Summary:

- Exxon Mobil’s recent financial performance reflects a challenging environment, with lower earnings due to lower natural gas realizations and refining margins.

- Despite these difficulties, the company has made progress in cost-saving measures and has a solid financial position.

- Exxon Mobil’s strategic moves, including the acquisition of Denbury Resources and exploration of opportunities in the electric vehicle sector, position it for future growth and appeal to investors interested in sustainability.

- The appearance of a double bottom, inverted head and shoulders, and the breakout of the symmetrical broadening wedge pattern signals a continuation of bullish momentum.

Justin Sullivan/Getty Images News

Exxon Mobil Corporation (NYSE:XOM)’s recent quarter illustrates a multifaceted scenario of success and struggles, revealing a challenging financial environment. The company reported earnings that were down from the previous quarter’s figures, affected by lower natural gas realizations and industry refining margins. Despite these difficulties, the negative influence was partially softened by the absence of unfavorable derivative mark-to-market impacts from the earlier quarter. This article outlines the technical analysis of Exxon Mobil to predict the stock price’s future trend and identify investment opportunities for long-term investors. The analysis reveals that the stock price is currently situated within a long-term upward trend and appears poised for further growth. Investors may consider buying shares at the current levels to capitalize on anticipated future gains.

Exxon Mobil Focus on Sustainable Future

Exxon Mobil’s financial performance in the recent quarter shows a mixture of achievements and challenges. The earnings of $7.9 billion were down compared to the first-quarter earnings of $11.4 billion, impacted by lower natural gas realizations and industry refining margins. However, these adverse effects were somewhat offset by the absence of unfavorable derivative mark-to-market impacts from the prior quarter. The company’s progress towards cost-saving is noteworthy, being on track to deliver $9 billion of structural cost savings by the end of 2023 and having already achieved $8.3 billion. Cash flow from operations stood at $9.4 billion, with free cash flow at $5.0 billion, and a solid financial position reflected in a 17% debt-to-capital ratio. Shareholder distributions in the second quarter were significant, amounting to $8.0 billion, including share repurchases and dividends.

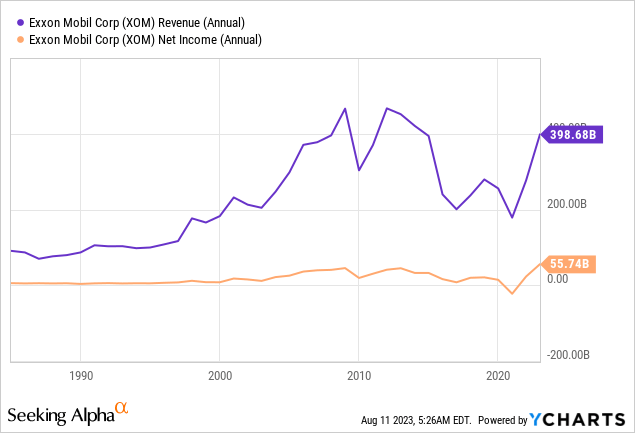

The formation of three new central organizations and advancements in carbon capture and storage also indicate strategic movements aligning with both operational efficiency and climate solutions. Overall, the financial picture reflects Exxon’s resilient strategy in cost management and future-oriented investments, despite the challenges in earnings compared to the previous quarter. The annual revenue and net income for Exxon Mobil present strong profitability for the company as shown in the chart below.

Exxon Mobil’s acquisition of Denbury Resources highlights the strategic shift towards sustainability and lower-carbon energy solutions. The focus is not on Denbury’s oil production, but rather its carbon dioxide expertise and extensive infrastructure. By integrating Denbury’s capabilities, Exxon Mobil positions itself as a leader in the growing Carbon Capture, Usage, and Storage (CCUS) market. This alignment with global sustainability trends not only enhances Exxon Mobil’s public image but opens new revenue streams, appealing to investors interested in both environmental responsibility and financial growth.

The acquisition provides Exxon Mobil access to Denbury’s largest owned and operated carbon dioxide pipeline network in the U.S., including crucial regions like the Gulf Coast. These assets will allow Exxon to profitably reduce emissions by more than 100 million metric tons per year. By focusing on a cost-effective transportation and storage system that integrates with existing assets, Exxon is building an optimized CCUS solution. This innovative approach signals that the company is future-oriented and ready to capitalize on emerging technologies, making it an attractive long-term investment.

Exxon Mobil’s involvement in early-stage talks with automakers such as Tesla, Inc. (TSLA), Ford Motor Company (F), and Volkswagen to supply lithium for electric vehicles and engage in lithium extraction may signal a bullish trend for the stock price. The company’s efforts to explore this opportunity demonstrate a strategic move to penetrate the growing electric vehicle sector, aligning with the global transition toward green energy. This may be viewed favorably by investors interested in sustainable growth. The ongoing conversations with renowned automotive manufacturers suggest promising business opportunities, and if these dialogues lead to successful collaborations, Exxon Mobil could secure a strong position in this emerging market, possibly leading to substantial revenue streams.

A Look at Historical Price Developments

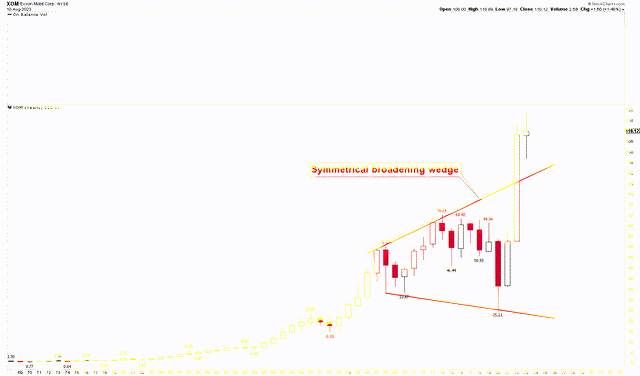

The long-term yearly chart presents a strong bullish trend for Exxon Mobil. In 2022, the price notably broke away from the symmetrical broadening wedge pattern, closing at elevated levels, signifying the likelihood of sustained gains. The origins of this powerful rally can be traced back to 2020 when the stock reached a low of $25.21. This was mainly shaped by the global ramifications of the COVID-19 pandemic, which heavily influenced the oil and energy sector. With the imposition of travel restrictions and worldwide lockdowns, the demand for oil and other energy products sharply declined. This decreased demand caused an oversupply, leading to a catastrophic drop in oil prices. As one of the top oil producers, Exxon Mobil also felt the effects of the reduced demand. The situation was further aggravated in early 2020 when Saudi Arabia and Russia engaged in a price war, ramping up production and flooding the market with inexpensive oil during an already suppressed demand period. This double whammy led to a further dip in oil prices, taking a toll on Exxon Mobil’s revenue and profits. Consequently, the company grappled with business challenges, including an onerous debt burden and non-lucrative investments.

XOM Yearly Chart (stockcharts.com)

A seeming disconnect between the company’s focus on long-term oil exploration and production projects and the immediate market dynamics created skepticism among investors. This immense decline was soon reversed with the global resurgence in oil demand as economies started to heal from the pandemic. This recovery, along with higher oil prices and Exxon Mobil’s strategic measures to cut costs, enhance operations, and channel investments into greener energy solutions-strengthened by renewed investor faith in the sector-contributed to the stock’s positive trajectory. The breakout from the symmetrical broadening wedge stands as a potent indicator in Exxon Mobil’s favor, hinting at an ongoing upward momentum in the market.

Investor Consideration

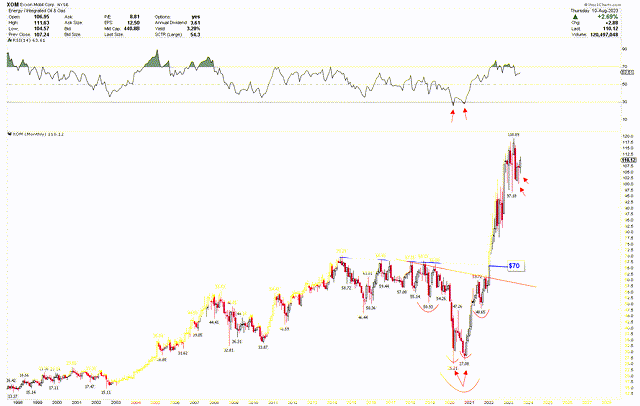

The monthly chart below further illustrates Exxon Mobil’s bullish outlook, spotlighting an inverted head and shoulders pattern at the long-term bottom of $25.21. The head is marked by a double bottom at $25.21 and $27.08, while the shoulders are at $50.93 and $48.65. Breaking the pattern’s neckline at $60 and a long-term blue trendline at $70, the stock rallied to an all-time high of $118.89. This pattern, corroborated by a double bottom in the RSI, signals strong bullish potential for further upward movement. The red arrows on the monthly candles for June, July, and August 2023 indicate readiness for continued growth, offering an investment opportunity at the current price.

XOM Monthly Chart (stockcharts.com)

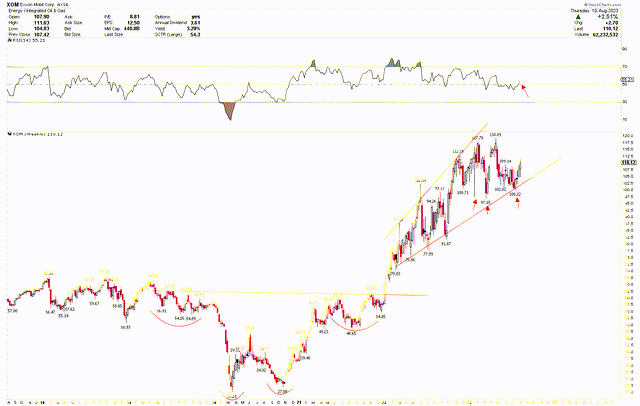

Additionally, a shorter time frame view of Exxon Mobil’s stock price emphasizes the inverted head and shoulders pattern, marked by red arcs. The price movement following the pattern’s breakout is contained within an ascending broadening wedge pattern, a bullish sign for investors. With the RSI above the mid-level of 50, buying strength is growing, indicating that buying at the current levels is a good option for investment.

XOM Weekly Chart (stockcharts.com)

Market Risks

Exxon Mobil’s financial well-being is closely tied to the global oil market. Sharp variations in oil prices can have an immediate effect on its profitability. The global economic landscape, still recovering from the COVID-19 pandemic, adds another layer of uncertainty. A slowdown or reversal in economic growth could lead to diminished demand for oil and gas, further impacting Exxon Mobil’s revenues. Additionally, the company faces fierce competition from other industry giants. Losing ground in terms of pricing or innovation could result in a loss of market share. Moreover, Exxon Mobil’s extensive infrastructure exposes it to risks such as accidents, natural disasters, or operational failures. Such incidents can result in substantial financial costs, legal complications, and reputational damage.

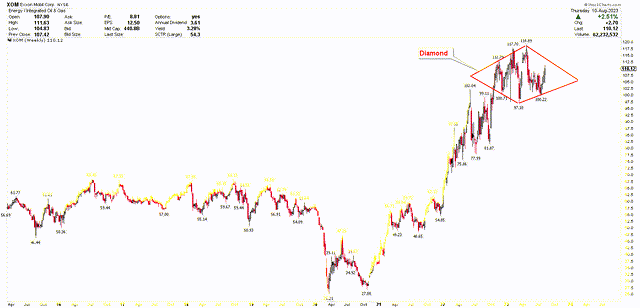

From a technical perspective, Exxon Mobil’s stock price has soared from its 2020 low of $25.21, currently trading at much higher levels and forming a diamond pattern as shown in the chart below. If the price fails to surpass the all-time high of $118.89 and begins to correct lower, it may signal further downward momentum in the market. This potential trend warrants close observation for those considering the investment, as it may indicate underlying challenges or changing perceptions of the company’s prospects.

XOM Weekly Chart (stockcharts.com)

Bottom Line

Exxon Mobil’s recent financial performance and strategic moves present a multifaceted and robust picture of a company navigating a complex and often unpredictable landscape. Despite facing a decrease in earnings from the first quarter, reflecting challenges such as lower natural gas realizations and industry refining margins, the company has demonstrated resilience and adaptability. The notable progress toward significant cost savings, strong free cash flow, and a conservative debt-to-capital ratio underscores a financially astute management approach. Moreover, the acquisition of Denbury Resources exemplifies Exxon’s forward-thinking alignment with sustainability trends and readiness to embrace the burgeoning CCUS market. This move, along with interest in lithium extraction for electric vehicles, showcases Exxon’s proactive stance towards diversification and future-oriented investments.

From a technical perspective, Exxon Mobil’s stock price continues to display a strong bullish trend, having broken the symmetrical broadening wedge pattern in 2022. Patterns such as the emergence of a double bottom, inverted head and shoulders, and a breakout of a symmetrical broadening wedge collectively present a strongly bullish outlook and signal positive momentum in the near future. If the stock price breaks above $119, it could trigger another significant rally in Exxon Mobil. Investors may consider buying the stock at current levels in anticipation of higher prices.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.