Summary:

- Exxon Mobil agreed to massive 9% pay hikes, questioning the structural shift in the cost structure.

- The energy giant faces a scenario of lower energy prices next year, especially natural gas.

- The stock is already priced for targeted 2027 EPS estimates, though the structural business shift needed to reach such goals has major questions.

JHVEPhoto

Typical of a company raking in record profits, Exxon Mobil (NYSE:XOM) has turned around and hiked employee pay and benefits by a large amount. The downside here is that the energy giant isn’t expected to maintain record profit levels in the years ahead as energy prices naturally fall. My investment thesis remains Bearish on the stock as profits decelerate next year and higher operating costs become a burden again.

Big Pay Hikes

Not surprising considering inflation and record profits, Exxon Mobil just paid large wage increases to employees. According to Bloomberg, the energy giant is paying 9% salary increases and handing out restricted stock options like hotcakes. Even employees that got promotions in the last year with average pay increases of 20% are expected to see a 5% boost in pay.

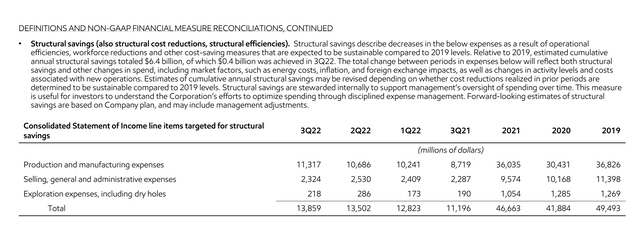

The company has made huge strides to strip out billions in expenses, with an estimate of structural savings of $6.4 billion. Exxon Mobil spent $9.6 billion on SG&A expenses in 2021 and those costs were running at a $9.3 billion annual rate in Q3, but a 9% pay hike immediately pushes the run rate back towards $10.1 billion to match the 2020 level.

Source: Exxon Mobil Q3’22 supplements info

The unknown amount is the impact of pay hikes on Production and Exploration expenses. A 9% hike in those expenses would add another $1 billion in quarterly costs.

The average pay hikes are interesting, considering the energy sector has long been stuck with excessive employee costs. According to Bloomberg, the workers in oil and gas extraction were already making the equivalent of over $80K annually due to 13% hikes in the last year. A 9% hike to any of these employees pushes annual income above $90K for nonsupervisory positions.

Whether Exxon Mobil pays those wages directly to employees or via contractors, the company could face $4 to $5 billion in additional costs next year just from pay hikes and increased costs due to inflation. The company continues to discuss a $9.0 billion reduction in structural costs, but the picture gets blurry with massive pay hikes.

Energy Prices Aren’t Structurally Higher

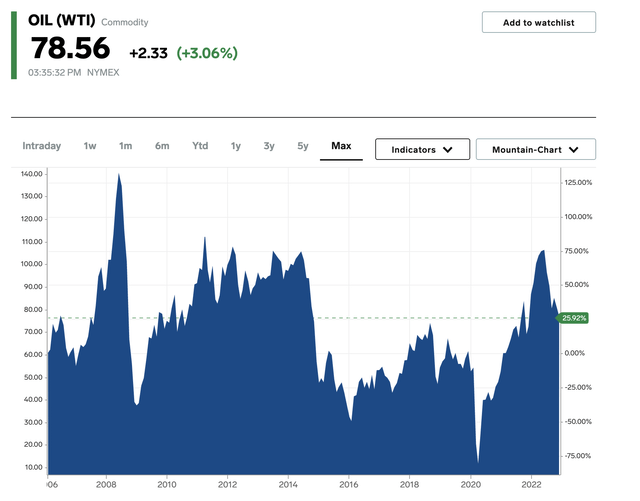

The problem with these large pay hikes is that energy prices aren’t structurally higher. Oil prices have already fallen back to the range of the last decade, and natural gas prices are surely set to follow due to potential oversupply.

WTI now trades in the upper $70s, below prices for most of the years prior to 2014. Oil prices fell below $70 from 2015 through 2020 with the covid lows before under investment and the Russian invasion boosted prices.

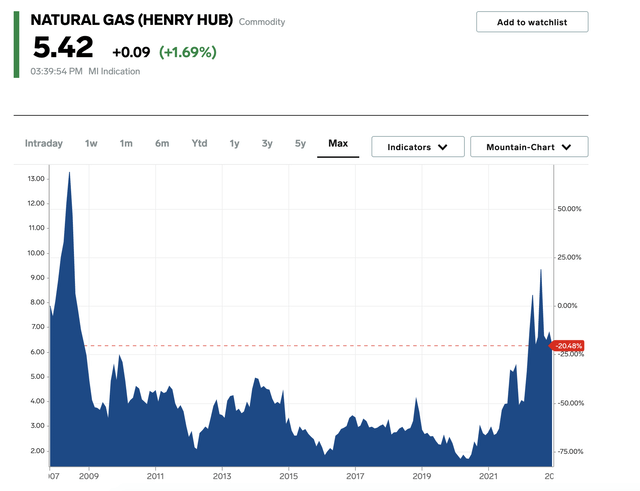

Natural gas prices are the only area where energy prices remain elevated. Since 2009, natural gas prices regularly traded below $4 at the Henry Hub and the US doesn’t lack for supplies regardless of the increased exports to Europe this year.

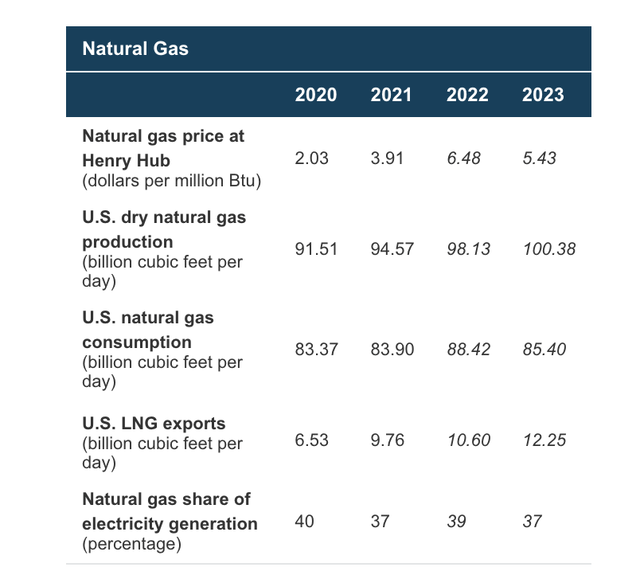

The EIA actually forecasts the U.S. having excess natural gas supply next year. The country has no new LNG export facilities coming online next year outside of the Freeport facility coming back online after the fire. With LNG exports at 12.25 Bcf/d and US consumption forecast to dip 3.02 Bcf/d to only 85.40 Bcf/d, U.S. production at 100.38 Bcf/D will suddenly leave excess daily supply at over a very large 2.73 Bcf/d.

Any scenario where Russian gas comes back online and U.S. LNG exports aren’t needed at double the rate of 2020 (prior to Ukraine invasion), nat-gas prices could plunge back to the 2020/21 levels of ~$3. Exxon Mobil didn’t exactly thrive when natural gas prices were at those levels along with lower oil prices.

The biggest fear here is that the energy giant added billions back to the cost structure based on large pay hikes due to the 2022 record profits. The company had structurally reduced costs from 2019 levels, but the massive size of pay hikes reduces any such benefits. The frustrating problem is that Exxon Mobil was supposedly structurally changing the industry, and now pay is returning to the levels problematic for the industry.

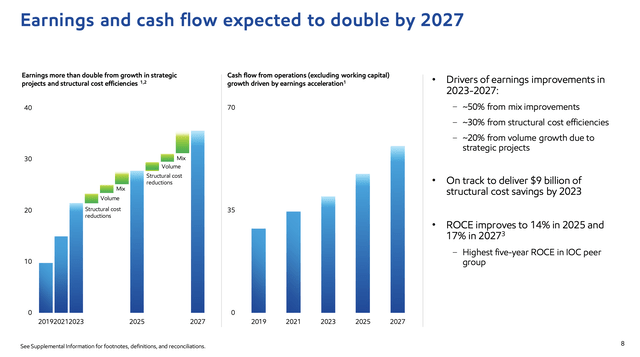

The energy giant has a corporate goal of doubling earnings and cash flows by 2027 from the 2019 levels, though the target EPS is targeted to double the $5.38 per share from 2021. Over 30% of the drivers were from the structural cost efficiencies, but Exxon Mobil is now blowing a lot of those structural gains by paying higher expenses without any guarantee energy prices will maintain at the current elevated levels.

Source: Exxon Mobil 2022 corporate plan

The energy giant needs to make a lot of progress towards hitting the above 2027 cooperate targets in order to reward shareholders with the stock already at $108. Exxon Mobil trades at 10x the 2027 EPS goal that would roughly equate to ~$10 per share.

Takeaway

The key investor takeaway is that Exxon Mobil remains unappealing at $108 with major questions regarding structural shifts in the business. In addition, the EIA forecasts a domestic oversupply of nat-gas next year likely leading energy prices back to more normal price levels, again highlighting how energy prices aren’t structurally higher.

Investors still have a solid opportunity to sell Exxon Mobil near the highs of the year at a price factoring in the projected earnings upside for the next 5 years that likely won’t occur.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.