Summary:

- Exxon Mobil has unveiled an ambitious plan to triple the earnings potential of its Product Solutions business by 2027.

- The plan includes strategic projects, cost reductions, and performance improvements that could generate $10 billion in extra annual earnings.

- However, the volatile nature of the industry means that financial performance may still be unpredictable, and the $10 billion improvement figure should not be taken for granted.

JHVEPhoto

On September 20th, the management team at energy behemoth Exxon Mobil (NYSE:XOM) revealed a rather detailed and ambitious plan that they believe will result in significant value creation for the company and, in turn, its shareholders, between now and 2027. At first glance, this strategy looks awfully appealing. The fact of the matter is that management likely does have an avenue that it can take in order to significantly improve operations from a cost perspective and a revenue perspective. But when you dig deeper into what the data says, it does become clear that this is not some panacea for the parties involved.

By the very nature of the company and the operations it has under its umbrella, volatility will still likely be rampant from year to year. But so long as management can deliver on at least some of these initiatives, it gives shareholders a reason to be optimistic about the future.

An ambitious plan… with a caveat

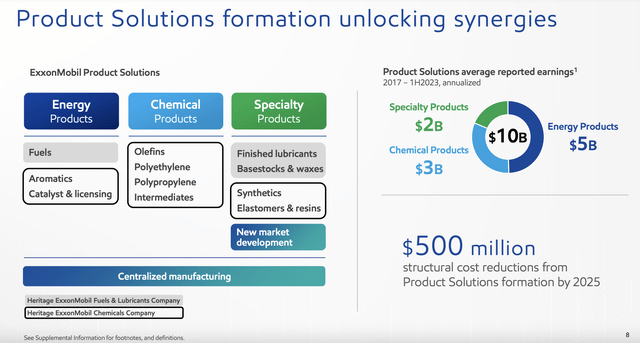

Operationally speaking, Exxon Mobil has four segments. You could technically call the Corporate and Financing unit a fifth segment, but that mostly covers revenue and expenses that cannot be allocated between the other segments. Ignoring this, then, we have the Upstream segment, the Energy Products segment, the Chemical Products segment, and the Specialty Products segment. For the purpose of its presentation, management lumped all of these, except for the Upstream segment, into what it calls the Product Solutions portion of the enterprise.

As most large companies tend to do, Exxon Mobil has decided to take a step back and look at its operations to see what kind of improvements might be made for the benefit of shareholders. During this process, management concluded that using 2019 as a starting point and 2027 as the endpoint, there is the opportunity to nearly triple the earnings potential of the Product Solutions business.

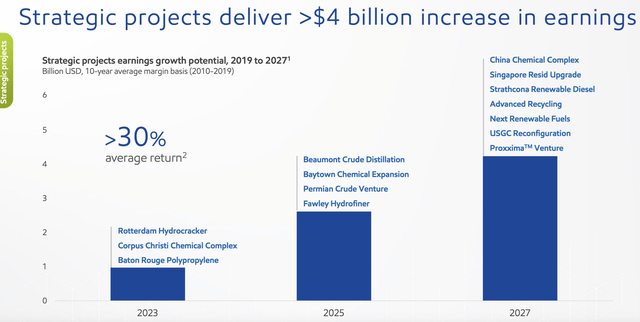

To put this in perspective, the expectation that management made clear is to generate around $10 billion in extra annual earnings by that point. In fact, just by combining these three units into the Product Solutions business, management is forecasting $500 million in run rate cost reductions by 2025. Strategic projects that are in the company’s pipeline should add at least another $4 billion in earnings potential during this time, while other performance improvements and structural cost reductions are expected to drive over $5 billion in incremental earnings as well. But to better understand the rest of the improvements, we need to dig deeper into each portion of the business.

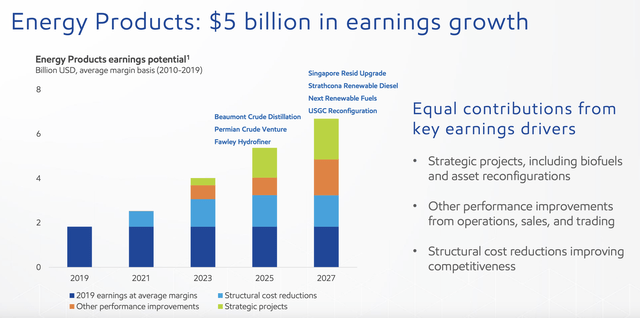

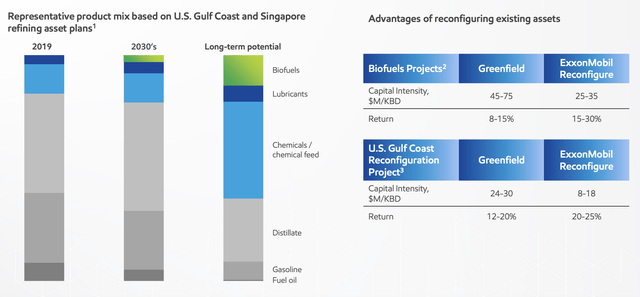

The first part of the company I would like to focus on is the Energy Products segment. Examples of products under this unit include biofuels, retail fuels that are used at gas stations, fuels that are used for commercial transportation, synthetic fibers, and more. The biggest chunk of the company’s entire push forward toward the $10 billion target will come from this segment. Forecasted earnings growth from 2019 through 2027 should be around $5 billion. As you can see in the image above, the overwhelming majority of any improvement will come from three different categories. For starters, strategic projects, such as those centered around biofuels, work out for a large chunk of any earnings increase. Management even provided some details on this front.

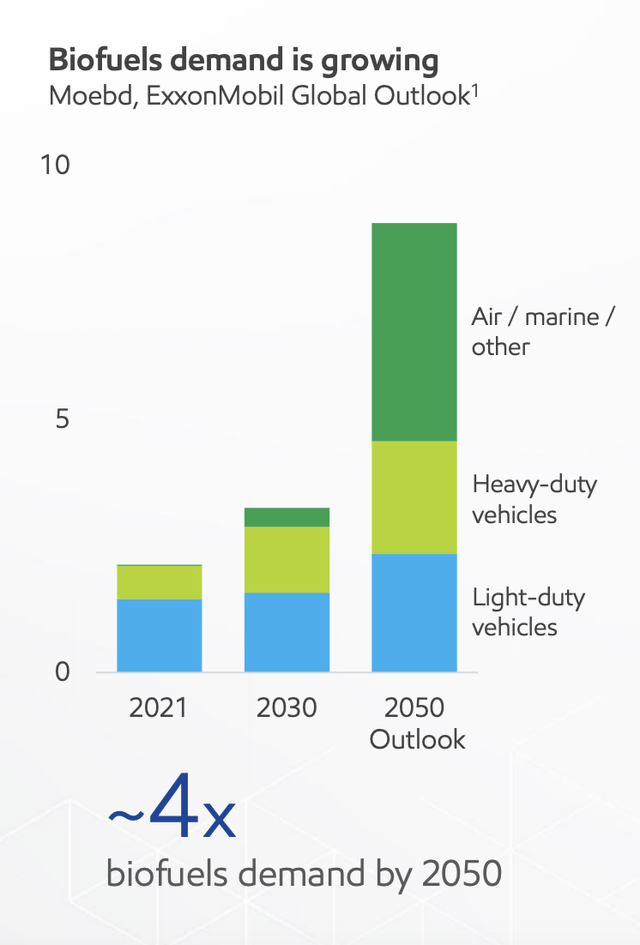

From 2021 through 2050, it’s expected that global biofuel demand will quadruple. Much of this growth will be associated with aircraft, vessels at sea, and other related activities and devices. In preparation for this surge, Exxon Mobil has 12 different biofuel projects currently under development.

Of course, growth alone would not be enough to boost earnings. Management has already started to focus on getting rid of lower margin and non-core assets. Back in 2019, for instance, it operated 18 refineries that fell under this category. By the end of this year, that number is expected to be down to 13. What’s more, the capacity that is integrated with chemicals at these facilities should rise from 70% back then to 85% this year. Higher capacity results in more revenue and higher margins in most cases.

Part of the company’s initiatives also involve reconfiguring assets that it already owns. Back in 2019, for instance, none of its refining assets under the Energy Products segment were equipped to deal with biofuels. By 2030, that is expected to change and, in the long run, management expects biofuels to become even more significant than lubricants.

But even bigger will be the growth of chemicals. Examples include olefins, polyethylene, polypropylene, and intermediates. Naturally, this falls under the Chemical Products unit, but each unit has operations that are critical for the success of all the others.

Management’s thought process here is that, by focusing on what it considers to be more valuable end products margins should improve significantly. And by high grading its portfolio, it believes that, by 2027, it can achieve $2 billion in annual net cash margin.

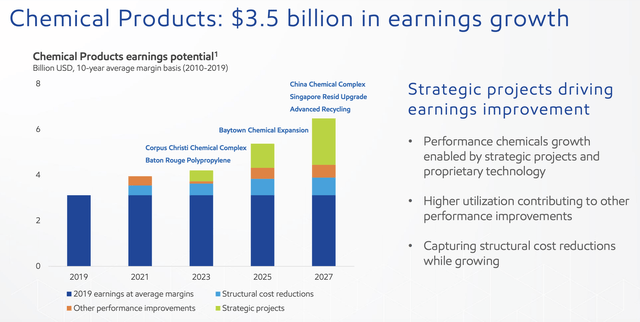

If everything goes according to plan, the Chemical Products segment of the company should see its average annual earnings come in at $3.5 billion above what we’ve seen as an average from 2010 through 2019. Much of this improvement should actually come from strategic projects that the company is focused on. Examples include its Corpus Christi chemical complex, its polypropylene facility in Baton Rouge, and its chemical complex in China. Management has a class of products under this umbrella that it considers to be ‘performance chemicals’, a class that it believes should grow at roughly double the rate of industry commodity chemicals if you look at the whole timeframe from 2010 through 2030 period.

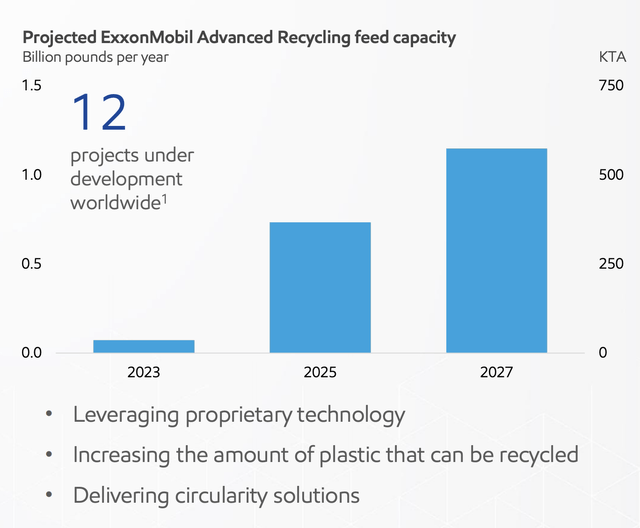

Specific examples include its Vistamaxx polymers and its Elevexx linear alpha olefins. The first of these is a type of polymer that is known to be useful in a variety of applications such as the automotive space, building and construction markets, the hygiene space, and even packaging. The latter, meanwhile, can be used in products like surfactants, drilling fluids, the creation of plastics, and more. Speaking of plastics, part of this initiative includes the 12 projects that the company has underway that will help with plastic recycling activities. As of 2023, the firm has less than 100 million pounds of advanced recycling feed capacity. That number should grow to well in excess of 1 billion pounds by 2027.

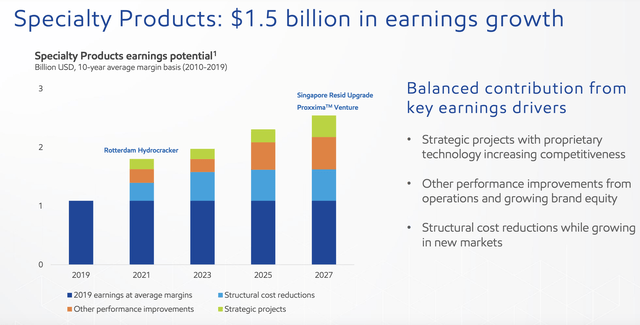

And finally, we have the Specialty Products unit, which focuses on a variety of offerings like finished lubricants, waxes, synthetics, elastomers, resins, and more. By focusing not only on some strategic projects, but also on significant structural cost reductions and other performance improvements, the company hopes to boost annual earnings by $1.5 billion. This should be accompanied by rapid growth in synthetic lubricants and it will be achieved in large part by using the company’s existing technology and new technologies it’s investing in that could help boost basestocks margins.

At first glance, all of this looks fantastic. My overall thought on the matter is that any investments the company does make in growth initiatives will likely bear some fruit. In addition to this, any way in which the firm can cut costs should be celebrated. I have no doubt regarding the company’s intentions, nor do I think that they are likely to move in the opposite direction of where they are today. But I would urge some caution when it comes to relying on these specific financial figures. And that is because of how management defines improvements.

You see, the industry in which Exxon Mobil operates is fraught with volatility because a lot of what it does boils down to spreads between the price that it pays for initial energy products and the price that it can sell these products for. This might seem like a no brainer since that is the business model of every company. But because of the extreme gyrations in price regarding feedstocks and end products alike, financial performance one year can look radically different from the year prior. As an example, we need only look at the presentation that management provided.

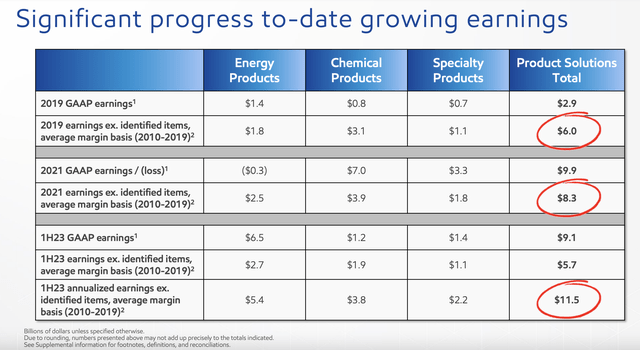

They based a lot of their numbers off of financial results for 2019. During that year, for instance, GAAP earnings reported by these three units came out to $2.9 billion. However, if you make certain adjustments and use average margins from 2010 through 2019, profits shoot up to $6 billion. That is a remarkable spread.

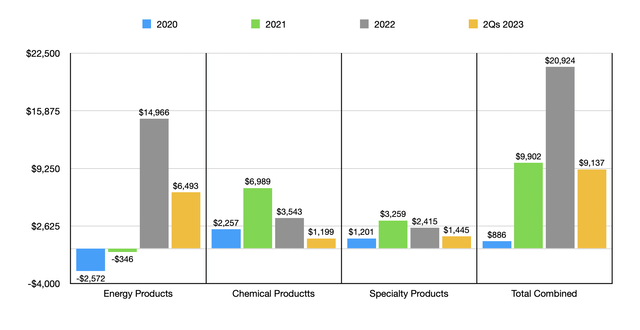

To illustrate this a bit better, I would like you to look at the chart below. In it, you can see profits for each of these units, as well as for the combination of the units as a whole, in the three years ending in 2022. It also includes results for the first half of the 2023 fiscal year. The Energy Products segment, for instance, went from a loss of $346 million in 2021 to a gain of nearly $15 billion in 2022.

The aforementioned image above shows that, in general, there has been progress toward the $10 billion in the savings over the past few years. But it’s difficult to know how much of this improvement can be attributed to what management has been working on and to broader industry volatility.

Takeaway

At this time, what is clear to me is that management is doing a fine job really thinking about their business and implementing strategies that they believe will reduce costs, and set the company up for additional revenue that should bring with it higher margins. Until we actually see this play out in its entirety, we won’t know the degree to which they will be successful.

However, I would urge investors not to take the $10 billion improvement figure for granted. This doesn’t necessarily mean that the company will achieve $10 billion in additional earnings from what it is generating today. Rather, it’s expected that, on average from year to year, results by 2027 should be about $10 billion per year better than they would have been without these initiatives, and if we use the 10 years ending in 2019 as a starting point. But at the end of the day, extreme volatility in financial performance will almost certainly still exist. This is not like the low carbon strategy that I wrote about regarding the company earlier this year, a strategy that will be more easily measured should it come to fruition.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!