Summary:

- Rising tensions in the Middle East created additional tailwinds and have driven Exxon Mobil’s stock to all-time highs, but the momentum may be short-lived.

- Long-term upside is not guaranteed as non-OPEC production continues to rise, and Saudi Arabia may abandon production quotas, potentially leading to lower oil prices.

- Despite recent gains, Exxon Mobil’s stock is a HOLD for me.

Oleksii Liskonih

In the last week, oil prices have rallied, and Exxon Mobil Corporation’s (NYSE:XOM) shares appreciated to all-time highs after Iran attacked Israel with ballistic missiles. The rising tensions in the Middle East constantly cause oil price volatility, since any escalation of regional conflicts could result in a decrease in global oil supply at a time when the demand for oil is rising. The rising tensions in the region created short-term tailwinds for Exxon Mobil’s stock, which could retain its momentum and appreciate further. This is primarily because the price action will be mostly dictated by the developments that happen in the Middle East in the following weeks.

However, in the long run, Exxon Mobil’s shares will likely retract from the current levels and could trade lower than today. This could happen not only due to the potential normalization of the situation in the Middle East, but also due to the increase in the global supply of oil from other regions and the potential policy pivot by OPEC+, which would undermine any major growth catalysts that Exxon Mobil has going for it. This is why at the current price, Exxon Mobil’s stock is a HOLD for me.

War Risk Premium Is Back

It’s not a surprise that the price of oil on an open market has significantly appreciated in the last few days. Ever since the discovery of major oil fields in the Middle East, the developments in the region had a direct impact on oil prices. In 1973, after the United States provided military aid to Israel during the Yom Kippur War, Arab states imposed an embargo on the United States and its allies, which significantly increased oil prices. In 1980, after Iran and Iraq went to war with each other, millions of daily barrels of oil were taken off the market, which also led to a spike in oil prices. The same thing happened during the Gulf War in the early 1990s and during the Iraq War in the early 2000s. That’s why it’s not a surprise that the recent oil rally was one of the biggest in the last two years, and it has the opportunity to retain its momentum for a while.

At this stage, an Israeli retaliation against Iran’s energy infrastructure could lead to a further spike in oil prices and continue to positively affect Exxon Mobil’s stock in the following weeks. Back in August, Exxon Mobil cut its Q4 forecast for Brent Crude Oil to $80 per barrel. In September, the EIA shared a similar forecast, where it expected the Q4 price for Brent Crude Oil to average at $82 per barrel. Given that oil prices now could rise by an additional $13 per barrel in case of the Israeli retaliation against Iran’s energy infrastructure or even up to $28 per barrel in case the shipments through the Strait of Hormuz are blocked, those forecasts could be too conservative.

However, the lack of a shared border between Iran and Israel will likely mean that there would be no direct ground operations similar to the ones that are currently happening in Russia and Ukraine. In April, Iran already attacked Israel with drones and missiles, which pushed the oil prices higher, but shortly after the momentum faltered. On top of that, when Ukraine bombed Russian oil infrastructure and disrupted 14% of Russia’s refinery capacity, the reaction of the oil market was mostly muted. That is why, at best, Israel’s potential retaliation against Iran’s oil infrastructure could create a short-term further spike in oil prices, after which the situation on the market will likely normalize.

Let’s not forget that oil production fairly quickly rebounded in Kuwait and Iraq after the ground operations happened in those countries. Therefore, without major ground operations on Iranian territory, it’s unlikely that the ongoing bullish momentum on the oil market will hold for long.

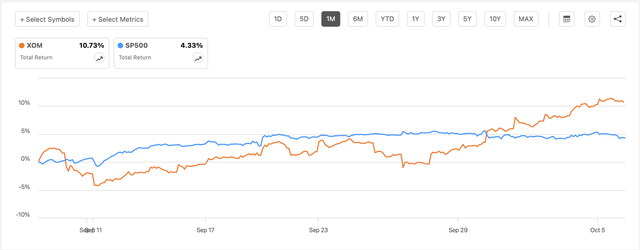

Considering all of this, in the foreseeable future, the price action of Exxon Mobil’s stock will be dictated primarily by the developments that are happening in the Middle East. This has its own upsides and downsides. While Exxon Mobil’s stock was mostly underperforming against the broader market since late 2023 when I published my latest article on the company, recently things started to change. The chart below shows that in the last six months, the total returns for Exxon Mobil’s stock were below the total returns of the broader market.

Exxon Mobil’s Stock Performance Against The Broader Market (Seeking Alpha)

However, on a 1-month chart, we see that the company’s stock has outperformed the broader market, primarily thanks to the increased volatility in the oil market caused by the rising tensions in the Middle East. It’s safe to assume that in the following weeks, Exxon Mobil’s stock will likely outperform the S&P 500 as well since the market is waiting for the Israeli retaliation that can result in greater volatility in the oil market and a further appreciation of the company’s shares.

Exxon Mobil’s Stock Performance Against The Broader Market (Seeking Alpha)

Other Growth Catalysts Are Still Out There

If we put the war risk premium aside, we would still be able to find several additional growth catalysts that Exxon Mobil has going for it. Firstly, Exxon Mobil has been excelling in risk management recently as it has been divesting from global projects and focusing on creating value in a safer Western hemisphere. This year alone, Exxon Mobil sold or is planning to sell onshore oil assets in Iraq, Equatorial Guinea, Malaysia, and Nigeria. By selling its stake in the West Qurna 1 oilfield, the company completely exited Iraq, and the risk of its operations being disrupted in the Middle East is now limited.

Despite unwinding stakes in global assets, Exxon Mobil also continues to scale its operations primarily in the Western hemisphere and was able to increase its total production in Q2 by 15% Q/Q to 4.4 million barrels of oil per day. Thanks to this, the company’s revenues in Q2 were able to increase by 12.2% Y/Y to $93.06 billion and exceeded expectations by an impressive $3.38 billion. Such results in part were achieved thanks to the completion of the purchase of Pioneer Natural Resources in May, which helped Exxon Mobil to boost its production primarily in the Permian Basin and contributed an additional $500 million to earnings in Q2. By having a greater presence in the Permian Basin, Exxon Mobil should be able to continue to scale its production without significantly increasing its costs of operations.

What’s more, is that Exxon Mobil’s oil projects in Guyana should also help the company grow its cash flow in years to come. As of early 2024, Guyana’s oil production was 645,000 barrels of oil per day, and Exxon Mobil believes that by 2027 it will be able to produce 1.2 million barrels per day there. In Q2, the company already achieved record production in the country, and it appears that a further increase in production is only a matter of time as Exxon Mobil is already on track to expand its presence in Guyana soon. Given that the average cost of production in Guyana is around $60 per barrel or less, Exxon Mobil should be able to continue to generate decent returns in the foreseeable future. Add to all of this the fact that the macro environment continues to improve and OPEC+ hasn’t abandoned the production quotas yet, and it becomes obvious that Exxon Mobil still has decent growth catalysts in addition to the war risk premium.

The Upside Is Not Guaranteed

Despite all the growth opportunities, the upside for Exxon Mobil is not guaranteed in the long run. Thanks to the rapid expansion of non-OPEC production across the globe, which was fueled primarily by the shale revolution in the United States, the developments in the Middle East are likely to have a lesser effect on the oil market in comparison to a few decades ago. The latest report by the EIA indicates that the production outside OPEC+ is expected to continue to increase in the foreseeable future, which could mitigate the potential decrease in supply from Iran in case of the potential Israeli retaliation against Iran’s energy infrastructure.

At the same time, there’s a possibility that Saudi Arabia will decide to abandon the production quotas that it implemented along with OPEC+ countries to win back the lost market share. The Wall Street Journal earlier this month reported that the Saudi Minister threatened to launch a price war and flood the market with additional oil supplies after some OPEC+ members failed to meet their quotas. On top of that, Citigroup Inc. (C) last month said that without deeper OPEC+ production cuts, the average price for Brent Crude Oil next year could be around $60 per barrel.

Therefore, Exxon Mobil’s exposure to global developments not only has upsides, but downsides as well. The company is expected to report its Q3 results next month, and it already expects weaker upstream earnings and refining margins due to the lower liquids prices during the period. While the situation is likely to improve in Q4 given that oil prices have already rallied this month, the momentum in the end could be short-lived and the company’s stock could retract after the rapid appreciation that happened in the last week.

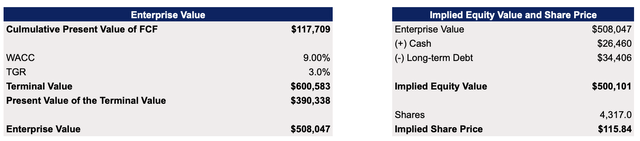

That’s why all of this brings us to the question of whether it makes sense to invest in Exxon Mobil at the current price given all the latest developments. In late 2023, my DCF model showed that Exxon Mobil’s fair value was $102.77 per share. It’s important to note that that model was made before Exxon Mobil acquired Pioneer Natural Resources and did not include the upside from the deal that was completed only this May.

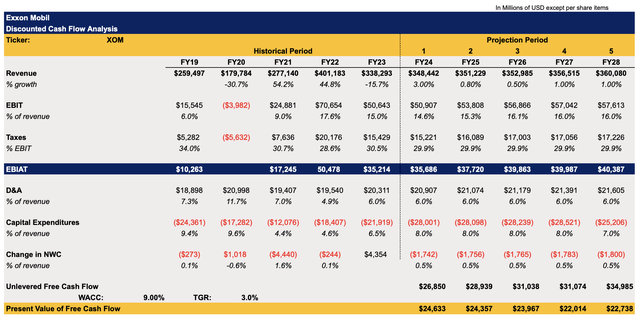

The updated model below assumes that revenues in FY24 and beyond will increase Y/Y primarily thanks to the higher-than-expected average oil prices for the year that were caused by rising tensions in the Middle East. The EBIT as a percentage of revenue is expected to stay at double-digits, as the company will be able to keep its margins relatively high thanks to receiving lucrative assets in the Permian Basin that Exxon Mobil got after acquiring Pioneer Natural Resources. The CapEx in the model closely correlates with the management’s guidance and includes the spending related to Pioneer Natural Resources assets. The WACC and the terminal growth rate in this model are the same as before.

Exxon Mobil’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

The updated model shows that Exxon Mobil’s fair value is $115.84 per share, which is ~5% below the current market price at the time of this writing.

Exxon Mobil’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

The Bottom Line

At this stage, it seems that without a war risk premium, there are little reasons to justify Exxon Mobil trading at the current market price. The company’s stock was underperforming against the broader market throughout most of the year and only recently began to rapidly appreciate since the escalation of tensions in the Middle East created additional tailwinds for the shares. Therefore, while the shares might appreciate further in the following weeks if Israel retaliates against Iran, the momentum could be short-lived due to the expected increase in oil supplies by non-OPEC producers and potentially by Saudi Arabia, which is ready to abandon production quotas. That’s why Exxon Mobil is a HOLD for me right now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.