Summary:

- Exxon Mobil and partners had a record-breaking profitable fiscal year in Guyana with the widest margins in the industry for a major project.

- Discovering oil in offshore Guyana took years and lots of money. There were many failures before there was oil found.

- The Sixth FPSO project, Whiptail, is underway and expected to be in production in fiscal year 2027, contributing to a future total production of 1.5 million BOD.

- The Hess interest is becoming more valuable with every FPSO that begins production, and really with every approved FPSO project.

- Competitively advantaged assets that last a long time are very similar to a competitive moat.

JHVEPhoto

Exxon Mobil (NYSE:XOM) and partners reported to the government of Guyana a very profitable fiscal year, as follows:

New government data shows Guyana’s agreement with the Exxon-led consortium (XOM) that includes Hess (HES) and Cnooc (OTCPK:CEOHF) generated $6.33B for the partners last year.

The combined net margin for the three companies totaled 56%, greater than the 49% earned by chipmaker Nvidia in its most recent fiscal year.

The story by Kemol King and Sabrina Valle on Reuters, which is the source of a Seeking Alpha article, further reported that Guyana has now updated its terms for new leasing to nearly double its take on future production on new leases. This is probably a more than reasonable strategy by the government because now there is a better definition as to where profits can be made. That was not the case for a long time.

What was left out of this story was all the years spent (and money) finding this oil in the first place. By most accounts, the industry looked (and spent money) for decades before the first oil was found. The reader can just bet on how many gave up hope of ever finding oil in offshore Guyana. It looks easy now, though.

The other consideration is that not all discoveries are this profitable. Sometimes the discovery is too small for a major to develop. Then a country has to wait for a smaller company like Vaalco (EGY) for example, to come along with a suitable plan to make money on that smaller discovery. Other times, a company like Eco Atlantic (OTCPK:ECAOF) announces a find only to realize that the breakeven was in the $50’s BOE range, which was too high.

In short, it is a long way to get to the point where the company discovers oil in the first place. That eliminates a lot of exploratory drilling results. Then after the discovery, it is every bit as risky to get to the point where there is enough to drill and develop more, as Exxon Mobil and its partners are doing.

Of course, the news would have the reader believe that all one has to do is drill an exploratory well and in rolls the money. The profits are far greater than the risk incurred.

How This Updates The Last Article

When Exxon Mobil took Chevron (CVX) and Hess (HES) to arbitration over some partnership contract provisions, the company stated they are not interested in Hess (as the last article noted).

However, the interest Hess has in the partnership appears to be becoming far more attractive to Exxon Mobil to the point that, even with the approval of yet another FPSO by the partnership as noted below, the company is proceeding to exercise what it believes are its rights in case that price is attractive.

Since another FPSO will likely begin production in 2025, if the schedule holds, the longer this dispute goes on (or arbitration process), the more valuable the Hess interest becomes. The partnership has been adding production in “more than a year” between each new FPSO.

The way things are going now, the time value of money tells you that as another FPSO begins production, cash flow takes a material jump. It looks to me like the price of the Hess interest is steadily rising. That could make an arbitration value outdated before the ink is dry if the process is slow enough.

The Sixth FPSO Project Is Underway

Back in April, the company has now approved the sixth project, known as Whiptail. This one would be expected to be on production in fiscal year 2027 if the current schedule of approvals to production holds. If all six FPSO’s actual production and planned production capabilities are added up, that means firm plans are in place for this acreage to produce 1.5 million BOD.

Note that the first three are producing above “nameplate” production given in the slide if the latest production reports are to be believed. Exxon Mobil is known for debottlenecking projects that often safely produce that result. Therefore, more of that could well be expected from future FPSO’s.

Note that schedules can vary, and the price level of oil can determine whether the schedule can be accelerated (if it is worth the effort). Things can also slow down during times of lower commodity prices. What seems to keep this Guyana partnership going is the very low breakeven price in the $30’s for oil as I have noted in several past articles for both Exxon Mobil and Hess.

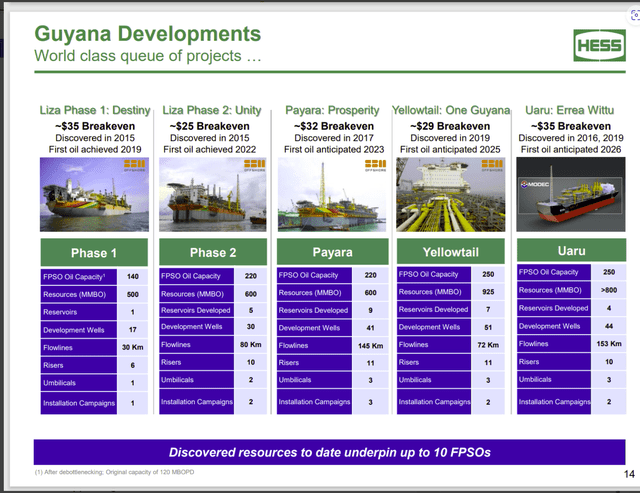

Hess Corporation Presentation Of Approved FPSO Projects For Guyana Partnership (Hess Corporation Presentation At JP Morgan Energy, Power, and Renewables Conference June 2023)

This is a slide taken from an older article on Hess Corporation (HES) because the whole presentation is now gone. The key here is that breakeven points this low are very seldom found in this day and age. Therefore, this project is likely to continue forward through some very hostile industry conditions simply because it will make money under all but the very worst circumstances.

Competitively Advantaged Assets

Management has stated that part of the way they are growing is through “competitively advantaged assets”. As writers, we are on the receiving end of that so many times it is not funny. Therefore, most of us look for some outside confirmation as the above discussion would indicate to support what management is telling us.

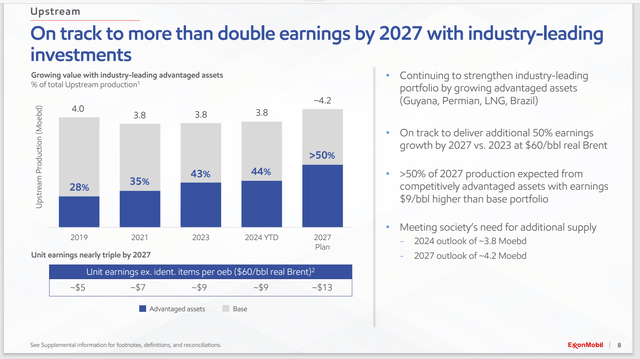

Exxon Mobil Guidance Of 50% Profit Increase By 2027 From Above Average Profitability Assets (Exxon Mobil First Quarter 2024, Earnings Conference Call Slides)

The thing about these competitively advantaged assets is that, like the Guyana partnership, they took some time for these lower cost assets to have a significant effect on earnings.

Now, the Guyana Partnership has a roughly 600,000 BOD interest (because any gas produced is reinjected to maintain reservoir pressure). That is about to rise to roughly 1.5 million BOD (probably within 5 years). It could go higher if the partners decide to produce the natural gas instead of reinjecting it.

In the meantime, there will be a third quarter production interruption as Exxon Mobil builds a natural gas pipeline to an energy generating plant under construction. In the long run, the company either makes a bundle or makes a bigger bundle of cash.

Even for a company of Exxon Mobil’s size, the Guyana project is becoming very important to the future of the company. Depending upon industry conditions and the Guyana government, the total partnership production may be as much as half of Exxon Mobil’s total production. Exxon Mobil’s share of those profits would be 45%.

Summary

Exxon Mobil management has stated for some years that they intended to lower the company breakeven so that earnings would double by fiscal year 2027. Then when management met its original cost-cutting goals, they engaged on yet another efficiency program to bring costs down more. Up until now, cost-cutting was center stage in company presentations for several years and many articles.

But management has also found a way to find “cost advantaged assets” as they put it. It was not good enough to just find good acreage, instead, as the Guyana project points out, management wanted lower costs that last long enough to be equivalent to a competitive moat. Now a filing with the Guyana government bears that out.

This also likely means that the company not only keeps its high debt rating, but that debt rating will become more secure due to the success of both cost-cutting and “cost advantaged assets” found.

For investors, commodity prices can cloud progress. But this company has the assets to turn this into a growth and income engine that could treat an investor well for at least a decade. For that reason, this issue remains a strong buy because rarely is a company this large a growth and income play.

Should Exxon Mobil actually manage to acquire the Hess interest, the case for growth and income becomes far stronger. But that is not likely.

Risks

Exxon Mobil is exhibiting considerable cost advantages over many in the industry. But that can change quickly as technology advances throughout the industry change profitability from time to time. Exxon Mobil has been very successful at staying near the top of the industry in profits performance so far, and that is likely to continue given the resources it has should something unfavorable happen.

The Guyana progress can stop “tomorrow” if no more discoveries are reported. While that is highly unlikely for a number of reasons, it points out to the fact that the future can change quickly in this industry without a lot of notice.

The whole industry is subject to the volatility and low future visibility of commodity prices. Any severe and sustained commodity price downturn can alter the future significantly from what is pointed out in the article.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM HES EGY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation for the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits its own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I analyze oil and gas companies like Exxon Mobil and related companies in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies — the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.