Summary:

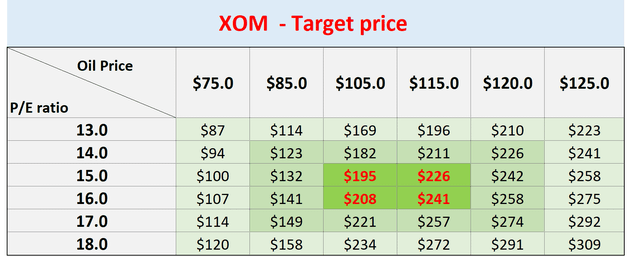

- We argue that there’s a chance oil prices could return to $115 per barrel, which could push Exxon Mobil’s stock price to around $200.

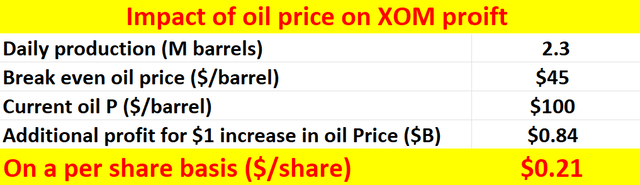

- Exxon Mobil’s breakeven oil price is well below the current oil price, and every dollar of oil price adds about $0.21 to its bottom line.

- Key catalysts for higher oil prices include inflation, geopolitical tensions, production cuts by OPEC, and recovering global economies.

- XOM is a GARP opportunity in hiding, with very reasonable P/E yet plenty of growth potential and catalysts afoot.

luismmolina

Oil price vs. XOM’s breakeven oil price

The thesis of this article is quite straightforward. I will argue that A) there’s a good chance that the oil price should return to the $115 level, and B) such an oil price could push Exxon Mobil’s (NYSE:XOM) stock price to the ~$200 level.

Crude oil prices increased by almost 9% in the past month and currently sit at around $86 per barrel. The increase was largely driven by a few factors. I see key driving forces on both the supply and demand side that can drive the price even higher. And I will elaborate on these factors in the second section.

Even an oil price of $86 is well above XOM’s breakeven price already. Before I begin to quote numbers, let me first point out that estimating the breakeven price is more of an art than a science. Production costs are influenced by factors like technology breakthroughs, regulation changes, and unexpected events (such as weather or natural disasters). Also, even if breakeven calculations can nail down these cash costs accurately, there are non-cash costs that are even harder to track down. Depreciation, amortization, and other non-cash costs can be significant and influence the overall analysis.

With these caveats in mind, let me quote a few numbers. For major oil producers like XOM and CVX, breakeven costs in the range of $25 to $35 per barrel across producing projects are considered a very competitive level. If we include capex investment and depreciation as part of the costs, my estimate of XOM’s breakeven cost is around $45 in recent years. Note, this is before XOM’s acquisition of Pioneer Natural Resources. After the acquisition, I expect the breakeven price to be lower. But here I will use $45 to be on the conservative side.

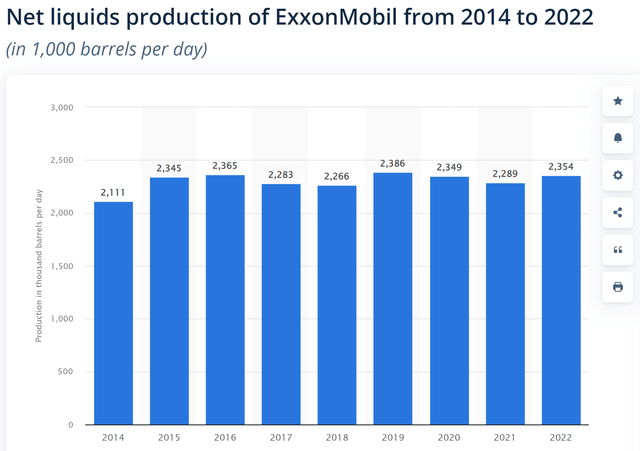

Based on this breakeven cost, my analysis of the oil price’s impact on XOM’s bottom line is shown in the table below. These calculations were based on A) an average of 2.3M barrels of oil production per day (see the second chart below showing XOM oil production in recent years), and B) a share count of 4,052 million (on a fully diluted basis). As seen, under these assumptions, every $1 change in oil price would have a $0.21 impact on its EPS.

Next, I will elaborate on the implications for its return potential.

Source: author

Source: Statistica.com

Return projections

XOM currently trades around 13.5x P/E with an FWD EPS forecast of $8.99. As aforementioned, every $1 of oil price increase is expected to boost its EPS by about $0.21 based on my above analysis. As such, if the oil prices increase, its EPS would rise correspondingly. In the meantime, I think its valuation is also more on the compressed end of its historical spectrum. Its historical FWD P/E on average is about 15.6x in the past 5 years, and its median is about 18x in the past 10 years.

To illustrate the combined effects of both variables (oil price and P/E ratio), the table below shows my price projections for XOM prices under different conditions. The conditions highlighted are the most probable scenarios in my mind – with a P/E between 15x to 16x (consistent with the past 5-year average) and an oil price in the range of $105 to $115. And next, I will elaborate on why I think such an oil price would be possible.

Author

Key catalysts for oil prices

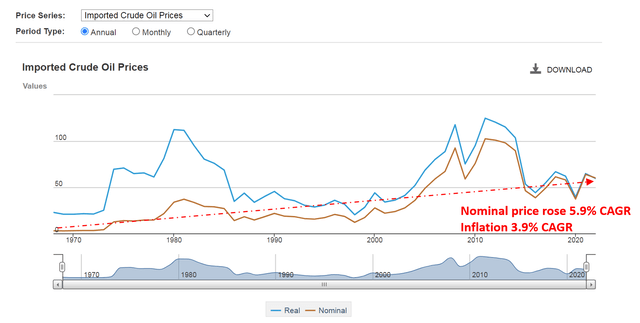

As aforementioned, oil prices rose by about 9%, which sounds like a lot. However, if we expand our horizon a bit, I’d like to argue it has more room to run further up. As shown in the next chart, oil’s current prices are still about the same as they were back in 2014. Historically, oil prices have been rising more rapidly than inflation (see the second chart below provided by the U.S. Energy Information Administration, EIA). However, even at its recent peak of ~$115, the price appreciation of oil between 2014 and now did not even keep up with inflation during this period. The CPI (Consumer Price Index) was 234 in 2014 and is now above 310. If oil prices were to rise in tandem with CPI, it would be about $114 per barrel now.

Besides inflation, I see a few more catalysts that could drive oil prices higher on both the supply and demand ends. At the supply end, geopolitical tensions and production cuts by the OPEC (Organization of the Petroleum Exporting Countries) can persist and keep restricting oil supply. On the demand end, as global economies recover and travel restrictions ease, demand for oil has been recovering and is likely to keep rising, in my view. This can put a strain on existing supplies and contribute to further oil price hikes.

Seeking Alpha

U.S. Energy Information Administration (EIA)

Other risks and final thoughts

Besides the above catalysts, there are two more upward risks worth mentioning. First, this analysis does not include XOM’s acquisition of Pioneer Natural Resources, which is likely to further reduce its breakeven prices. Second, this analysis only considered its oil business, which is the largest part of its revenue source. But it does have other significant income streams (such as its natural gas segment) and I’m optimistic about these streams too.

In terms of downside risks, as mentioned above, XOM has a larger focus on upstream operations (exploration and production) compared to some peers who are more diversified across the oil and gas value chain (refining, marketing). This makes XOM more vulnerable to fluctuations in exploration and production costs. Given XOM’s sheer scale and long history of operations, it’s also more susceptible to legacy environmental issues and potential lawsuits. Finally, the company also has several moving pieces in its asset portfolio. The company has divested quite a bit of its assets in the past year alone, including its upstream assets in East Texas. Moreover, Exxon recently announced plans to exit operations in Equatorial Guinea in West Africa, after nearly three decades of operation in the region. In the meantime, investment has continued to support its alternative energy initiatives. Most notably, Exxon recently launched a new lithium venture, which aims to supply as many as one million electric vehicles per year by 2030. These developments, especially the initiatives in renewables, can create both earning and balance sheet uncertainties.

All told, my overall conclusion is that XOM presents a compelling opportunity as a GARP stock (growth at a reasonable price). First of all, XOM’s P/E ratio remains very reasonable, either in absolute terms or relative terms. Yet, the stock has very healthy growth potential and many catalysts afoot in the near future. Oil price alone could drive sizable upward EPS surprises. As analyzed in the article, a $10 increase in oil price could create a ~$2.1 EPS boost, about 23% of its current forecast. And I think there are good odds that oil price can advance $20 or even return to its recent peak of ~$115.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.