Summary:

- Exxon Mobil Corporation benefits from technological advancements, low-cost operations, emissions reduction efforts, resilient financial strategies, significant discoveries in Guyana, and recognition of the need to replace declining reserves.

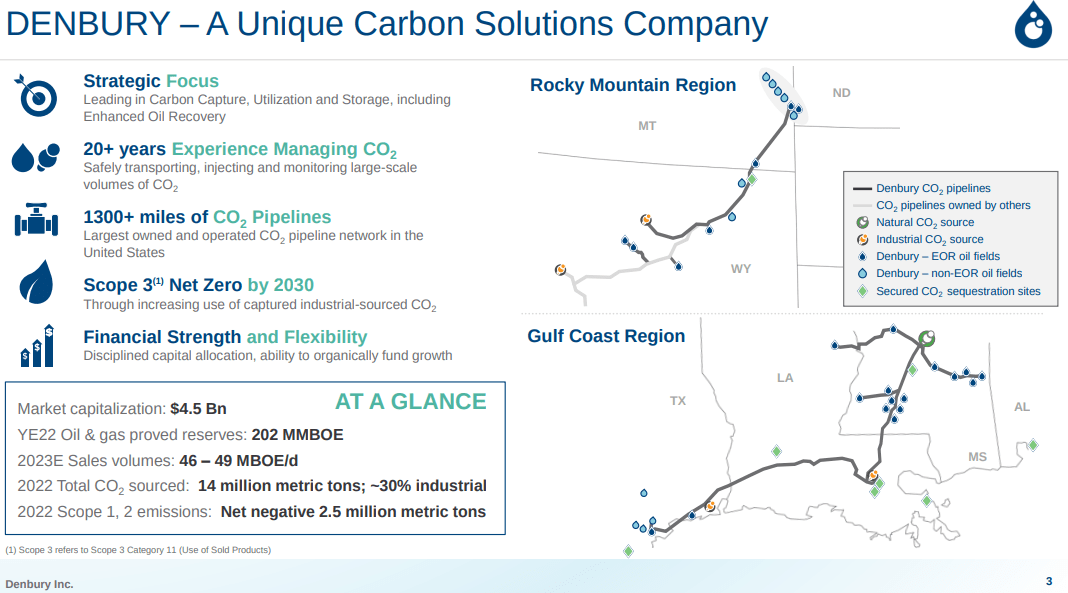

- Exxon Mobil’s acquisition of Denbury enhances its carbon capture and storage capabilities, providing a robust CO2 pipeline network and strategic sequestration sites.

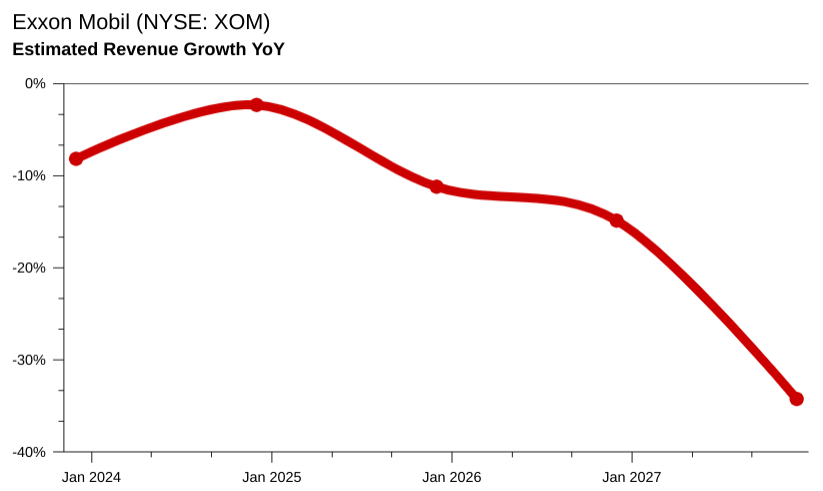

- The company faces challenges with deteriorating revenue estimates in the long term due to factors like declining oil and gas prices and the transition towards low-carbon solutions.

- Short-term factors such as increasing crude oil and natural gas prices may provide some support.

Brandon Bell

Investment Thesis

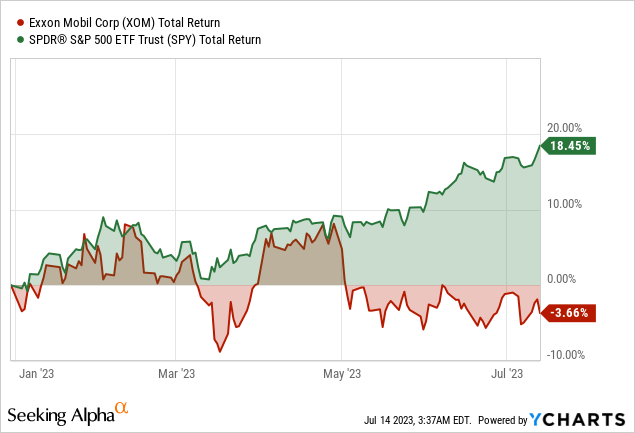

Exxon Mobil Corporation (NYSE:XOM), after experiencing a bull run in 2022, now trades sideways, moving in tandem with the decline in oil and gas prices. XOM strives to adapt to the challenges and opportunities the energy industry presents to maintain its lead.

With technological advancements, a focus on low-cost operations, and a commitment to emissions reduction, the company is positioning itself for long-term value creation. Additionally, its strategic acquisition of Denbury enhances its carbon capture and storage capabilities, solidifying its position as a leader in the field. However, as the industry transitions towards low-carbon solutions, Exxon Mobil faces the hurdle of deteriorating revenue estimates. Nonetheless, short-term factors are still favoring Exxon Mobil.

The article explores XOM’s strategic and operational perspective, its focus on carbon capture and storage, and the impact of the Denbury acquisition, shedding light on its position in the energy market, leading to the hold rating.

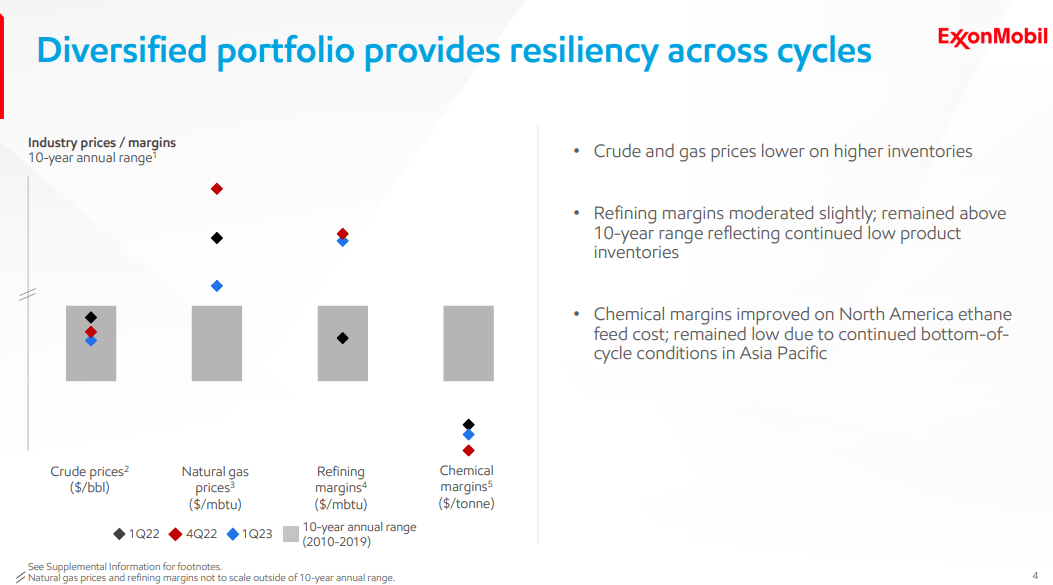

Strategic & Operational Assessment

Regarding long-term price forecasts, Exxon Mobil synthesizes diverse views and projections from various organizations to estimate future demand. However, predicting the supply side, such as discovering and producing oil, remains a critical part. The company expects the long-term price of oil to be around $60 per barrel, which provides the right incentive for its exploration and production operations.

Regarding natural gas, Exxon Mobil focuses on timing production to align with demand. The liquefied natural gas (LNG) market operates differently from the oil market, with long-term contracts dictating facility development. Price volatility can occur in the spot market, but long-term contracts provide stability.

Exxon Mobil sees potential for continued gas demand as a transition fuel, especially to replace coal. It focuses on the possibility of converting gas into ammonia and hydrogen, gradually reducing emissions. Thus XOM can optimize its operations and maximize profitability by focusing on low-cost upstream barrels and timing natural gas production to align with demand.

Moreover, the company recognizes the depletion curve and the need to replace every barrel of crude oil or tonne of LNG produced to offset the decline. Even if demand remains flat, maintaining production volume requires significant growth due to the depletion rate. However, the industry is underinvesting resources, leading to a potential supply shortage over the long term. Lastly, the company expects the depletion curve will eventually catch up, and inadequate investment will result in a market shortfall.

Exxon Mobil

Reflecting on the shale cycle, Exxon Mobil and the industry explore new resources through technological advancements. While the initial shale rush has subsided, there is still room for technological improvements. Currently, the recovery rate for unconventional resources is around 10%. The conglomerate has focused on optimizing the fracking process to improve lateral fracture efficiency and maintain open fractures for enhanced recovery.

Regarding strategy, XOM is focused on differentiating itself from its peers by emphasizing technology and research. Its future trajectory involves a balanced mix of businesses, including the growth of its chemicals business, investments in refineries that produce high-value products, and continued focus on low-cost upstream barrels.

XOM recognizes that oil will continue to be needed in the foreseeable future, and its goal is to secure the lowest-cost barrels on the supply curve. By staying at the forefront of technological advancements, XOM can enhance recovery rates and reduce costs, ensuring a competitive advantage in the industry.

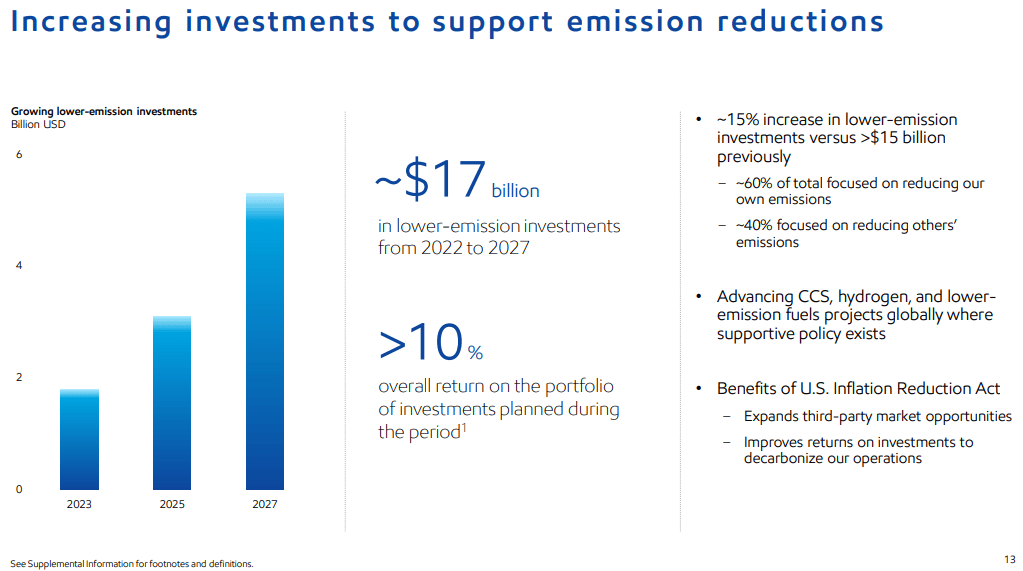

Additionally, the company specializes in manipulating and transforming hydrogen and carbon molecules. Also, it is now prioritizing technologies aligned with reducing emissions and climate impact, such as carbon capture and storage, biofuels, and hydrogen. Any new policy framework that incentivizes carbon reduction investments, as there is currently no established carbon market, will benefit Exxon Mobil. Moreover, it has secured significant carbon capture and storage contracts and is investing in biofuels and blue hydrogen projects.

One key focus area is carbon capture and storage (CCS). While enhanced oil recovery (EOR) can provide a valuable byproduct for captured CO2, the challenge lies in capturing CO2 directly from the atmosphere. It is similar to picking small marbles from a large bag, as atmospheric CO2 is highly diluted.

The company’s approach to CCS involves targeting concentrated CO2 sources, such as hydrogen and LNG plants, which current government policies incentivize. The company is concentrating on developing technologies to reduce direct air capture costs and make it economically viable, thereby addressing the larger emissions problem without replacing existing infrastructure.

Corporate Plan Update (Exxon Mobil )

Further, the cost of carbon capture remains a significant challenge. A price tag of around $600 to $1,000 per tonne of CO2 removed equals approximately $200 per barrel of oil equivalent. Implementing such costs for consumers through taxes is politically challenging. Therefore, Exxon Mobil is moving forward to reduce carbon capture costs and make it more affordable.

XOM has a technology program dedicated to advancing direct air capture, aiming to cut costs in half. However, the conglomerate acknowledges that it is still early in the technology curve and that the progress and limits of these technologies remain uncertain. By targeting concentrated CO2 sources and developing cost-effective methods for direct air capture, Exxon Mobil can address emissions challenges without requiring extensive infrastructure replacements.

Regarding Guyana, Exxon Mobil has made significant discoveries, with 11 billion barrels of resources. It has successfully brought two production vessels online ahead of schedule, under budget, and exceeding their initial investment basis. The third vessel is in the commissioning phase and is expected to begin production by the end of 2023. Exxon Mobil plans to continue bringing additional vessels online every 1 to 2 years. Over the long term, the company can capitalize on these assets and contribute to its long-term growth and profitability.

Finally, Exxon Mobil’s financial strategy focuses on attaining a balance between investing in advantageous projects, building a resilient balance sheet, and delivering shareholder returns. For example, during Q1 2023, Exxon Mobil distributed over $8 billion to shareholders, including a dividend payment of $3.7 billion. XOM chooses projects that are low on the cost of supply and advantage the company in the industry. Lastly, the company maintains a strong balance sheet to support long-term capital investment programs and weather the industry’s cyclical nature.

Denbury’s Acquisition Leads In CCS Solutions & Enhanced Oil Recovery

Exxon Mobil’s acquisition of Denbury may boost its lead in specializing in CCS solutions and enhanced oil recovery. The all-stock transaction is valued at $4.9 billion, with Denbury shareholders receiving 0.84 shares of Exxon Mobil for each Denbury share. The acquisition is part of Exxon Mobil’s strategy to expand its Low Carbon Solutions business and provide comprehensive CCS offerings to hard-to-decarbonize industries.

The transaction may bring significant synergies and opportunities for growth and returns for Exxon Mobil. It grants XOM ownership of the largest CO2 pipeline network in the U.S., spanning 1,300 miles, including 925 miles of CO2 pipelines in Louisiana, Texas, and Mississippi. The network, coupled with Denbury’s ten strategically located onshore sequestration sites, accelerates the deployment of CCS for both Exxon Mobil and third-party customers. Moreover, the transportation and storage system supports various low-carbon value chains, including CCS, hydrogen, ammonia, biofuels, and direct air capture.

Corporate Presentation (Exxon Mobil)

The acquisition may support Exxon Mobil’s low-carbon focus and robust balance sheet. Denbury’s CO2 infrastructure complements Exxon Mobil’s Gulf Coast value chains and provides the potential to reduce emissions by over 100 million metric tons per year. Remarkably, it is one of the highest-emitting regions in the U.S.

The acquisition also includes Gulf Coast and Rocky Mountain oil and natural gas operations, contributing to immediate operating cash flow and further opportunities for CO2 utilization and the CCS business. Lastly, Denbury’s acquisition illustrates Exxon Mobil’s commitment to advancing its Low Carbon Solutions business and expanding its CCS capabilities.

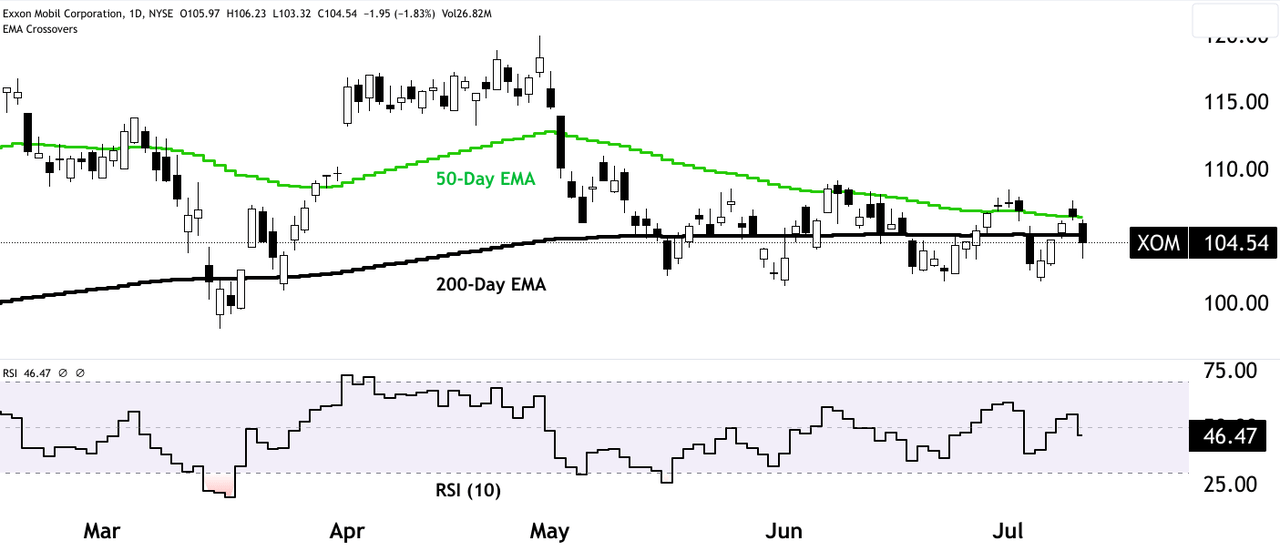

Technical Analysis Suggests A Sideways Trend

Exxon Mobil’s stock price is moving into the distribution phase of its market price cycle. It can be observed in the Relative Strength Index (RSI) and the 200-day Exponential Moving Average (EMA). RSI is near 46; therefore, the stock price is neither overbought (above 70) nor oversold (below 30) state per the indicator.

Similarly, Exxon Mobil’s stock price is demonstrating a sideways trend at the 200-day EMA, where the EMA can turn into further support for the next jump in stock price, or it may become critical resistance if the stock price follows a bearish trajectory.

The 50-day EMA is approaching the 200-day EMA, which may lead to a short crossover. Consequently, the stock price may enter a mark-down price cycle. Lastly, the crossover could indicate a shift in momentum, potentially triggering a decay in investor confidence and an intensification of selling pressure.

Deteriorating Revenue Estimates Remains A Challenge

Exxon Mobil faces a challenging long-term outlook with deteriorating revenue estimates. The company’s revenue growth is expected to decline yearly due to several factors impacting the energy market.

Firstly, there is a downward trend in natural gas and oil prices as weaker demand is anticipated based on normalized energy market conditions and increased energy supply. Resolving the Russian-Ukraine conflict may also stabilize oil prices, further affecting revenue growth. Moreover, softer economic growth in China adds to the concerns, as it is a significant energy consumer.

Author’s Chart (Seeking Alpha)

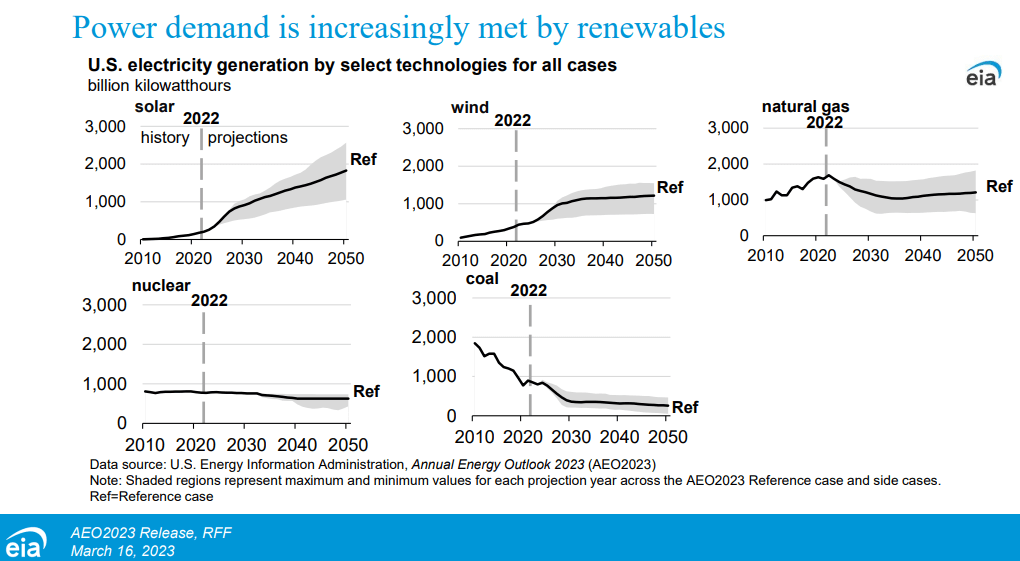

The long-term trend in the energy market does not favor Exxon Mobil’s oil and gas revenues, particularly with the transition towards green business or low-carbon solutions. By 2030, energy-related CO2 emissions will decrease significantly, and renewables will increasingly meet power demand. Solar and wind energy are expected to generate most U.S. electricity by 2050. Technological advancements and electrification are driving decreases in demand-side energy intensity.

Additionally, there will be an increase in light-duty vehicle fuel economy and electric vehicle market share due to rising Corporate Average Fuel Economy (CAFE) standards and other incentives. Despite these developments, the United States is projected to remain a net exporter of petroleum products through 2050, with LNG exports driving production while domestic consumption remains stable.

eia.gov

However, some positive factors may impact Exxon Mobil’s performance in the short term. Crude oil prices are forecast to gradually increase, with the Brent crude oil spot price expected to average $78 per barrel in July, $80/b in Q4 2023, and $84/b in 2024 because it is expected that global oil inventories will continue to drop during the next five quarters.

Similarly, natural gas prices are also expected to rise in the coming months as declining production narrows the existing surplus of inventories. The Henry Hub spot price is projected to average more than $2.80 per million British thermal units (MMBtu) in H2 2023, up from around $2.40 per MMBtu in H1 2023.

Finally, while Exxon Mobil faces deteriorating revenue estimates in the long term due to several factors impacting the energy market, short-term factors, such as increasing crude oil and natural gas prices, may provide some support.

Takeaway

In conclusion, Exxon Mobil navigates a complex energy landscape with a forward-looking approach. It recognizes the need to replace declining reserves and capitalizes on technological advancements, low-cost operations, and emissions reduction efforts. XOM’s acquisition of Denbury strengthens its carbon capture and storage capabilities, positioning Exxon Mobil as a leader in CCS solutions and enhanced oil recovery.

However, the company faces challenges with deteriorating revenue estimates in the long term as the energy market shifts towards low-carbon solutions. Despite this, short-term factors like increasing oil and gas prices offer some support. Based on the analysis, standing on the sidelines seems appropriate; Exxon Mobil is on hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.