Summary:

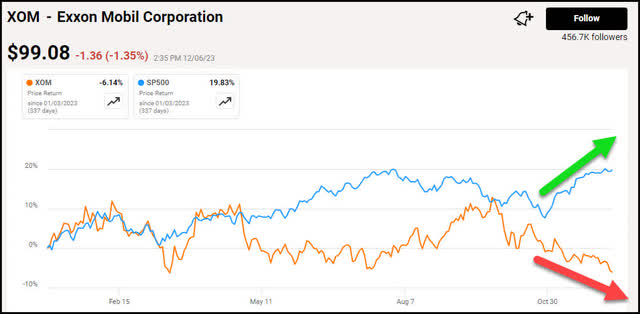

- Exxon Mobil’s stock has decreased by 10% while the S&P 500 has increased by 19% since December 2022.

- The stock’s run-up prior to 2023 suggested the Exxon Mobil story already was well known and most of the upside was already priced in.

- Now is not the time to start a new position in Exxon Mobil. The risk is not worth the return. In the following piece, I make my case.

Joe Raedle

Exxon Mobil Avoid Thesis Executive Summary

For those of you who follow me, you know I’ve been negative on Exxon Mobil (NYSE:XOM) for the last year. I went negative in December of last year stating Exxon Mobil had run out of gas. Since that time, Exxon’s stock is down substantially while the S&P 500 is up 19%, according to Seeking Alpha data.

Exxon vs. S&P 500 Year-to-date Chart

Seeking Alpha

The stock is in a very precarious technical state presently. It has just achieved the dreaded “Death Cross” which is when the 50-day SMA crosses below the 200-day SMA.

Exxon Mobil Current Chart

Finviz

This has more often than not been a sign of further downside to come. On top of this, the Texas oil titan’s stock has broken below the bottom of the recent uptrend channel. This suggests a trend reversal may be in the works.

What I see as the final nail in Exxon’s stock’s technical coffin, is the fact the stock is now trading nearly 10% below its 50- and 200-day SMAs. Once a stock falls below these levels, they turn from support to resistance. This makes it that much harder to regain the upside.

Exxon Long-term Chart

When I stated Exxon had topped out, I received a ton of push back from members in the comments section. I tend to view this as a contrarian indicator. What that tells me is that most investors are already in the stock. It’s not like the Exxon Mobil story wasn’t already well known.

Finviz

In fact, one of the points I made was with the stock’s recent massive run up in the stock over the past couple of years was a sure sign most investors had already piled in. This was primarily due to the fact everyone had bought in to the mantra that the supply/demand equation was locked in oil’s favor ad infinitum, (i.e. till the end of time.) As usual, that turned out to be a falsehood. I like to quote the Saudi Oil Minister, Ali Al-Naimi, whenever anyone starts telling me they are sure which way the price of oil will go. He says only Allah knows.

“Influential Saudi Oil Minister, Ali Al-Naimi, told CNBC Tuesday that “no one can set the price of oil – it’s up to Allah.” The remark comes amid widespread speculation over how long Saudi Arabia will maintain its decision not to cut production – a move that could support prices.”

When everyone was jumping on the bandwagon a few months ago, there were several calls for exorbitant oil prices. I even saw an article saying oil could reach $300 at one point, that did not turn out to be the case.

Current WTI Oil Chart

CNBC

WTI crude has actually dropped about 20% in the last few months. many may be wondering. How is this possible with OPEC+ enacting production cuts and the tinderbox that is the middle east seemingly about to explode. Not to mention the “post COVID” comeback for China predicted by many did not come to fruition. Historically, these macroeconomic and geopolitical events would cause oils price to spike. Back in the day, I actually sold oil ventures as a FINRA registered securities broker. The following is what I perceive has changed making these formerly daunting develops for oil in the past somewhat muted today.

OPEC+ production cuts

Firstly, after many years of living through these production cut announcements, many oil industry insiders have come to the conclusion that, more often than not, they aren’t worth the paper they’re written on. It’s all smoke and mirrors. It’s like when the Fed tries to jawbone down inflation by talking about possible further rate hikes.

Secondly, the non OPEC producers such as Guyana, Brazil, and the U.S. have vastly increased production at this point, weakening OPEC’s grip on oil prices. The second issue, Middle East turmoil, is basically a paper tiger at this point as well. Here’s why.

Middle East turmoil no longer a major impact on oil prices

The primary reason is the fact the U.S. is now one of the largest producers of oil. Years ago, the West was much more dependent on Middle Eastern oil. This is no longer the case. Iran used to threaten to block the Strait of Hormuz which would cripple oil’s supply to western nations. Now, they primarily supply oil to China. So they would only be cutting their own throats, so to speak.

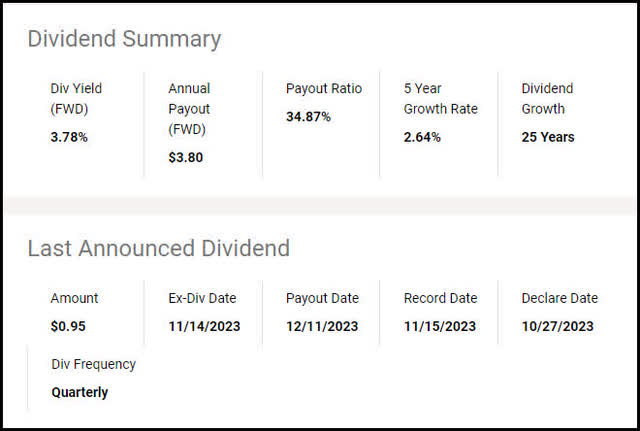

Yet, the main issue I have is the fact Exxon’s dividend yield currently at 3.47% is nothing to write home to mom about.

Seeking Alpha Dividend Summary

Seeking Alpha

Moreover, Exxon has always been primarily an income/dividend investor name. The fact you can still get a risk-free return of 5% from a CD or even a money market account presently. I see as the primary reason not to invest in Exxon Mobil at this time. Why take on the additional risk for such a paltry return?

The Wrap Up

Now is not the time to start a new position in Exxon Mobil. The risk is not worth the return. If you’re already in the name and bought in at a much lower basis, more power to you. I’m not advocating for anyone to “sell out” of their position of they have locked in a superior yield at a lower price point. I’m merely stating that, now, is most likely not such a great time to buy in to a new position. The technical status is extremely weak, the dividend yield is below the risk-free rate of 5%, and the macroeconomic and geopolitical state of affairs is highly unfavorable. Things may change for the better in the coming months. I say take a wait-and-see approach. You may end up getting in for a higher yield attached to a much better margin of safety. One of my investing mantras I have coined over my 30 years in the markets is “patience equals profits.” Be patient with Exxon. At the very least, I would layer in over time to reduce risk. Those are my thoughts on the matter, I look forward to reading yours.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

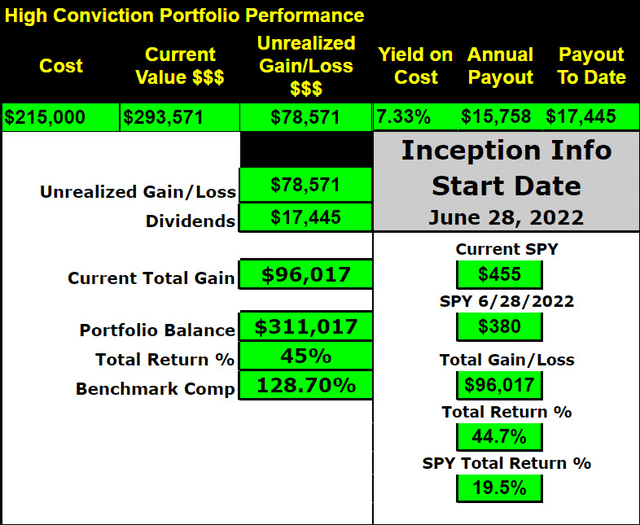

Join Seeking Alpha’s #1 Service for Income coupled with Growth Targeting 20% Total Return! Our Concentrated High Conviction Portfolio is up 45%, beating the SPY by 128%.

We have 28 FIVE STAR reviews already!

We have several portfolios to choose from:

Quality High Yield- 11% yield

SWAN Income – 9% yield

Super Swan – 5.4% yield

Quality Growth – up 19%

Speculative Growth – Up 28%

High Conviction – Up 45%, 7% yield

Join now for best-in-class income & growth picks (One top pick per week), timely macro insights, and a lively chat room! A portion of the proceeds are donated to the DAV (Disabled American Veterans).