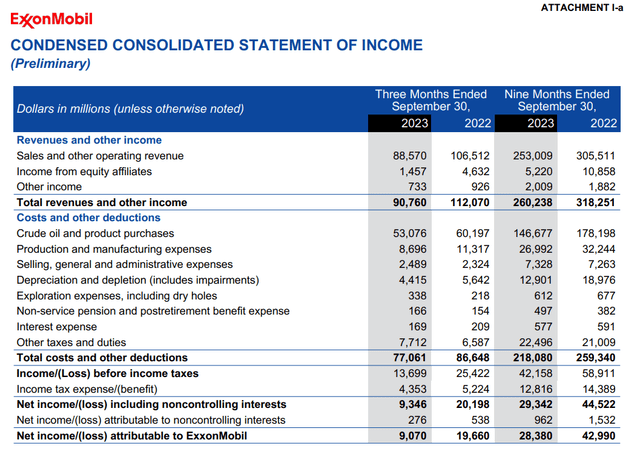

Exxon Mobil Q3 2023 Earnings Press Release

Without context, Exxon Mobil’s financial results for the third quarter ended September 30 left a bit to be desired. The company’s total revenue dropped 19% year-over-year to $90.8 billion during the quarter, missing the analyst consensus by $1.8 billion.

It’s important to note that energy companies are volatile, so this often leads to bigger beats and misses than is the case with most other industries. Beneath the surface, I believe Exxon Mobil’s results show a company heading in the right direction.

Rather than any troubling developments in the business, this topline decline was driven by cyclical headwinds. Mainly, the average price of WTI crude oil was lower than in the year-ago period. Average natural gas prices were also significantly less than in Q3 2022.

Overall, the company’s crude oil production was relatively flat at 3.7 million barrels a day in the third quarter. What’s more, Exxon Mobil processed a record 4.2 million barrels of oil daily for the quarter at its refining facilities.

The company’s non-GAAP EPS dropped by 49% over the year-ago period to $2.27. That was $0.09 below the analyst consensus. Aside from the lower revenue base, weaker industry refining margins also played a role in this drop in profits.

The future appears to be promising. First, Exxon’s commitment to between $20 billion and $25 billion in annual capex spending through 2027 should steadily grow production. Also, the merger with Pioneer Natural Resources (PXD) will make the company the most dominant producer in the Permian Basin by a wide margin per fellow contributor, Invest Heroes

Third, Exxon Mobil completed its $4.9 billion acquisition of Denbury, the carbon capture and storage company, in November. That uniquely positions the company as the largest CO2 pipeline operator in the U.S., with 1,300 miles of pipeline. For context, the global CCS market is anticipated to grow by 7.1% annually from $3.5 billion in 2023 to $5.6 billion by 2030, per Grand View Research.

As I hinted at in the intro, Exxon Mobil also has an excellent balance sheet. Adjusting for the cash on its balance sheet, the company’s net debt-to-capital ratio was just 4%. This should help it to navigate the boom and bust cycles within its industry in the years to come.

Exxon Mobil Is Printing Free Cash Flow

As Exxon Mobil continues to shape its future, it also has loads of free cash flow to return to shareholders via share buybacks and a rising dividend.

Through the first nine months of 2023, the company generated $28.1 billion in free cash flow. Against the $11.1 billion in dividends paid, that equates to a secure free cash flow payout ratio of just 39.5%. Even including $13.1 billion in share repurchases, Exxon Mobil was left with nearly $4 billion in excess free cash flow (details sourced from page 6 of 54 of Exxon Mobil’s 10-Q filing).

That’s why I believe that Exxon Mobil can deliver mid-single-digit annual dividend growth to shareholders in the foreseeable future.

Risks To Consider

Exxon Mobil is a high-quality business, but it has its share of risks that are worth briefly highlighting.

One of the more obvious risks is that the company is cyclical. Rather than being a price maker, Exxon Mobil is a price taker. This leaves its operating results particularly vulnerable to downturns in energy markets. If the looming recession is worse than expected, that could negatively impact Exxon Mobil’s financial results. This cyclical nature is why some investors may be turned off by the company. But in my view, as long as the company stays committed to profitably growing its production, it should come out stronger on the other side of industry downturns.

Regulatory risks are another threat to Exxon Mobil. The company operates in markets around the world where there are less established legal systems. Thus, Exxon Mobil’s assets could potentially be seized in certain markets with less robust legal systems. That could also limit the company’s ability to recoup losses if it were to happen.

Additionally, more economically developed countries often have environmental regulations that evolve. Interpreting new regulations and staying in compliance with them could require Exxon Mobil to spend more resources. That could weigh on the company’s profitability to at least some extent.

The risk that is furthest down the horizon for Exxon Mobil is the energy transition. The company has plenty of irons in the fire aimed at positioning itself as the leader of tomorrow’s energy industry. These include carbon capture storage projects and the planned launch of its Mobil Lithium brand. However, there are no guarantees that Exxon Mobil will be able to successfully adapt its business model to the future. If the company fails to do so, its fundamentals could be adversely impacted.

Summary: Exxon Mobil Is An Undervalued Dividend Aristocrat

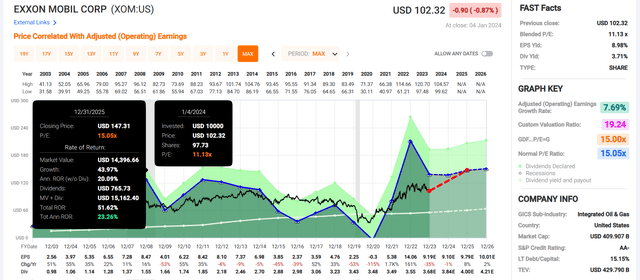

FAST Graphs, FactSet FAST Graphs, FactSet

Exxon Mobil’s 41 consecutive years of dividend growth firmly establishes it as a Dividend Aristocrat. Not to mention that the company does appear to be making the right moves to position itself for future growth. That’s why analysts anticipate that after a 1% drop in earnings in 2024, Exxon Mobil will bounce back with 8% growth in 2025.

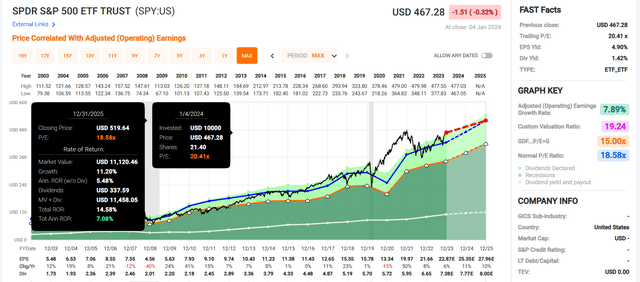

The company’s shares are also trading at a blended P/E ratio of just 11.1, which is well below the normal P/E ratio of 15.1. If the company meets these growth predictions and returns to fair value, it could deliver 52% cumulative total returns through 2025. That’s a substantially higher total return potential than the 15% cumulative total returns expected from the SPDR S&P 500 ETF Trust (SPY) in the next two years. This is why I am maintaining my buy rating on shares of Exxon Mobil.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.