Summary:

- Exxon Mobil Corporation stock has delivered a flat 1-year total return as investors rotated out after its 2022 cycle peak. XOM investors shouldn’t be surprised.

- The energy sector is assessed to be 8% below its fair value, suggesting relatively attractive opportunities compared to the US market.

- Exxon Mobil’s growth metrics are expected to improve, potentially attracting more buyers and leading to an uptrend continuation for the stock.

- I assessed that inward sector rotation to energy stocks had already started in mid-December and continued through the first week of 2024.

- I argue why high-quality plays like XOM are well-poised to benefit from a welcomed sector rotation, as I’m ready to upgrade it into a Strong Buy.

JHVEPhoto

Exxon Mobil Corporation (XOM) investors who added in early 2023 haven’t had much to cheer about over the past year. Accordingly, XOM delivered a flat 1Y total return, as its dividends helped to mitigate the languid price performance. However, after a blistering year in 2022, as XOM recovered its mojo, a consolidation phase allowing sector rotation and profit-taking shouldn’t surprise holders. A healthy consolidation phase will enable investors to assess XOM’s key support zones and possible resistance levels. As a result, it helps provide us with insights to glean attractive risk/reward opportunities for leading integrated oil and gas players like Exxon Mobil.

As the S&P 500 (SPX) (SPY) and the Nasdaq (QQQ) (NDX) started 2024’s trading year with a sharp pullback, the energy market (CO1:COM) (NG1:COM), as seen by its underlying futures, remain above their December 2023 lows. Based on Morningstar’s sector valuation estimates, the energy sector (XLE) is assessed to be 8% below its implied fair value, suggesting relatively attractive opportunities compared to the fairly valued US market.

Given the recent strength in energy stocks, could XOM and its leading peers be ready to emerge from their slumber after moving nowhere for the past year?

In late October, Exxon Mobil’s third-quarter or FQ3 earnings release confirmed that lower energy price realizations and weaker refining and chemical margins affected its overall operating performance. As a result, the company posted a 51% drop in adjusted net income, leading to an adjusted EPS decline of 49% to $2.27. However, analysts’ estimates suggest that the worst in Exxon’s adjusted net income growth normalization could have bottomed out in FQ3. Despite that, it could take another two more quarters to inflect back into growth. Accordingly, Exxon’s adjusted net margin is expected to bottom out in FQ4 (December quarter) before recovering in the second half of 2024.

Astute investors know that the market is forward-looking. Therefore, if Exxon Mobile’s growth metrics are expected to improve further, it should attract more robust buying sentiments as more buyers potentially return. I believe Exxon Mobile remains well-positioned to navigate the recent challenges and bolster its higher-margin production moving ahead. Its operations in the Permian have been lifted with the acquisition of Pioneer Natural Resources (PXD), as I highlighted in my previous update. I indicated that the deal value isn’t excessive and expected to be accretive to XOM’s bottom line. While a near-term share dilution likely affected investor sentiments, I don’t expect the decline to worsen, as XOM bottomed out neatly in mid-December, in line with the underlying energy markets.

Furthermore, it has provided an expected boost to Exxon Mobil’s production growth through 2027, coupled with its operations in Guyana. Based on the updated Wall Street estimates, Exxon Mobil is projected to deliver an average total production of 4.25 mboe per day by 2027, nearly 14% above 2023 production estimates. Given the higher margin quality from these assets, it should help Exxon Mobil sustain its adjusted net margin in the medium term, despite the normalization from its 2022 cycle peak.

XOM is valued at a forward EBITDA multiple of 5.4x, well below its 10Y average of 7.2x. Its forward dividend yield of 3.7% should bolster buying sentiments in its high-quality business model, corroborated by Seeking Alpha Quant’s best-in-class “A+” profitability grade. XOM is also assigned a “B-” grade for dividend safety, bolstering the outlook for XOM from a total return basis if its December 2023 bottom holds robustly.

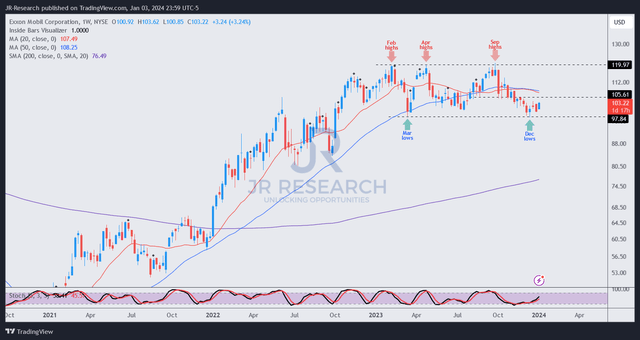

XOM price chart (weekly) (TradingView)

My analysis suggests that XOM formed an astute bear trap (false downside breakdown) in December 2023 at the $97.5 level, in line with its March 2023 low. The bullish reversal is expected to be robust, potentially culminating in an uptrend continuation for XOM based on its long-term monthly chart after a year of consolidation.

While I expect XOM’s $120 level to remain a robust resistance zone, the risk/reward from the current levels looks relatively attractive. Coupled with the constructive performance in the energy markets suggesting inward sector rotation, I anticipate XOM’s implied undervaluation, strong fundamentals, and robust price action to work in its favor in 2024.

As a result, I’m ready to lift XOM into the Strong Buy zone and encourage investors to capitalize before the train leaves the station. In addition, buy levels below the $100 zone should be capitalized aggressively.

Rating: Upgraded to Strong Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in XOM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!