Summary:

- Oil market expected to shift from short supply in 3Q 2024 to surplus in 4Q 2024, leading to lower oil price forecast.

- Russia’s oil production cuts and economic downturn impacting oil demand, leading to changes in market balance outlook.

- Exxon Mobil’s deal with Pioneer Natural Resources expected to boost production capacity and reduce costs, leading to revised revenue and EBITDA forecasts.

imaginima

Investment thesis

We have covered the stock before, and there have been a number of changes since last quarter, which are the subject of this report:

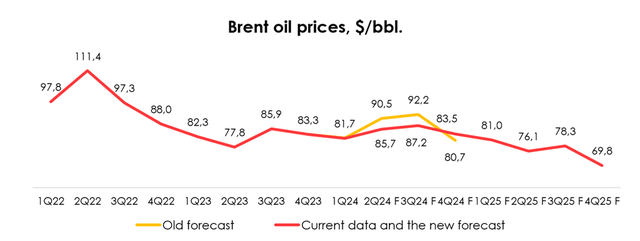

- We expect the oil market to have a short supply in 3Q 2024, but swing to a surplus in 4Q 2024. We have lowered our oil price forecast for 2024 from an average of $86.3/bbl to $84.5/bbl.

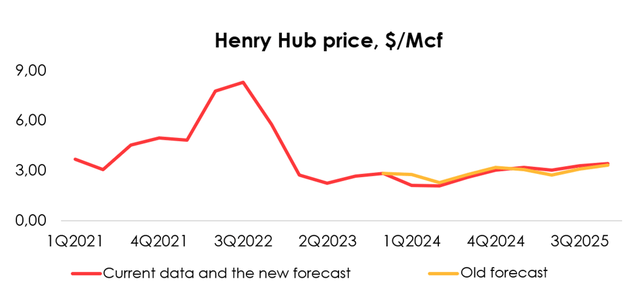

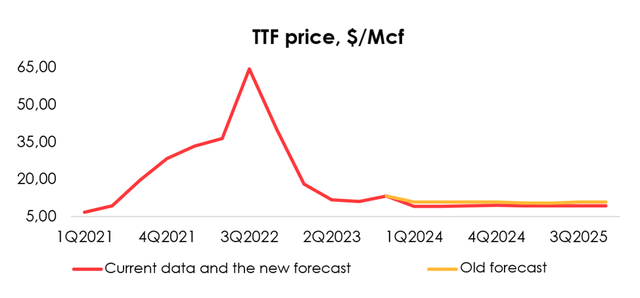

- Both the TTF and Henry Hub forecasts have also been lowered for 2024.

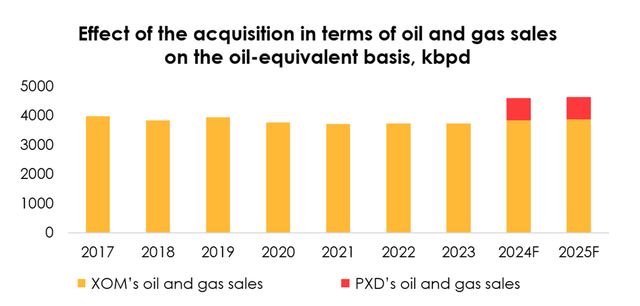

- Given the minor reduction in the projected global demand for natural gas, we are lowering the average oil and natgas volumes available for sale from 3891 kbpd to 3845 kbpd for 2024, and from 3929 kbpd to 3877 kbpd for 2025.

The deal with Pioneer Natural Resources was closed on May 3, 2024. We expect that, once the deal is completed, it will boost Exxon Mobil’s (NYSE:XOM) capacity to produce oil and gas from 3845 kbpd on the oil-equivalent basis to 4598 kbpd in 2024, and from 3877 kbpd to 4637 kbpd in 2025, which is equivalent to a growth of 23% y/y and 1% y/y, respectively.

Based on the new assumptions, we maintain the HOLD rating for the shares.

Oil market balance

In April of 2023, Russia announced voluntary oil production cuts of 0.5 mln barrels per day – from 11.2 mbpd in February of 2023 to 10.7 mbpd through the end of 2024. In March of 2024, it was decided to make additional oil production and export cuts averaging a total of 471 thousand bpd throughout 2Q 2024.

According to the US Department of Energy, Russia’s oil production declined from 10.7 mbpd in 1Q 2024 to 10.5 mbpd in April 2024 and 10.4 mbpd in May 2024. At the OPEC+ meeting on June 2, it was decided to extend the current oil production cuts from 2Q through 3Q 2024, and then incrementally lift the restrictions. Earlier, we had expected this to happen as soon as 3Q 2024. Therefore, we lowered our average forecast for Russia’s oil production in 2H 2024 to 10.4 mbpd, and the forecast for OPEC oil production (excluding Russia) in 2H 2024 to 32.1 mbpd.

In the US, EU, and China the PMIs were below or near to 50 in 2Q 2024, indicating a decline in business activity. We expect the economic downturn will prompt oil demand to decline by 0.1 mbpd in 2024 from 2023 in the EU, and rise slightly – by 0.2 mbpd y/y – in the US. We expect demand in China to increase by 0.4 mbpd y/y in 2024, and by 1.3 mb y/y in other countries (excluding the US, EU and China).

We have lowered the forecast for Russian oil production in 2H 2024 to 10.4 mbpd as Russia extended its voluntary production cuts for 3Q 2024. In 4Q 2024 Russia will incrementally ramp up production.

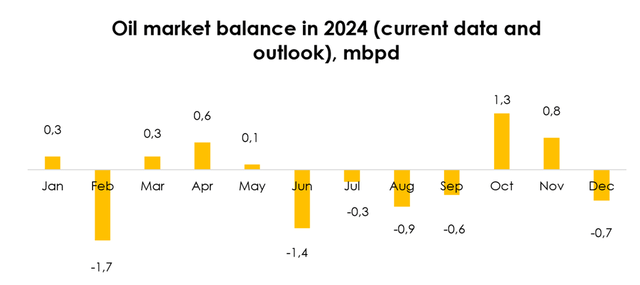

Given the lower forecast for OPEC+ production, we have changed the outlook for oil market balance in 3Q 2024 from balanced to undersupplied. We expect the market to swing to surplus in 4Q 2024.

Outlook for Brent oil prices

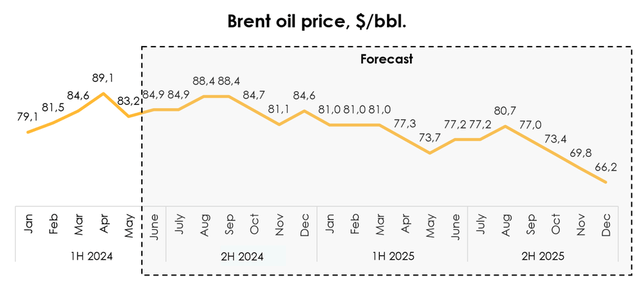

Because the current oil price environment is weaker than we previously expected, we are making a more conservative assumption for price growth in June 2024. At the same time, given that the outlook for 3Q 2024 changed from a balanced market to undersupplied market, we are projecting a more positive oil price trend for that period.

As a result, we are lowering the forecast for the 2024 average oil price from $86.3/bbl to $84.5/bbl. We expect oil prices to climb to $88.4/bbl in August and September amid the OPEC+ production curbs and short supply in the market, before sliding to $81.1/bbl in November as the removal of the OPEC+ production curbs will bring about a market surplus.

We expect Brent prices to average $76.3/bbl in 2025 amid a surplus. We estimate that oil prices will fall as low as $66.2/bbl by December 2025.

Macro outlook for the gas market

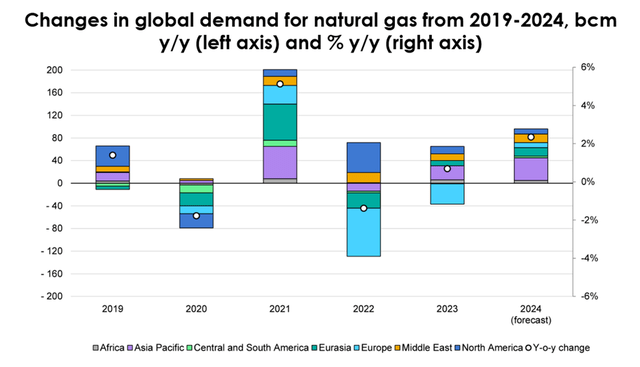

Compared with last quarter, the International Energy Agency has slightly reduced its forecast for growth in gas demand in 2024 from 2.5% y/y (+2 pp y/y) to 2.3% y/y (+1.8 pp y/y). Most of the demand will continue to come from fast-growing Asian markets.

The forecast for growth in the Asia-Pacific region (which includes Exxon Mobil’s two major gas markets: Asia and Australia and Oceania, together accounting for more than 60% of gas demand) was left unchanged at 4% y/y in 2024. Demand In Asia continues to expand, driven by China, India and some Asian developing markets (Thailand, Bangladesh and Pakistan), even as consumption falls in Japan and Korea, which develop nuclear-powered energy generation, and despite warmer weather during the 2023/2024 heating season.

The forecast for US demand growth was also left unchanged at less than 1%. In North America, natural gas demand throughout the 2023/24 heating season remained largely unchanged from a year earlier. Although gas-fired power generation continued to expand strongly, this growth was more than offset by a sharp decline in demand in the residential and commercial sectors amid unseasonably mild weather conditions.

The outlook for global demand was affected by a lower forecast for gas demand in Europe. Previous expectations were for an increase of 3% y/y in 2024, but due to lower 1Q 2024 results, the forecast was revised downward to less than 2% y/y, largely because industrial recovery remained moderate. Despite some recovery in industrial demand in such countries as Germany and the Netherlands, short-term economic demand indicators remain almost unchanged, with the euro area Manufacturing PMI holding below 50. In addition to weak economic activity, warm weather also meant the level of inventories in underground gas storage facilities remained high.

Gas price outlook

We use the Henry Hub and TTF benchmarks to forecast gas prices for US domestic sales and for international sales, respectively.

Despite weak demand, US natural gas production during the heating season climbed by about 3% y/y. Continued production growth, when combined with weak demand, led to a decline in US natural gas prices, with prices falling to 10-year lows in 1Q 2024.

The forecast for the Henry Hub benchmark is provided by the US Energy Information Administration (EIA). The agency reduced the price estimate for the short term, and we believe that’s because the heating season is over and inventories are high. The EIA raised the price estimate for the medium term, and we believe that’s because of expectations that producers will cut drilling activity amid record low US gas prices, and therefore, prompt the country’s balance to shed the excessive gas inventories by the end of the 2024/2025 heating season.

The Henry Hub price estimate was cut from $2.76/Mcf to $2.46/Mcf for 2024, but raised from $3.06/Mcf to $3.24/Mcf for 2025.

Based on the macroeconomic environment that we described above, we are lowering the forecast for the TTF price from $10.84/Mcf to $9.30/Mcf for 2024, and from $10.69/Mcf to $9.37/Mcf for 2025.

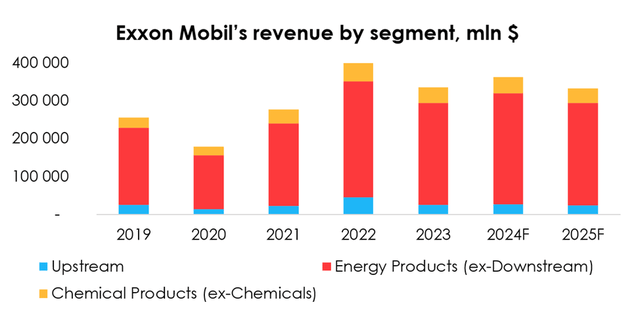

Exxon Mobil’s revenue structure

The biggest proportion of the revenue structure comes from the Energy Products segment (ex-Downstream), which consistently brings XOM ~80% of its revenue and comprises oil and gas processing. The Chemical Products segment (ex-Chemicals), which produces petrochemicals, brings in ~12%. The Upstream segment (oil exploration and production) makes up ~8% of the company’s total revenue.

We expect the revenue structure by segment to hold steady over the forecast period.

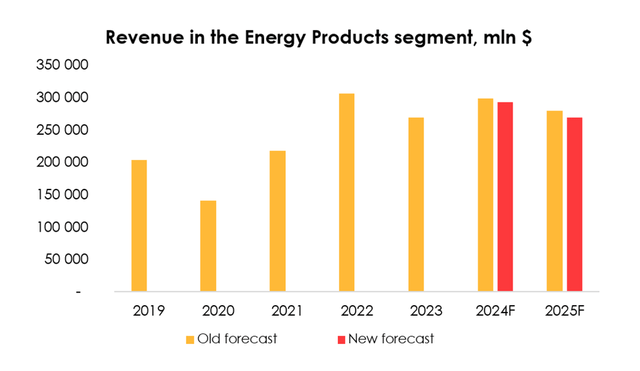

We have lowered the revenue forecast for the Energy Products segment from $298.3 bln (+11% y/y) to $292.5 bln (+9% y/y) for 2024, and from $279 bln (-6% y/y) to $269.1 bln (-8% y/y) for 2025 due to:

- the decrease of the forecast for Brent oil prices from $86.3/bbl to $84.5/bbl for 2024, and from $80.7/bbl to $76.3/bbl for 2025;

- the expected decline of selling prices of oil products in 2024-2025 that will follow oil prices;

- the reduced forecast for natural gas prices on the US domestic market and in international sales in 2024, which dampened expectations for the segment’s higher revenue in 2024;

- the increased forecast for natural gas prices on the US domestic market in 2025, which mitigated expectations for the segment’s lower revenue in 2025.

Given the minor reduction in the projected global demand for natural gas, we are lowering the average oil and natgas volumes available for sale from 3891 kbpd to 3845 kbpd for 2024, and from 3929 kbpd to 3877 kbpd for 2025.

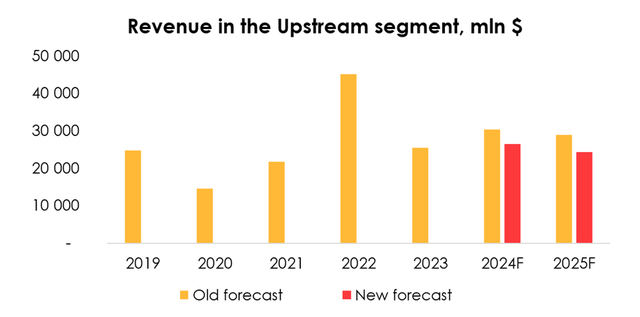

As such, we are lowering the revenue forecast for the Upstream segment from $30.4 bln (+19% y/y) to $26.5 bln (+4% y/y) for 2024, and from $29 bln (-4% y/y) to $24.4 bln (-8% y/y) for 2025 due to:

- the lower projected sales of oil and natgas in 2024 and 2025;

- the decrease of the forecast for Brent oil prices from $86.3/bbl to $84.5/bbl for 2024, and from $80.7/bbl to $76.3/bbl for 2025;

- the lower forecast for natgas prices for international sales in 2024 and 2025 and for domestic sales in 2024, although the forecast for natgas prices for domestic sales in 2025 was raised, mitigating the reduction of the forecast for the segment’s revenue in 2025.

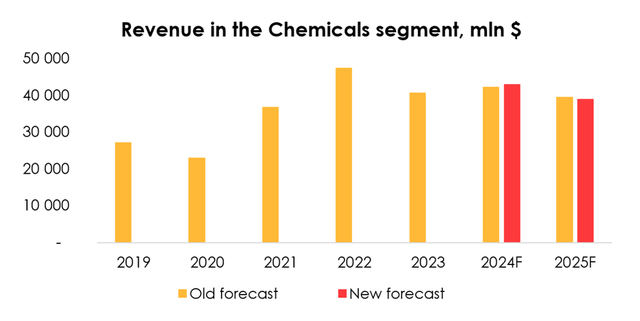

The forecast for revenue in the Chemical Products segment has been raised from $42.4 bln (+4% y/y) to $43.1 bln (+6% y/y) for 2024, but cut from $39.6 bln (-7% y/y) to $39.1 bln (-9% y/y) for 2025.

Exxon Mobil’s financial results

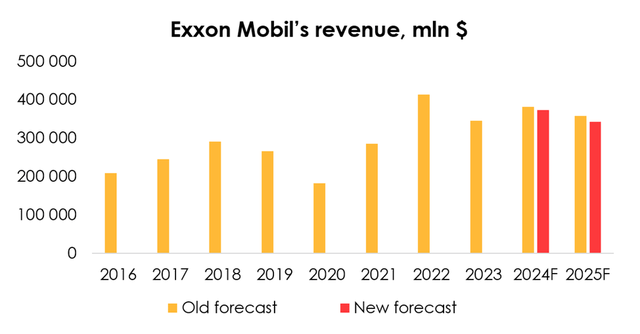

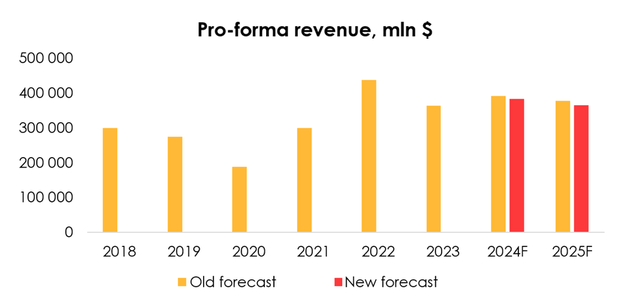

We are lowering the forecast for Exxon Mobil’s revenue from $381.6 bln (+11% y/y) to $372.8 bln (+8% y/y) for 2024, and from $358 bln (-6% y/y) to $342.5 bln (-8% y/y) for 2025 due to the reduced revenue forecast for almost all of the company’s three segments for 2024-2025.

In 1Q 2024 the spread between the purchasing price of oil and oil products and the Brent oil price moderately increased, following the sharp decline in the prior quarter, to a level where we expect it will stabilize.

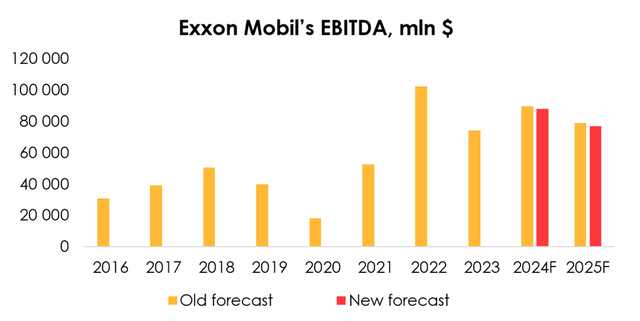

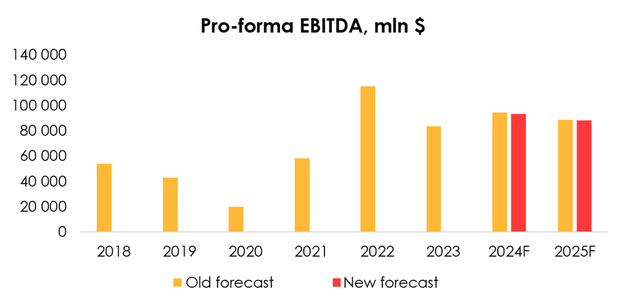

We are lowering the forecast for Exxon Mobil’s EBITDA from $89.6 bln (+21% y/y) to $88.2 bln (+19% y/y) for 2024, and from $79.2 bln (-13% y/y) to $77.1 bln (-6% y/y) for 2025 due to the reduced forecast for Exxon Mobil’s revenue in 2024-2025.

Deal to buy Pioneer Natural Resources

On May 3, 2024, Exxon Mobil closed the deal to merge with Pioneer Natural Resources. The number of shares expected to be issued following the transaction is about 545 mln.

In the report for 3Q 2023 we have described in detail what benefits we expect to arise from the deal for both companies. Here are the highlights:

- Exxon Mobil is set to reduce oil and gas production costs, compared with the industry-average level, through technology and knowledge sharing with Pioneer Natural Resources.

- In what sets it aside from competition, XOM widely uses the cube development technique, and the acquisition of Pioneer, which has also fully moved to using this practice, is in line with Exxon Mobil’s well development strategy.

We expect that, following the completion of the deal, it will boost Exxon Mobil’s capacity to produce oil and gas from 3845 kbpd on the oil-equivalent basis to 4598 kbpd in 2024, and from 3877 kbpd to 4637 kbpd in 2025, which is equivalent to a growth of 23% y/y and 1% y/y, respectively.

Therefore, by combining capabilities with Pioneer Natural Resources, Exxon Mobil will be able to produce more resources, while improving efficiency through technology sharing.

Pro forma financial results

We anticipate that following the acquisition of Pioneer Natural Resources, Exxon Mobil’s combined revenue will reach $383.5 bln (+5% y/y) in 2024, down from our earlier expectations of $391.9 bln (+8% y/y), and it will reach $364.8 bln (-5% y/y) in 2025 versus $378.2 bln (-3% y/y).

The lower forecast for 2024-2025 was largely driven by the cut to the Exxon Mobil revenue forecast, although it was partially mitigated by a higher revenue forecast for Pioneer.

Consequently, the forecast for Exxon Mobil’s combined EBITDA was lowered from $94.4 bln (+13% y/y) to $93.3 bln (+12% y/y) for 2024, and cut from $88.8 bln (-6% y/y) to $88.5 bln (-5% y/y) for 2025.

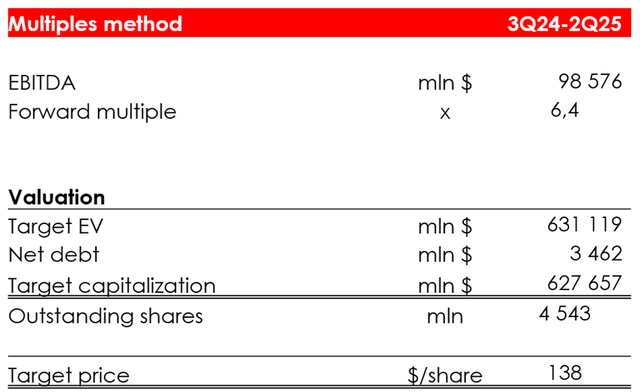

Valuation

We are raising the target price of the shares from $124 to $134 due to:

- the higher EBITDA forecasts for the period from 3Q 2024 – 2Q 2025;

- the reduction of the projected cumulative net debt of the two companies from $10.8 bln to $3.5 bln;

- the shift of the FTM valuation period.

Based on the new assumptions, we are maintaining the rating for the shares at HOLD.

The price of $134/share was achieved by computing the target price based on the multiples method, and discounting it at the rate of 13% per annum. The discount rate of 13% is the average growth of the S&P 500 Index over the past 20 years. In other words, when we value a company based on its long-term results, it is important to us that the company’s growth exceeds the average growth of the index.

Conclusion

In line with the company’s portfolio diversification strategy, Exxon Mobil is actively pursuing M&A deals. On May 3, 2024, Exxon Mobil closed the deal to merge with Pioneer Natural Resources, and it will not only increase Exxon Mobil’s capacity to produce oil and gas, but also will reduce oil and gas production costs, compared with the industry-average level, through technology and knowledge sharing with Pioneer Natural Resources.

Based on the new assumptions for the oil balance market and the gas market, we assign a HOLD rating to the stock. To manage your positions, we recommend following the earnings releases of Exxon Mobil and Pioneer Natural Resources, as well as the news related to the oil and gas market.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.