Summary:

- Exxon is making moves towards an electric car future by buying lithium-rich land in Arkansas and hiring for lithium positions. This project is massive in scope at 100,000 tons.

- Arkansas is an ideal location for lithium production due to factors such as high lithium grades, friendly locals, and abundant infrastructure.

- Exxon’s entry into the lithium market is driven by future demand for lithium and the need to impact its bottom line.

Olemedia

White Gold Hunting In Arkansas

Much has been written about the demise of electric cars. Yet, new contenders are flowing into Arkansas in search of white gold, also known as lithium. There are big boys entering the lithium chessboard, such as Exxon Mobil (NYSE:XOM) (NEOE:XOM:CA). I say follow the money, and money continues to flow into lithium projects (primarily on the future demand side). Part of this future demand could be from Tesla (TSLA) and its Optimus robot initiative.

The main theme that many are missing is that a shift to an EV future will take time. It will require what amounts to an unnatural patience (aka long-term investing, be it a few years or even longer in order to realize equally unnatural returns) but as we see EV make further inroads into the car market combined with a future outlook of increasing AI and robots — these will require additional energy storage and that storage could be in the form of additional lithium demand. In this article, we will look at oil giant Exxon and how they are hedging some energy bets via lithium. A secondary mental consideration is to know that increasing lithium projects in Arkansas raises the viability of that geographic area. More on this later, first we need to look at what is bringing powerhouse Exxon to the natural state.

Exxon: A Deep Pocket Lithium Contender

When pondering an EV future, Exxon is not a name that usually pops up in discussion, yet we can see Exxon has acquired 120,000 acres of lithium rich land in Arkansas, and they have been hiring for lithium positions. Why Arkansas, though? Easy, Arkansas has everything you could possibly want — water, infrastructure, and chemical experienced personnel.

People like Elon Musk of Tesla have commented that lithium is everywhere and while this is true, “economical” lithium is not everywhere. For a project to work, from an economic sense, you need a variety of factors like good lithium grades, good flow rates if brine based, friendly locals, manageable impurities, and a supportive local government is a plus. Ample sunlight helps if you are going the brine evaporation route. You also need infrastructure, be it power, logistics, rail, and roads. Some of the South American projects suffer from a challenging infrastructure via high elevations, and some have to contend with hostile locals. Hence, Arkansas makes ample sense and Exxon is placing its lithium bets in Arkansas, but they are not alone. Other established players are in southern Arkansas, and this is good. A rising lithium network of industry raises all ships in Arkansas.

The Rising Lithium Tide In Arkansas

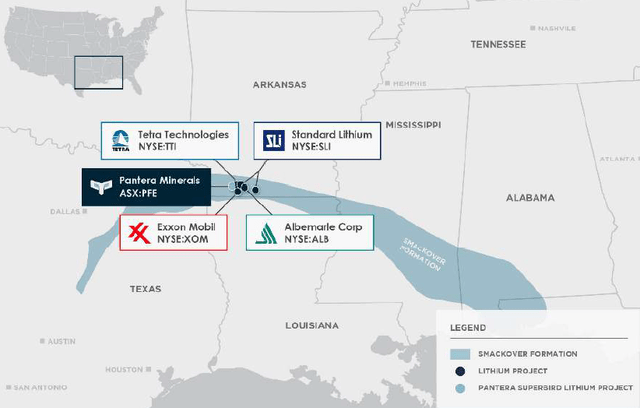

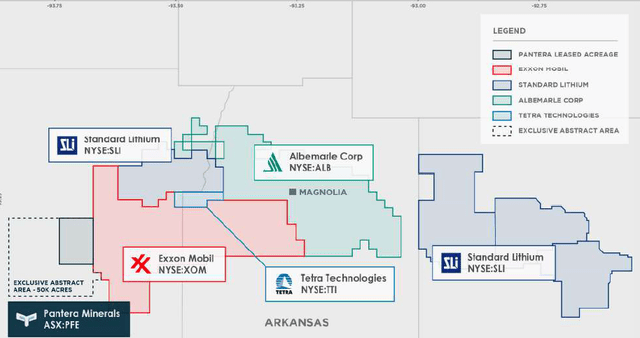

Some Arkansas lithium prospectors are old hands in the game and have been around for some time like Standard Lithium (SLI) and TETRA Technologies (TTI). In fact, Exxon and Tetra Tech have teamed up on some lithium projects in Arkansas:

“We’ve teamed up with ExxonMobil to help us develop the lithium opportunity in the Smackover Formation. Tetra and Exxon are going to work together in what we call our Evergreen Unit. We will be able to expand our bromine capacity and also to be in the lithium market of the United States.” – Source: Magnolia Reporter

TETRA Technologies is also in bed with Standard Lithium via:

Tetra Technologies and Standard Lithium have an agreement that allows Standard Lithium to extract lithium from Tetra’s brine leases outside the Evergreen Unit, he said.” – Source: Magnolia Reporter

and

Tetra will build a bromine-lithium plant on 60 acres of a 127-acre site it has acquired on the northwest corner of Lafayette County roads 21 and 81 about six miles south of Stamps.” – Source: Magnolia Reporter

Another primordial name, that is exploring using its existing bromine fields to extract lithium in Arkansas, is none other than Albemarle (ALB).

“Albemarle Corp is building a pilot plant in Arkansas to test a version of direct lithium extraction technology, its CEO said on Thursday.” and “We have proprietary technology around that. We’re building a pilot plant at the moment. And we plan to execute projects around that,” – Source: Yahoo Finance

I also saw that EnergyX is going to expand into Arkansas with a 5,000 tons project for phase 1 and 25,000 tons for phase 2. Quite large if they build it all out. It is very interesting to note they have agreements with General Motors (GM) and Koreans giant POSCO (PKX). Per EnergyX:

Project Lonestar Lithium, located in the “Ark-La-Tex” region, will have a target lithium production of 5,000 tons/year in Phase 1, and 25,000 tons/year in Phase 2. Currently, the largest active lithium plant in the US produces 5,000 tons/year, underscoring the vast potential of Project Lonestar to ramp up US lithium production. Earlier in 2023, EnergyX closed its Series B financing from strategic institutional partners including General Motors and POSCO, who have first rights to portions of EnergyX’s lithium production offtake. – Source: EnergyX

The Australians are even showing up via micro player Pantera Minerals.

Primordial Lithium Contenders (Pantera Minerals)

Direct Lithium Extraction in Arkansas

As a side note, many companies are engaged in direct lithium extraction (DLE) but how many will actually be successful? DLE needs to be tailored for each project to some extent. Standard Lithium has a joint venture with KOCH for DLE, and it appears to be working. EnergyX also has DLE in the works, and it makes you wonder who Exxon might go with for a DLE solution? The winner would need some deep pockets, of course, so that cuts all many of the micro players who advertise DLE. This is something to watch.

Lithium Contenders (Pantera Minerals)

Exxon and Tesla

So we can see much interest centering around Arkansas and Texas (something we wrote about). This might be because it is centrally located. You have Tesla on one side in Texas and to the east you have the auto manufacturing areas. This is a shorter distance than say Nevada. This gives lithium derived from Arkansas a logistical cost advantage as opposed to lithium shipped from distant lands. Given the high grades of lithium in Arkansas and Texas and the logistical advantage, now you see why many are centering efforts in Arkansas.

Exxon On Lithium Demand

While lithium prices remain low compared to the all-time highs they are still elevated over historical prices. Exxon had this to say concerning lithium demand:

“We’ve seen a redoubling of efforts from customers to reach out to us to engage at the most senior levels of the corporation,” Exxon’s lithium global business manager Patrick Howarth told Bloomberg on the sidelines of an industry event this week, adding that potential customers “are changing their demand forecast, but their consistent theme is they need more lithium than they have today.” – Oilprice.com

Just How Big Could Arkansas Be For Exxon?

One word: Big. Exxon publicly announced they have signed a deal with SK. Here is what Exxon had to say about it:

ExxonMobil has signed a non-binding memorandum of understanding (MOU) with SK On, a global leading electric vehicle (EV) battery developer, that opens the door to secure a multiyear offtake agreement of up to 100,000 metric tons of MobilTM Lithium from the company’s first planned project in Arkansas. SK On plans to use the lithium in its EV battery manufacturing operations in the United States. This will contribute to ExxonMobil’s goal, announced in late 2023, of supplying lithium for about 1 million EV batteries annually by 2030 and support the build out of a U.S. EV supply chain.

Demand for lithium is forecasted to grow sharply in coming years, as it is an essential component for EVs, consumer electronics, energy storage systems, and other clean energy technologies. The planned project will extract lithium from underground saltwater deposits and convert it into battery-grade material onsite in Arkansas. This approach aims to produce lithium more efficiently and with fewer environmental impacts than traditional hard rock mining. – Source: Exxon Mobil

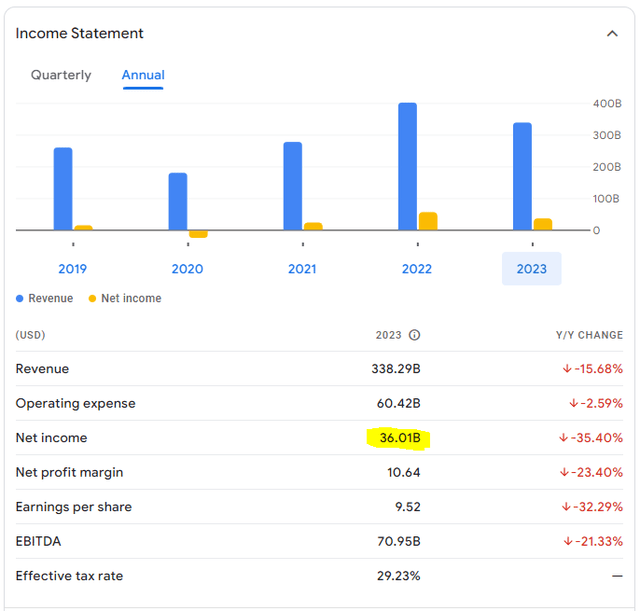

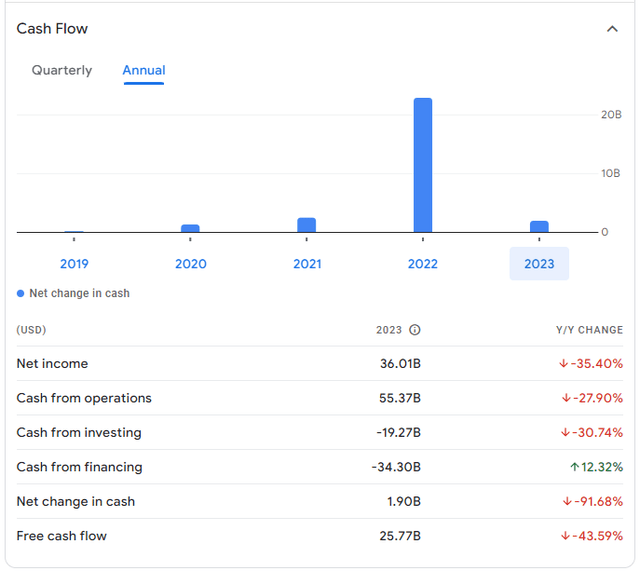

Now, the first thing you should ponder is what does 100,000 tons of lithium translate to profit wise? The answer is a lot. While we do not have a DFS (definitive feasibility study) to reference, we can make some assumptions by looking at neighboring SLI. First, we have to realize that lithium mines can last for decades. Because of this (and inflation) they typically use figures that are above the current price of lithium. In the case of Thacker Pass by Lithium Americas (LAC), they have a lithium average price over the life of the Nevada mine estimated at $24,000. For SLI (in Arkansas) they used $30,000. Given the geographic area, we shall assume $24,000 in revenue per ton for the life of the mine. Then we have to factor in operating expenses. For this, we shall assume $7,500 a ton. This is online with LAC. Remember, this is just basic guess work. $24,000 – $7,500 = $16,500 a ton in profit. Multiply that by 100,000 tons, and you get $1.65 billion a year in profit. Pulling up the annual financials, we can see this would have an impact upon Exxon. While Exxon had net income of $36.01 billion, revenues were down. Hence, lithium can help move the needle in the right direction. Per Google Finance:

Exxon Income Statement (Google Finance)

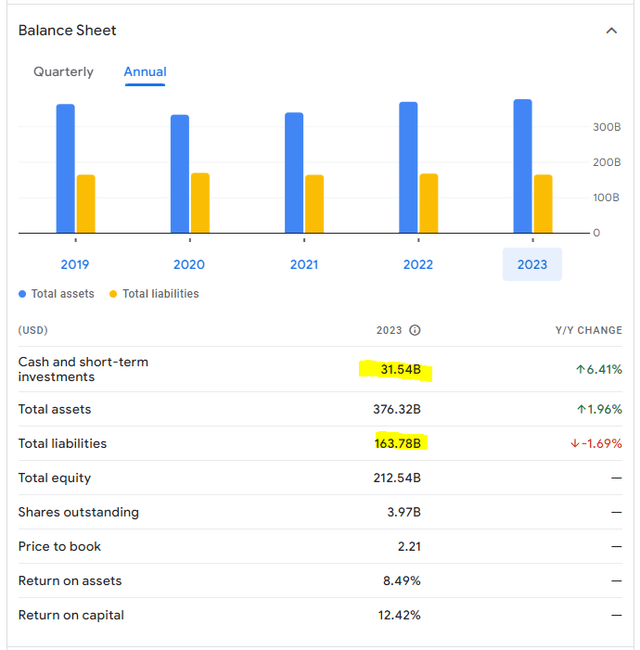

Now, this project does come with a price tag. Exxon has not said how much the project will cost. Given the size of the project at 100,000 tons and also factoring in the region, we might take a guess of $5 billion plus. I’m basing this some off what I know of the costs of Lithium Americas, but also factoring in that Arkansas is cheaper. It could be more or less. We really do not know, but what we do know is the Inflation Reduction Act can fund about 72% of a project if we look at how much the Feds funded Lithium Americas (We covered this here). If the government is going to cover 72% and Exxon only has to cover the remaining 28% (while making $1.65 billion in profit per year, minus IRA loan payback and some interest), this represents a very good deal for Exxon and securing domestic lithium supply. While Exxon has high liabilities, they also have a lot of cash and assets. Plenty to fund the portion they would be due. Per Google Finance:

Exxon Balance Sheet (Google Finance)

Lastly, we see some cash flow numbers deteriorating. Lithium might provide a small counterweight to this action. If anything, it would offer Exxon some additional diversification. Exxon has stated they want to sell lithium by 2027. That is only 2.5 years away. I think we will see some slippage in time due to Mr. Murphy, but overall, this is not a big issue. Just something to be aware of.

Exxon Cash Flow (Google Finance)

Exxon Mobil Risk

I do not see fossil fuels going away anytime soon. Even the most aggressive insane EV prediction says that 40% of the market will be EV by 2030. I would put that figure far lower. I would guess 25%, but a lot of that depends on the economy in general. Frankly, fossil fuels offer a lot of energy density for the buck. Looking at a 5-year chart, the stock seems rather stable given the inflationary economy.

Exxon Mobil 5-year Chart (Seeking Alpha)

The biggest risk is just the general economy. Inflation is still running wild and what is left of the middle class is struggling to make ends meet. If this continues to deteriorate, then it would obviously impact the economy in general and that could have an impact on energy use.

Conclusion

Exxon, being as large as it is, needs to develop or acquire projects that impact the bottom line. Looking at potential demand and upcoming projects, we can see that lithium demand is alive and healthy (contrary to rumors). Should you buy Exxon just based on lithium? I’d say no, but if you want an energy giant that pays a 3.33% dividend and is diversifying into lithium for the EV sea change, then I would say yes.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SLI, TSLA, LAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.