Summary:

- Exxon Mobil Corporation stock is unlikely to rally to new highs in the foreseeable future due to the upcoming end of supply disruptions in the oil market.

- At the same time, the disagreements within OPEC+ along with the increase of American oil production would likely prevent oil prices from reaching 2022 levels anytime soon.

- While Exxon Mobil’s stock was a great growth investment in 2022, it appears that is no longer the case in 2023.

sefa ozel

The disruption of oil supplies from last year that was caused primarily by Russia’s invasion of Ukraine is coming to an end. While Exxon Mobil Corporation (NYSE:XOM) has greatly benefited from higher oil prices in recent quarters, there’s an indication that the market has stabilized, and the potential additional disruptions are unlikely to happen anytime soon. Despite Saudi Arabia’s efforts to ensure that prices remain high via production cuts, it becomes obvious that OPEC+ members no longer support the idea of constant cuts, while the increase of American oil production makes such efforts ineffective. Therefore, while Exxon Mobil was a great growth investment last year, its stock is no longer as attractive as before at the current levels.

The Growth Story Is Coming To An End

After I published my first rating downgrade article on Exxon Mobil in February, the company’s stock has depreciated by ~10% since that time. There are now questions about whether there’s any upside left to XOM shares at the current levels. The company’s latest earnings report for Q1, which came out in April, showed that the business’s revenues were already down 4.4% Y/Y to $86.56 billion and were also below the street estimates by $3.51 billion. Even though Exxon Mobil’s profits more than doubled Y/Y during the three-month period, they nevertheless decreased on a quarterly basis as earnings from the upstream segment declined by 21% Q/Q to $6.45 billion mostly as a result of lower oil prices.

Considering that the Street expects earnings and revenues to be down Y/Y in Q2 and Q3, it would be safe to assume that the oil market has mostly stabilized after the 2022 supply disruptions. As such, there’s a case to be made that Exxon Mobil’s growth story is coming to an end for now.

While all of this doesn’t mean that Exxon Mobil is not a well-run business, especially since the company ended Q1 with $32.7 billion in cash reserves, the issue here is that at this moment in time, it’s hard to see how the company’s shares could significantly appreciate further from the current levels anytime soon. If we look at the EIA’s latest energy report for June, we’ll see that the supply disruptions that added much of the volatility to the oil markets in 2022 are indeed coming to an end.

As of today, the EIA expects the oil prices to stay close to the current levels due to the constant increase of supply as a result of a greater level of production along with the ongoing destruction of demand caused by macroeconomic issues. The U.S. crude production is forecasted to increase from 11.89 mbd in 2022 to 12.61 mbd and 12.77 mbd in 2023 and 2024, respectively. At the same time, the average price for Brent crude oil is expected to be ~$80 per barrel in 2023 and ~$83 per barrel in 2024, significantly below the average 2022 levels of over $100 per barrel. Therefore, the end of supply disruptions, among other issues, is more than likely to limit Exxon Mobil’s upside at this stage.

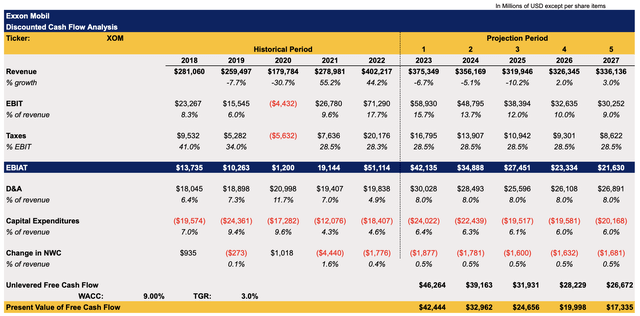

Considering this, it makes sense to update my discounted cash flow (“DCF”) model, which in February showed Exxon Mobil’s fair value to be $110.05 per share. The top line growth assumptions in the new model below have been revised and are now mostly in-line with the Street expectations for the following years while EBIT is more closely aligned with the company’s historical profitability levels by the end of the terminal year. All the other assumptions remained mostly the same.

Exxon Mobil’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

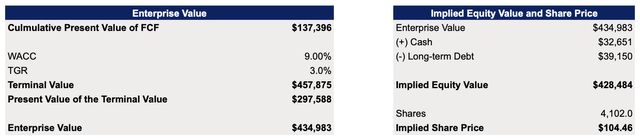

The updated model shows Exxon Mobil’s enterprise value to be ~$435 billion while its fair value is $104.46 per share, which is close to the current market price and indicates that the upside is limited for now.

Exxon Mobil’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

The Bigger Picture

Despite all of this, there are nevertheless reasons to be optimistic about Exxon Mobil’s future since there’s a case to be made that the overall economy could perform better than expected, which could lead to a greater demand for oil. After all, the CPI has increased at the slowest annual pace in over two years in May, while some analysts believe that the U.S. could be able to avoid a recession whatsoever in the baseline scenario.

However, even if that’s the case, it’s unlikely that we’ll see major supply disruptions happen anytime soon as was the case a year ago. To this day, Russia continues to export its oil to various nations at a discount to market value due to the price cuts that were imposed on it by Western governments. This makes it possible for the market to have enough oil to meet the demand at a reasonable price and at the same time makes it harder for Russia to fund its war efforts in Ukraine. Thanks to various restrictions on Russian energy exports, the Russian oil revenues in the first five months of the current year have already declined by nearly 50% Y/Y. Add to all of this the fact that American oil production increased and is on track to reach all-time high levels later this decade and it becomes obvious that additional supply disruptions are unlikely to happen anytime soon.

On top of all of this, it also becomes obvious that the OPEC+ production cuts are becoming less effective with each new announcement of such cuts. Earlier this month, Saudi Arabia became the only country to announce the cut of its oil production by 1 mbd, while all the other countries of the cartel agreed to only extend their previous commitments through the end of 2024. Such a move failed to significantly push the oil prices higher, while at the same time, it only made Saudi Arabia lose some portion of its share in the oil market. This is because there’s now an indication that shortly after suspending the publication of its import-export data, Russia began to flood the market with its discounted oil to narrow its budget deficit and fund its war of aggression against Ukraine. At the same time, Iran’s oil exports recently hit five-year highs of 1.6 mbd and could increase further while the EIA in the report that was mentioned earlier expects non-OPEC producers to drive global liquids production to growth of 1.5 mbd in 2023.

As such, it’s hard to see why Saudi Arabia would continue to cut the oil output on its own and let others take its market share. That’s also one of the reasons why we are unlikely to see major supply disruptions happening anytime soon, and that’s also one of the main reasons why Exxon Mobil’s upside is likely to remain limited in the foreseeable future.

The Bottom Line

While there’s nothing to stop oil prices from reaching all-time highs in the future, there’s an indication that it’s unlikely to happen this or next year at the very least. That’s why it would be nearly impossible for Exxon Mobil to generate the same returns in 2023 or 2024 as it did in 2022 going forward. Add to all of this the fact that the upcoming end of supply disruptions, along with the demand destruction caused by the macroeconomic uncertainty, are likely to keep the oil prices at the current levels, and it becomes obvious that the upside in Exxon Mobil’s stock will likely remain limited for the foreseeable future.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi and/or BlackSquare Capital is/are not a financial/investment advisor, broker, or dealer. He's/It's/They're solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Brave New World Awaits You

The world is in disarray and it’s time to build a portfolio that will weather all the systemic shocks that will come your way. BlackSquare Capital offers you exactly that! No matter whether you are a beginner or a professional investor, this service aims at giving you all the necessary tools and ideas to either build from scratch or expand your own portfolio to tackle the current unpredictability of the markets and minimize the downside that comes with volatility and uncertainty. Sign up for a free 14-day trial today and see if it’s worth it for you!