Summary:

- Is Exxon Mobil at it again? In what would be its first major deal since the ill-timed XTO acquisition, Exxon is reportedly interested in taking out Pioneer Natural Resources.

- Unlike its major U.S. peers Chevron and ConocoPhillips, both of which bought assets during the pandemic’s low-price environment, the price of oil is now relatively high.

- But that likely won’t stop Exxon. As I have commented on Seeking Alpha, the piddly 3% dividend increase last year meant one thing: Acquisition time.

- If it goes through, and there’s no assurance it will, it won’t be the disaster that XTO was because PXD produces lots of oil whereas XTO was a gas play.

- However, I’m rather ambivalent about such a deal, because it doesn’t seem XOM is interested in giving shareholders a fair shake on the dividend either way.

JHVEPhoto

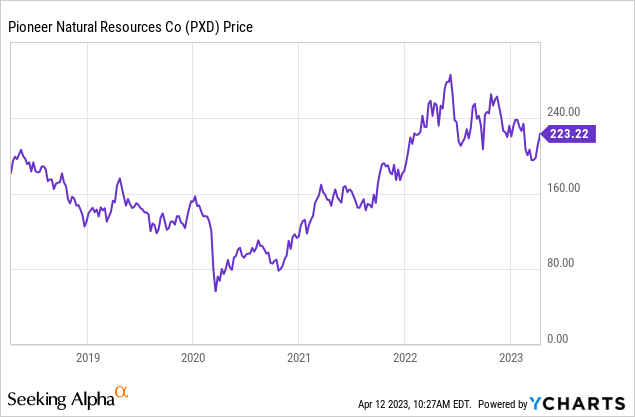

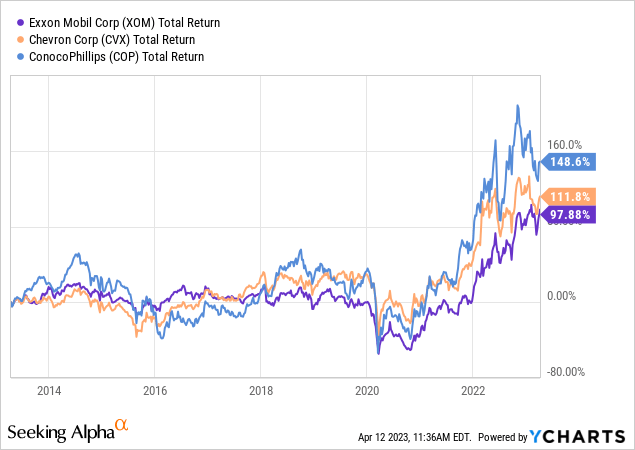

As you already know, rumors are swirling that Exxon Mobil (NYSE:XOM) is taking a long hard look at purchasing Pioneer Natural Resources (NYSE:PXD) – a Permian Basin pureplay with a deep inventory of relatively high-return wells. However, note that peers Chevron (CVX) and ConocoPhillips (COP) made their recent big acquisitions during the pandemic-induced bottom of the commodity cycle: Chevron closed the Noble Energy acquisition in 2020 and Conoco closed the Concho Resources and Shell (SHEL) deals in 2021. Exxon’s balance sheet was too weak to make any deals during the pandemic. Indeed, the company was stretched so thin due to over-spending on mega capex projects that it had to take on debt during the pandemic just to keep from cutting the dividend. As a result, and similar to the disastrous and ill-timed XTO deal, Exxon finds itself lagging on resource accumulation and, apparently, now wants to make up for it with a large acquisition now that the price of oil is relatively high. I say that because the average price of WTI in 2020 was $39.68/bbl and the current price of WTI is $82.87/bbl – more than 2x. That being the case, as a long-time Exxon shareholder who suffered for years after the XTO acquisition, I’m less than thrilled about the prospect of Exxon buying PXD at this moment in time.

As the chart above shows, the time to buy PXD was clearly in the 2020-2021 time frame.

Exxon’s Share Buybacks

I got a lot of pushback from Exxon shareholders when I criticized the company’s relatively miserly 3% dividend increase after the massive profits and free cash flow ($62 billion) the company generated last year. I have pointed out in commentary on Seeking Alpha that the piddly dividend increase in light of a mended balance sheet and year-end FY22 cash of $29.7 billion meant one thing: Exxon was going to make another acquisition. And here we are.

A look back at the disastrous XTO transaction is warranted here. My followers know that I’m strongly against O&G companies that allocate much more shareholder capital to buybacks over dividends directly into shareholders’ pockets (as Exxon, once again, is doing now). This has been the history of Exxon going back many years (see my Seeking Alpha article from back in 2013 – Exxon: Buyback Heavy, Dividend Light).

And, of course, like most-all O&G companies, these buybacks are typically over-emphasized during the top of the cycle price cycle when the stock price is high (Exxon is near record highs).

The reality of that fact for Exxon Mobil shareholders came crashing down when the majority of its repurchased shares were re-issued onto the market for the ~$40 billion XTO deal. Later, after the price of natural gas crashed, shareholders found out the acquired XTO assets could not even cover the dividend obligation on all the re-issued shares (!). This is the primary reason (there are others …) why Exxon delivered a negative total return over a 10-year period and why Engine #1 got so much support from institutional investors and professional money managers and got three of their candidates placed on Exxon’s board of directors (see: How Tiny Engine #1 Was Able To Turn Exxon Around).

After a severely compromised balance sheet kept Exxon from making a well-time acquisition during the pandemic-induced cycle lows, Exxon finds itself desiring to make a big acquisition. That’s especially the case after wasting billions of shareholder capital looking for elephant fields in Brazil but instead drilling dry holes.

Pioneer’s Assets

At year-end 2022, Pioneer reported proved reserves of 2.377 million boe of which 89% were proved developed. Its RRR (reserve replacement ratio) last year was a very healthy 152%, adding 365 million boe after producing 240 million boe during the year.

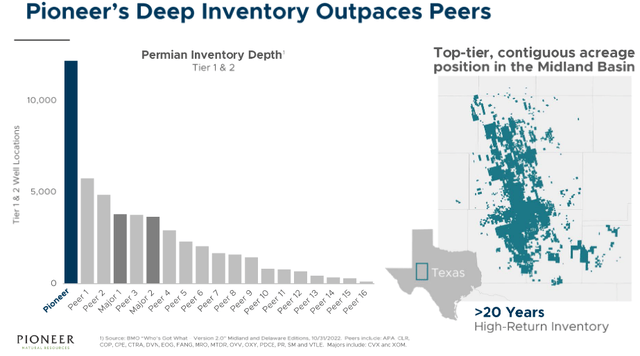

The slide above came from the Q4 presentation and shows that PXD’s inventory of “top-tier” wells will last over 20-years at PXD’s current exploitation rate.

In 2022, PXD generated $8.4 billion of FCF (13.5% of Exxon’s), paid shareholders $26/share in dividends, and bought-back $1.65 billion of stock. Clearly, this PXD is no XTO.

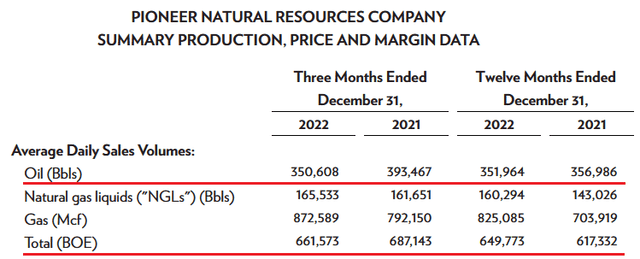

As can be seen below, PXD’s production split is 57.8% oil:

That split better than I expected considering old shale wells tend to get significantly gassier over time (see The Demise of NYMEX Gas (Not To Mention Waha).

In Q4, PXD’s average realized price for oil was $83.53/bbl, natural gas liquids (“NGLs”) was $27.67/bbl, and its average realized price for gas was $4.98/MMcf – all of these prices exclude the effects of derivatives, which are likely relatively substantial given the dramatic drop in Permian Basin gas (Waha went negative last year and, in my opinion, will likely go negative again this year).

Regardless of the potential gas downside, PXD is obviously no XTO and has a large inventory of excellent low-cost Permian oil production that generate strong free cash flow.

Valuation

After the run-up following the rumored interest in the company by Exxon, PXD’s current market-cap is $51.8 billion. According to Seeking Alpha, PXD ended FY22 with $3.8 billion in cash and $6.7 billion in debt. If we add the $1.1 billion of 5.1% Senior Notes PXD issued late last month, I come up with an EV estimate of $55.8 billion.

In order to get PXD’s CEO, executive management team, board of directors, and shareholders to go along with a buyout, Exxon would likely have to bid at least $250/share (~10% above the current price), which is the price the stock was at last November. More realistic might be something around ~$275/share, or a market-cap of an estimated $64 billion and EV of ~$68 billion.

Given Exxon’s ~$30 billion cash position at the end-of-the-year, and even considering how that likely grew substantially during Q1, the $68 billion estimate for a PXD takeover means Exxon shareholders will likely see a sizable re-issuance of Exxon stock back onto the market to fund the acquisition. As a result, Exxon’s total dividend obligation will grow considerably, and XOM management is likely to use that as an excuse for muted dividend growth and the urgent need to buyback stock (once again).

Exxon’s Returns

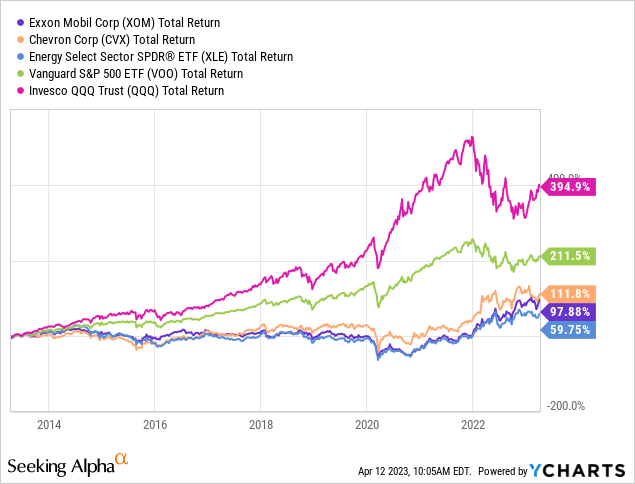

Over the past 10 years, Exxon has grown the quarterly dividend from $0.57/share in 2013 to the current $0.91/share, or by 59.65%. For comparison, its primary integrated international peer, Chevron (CVX), has grown its quarterly dividend from $1.00/share in 2013 to the current $1.42/share, or by 42% over the past decade.

From a total returns perspective, over the past decade CVX has outperformed Exxon by ~14% with both companies outperforming the broad Energy Sector as measured by the SPDR Energy ETF (XLE), but getting looped by the broad market as represented by the Vanguard S&P 500 ETF (VOO) and Nasdaq-100 Trust (QQQ):

Summary and Conclusion

First off, investors should not assume that Exxon will make a bid for PXD. Or, even if it did, if regulators would approve it. Yet given ConocoPhillips’ and Occidental Petroleum’s (OXY) large Permian acquisitions, I think Exxon would likely get regulatory approval.

As a long-time Exxon shareholder, I find myself relatively ambivalent about the deal because I don’t think we’ll see significant dividend growth either with – or without – the acquisition. I also see Exxon forcing shareholders to double down on oil (i.e. both through buybacks and the acquisition) even as we head into an accelerating EV and clean energy future. And even in that case, and in spite of Exxon’s jewel in Guyana, I still prefer both Chevron and ConocoPhillips due to what I consider to be superior management. However, I suspect that the broad market (VOO and QQQ, for example) will continue to outperform all three of these O&G companies going forward. After all, the higher they are able to push the price of oil (i.e. gasoline), the faster the EV and clean-energy transition is likely to accelerate.

Bottom line: Exxon is a HOLD, and I wouldn’t buy PXD here simply because I never buy stocks based solely on a takeover thesis and, otherwise, PXD’s stock currently looks fully valued. Chevron and COP both look more appealing to me here.

I’ll end with a 10-year total returns comparison of the three biggest U.S. O&G producers and note that COP has run-rings around Exxon – and that doesn’t even count the Phillips66 (PSX) spin-off. Given COP’s 2023 Investor Presentation this morning, I think the next decade will likely be similar.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CVX, COP, XOM, PSX, QQQ, VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am an electronics engineer, not a CFA. The information and data presented in this article were obtained from company documents and/or sources believed to be reliable, but have not been independently verified. Therefore, the author cannot guarantee their accuracy. Please do your own research and contact a qualified investment advisor. I am not responsible for the investment decisions you make.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.