Summary:

- Exxon Mobil Corporation is an attractive investment option for 2024 due to its strong balance sheet, declining share value, and potential for sector rotation into dividend stocks.

- The Fed tightening cycle is likely coming to an end, with inflation at a 4-month low and the possibility of a rate cut in 2024, making income-producing assets more appealing.

- Exxon Mobil has a solid financial position, with a large amount of cash on hand, strong revenue and profitability, and a history of returning capital to shareholders through buybacks and dividends.

PM Images

I’ve been hunting for income-producing equities with strong balance sheets that return capital to shareholders, and they have declined throughout 2023 as I look to get ahead of a Fed pivot. Many dividend companies have seen negative returns in 2023 and look compelling as treasury yields decline, and a Fed pivot looks more likely for 2024. While tech companies saved the market in 2023, I think that a sector rotation into quality dividend companies will occur in 2024, and investors will gravitate toward the qualities I am currently looking for.

Exxon Mobil Corporation (NYSE:XOM) has currently retraced to 52-week lows, and the dividend yield is approaching 4%. XOM checks off all the boxes for me, and recently announced that they will boost the buyback program to $20 billion in 2024. Shares of XOM could continue to decline, as there is no indication that a bottom has been established or is trying to form. I am planning on adding to my position at these levels, as I think XOM will have a strong year in 2024.

Following up on my previous article about Exxon Mobil

It’s been a while since I wrote about XOM, as my last article was published on 2/14/20 (can be read here). Since then, shares of XOM have appreciated by 60.25%, and when the dividends are factored in, the total return has been 94.71% compared to the S&P 500 (SP500) appreciation of 36.91%. That article was published a month before the pandemic, and I had discussed the momentum XOM had in its drilling projects and why the energy landscape was setting up well for XOM.

It’s been almost 4 years since that article was published, and I wanted to provide an update, as my investment thesis regarding XOM has changed a bit. I think XOM has tremendous potential on a total return basis over the next several years through capital appreciation and income generation.

Inflation came in at a 4-month low, and the Fed tightening cycle looks like it’s coming to an end

The macroeconomic environment has been changing, and we just got an inflation print that slowed to 3.1% in November. Core inflation remained flat at 4% in November, and CME Group has the chances of a continued pause at 98.4%, with only a 1.6% chance that the Fed will increase rates by 25 bps at the Fed meeting on 12/13. All eyes will be on Jerome Powell as he delivers his commentary about rates. I am expecting him to remain hawkish and leave the door open for another hike.

The Fed was late to the party and got caught offside during the narrative of transitory inflation. The Fed took rates higher at the quickest pace in several decades, and I think the Fed would rather leave rates where they are longer than they must be so they can ensure they will not be caught offsides again. I have continuously disagreed with commentary throughout 2023 about a rate cut, and I think that the more likely scenario is that the Fed will hold rates where they are until May or June of 2024.

We just got an unemployment print that fell to 3.7% as GDP expanded 3% YoY in Q3. The economy is indicating that it can endure rates where they are, and I am expecting that the Fed will include this in its message and pivot in 3-6 months before the majority of debt from the real estate sector needs to be refinanced.

Nobody knows what Jerome Powell is going to say at the Fed meeting, but with inflation well off its peak and yields in the bond market declining, all signs are pointing to the Fed being at the end of its tightening cycle. The Fed Dot Plot indicates that a pivot will occur in 2024, and we could see a substantial drop in rates over the next 2-years. There is currently $5.7 trillion of cash parked in money market accounts in addition to capital locked up in CDs and treasuries on the sidelines.

As a pivot occurs, there will be less of a reason for investors to utilize money market accounts as a proxy to generate income, as the yield isn’t protected as it is with a CD or treasury. This is capital that can be moved instantaneously, and I believe that once the Fed conducts their first rate cut, a substantial amount of capital will flow into the capital markets looking to front-run an easing cycle. I want to get ahead of this, as income-producing assets are likely to become magnets for incoming cash to recreate the yields investors were accustomed to generating in risk-free assets.

Why Exxon Mobil checks off all of my boxes going into 2024

I am looking for income-producing assets that have declined in share value, have strong balance sheets, generate large amounts of profits, and return capital to shareholders through dividends and buybacks. XOM checks off all these boxes, and I think it will be a top candidate, as a sector rotation into dividend stocks is likely to occur while incoming capital throughout the year goes yield hunting.

XOM’s balance sheet is a fortress that only a few companies can replicate. XOM has $32.94 billion sitting in cash on hand, with another $40.06 billion in long-term investments. XOM has $34.77 billion of long-term debt on the balance sheet, with $41.25 billion in total debt. Their net debt is only $8.31 billion, and when the long-term investments are factored in, XOM can pay off all of their debt obligations, placing them in a unique position that allows them to focus on future growth rather than being an overleveraged company. The other aspect of their balance sheet that I love is the amount of equity found on it. XOM has $207.53 billion of total equity, which is roughly half of its market cap.

XOM’s asset base produces a tremendous amount of revenue and profitability. In Q3, XOM generated $89.85 billion in revenue and produced $17.38 billion of EBITDA, $15.96 billion in cash from operations, $9.07 billion in net income, and $11.04 billion in free cash flow (FCF). Over the trailing twelve months (TTM), XOM has generated $351.28 billion in total revenue and produced $41.13 billion in net income and $37.83 billion in FCF. There aren’t many companies that generate this level of revenue or profitability, and it provides XOM with a lot of options, from returning capital to shareholders to expanding their operations.

Steven Fiorillo, Seeking Alpha

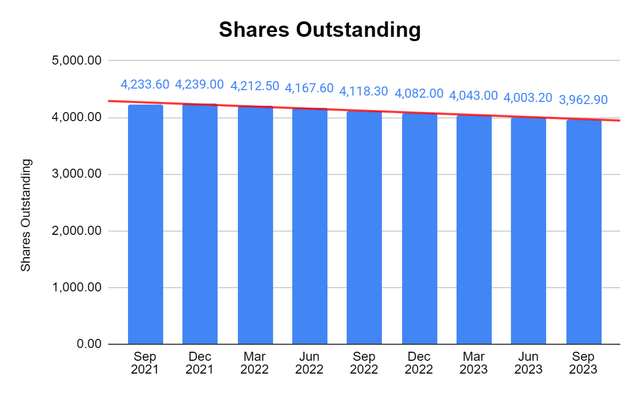

XOM’s level of profitability allows them to return billions to shareholders through buybacks and dividends. Since the end of 2012, XOM has repurchased an average of 39.44 million shares each quarter and reduced the float by 276.1 million shares or -6.51%. XOM has also restarted its dividend increases, paying 34.87% of its forward EPS in dividends to its shareholders yielding 3.81%. Each quarter, XOM allocates billions toward buybacks and dividends and creates value for shareholders.

Steven Fiorillo, Seeking Alpha Seeking Alpha

XOM checks off all the boxes for what I am looking for going into 2024. I think that capital will flow into the capital markets from the sidelines and gravitate toward companies that are returning capital to shareholders with strong balance sheets and elevated levels of profitability. I think that investors will see value in shares of XOM, as it is trading at a 10.75 P/E, is well off its 2023 highs, while continuing to buy back shares and increase the dividend.

I would argue that the capital sitting on the sidelines isn’t necessarily going to flow into the more popular tech names because there have been opportunities all year for that to occur. I think that the majority of the capital is more value-oriented and income-focused, which is why I feel that XOM will be a magnet for capital as it flows back into the market. When the Fed finally pivots, XOM’s dividend between 3.5% – 4%, which is growing on an annual basis, will look attractive compared to declining risk-free rates of return.

Exxon Mobil is positioned to expand its profitability going forward and create more value for shareholders

XOM has spent the past several years improving the performance of its upstream business and product solutions. Over the next 4 years, XOM plans to allocate 90% of its planned capital investments in new oil and flowing gas production, which is projected to generate returns greater than 10% at Brent prices of $35 per barrel. In the liquified natural gas (LNG) segment, all of the new volume XOM plans to take online over the next 4 years are also projected to generate returns greater than 10% at prices of $6 per million BTUs.

XOM is expecting 50% of its production to be generated from competitively advantaged assets, driving long-term growth in overall production and earnings per barrel, with production growing from 3.8 million bpd in 2024 to 4.2 million bpd in 2027. In addition to larger production output, XOM expects its unit earnings from key growth assets to be $9 per barrel higher than from its base portfolio.

Despite the narrative the current administration created around oil and gas during 2020, oil production in the U.S. has reached all-time highs. The reality of the energy transition is setting in, and the realization that oil and gas will be part of the energy mix for decades to come is apparent. From 2019 through 2023, XOM has roughly doubled its earnings and increased cash flow from operations by about $10 billion at $60 real Brent and constant margins. XOM is projecting that it will increase earnings and cash flow by roughly $14 billion through 2027.

At Brent prices of $60, XOM expects to generate about $80 billion of surplus cash above capex requirements and dividend distributions over the next 4 years. Even if Brent slips to $50, XOM will generate enough cash to cover the dividend and their planned CapEx while generating $55 billion of surplus cash by 2027.

Conclusion

I think Exxon Mobil stock looks undervalued under $100 as its dividend yield approaches 4%. XOM is positioned to grow its earnings and cash flow by roughly $14 billion over the next 4 years, and its surplus cash potential throughout 2027 could be upwards of $80 billion, depending on the price of Brent. Shareholders will be rewarded as billions are allocated to buybacks on a quarterly basis, and the large dividend continues to grow on an annual basis.

I think that the recent pullback in XOM’s share price could be a holiday gift that keeps on giving, as there could be a significant upside at the current valuation while collecting growing dividend payments. I plan on adding to my position, as I wouldn’t be surprised if shares go back to the $120 level in 2024.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.