Summary:

- Exxon Mobil has agreed to acquire Denbury in an all-stock deal valued at nearly $4.9 billion, a move seen as positive for Exxon Mobil’s long-term strategy.

- Exxon Mobil’s focus is not on Denbury’s energy production but on its carbon capture initiatives, which align with Exxon’s shift towards green initiatives and carbon capture.

- The acquisition will provide Exxon Mobil with a significant network of assets for carbon capture, including over 1,300 miles of carbon dioxide pipelines and 10 onshore sequestration sites.

- The move should bring with it attractive long-term growth, but investors should also focus on what’s right around the corner with earnings.

pcess609

July 13th proved to be a really interesting and positive day for shareholders of energy giant Exxon Mobil (NYSE:XOM). Management announced that they had entered into an agreement to acquire Denbury (NYSE:DEN) in an all-stock deal valuing the latter at nearly $4.9 billion. Truthfully, this is rather disappointing for investors of Denbury, but for those focused on the long haul, and who happen to own shares of Exxon Mobil, I see this as a win. The transaction may seem peculiar to some at first glance. And if you really only focus on the energy picture of Denbury, it is. But when you dig down and look at the long-term situation, and the potential it offers, I believe that the energy behemoth has made a really fantastic move.

A long-term play

Whether you like it or not, the days of oil and natural gas serving as the primary means of energy sourcing are numbered. Recognizing this to be the case, Exxon Mobil began years ago it’s shift toward becoming a company that focused more on green initiatives. This was something that I wrote about in an article published in early April of this year. In all, the company’s expectation is to spend about $17 billion on lowering emissions activities, both for it and customers, between 2022 and 2027. 60% of this amount will be focused on lowering the company’s emissions, while the other 40% is supposed to focus on providing services that lower the emissions of others. The company is even spending $7 billion of this capital on developing the world’s largest low carbon hydrogen plant down in Texas.

When you come to understand the transition the company is making, it no longer becomes surprising that the business would make some major acquisition in order to help propel it toward its targets. The most recent acquisition in question that fits this description is Denbury. According to a press release issued by the company on July 13th, it struck a deal to acquire Denbury in an all-stock transaction valuing the company at approximately $4.9 billion. In short, for each share of Denbury that somebody owns, they will swap that share out and receive 0.84 of a share of Exxon Mobil. Given the price at the time, this implies a price per share of $89.45. Unfortunately for shareholders of Denbury, this transaction isn’t all that exciting. Over the past year, 37% of all trading days resulted in the price of the company’s shares trading above that point. So essentially, no real premium was offered for the enterprise.

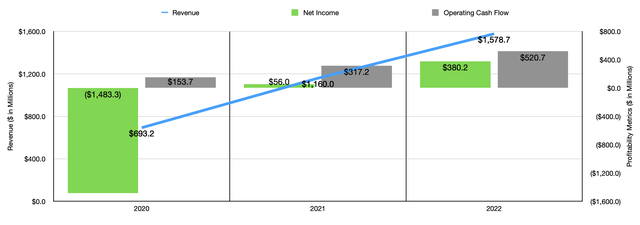

The real winner of this, in my opinion, is none other than Exxon Mobil. When he first looked at the deal, you might be a bit perplexed. Consider the selected financials for Denbury shown in the chart above. Yes, the company has exhibited fantastic revenue, profit, and cash flow growth over the past three years. And in fact, using the operating cash flow from 2022, this purchase places a price on Denbury of 9.2 times operating cash flow. But the sad truth is that the vast majority of the upside scene in terms of revenue, profits, and cash flows, have not been the result of true organic growth. In fact, overall daily production of oil and other products declined by 8.5% during this three-year window. The bulk of the upside, then, came from higher energy prices.

This does seem a bit like gambling. After all, if Denbury were to see its operating cash flow fall back to what it was in 2020, then the company goes from trading for 9.2 times operating cash flow to 31.3 times. That takes it from attractively priced to drastically overpriced very quickly. And anybody who has more than a year or two of experience in the energy market will know that energy prices can be incredibly volatile, particularly during times of heightened economic uncertainty.

The first thing that you are struck by when looking at both the press release and the investor presentation put out by Exxon Mobil is that the company’s focus is not really on the energy production that Denbury is responsible for. Instead, the company zeroes in on the carbon capture initiatives that Denbury brings to the table. As I brought up in my aforementioned article on Exxon Mobil, the business has been focused a great deal on carbon capture. For those who don’t know, carbon capture is basically what it sounds like. When you have certain industrial processes, you end up producing, usually, a great deal of carbon dioxide emissions. Examples of activities that produce a lot includes steel and cement manufacturing, as well as the burning of fossil fuels for power generation.

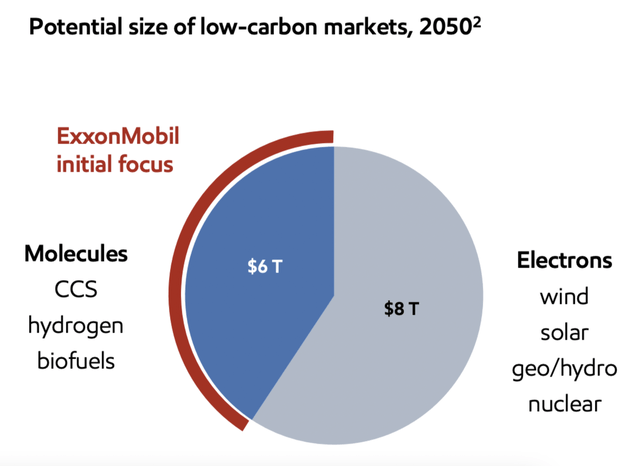

Carbon capture means utilizing technologies have come about in recent years to capture the carbon dioxide emissions that come from said activities. This carbon can that either be used for other industrial purposes, or it is often transported to some location and stored underground in specific geological formations so that it does not come to the surface. The goal is to reduce the amount of carbon dioxide that goes into the atmosphere in an attempt to combat climate change. This is one significant piece of what Exxon Mobil believes will be a $14 trillion low carbon market by 2050, with about $6 trillion in all focus on things that are not wind, solar, geothermal, hydropower, and nuclear.

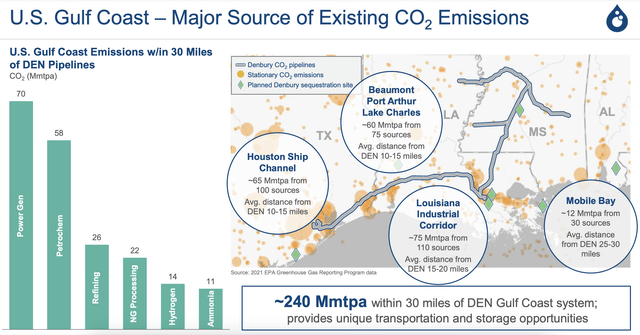

While Exxon Mobil already focuses on most aspects of carbon capture, acquiring Denbury will open up the door to a more significant network of assets that will help the company leapfrog what many investors likely assumed the picture would come to look like. For starters, Denbury alrighty owns over 1,300 miles of carbon dioxide pipelines. Its assets also include 10 onshore sequestration sites. These are sites where the company actually captures and stores the carbon dioxide. What’s really exciting for investors is that, because of the tremendous amount of industrial activity, including energy production, that occurs where Denbury operates, it’s estimated that there are around 240 million metric tons per year worth of emissions within 30 miles of the company’s Gulf Coast system. But of course, the company needs to take time to scale up to that point. It sourced 14 million metric tons worth of carbon dioxide last year, with about 4.3 million tons of it coming from industrial sources.

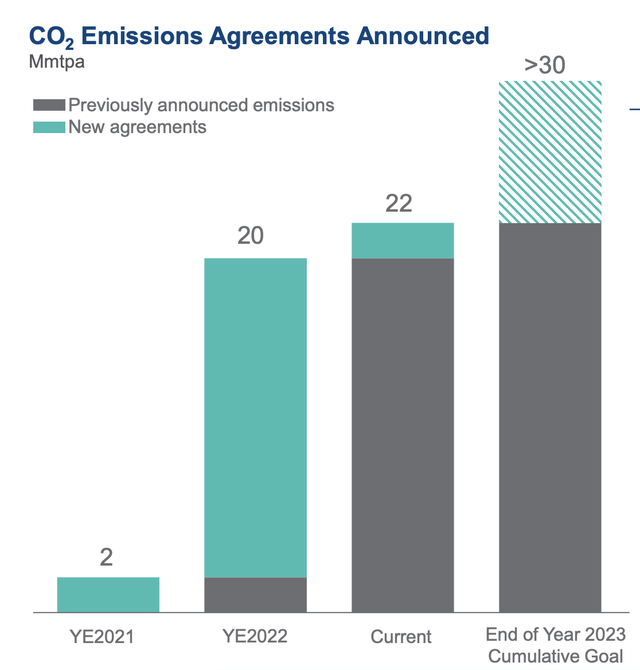

Even that amount should be considered amazing for the company. By the end of the 2021 fiscal year, the company only had agreements in place covering 2 million metric tons per year of carbon dioxide. By the end of last year, this number had grown to 20 million before climbing to 22 million by the end of the most recent quarter. If everything goes according to plan, it should reach 30 million or more by the end of 2023. Of what it does have in place, about 70% involves signed emissions agreements associated with blue ammonia. The company is also actively engaged with over 55 million metric tons per year worth of carbon capture projects.

It’s also important to note that the company is an equity owner of the Ascension Clean Energy Project that is supposed to produce about 7.2 million tons per year of ammonia. The 12-year term agreement that it has in place with that company will see about 12 million metric tons per annum worth of carbon dioxide offtake volume that the company can capitalize on. But that doesn’t come into play until 2027. In all, Exxon Mobil believes that there will be an opportunity to accelerate up to 100 million metric tons per annum of carbon dioxide emissions reduction activities as a result of this acquisition.

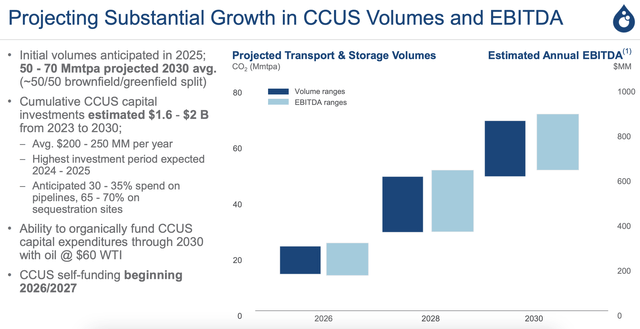

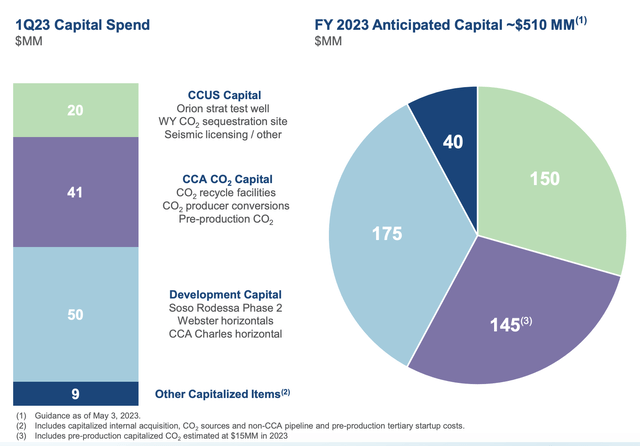

On its own, Denbury has gone so far as to say that applies that it can grow to the point of transporting up to 150 million metric tons per annum of carbon dioxide. But even if Denbury falls far short of that, the company has significant upside potential. By 2030, the firm believes that it can generate between $650 million per year and $900 million per year worth of EBITDA off of volumes of between 50 million metric tons per annum and 70 million metric tons per annum. Of course, it will not necessarily be an easy road to that point. Between this year and 2030, the company would need to spend between $1.6 billion and $2 billion on growing its capacity. Between 30% and 35% of this will be centered on pipelines, with the rest focused on sequestration sites. This year, the firm was spending about $150 million on carbon capture initiatives, and about $145 million on carbon dioxide capital projects.

The hope that management has is that current spending will be covered by the cash flows the company is generating from its energy production. By volume, about 97% of output is in the form of oil. With oil pricing at $75 per barrel for this year, the company should generate about $1.07 billion in operating cash flow and $560 million in free cash flow. By 2026 or 2027, the firm hopes that the cash flows generated by its carbon capture projects will be enough to self-fund the rest of the growth through 2030.

An eye on earnings

It’s clear at this point that Exxon Mobil is focused on the long-term picture here. Given the green oriented spending the company has already earmarked for the next few years, and the nature of that green spending, this all makes a great deal of sense. But we should also continue to focus on the near term as well. It just so happens that, before the market opens on July 28th, management will be announcing financial results covering the second quarter of the company’s 2023 fiscal year. Investors would be wise to see if there have been any major changes, such as planned spending on green initiatives, as a result of this acquisition. It’s also possible the company could double down on organic opportunities in light of this rather significant change.

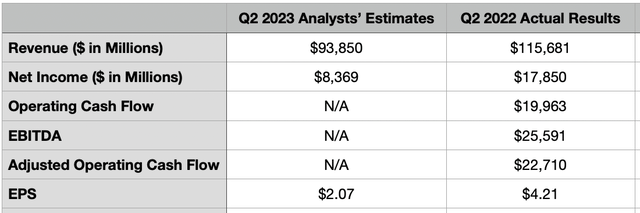

When the company does report, the first thing that investors will likely focus on will be the headline news items. At the very top, we have revenue. The current expectation is for the company to report sales of $93.85 billion. This would actually be down from the $115.68 billion reported the same time last year. Although disappointing, this would not be a surprise. Energy prices have pulled back some, particularly natural gas. And the fact of the matter is that revenue for ExxonMobil has always been very volatile because of the nature of the industry in which it operates.

Naturally, this would also have an impact on the company’s bottom line. At the moment, analysts are forecasting earnings per share of $2.07. That would translate to roughly $8.37 billion of profit. This would be about half the $4.21 per share, or $17.85 billion, that the company generated the same time last year. Analysts have not provided guidance when it comes to other profitability metrics. But we would be wise to pay attention to them. For context, operating cash flow in the second quarter of 2022 was $19.96 billion. If we adjust for changes in working capital, it would be even higher at $22.71 billion. Finally, EBITDA for the business was $25.59 billion. It’s highly probable that all of these would see a meaningful decline year over year.

Takeaway

Based on the data provided, I must say that I remain very optimistic about the long-term picture for Exxon Mobil. Even though I don’t own shares of the company, I do believe that it is likely to go on to create attractive value for its investors. This latest move may seem peculiar at first glance. But I view it as a long-term play that should be bullish for the company and its investors. Because of this, I have no problem keeping the company rated the ‘buy’ I rated it previously.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!