Summary:

- Exxon Mobil Corporation is the second largest publicly traded oil company in the world, with a high valuation and potential for growth.

- Quarterly performance includes strong earnings, dividends, and debt management, focusing on continued growth and shareholder returns.

- The acquisition of Pioneer Natural Resources, expected earnings growth, and guidance for increased production make Exxon Mobil a valuable investment despite market capitalization risk.

apomares/E+ via Getty Images

Exxon Mobil Corporation (NYSE:XOM) is the second largest publicly traded oil company in the world, behind Saudi Aramco. We discussed the company’s lofty valuation in our last article, and the company’s valuation remains high. However, with the potential to continue growth and drive long-term returns, Exxon Mobil is a valuable investment.

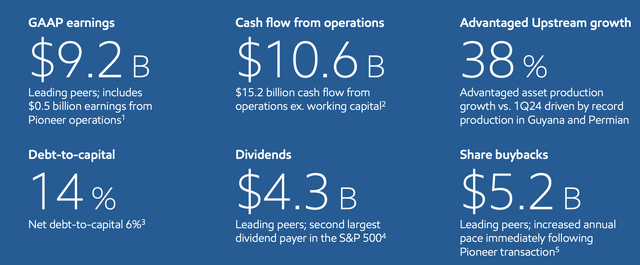

Exxon Mobil Quarterly Performance

Exxon Mobil had strong quarterly performance versus its market capitalization of $520 billion.

Exxon Mobil Investor Presentation

The company had $9.2 billion in GAAP earnings, and was one of the strongest companies in the world, with $10.6 billion in CFFO. The company paid out $4.3 billion in dividends, a yield of more than 3.3%, and has a 14% debt-to-capital, a level it can comfortably manage. The company puts effectively all of its CFFO into dividends and share buybacks at an 8% annualized yield.

The company had a strong quarter, but at an 8% yield, it needs to continue growth. It’s also worth noting the company’s true earnings yield is higher, given the partial integration of Pioneer into the results.

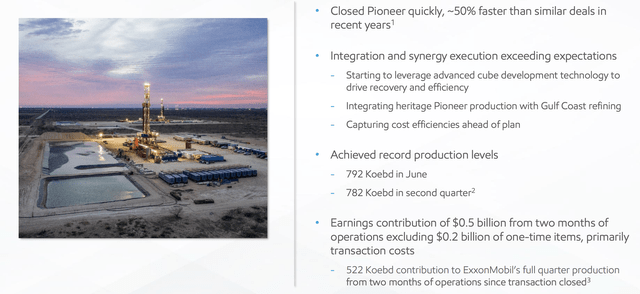

Exxon Mobil Pioneer Integration

The company has closed its second-largest acquisition ever with its almost $65 billion purchase of Pioneer.

Exxon Mobil Investor Presentation

The company has managed to close the deal and is already earning money and hundreds of thousands of barrels/day in production. Pioneer has achieved record production with almost 800 thousand barrels/day in production and is an incredibly strong producer in the Permian Basin. The company needs to capture strong efficiency to have the acquisition pay off.

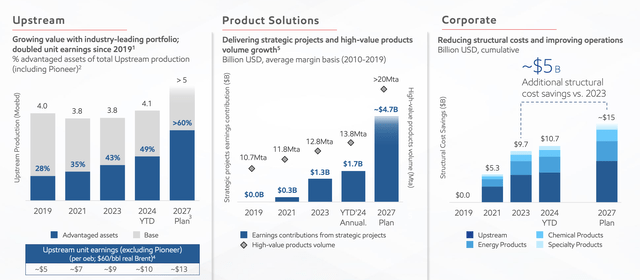

Exxon Mobil Earnings Growth

The company expects to have strong continued earnings growth supported by its incredibly strong assets.

Exxon Mobil Investor Presentation

The company’s upstream portfolio has doubled unit earnings since 2019. The company’s earnings at $60/barrel real Brent have grown to $13/barrel and should be able to continue their growth. The company’s 2027 plan is to produce over 5 million barrels/day, supported by continued growth in its core assets as well.

The company’s downstream segment continues to have high margins with volume growth. The company again expects earnings to more than double by 2027, as the company works to extract value at every portion of the value chain. All of this will combine with additional cost savings, enabling the company’s overall margins and earnings to continue their growth.

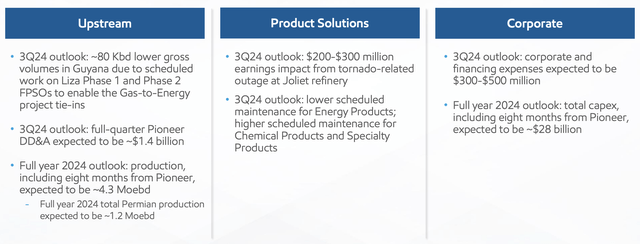

Exxon Mobil Guidance

The company’s guidance is supported by strong growth, especially in Guyana and the Permian Basin.

Exxon Mobil Investor Presentation

The company expects scheduled FPSO work in Guyana to temporarily lower volumes, but Guyana is expected to grow to more than 600 thousand barrels/day of production. The company has recently announced its 6th project, Whiptail, which at $12.7 billion should add another 250k barrels/day of production by YE 2027.

The company’s trends point to production passing 1.3 million barrels/day by 2027, which means over 300 thousand barrels/day in additional production attributable to Exxon Mobil. The company also expects Permian production to be ~1.2 million barrels/day, almost doubling from Pioneer, along with future growth.

The company’s capital expenditures remain lofty at $28 billion, making it one of the largest capital spenders in the industry. The company’s full-year growth emphasizes its focus on long-term shareholder returns. The company’s impressive growth potential makes it a valuable investment.

Thesis Risk

The largest risk to our thesis is the company’s market capitalization of more than $500 billion. The company needs continued growth to justify that valuation, and it’s also a tough valuation to maintain as oil demand starts to trend down going into the end of the decade. That can hurt the company’s ability to drive future returns.

Conclusion

Exxon Mobil is an even larger oil corporation, with the company’s acquisition of Pioneer Natural Resources pushing its market capitalization past $500 billion. The company has a dividend of more than 3% and is continuing to repurchase shares, which pushes its total yield to roughly 8%. That’s a strong shareholder yield for a growing company.

The company has a debt load that it can comfortably afford and is directing effectively all of its cash to shareholder returns. The company’s 2024 production is expected to be at ~4.2 million barrels/day, and the company is expecting to push that past 5 million barrels/day in 2027. That will enable strong returns, making the company a valuable investment with hefty cash flow.

Please let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.