Summary:

- Exxon Mobil’s shares have underperformed the market and are likely to continue to do so due to overexposure to commodity price cycles.

- Q4 earnings could disappoint investors due to the plunging oil prices.

- The completion of the Pioneer Natural Resources acquisition may expand Exxon Mobil’s presence in the Permian Basin, but is unlikely to significantly impact its shares in the short term.

sefa ozel

Since the publication of my latest article on Exxon Mobil (NYSE:XOM) in late July, the company’s shares have underperformed against the broader market and there’s a possibility that they will continue to underperform in the following months. This is mostly due to the company’s overexposure to the commodity price cycles that directly affect Exxon Mobil shares.

Since the oil market has now mostly normalized after experiencing a shock in 2022 due to geopolitical and macroeconomic issues, there are few reasons to believe that the oil prices will aggressively appreciate anytime soon due to the abundance of supply and lack of clear growth catalysts. Therefore, there are reasons to believe that Exxon Mobil is fairly priced at the current price, and it’s unlikely that its shares would be able to reach their all-time high levels anytime soon.

What’s Next For Exxon Mobil?

Next month, Exxon Mobil is expected to report its Q4 earnings results and there’s a high chance that the revenues will be down Y/Y as was the case in Q3 when the revenues declined by 19% Y/Y to $90.76 billion and were below the estimates by $1.81 billion. Net income in Q3 has also decreased by more than a half to $9.07 billion, mostly as a result of plunging oil prices that are currently considerably below last year’s highs. Such results show that Exxon Mobil along with its shares is constantly going to be at the whims of the commodity price cycles even if it’s considered to be one of the best well-run energy companies in the world.

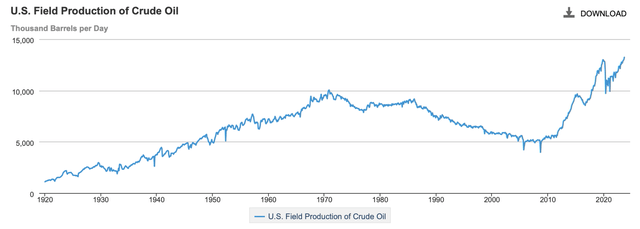

Even though Exxon Mobil increased its net production by ~80K boe/day in Q3 and is on track to reach an average production of 3.7 million boe/day in 2023, the normalization of the oil market is unlikely to help the company improve its Y/Y top-line and bottom-line performance in FY23. Considering that the oil production in the United States is now at all-time high levels, it’s unlikely that oil prices are going to aggressively increase anytime soon to help Exxon Mobil achieve similar results that it achieved in 2022.

What’s more, is that there’s also an indication that OPEC is also losing its ability to influence the oil market as oil exporters such as Saudi Arabia and Kuwait are about to have budget deficits this year due to the normalization of the oil market in 2023 that brought the prices lower. Even though the oil cartel has been cutting its production in the last year to bring the prices higher, the increase in oil production by the United States, Brazil, Guyana, and others, along with the disagreements within OPEC+ itself loosened the grip of Saudi Arabia and its partners over the oil market. Add to all of this the fact that the IAE expects the demand in Q4 to decrease, while the EIA forecasts the average price of Brent Crude oil per barrel in 2024 to be $82.57, and it becomes obvious that it’s unlikely that we’ll see a repeat of the 2022 scenario anytime soon.

In a world where supply becomes greater than the demand and supply disruptions are mostly over, the exposure to commodity price cycles is likely to negatively hurt Exxon’s shares in the following quarters. While having an overall breakeven price of ~$40 per barrel and aiming to lower it to $35 in the following years would help Exxon Mobil to continue to generate great returns for years to come even if prices fall further, we’re unlikely to see the record high margins anytime soon.

In addition to that, due to the potential invasion of Guyana by Venezuela, Exxon Mobil’s operations in the region, where it produces ~400,000 barrels a day that account for around 10% of the company’s overall daily oil production, are now at the risk of disruption. Venezuela’s potentially aggressive actions toward its neighbor could also derail Exxon Mobil’s ambitions in the region, where it intends to increase its overall production to over 1 million barrels per day by 2027. While wars and conflicts historically drove the prices for oil higher, it’s hard to imagine how Exxon Mobil could benefit from the current situation, considering that its own assets are on the line in Guyana.

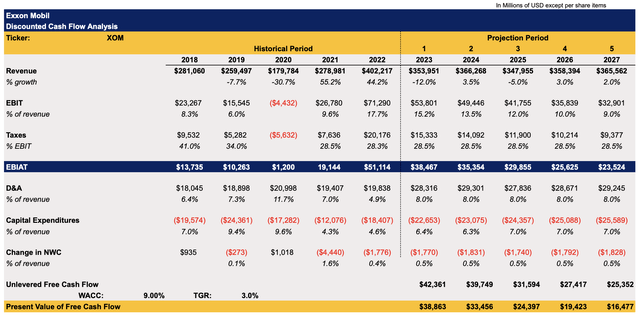

Considering all of this, it makes sense to believe that the upside is likely to be limited for Exxon Mobil shares in the following months. My DCF model below assumes that the top-line growth along with the earnings in FY23 are going to decline Y/Y due to the normalization of the oil market this year. After that, the growth is likely to remain limited due to the abundance of oil supply and the inability of OPEC+ to decisively impact the oil market. Those assumptions are mostly in line with the Street estimates. The CapEx assumptions are mostly in line with the management expectations as well, while the assumptions for other metrics mostly mirror the company’s historical performance. The WAXX in the model stays at 9%, while the terminal growth rate is 3%.

Exxon Mobil’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

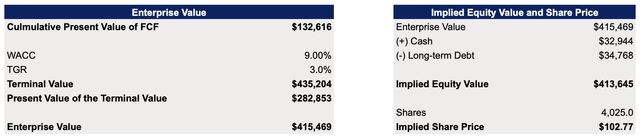

The model shows that Exxon Mobil’s fair value is $102.77 per share, which is close to the current market price. This indicates that the company is currently fairly valued at this stage.

Exxon Mobil’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

Is Pioneer Deal A Game Changer?

One thing that could greatly impact Exxon Mobil’s investment attractiveness is the completion of the purchase of Pioneer Natural Resources (PXD) for $59.5 billion next year. The deal was announced a couple of months ago and upon its completion, it will help Exxon Mobil greatly expand its presence in the Permian Basin. Currently, Pioneer has one of the largest undeveloped Tier 1 inventories in the region. The acquisition will certainly make it possible for Exxon Mobil to minimize its international risks and at the same time increase its production in the Permian Basin to ~2 million barrels per day in the following years.

The only major issue with the purchase is that Pioneer is also exposed to the commodity price cycles and is unlikely to help Exxon Mobil generate the same results as it did in 2022 on its own anytime soon. While the purchase is likely going to add ~$20 billion in additional revenues annually, the overall sales are likely to be below the 2022 levels in the following years due to the abundance of supply in the oil market. That’s why, even though the purchase will help Exxon Mobil minimize its international risks and expand its presence in the Permian Basin, it will likely have minimal impact on its shares in the following quarters.

The Bottom Line

I believe that Exxon Mobil is one of the best-run energy companies in the world right now. I also believe that its stock is subject to the whims of the commodity price cycles. Given the fact the United States along with non-OPEC countries continue to increase the production of oil while the grip of OPEC+ over the market wanes, it seems that we’re unlikely to see the repeat of the 2022 scenario, which helped Exxon Mobil shares to aggressively appreciate, anytime soon. While the company will continue to make decent profits due to the relatively low breakeven price and the purchase of Pioneer certainly makes sense in the long-term, Exxon Mobil’s upside will likely be limited in the short to near term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi and/or BlackSquare Capital is/are not a financial/investment advisor, broker, or dealer. He's/It's/They're solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Brave New World Awaits You

The world is in disarray, and it’s time to build a portfolio that will weather all the systemic shocks that will come your way. BlackSquare Capital offers you exactly that! No matter whether you are a beginner or a professional investor, this service aims at giving you all the necessary tools and ideas to either build from scratch or expand your own portfolio to tackle the current unpredictability of the markets and minimize the downside that comes with volatility and uncertainty. Sign up for a free 14-day trial today and see if it’s worth it for you!