Summary:

- Exxon Mobil Corporation reported a mixed Q4 with a trend downward due to slumping energy prices and excess production capacity.

- The company reported a decline in revenues and plans to ramp up production, despite the risk of a supply glut.

- The stock trades at 12x ’24 EPS targets and analysts forecast lower earnings and the risk is lower energy prices after a period of energy prices above the 10-year averages.

Jaromir Ondra

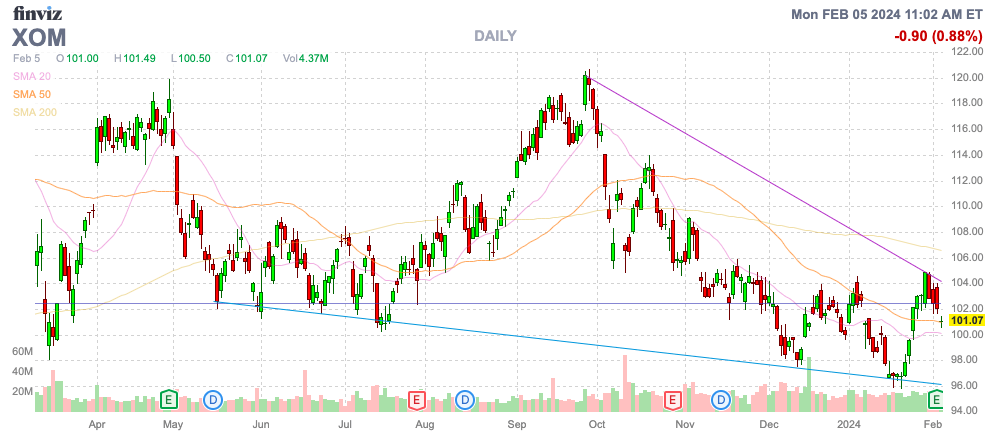

Following mixed Q4 earnings, Exxon Mobil Corporation (NYSE:XOM) continues to trend downward. The energy giant faces a sector where supply is plentiful, and energy prices are slumping. My investment thesis remains Bearish now with the stock above $100 while earnings are likely to continue trickling lower with oil prices facing a supply glut around the world due to excess production capacity.

Source: Finviz

Production Growth

Exxon Mobil reported a mixed Q4 ’23 quarter due to pressure on energy prices that could only get worse.

The energy giant reported revenues declined nearly 12% from last Q4 due to slumping energy prices following the Russian invasion of Ukraine in 2022. Exxon Mobil still reported massive profits due to cost containment efforts.

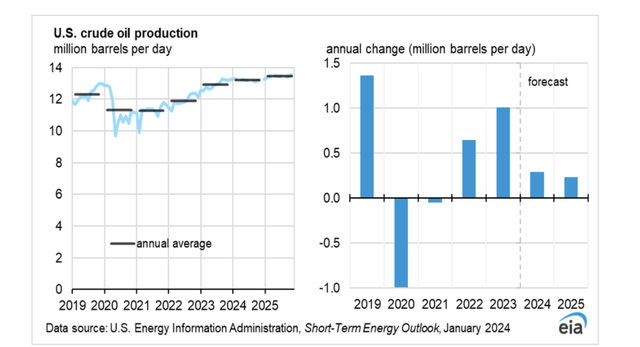

The issue here is that OPEC+ continues to slash oil production in order to elevate oil prices, yet prices (CL1:COM) continue slumping due to domestic production growth in the U.S. The U.S. is set for record oil production during 2024 and at least into 2025.

U..S oil production hit a record 12.92 million b/d in 2023 with predictions for slightly higher production in the next 2 years. EIA predicts improved well productivity will increase U.S. crude oil production by 0.3 million b/d in 2024 and 0.2 million b/d in 2025 to reach 13.44 million b/d.

Non-OPEC supply growth reached 2.08 mb/d in 2023 and the forecast is for growth of 1.34 m b/d in 2024 followed by a similar amount in 2025. Canada, Guyana, and Brazil will add to the production growth in the U.S. to potentially create a supply glut.

Exxon Mobil plans to ramp up production in Guyana and the Permian basin in 2024. As usual, the energy giant is typically its own worst enemy, with higher oil production into lower oil prices.

The energy giant spent an incredible $7.8 billion on capital expenditures during Q4, pushing the yearly amount to $26.3 billion. Exxon Mobil only spent $22.7 billion on capex last year, boosting the spending by $3.6 billion this year as energy prices slumped.

The company forecasts reducing capex in 2024 back to $23 to $25 billion. A big question is whether the energy giant will hold to these capex targets.

Exxon Mobil produced solid profits due to cutting structural expenses over the period since 2019 by nearly $10 billion. Unfortunately, the energy sector typically uses cost-saving to produce more energy products and restrain any potential growth in prices over time due to the higher prices.

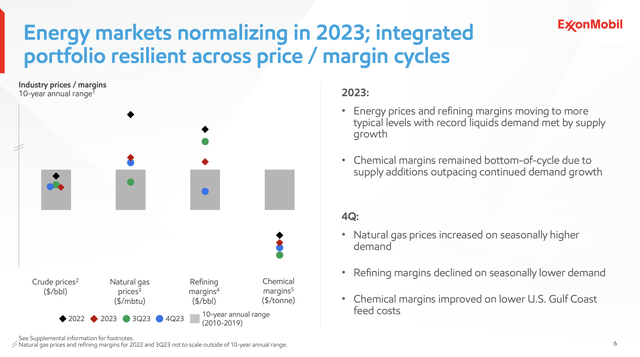

The energy giant still faces a period where oil, natural gas, and refining margins are below 10-year averages. Exxon Mobil saw net realized prices of key oil and natural gas prices reach around the upper end of the 10-year range, but the cyclical nature of energy prices is the natural path for periods below the averages.

Source: Exxon Mobil Q4’23 presentation

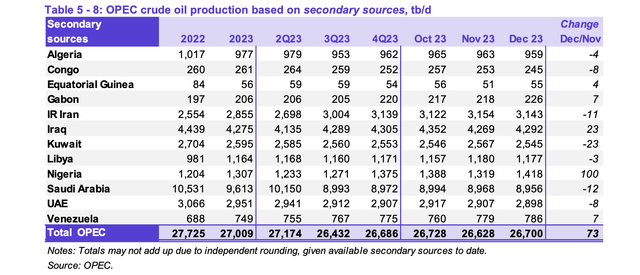

The risk remains that OPEC actually returns to producing more energy as the US takes market share and pushes prices lower. OPEC is now watching lower production amount to even lower revenues and the only solution is to ramp up production to force high cost producers in the U.S. out of the oil production business.

The oil alliance most recently cut production down to 26.7 million b/d, down ~1.0 million b/d from the 2022 levels. Saudi Arabia’s production is down ~1.5 million b/d from 2022 levels and the country has maintained a voluntary production cut of 1.0 million b/d along with an agreement to restrain Russian oil output.

Source: OPEC Oil Market Report – Jan. ’24

Along with Russia, OPEC+ agreed on targets to produce a combined 40.58 million b/d in 2024, up from the production levels of 38.2 million b/d. Either way, OPEC+ currently produces oil far below capacity with production cuts estimated at 3.66 million b/d on top of the voluntary cuts by Russia and Saudi Arabia.

Exxon Mobil and Chevron Corporation (CVX) are both planning to ramp up production in the Permian in 2024. Our view is that these energy giants shouldn’t increase production with so much spare capacity in the OPEC+ region. Exxon Mobil is even still working on closing the $59 billion deal with Pioneer Natural Resources Company (PXD) in a deal where oil production efficiency tools of the energy giant might lead to even further production increases.

Downside Risks

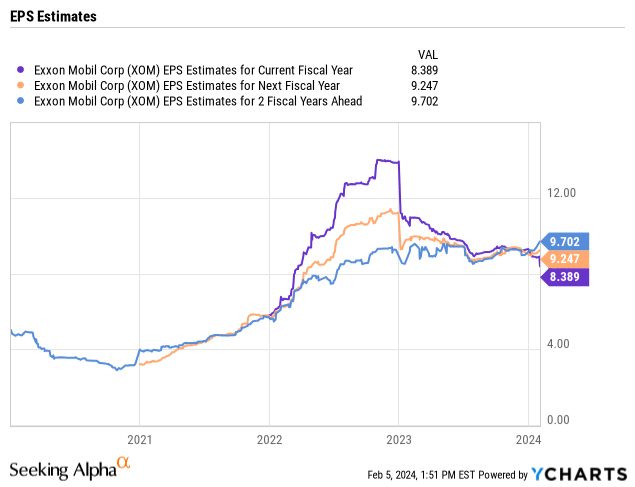

Analysts only forecast a 2024 EPS estimate of $8.39, down from $9.52 per share in 2023. The stock isn’t necessarily cheap now with Exxon Mobil trading at 12x consensus EPS targets.

The consensus analyst forecasts the energy giant producing EPS growth in 2025, but the key investment concept is that the stock isn’t appealing until a period of below-average oil prices occur. The consensus analyst estimates for Exxon Mobil don’t generally factor in any changes in energy prices, typical of the normal volatility of the energy market that impacts energy prices and stock valuations.

Exxon Mobil has an improved balance sheet now with net debt only in the $10 billion range. The company pays a solid dividend of nearly 4%, which will make the stock more attractive after some of the excesses in the energy sector are worked out.

Takeaway

The key investor takeaway is that investors should wait for lower energy prices to hit the stock before making an investment. Exxon Mobil Corporation has done a solid job of lowering structural costs, but the company faces a market with plenty of spare capacity to produce more oil even while production continues to grow in non-OPEC countries. The end result should be lower earnings for the energy giant, making Exxon Mobil Corporation stock expensive in the near term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start 2024, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.