Summary:

- Exxon Mobil Corporation continued its string of impressive earnings reports in the fourth quarter of 2022.

- The company boasted fairly significant YOY growth, although this quarter was not as good as the previous few.

- The company’s 3% dividend increase was a major disappointment. Exxon Mobil used to be much more shareholder-friendly.

- The company is unlikely to deliver much near-term production growth, although oil prices will likely go up a bit.

- The company’s stock price appears significantly undervalued and so it might still be worth purchasing today.

grandriver

On Tuesday, January 31, 2023, oil and gas supermajor Exxon Mobil Corporation (NYSE:XOM) (“Exxon Mobil”) announced its fourth-quarter 2022 earnings results. At first glance, these results were very impressive, as the company managed to beat the expectations of its analysts in terms of both revenue and net income. It is doubtful that anyone expected Exxon Mobil to perform poorly, though, as the generally high energy price environment that dominated during 2022 has allowed traditional fossil fuel companies to report some of the best results in their histories. Indeed, the five largest publicly-traded energy companies are expected to report $200 billion in net income, which would be a record for the industry.

Unfortunately for Exxon Mobil, not everything is perfect here, as the company’s fourth-quarter numbers were generally weaker than what it posted earlier in the year. Most projections right now are that 2023 will be weaker than 2022, as many are expecting energy prices to be somewhat lower this year. However, as I pointed out in a recent blog post, it is unlikely that energy prices will decline very much in the near term. Thus, Exxon Mobil will probably continue to report reasonably strong results going forward. When we combine this with the fact that the company looks to be significantly undervalued at its current price, it may still make some sense to pick up some of Exxon Mobil’s shares today.

As my long-time readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from Exxon Mobil’s fourth-quarter 2022 earnings results:

- Exxon Mobil brought in total revenues of $95.429 billion during the fourth quarter of 2022. This represents a 12.32% increase over the $84.965 billion that the company brought in during the prior-year quarter.

- The company reported an operating cash flow of $18.954 billion during the reporting period. This represents a slight decline from the $19.725 billion that the company reported during the year-ago quarter.

- Exxon Mobil produced an average of 3.822 million barrels of oil equivalents per day in the most recent quarter. This represents a slight increase over the 3.816 million barrels of oil equivalents per day that the company produced on average during the equivalent quarter of last year.

- The company declared a dividend of $0.91 per share for the quarter. This gives the stock a 3.15% annualized yield at the current price and represents a slight increase over the $0.88 per share that the company paid out following the prior year’s quarter.

- Exxon Mobil reported a net income of $12.750 billion in the fourth quarter of 2022. This represents a 43.74% increase over the $8.870 billion that the company reported in the fourth quarter of 2021.

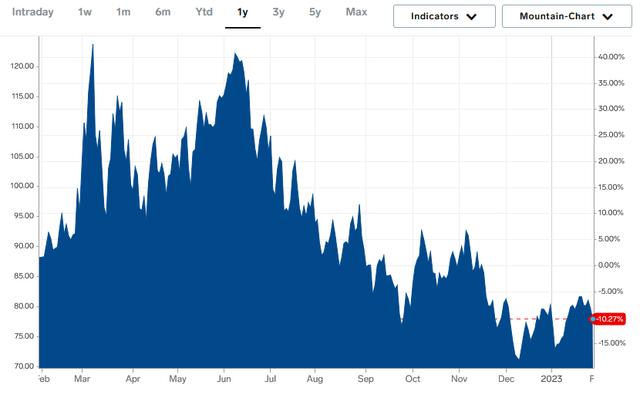

It seems almost certain that the first thing that anyone reading these results will notice is that Exxon Mobil reported generally better results than in the corresponding quarter of last year. It is unlikely that this is a surprise to anyone reading this since one of the major headlines over the past year has been the generally high energy prices that have prevailed throughout the economy. The price of West Texas Intermediate crude oil never went below $70 per barrel during 2022:

That is quite a bit higher than the prices that prevailed prior to the COVID-19 pandemic. This generally had a positive impact on Exxon Mobil’s revenues during the quarter. That makes sense, since the more money that the company can get for each unit of product that it sells, the more revenue it will bring in, all else being equal. Exxon Mobil stated that its average selling price per barrel of crude oil was 10% higher in the fourth quarter of this year than in the fourth quarter of last year.

However, the company did even better with natural gas as its average selling price was 46% higher than in the same quarter of last year. This had a positive impact on the company’s net income and cash flow as well as revenue, since the higher revenue that it received due to the higher selling prices caused the company to have more money to cover its expenses and make its way down to the bottom line.

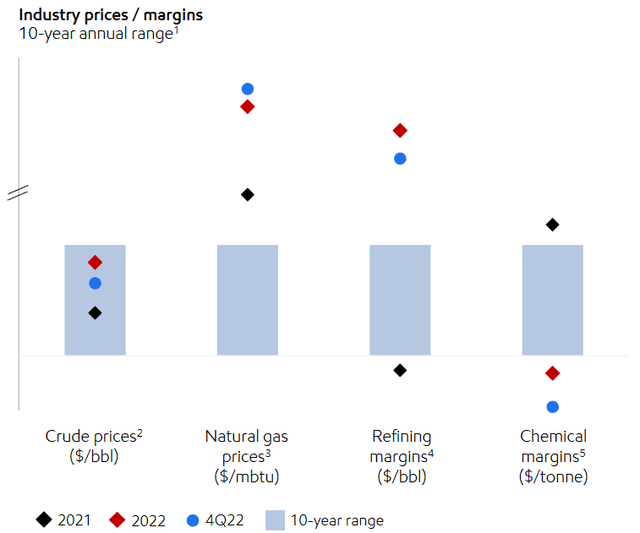

These higher prices had an impact on more than just the fourth quarter of 2022, however. As we can clearly see here, Exxon Mobil’s average selling price for both crude oil and natural gas was quite a bit higher in 2022 than in 2021:

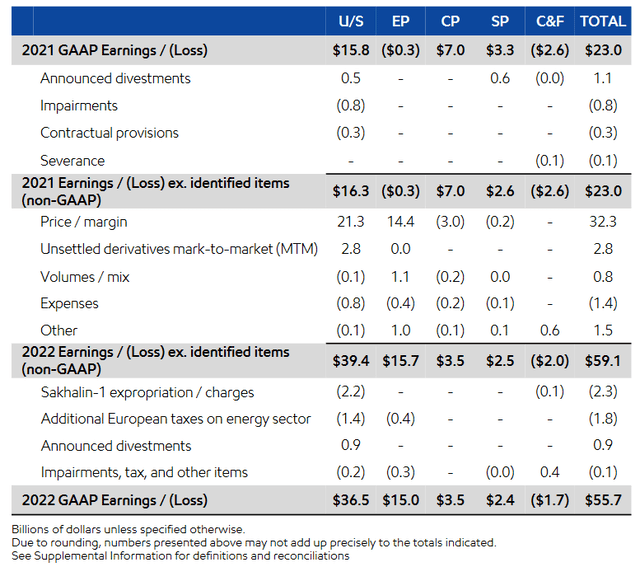

This was just one of the factors that allowed 2022 to be one of the best years in the company’s history. During the full-year 2022 period, Exxon Mobil had adjusted earnings of $59.1 billion, which represents a substantial increase over the $23.0 billion that it reported in 2021:

That is the highest adjusted earnings that have ever been reported by a publicly-traded energy company. Unfortunately, that makes the fact that Exxon Mobil only increased its dividend by 3.41% year-over-year a big disappointment for any income investor whose portfolio includes this company. As Exxon Mobil is one of the more popular dividend growth stocks, I can only imagine that many people will be expressing some disgust in the comments. This is a particular disappointment since there are other companies in the energy sector like Diamondback Energy (FANG) and Pioneer Natural Resources (PXD) that have committed to pay out 75% or more of their free cash flow to investors.

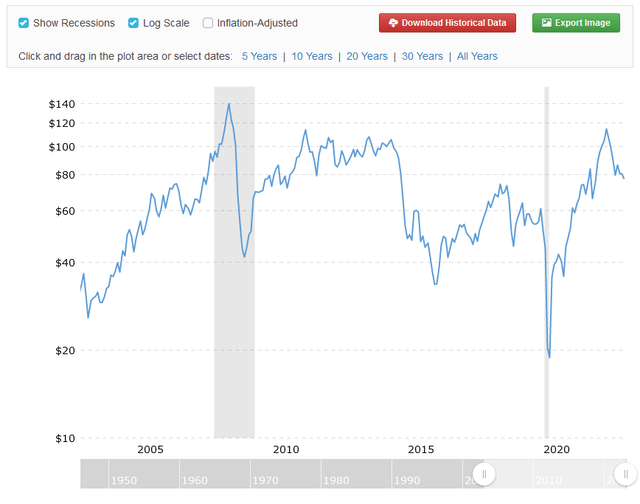

It is interesting to note that Exxon Mobil managed to achieve its record profit despite oil prices being lower than in 2008, which is the year that the company last set a profit record. The company’s adjusted earnings during 2008 were $45.2 billion, which was set on the back of a year in which crude oil prices topped $140 per barrel, which was 30% higher than the average price in 2022:

The biggest reason for Exxon Mobil managing to do better than it did during a year in which energy prices were higher is that the company embarked on an ambitious cost-cutting program when energy prices fell to a 25-year low during the height of the COVID-19 pandemic. This is similar to the methods used by many other energy companies to cut costs in response to the same event, and it is the reason why we are seeing several of Exxon Mobil’s peers also report record results despite, as mentioned, energy prices were not at record levels in 2022. Overall, this is something that is quite nice to see, as the less money the company has to consume in its business, the more that should be available to do things that benefit the shareholders.

One thing that also was nice to see is that Exxon Mobil managed to increase its production relative to the previous quarter. As stated in the highlights, the company produced an average of 3.822 million barrels of oil equivalents during the most recent quarter, which represents a 2.85% increase over the third quarter:

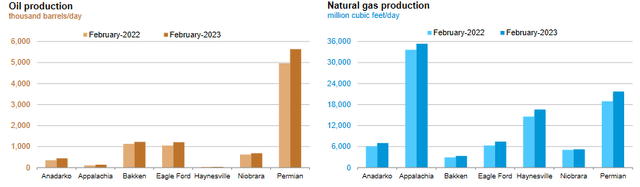

This increase was partly due to the company’s onshore production in North America. That is not really surprising, since as I pointed out in my analysis of peer company Chevron’s (CVX) earnings report, that company also delivered production growth in North America. In fact, every basin in the United States is currently producing more oil and natural gas than a year ago:

U.S. Energy Information Administration

In Exxon Mobil’s case, its Permian Basin production exceeded 560,000 barrels of oil equivalent per day during the fourth quarter, which makes it one of the biggest producers in the basin. It is not really surprising that the Permian Basin is one of the areas in which Exxon Mobil delivered growth as this is an area whose geography allows companies to quickly and cheaply increase or decrease production. This is in direct contrast to something like an offshore production project that can take many years and billions of dollars to bring to a production state. This situation is one of the reasons why the United States is starting to be considered a swing producer.

It is nice to see that Exxon Mobil managed to grow its production in the quarter. This is because production growth is one of the only ways that an energy company can grow its operations and it is the only method that is at least somewhat within the company’s control. After all, even an oil supermajor like Exxon Mobil cannot control crude oil prices and so it cannot actually ensure that it can deliver growth by raising its prices. It should be fairly obvious how higher production results in growth since the higher production causes the company to have more products to sell and generate revenue from. As we already discussed, higher revenue means that more money is available to cover the company’s expenses and make its way down to profits and cash flows.

Unfortunately, Exxon Mobil will probably not see any further production growth in the near term. During its earnings conference call, the company stated that its production in the first quarter of 2023 will likely be in line with its production during the fourth quarter of 2022. However, it did state that it will be increasing its production in the Permian Basin slightly over the course of the year. The company will keep growing its production in that area, with the goal of hitting one million barrels of oil equivalents per day by 2027. While that may certainly look like production growth, it is important to keep in mind that much of this will only serve to offset production declines elsewhere. The company will overall be dependent on energy prices to boost its upstream revenue and profit. Exxon Mobil does seem optimistic about that though. In an interview with CNBC, CEO Darren Woods stated,

“As the economy continues to recover, it’s going to take time for the investments being made right now to bring additional capacity on. We’re going to be in this fairly tight window of demand and supply being tight. We’ll see prices come back up again.”

For my part, I have to agree with Mr. Woods. As I have discussed in numerous articles, the long-term fundamentals for both crude oil and natural gas are quite strong, and global demand will almost certainly grow more quickly than the supply of these resources. Exxon Mobil is positioned quite well to take advantage of this environment and continue to reward the stockholders.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a sure-fire way to generate a suboptimal return on that asset. In the case of an energy supermajor like Exxon Mobil, one metric that we can use for valuation is the price-to-earnings growth ratio. This ratio is a modified version of the familiar price-to-earnings ratio that takes a company’s forward earnings per share growth into account. A price-to-earnings growth ratio of less than 1.0 is a sign that the stock may be undervalued relative to its forward earnings per share growth and vice versa. However, nearly everything in the traditional oil and gas industry is significantly undervalued at the present time. As such, it makes sense to compare Exxon Mobil’s valuation to that of its peers in order to determine which company has the most attractive valuation today.

According to Zacks Investment Research, Exxon Mobil will grow its earnings per share at a 23.47% rate over the next three to five years. This gives the company a price-to-earnings growth ratio of 0.48 at the current stock price. Here is how that compares to the company’s peer group:

|

Company |

PEG Ratio |

|

Exxon Mobil |

0.48 |

|

Chevron Corporation |

0.77 |

|

Occidental Petroleum (OXY) |

0.41 |

|

APA Corporation (APA) |

0.18 |

|

ConocoPhillips (COP) |

0.57 |

|

Marathon Oil (MRO) |

0.32 |

As we can clearly see, all of these major oil producers appear to be substantially undervalued today. This is in stark contrast to pretty much every other sector in the market. Exxon Mobil is not the most undervalued company on the list but admittedly we did not expect it to be given its size. The valuation does imply a fair value of $240.52 for the company’s shares though, which would represent a substantial return from today’s levels. Overall, there appear to be some reasons to add Exxon Mobil to a portfolio today.

Conclusion

In conclusion, there was a lot to like in Exxon Mobil Corporation’s fourth-quarter earnings report. The company’s net income and cash flow were both very strong and its production growth is laudable. I will admit to being very disappointed with the meager dividend increase, however. Exxon Mobil Corporation has a long history of being a very shareholder-friendly company, and it certainly did not live up to its reputation. There could still be some reasons to buy Exxon Mobil Corporation, though, as crude oil prices are likely to go up over the long term and XOM stock looks incredibly undervalued today.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long various energy-focused funds that currently hold long positions in XOM, CVX, MRO, and APA. I exercise no control over these funds and their positions may change at any time.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. In addition, all subscribers can read any of my work without a subscription to Seeking Alpha Premium!

We are currently offering a two-week free trial for the service, so check us out!