Summary:

- Exxon Mobil Corporation’s valuation has yet to return to historical levels due to the challenges of 2015-2020.

- The company has achieved its cost-cutting goals. Therefore, those goals were increased.

- The market may be conservative in evaluating the company until a track record for the new management approach is established, presenting an opportunity for investors.

- The challenges of 2020 and 2016 are unlikely to be repeated in the near future as speculative money is not pouring in to bring about a downcycle.

- Details about Guyana And Other Exxon Mobil projects may come out during the arbitration process depending upon how heated that process gets.

Jeremy Poland

Exxon Mobil Corporation (NYSE:XOM) is in an area of the market that has yet to return to historical valuations. Some of this is due to the end of the boom times in 2014. The price of oil (CL1:COM) declined sharply in 2015 (roughly) and the following recovery aborted early. This was followed by the pandemic. But all of that is unlikely to repeat quite the way it happened in the future. Therefore, it is time to reassess how a company should be valued now that the cyclical nature of the business should reassert itself without all the trauma in the recent past. The success of the company cost-cutting program is icing on the cake.

Guyana

Already, Exxon Mobil appears to be ready for a good legal brawl over Guyana now that Hess (HES) might be acquired by Chevron (CVX). The fact that Exxon Mobil just filed for arbitration sounds like a good old-fashioned shakedown, corporate style.

If Exxon Mobil succeeds in arbitration, then investors can expect a lot of shouting and screaming along with all kinds of theories. The odds that the acquisition will complete are still good. But this could highlight for investors the potential of this asset in a way that Wall Street really cannot on a regular basis. Depending upon how nasty it gets, a lot of good investment assessment ideas could come out of this for investors.

But no matter what happens, it is hard to see how the investors of Hess lose under any scenario.

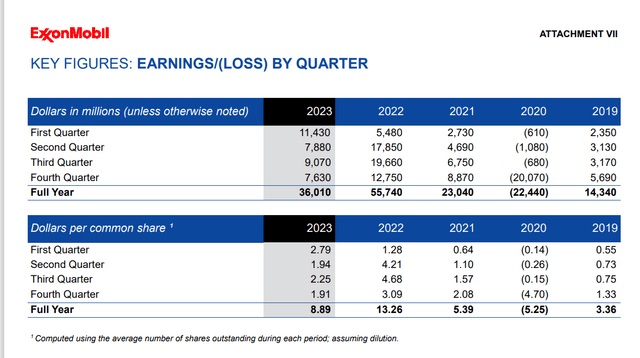

Recent Earnings History

Management posted the recent earnings history that many analysts use to evaluate a company going forward.

Exxon Mobil Five Year Quarterly Earnings History (Exxon Mobil Earnings Press Release Fourth Quarter 2023)

Management noted in the earnings press release that the company achieved its cost-cutting goal early. Management raised that cost-cutting goal as a result.

Many do not realize that a lot of commodity industries find ways to “do more for less” constantly. This is how commodity prices often increase less than the rate of inflation, while the companies in the industry stay profitable.

Management increases the cost-cutting possibilities by noting that they expect to do better with the Pioneer (PXD) acreage than the current management once they get this acquisition completed. I noted a while back that Pioneer management was not as cost conscious as it could be. Now, it seems that Exxon Mobil management is basically making the same claim.

Pioneer has some of the best acreage in the business. But management chose to report good results based upon the geology rather than pushing hard for the best results they could possibly get. That will change under Exxon Mobil.

But all of this means that the earnings history is going to improve going forward as management continues to drop the corporate breakeven point. As management continues the cost-cutting campaign, the company should be more profitable at each pricing point than was the case in history. That makes projections very hard (and Mr. Market very frustrated).

Valuation

The market likes “easy and simple.” Change “throws a monkey wrench” into that idea. Therefore, until a track record for the management approach is well established, the market will be conservative in its evaluation.

This is where investors can beat the market by getting in before the market establishes a proper evaluation. Many analysts look at the last five years and stop with “overpriced”. But out of those five years, only the last two represent typical going forward.

The reason is that the market now demands shareholder returns, definitely “hates” growth, and wants much stronger balance sheets. But Exxon Mobil already has one of the strongest balance sheets in the industry. It is also one of the few companies that is projecting production growth while raising the dividend and repurchasing stock. When that is combined with the cost-cutting underway and opportunistic acquisitions, the future is likely to be far more profitable than the past.

Industry Conditions

The rapid growth of the unconventional business appears to be over. Therefore, the price levels of 2016 and especially the pandemic of 2020 appear to be a thing of the past.

Furthermore, the rush of speculative money into the industry that caused the 2018 recovery to abort quickly is unlikely to repeat. Those investors lost a lot of money in the bankruptcies that followed the 2015 price decline and the pandemic challenges. As long as that money stays away and the current consolidation continues, then the current recovery will remain on track for the foreseeable future.

Market tops and low prices often come about from too much production caused by a lot of (full cycle) uneconomic projects that look good when prices are strong but fail during the downturn. Industry insiders can avoid that trap. But inexperienced money loses every time it happens. Right now, we appear to be far away from such a situation, as “everyone knows” to stay away from oil and gas.

But that is precisely the time for investors to get in. It is a darn good contrarian opportunity when “everyone knows.” As David Dreman points out in any of his “Contrarian Investing” books, group-think (which is a fancy word for “everyone knows”) is very often the wrong logic to use when going forward. It makes contrarian investing hard. But it also makes that investing very profitable.

The Past

Many have noted that Exxon Mobil Corporation stock did nothing for roughly a decade (depending on your choice of start and finish). It took this CEO years after he took over to get a company the size of Exxon Mobil moving in a growth direction. That is not unusual for a large company.

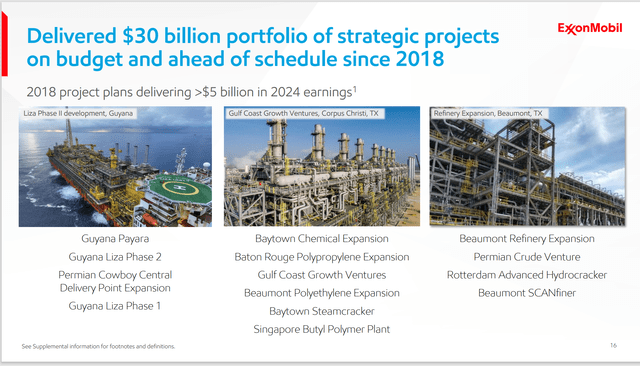

Exxon Mobil Capital Projects Completed For 2023 (Exxon Mobil Corporate Presentation Fourth Quarter 2023)

Interestingly, the next slide shows the projects underway that will complete in the future. Production growth combined with the projects shown above should enable long-term single-digit growth of roughly 4%.

The opportunistic acquisitions, if done correctly, could raise that to roughly 7%. Notice also that the dividend increase was greater this time than the usual nominal increase that marked several previous years. As management continues to push for slow growth, dividend increases will likely be higher as a result. The combined result for shareholders from current price levels should be in the low teens as a result.

Now, oil and gas probably provides some of the best shareholder returns to investors outside of obvious income vehicles. As the market realizes that the whole industry could approach historical levels of valuation. Right now, oil and gas is clearly out of favor.

Risk

Even an integrated giant like Exxon Mobil is dependent upon the commodity price (both current and future outlook). An unsatisfactory price level that is sustained could cause a material change in returns to investors.

The capital projects could suffer cost overruns.

Exxon Mobil has one of the strongest balance sheets and highest profitability in the business. There is no guarantee that in the future that would not change unfavorably.

The Result

Exxon Mobil remains a strong buy as management continues to execute a long-term plan to provide steady long-term growth. Large companies like this often move into an income and growth category as a result. Shareholders could get an additional boost from the fact that oil and gas remains out of favor. Generally, that will cycle back into favor at some point.

The last consideration is that the cost-cutting program should increase the company profitability at various pricing points. Since the market tends to value companies like this on average business cycle profitability, that should mean another reason for greater stock price valuation.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM HES either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to do their own research that includes the review all company documents, and press releases to see if the company fits their own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Long Player believes oil and gas is a boom-bust, cyclical industry. It takes patience, and it certainly helps to have experience. He has been focusing on this industry for years. He is a retired CPA, and holds an MBA and MA. He leads the investing group Oil & Gas Value Research. He looks for under-followed oil companies and out-of-favor midstream companies that offer compelling opportunities. The group includes an active chat room in which Oil & Gas investors discuss recent information and share ideas. Learn more.