Summary:

- Exxon Mobil recently completed the merger with Pioneer Natural Resources, adding debt and boosting production at relatively high oil prices.

- OPEC+ restricting oil production and holding spare capacity is likely to lead to a future oil price collapse when production ramps back up.

- The stock would be far more attractive if XOM would restrain from share buybacks and build up the balance sheet for the next storm in the energy sector.

narvikk

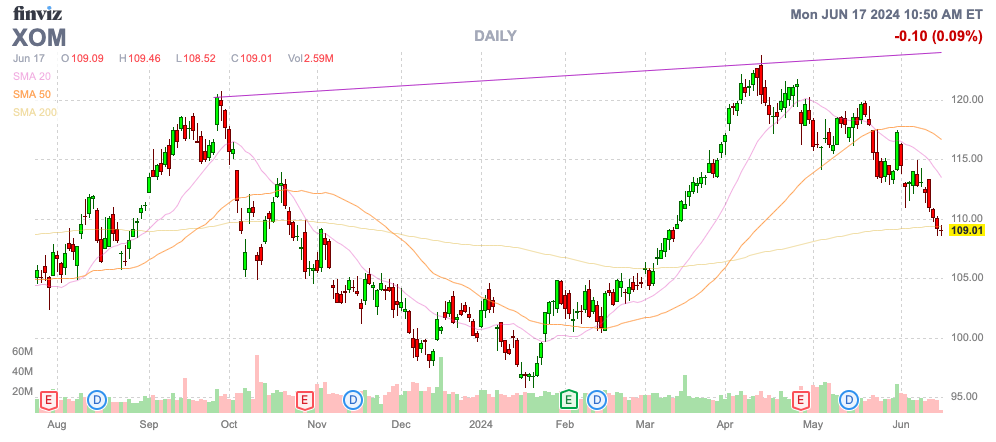

Most energy stocks remain unappealing, trading close to all-time highs, while OPEC+ restricts oil production. Exxon Mobil Corporation (NYSE:XOM) recently completed a merger with Pioneer Natural Resources, adding to debt and boosting production in another move that doesn’t help long-term industry pricing. My investment thesis remains Bearish on the energy giant.

Source: Finviz

Bad Premise

Last month, Exxon Mobil completed the merger with Pioneer Natural Resources with the goal of recovering more resource, more efficiently with industry-leading development technology of the energy giant. The combined Permian footprint is expected to grow production volume from the 1.3 million boe/d range in 2023 to 2.0 million boe/d in 2027.

Exxon Mobil paid $253 per share for Pioneer Resources at a price of $59.5 billion with an enterprise value of $64.5 billion. As with most deals in the energy industry, the oil deal was bought for all-time high prices, while oil isn’t anywhere close to the highs.

Naturally, the premise of the deal is the problem. Exxon Mobil doesn’t actually want more production to hit the markets, as it only reduces the value of existing production.

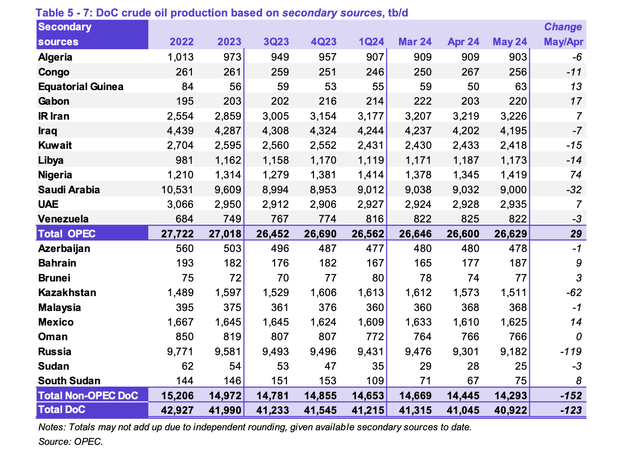

The oil market is already facing issues with extra production being held off the market. In May, total OPEC production was down over 1 million b/d to 26.6 million b/d. Due to working with Russia, total oil production of OPEC+ is down ~2 million b/d.

In essence, this oil production will flood the oil markets at some point in the future. Saudi Arabia and Russia will get tired of reduced production and the U.S. taking market share when most producers are highly profitable on WTI prices in the mid-$70s.

The whole problem with the Pioneer deal is Exxon Mobil working to further increase production into a market that is already supply reduced due to fears of oil prices collapsing under normal production levels. The energy giant should be working on how to constrain any production growth.

Exxon Mobil famously bought XTO Energy in 2009 to obtain natural gas production, far after the heights of the peak prices in 2008. Yet, the merger ended horribly, with natural gas prices trading sub-$2/mcf recently.

The Pioneer Natural deal doesn’t have to end as badly, but oil prices could collapse, if Saudi Arabia ever wants to take back market share. Also, Russia will eventually end the war in Ukraine and need oil money to rebuild the country, and boosting oil production will be the primary solution.

More To Come

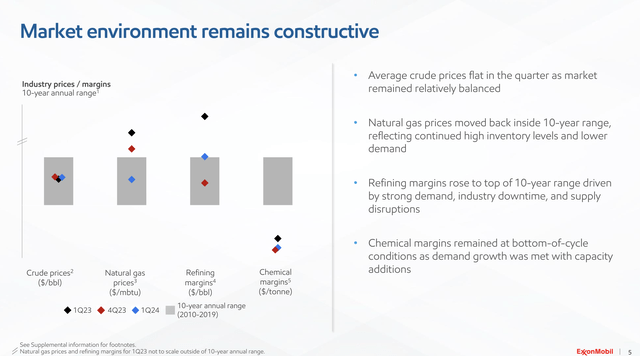

Exxon Mobil started the year with an EPS of only $2.06 and a $0.10 miss. The issue is that earnings were based on still elevated oil prices in the quarter.

The energy giant reported Q1’24 oil prices in the normal range of the last decade. Only the chemical margins were below the prior decade averages, while refining margins remain elevated.

Source: Exxon Mobil Q1’24 presentation

The risk remains of lower energy prices, especially oil, in the next couple of years. Exxon Mobil bought Pioneer Energy based on elevated oil prices and higher production. With OPEC+ vastly under producing capacity from just 2 years ago, the ultimate risk is that the organization ultimately gets tired of the US gaining market share and the group goes on a path to undercut U.S. producers.

Exxon Mobil plans to strip out another $5 billion in costs through 2027, which in theory will boost profits. The problem here is again costs stripped out of the business tend to lead to more spending on capex, or the willingness of oil giants to overproduce, causing prices to slump.

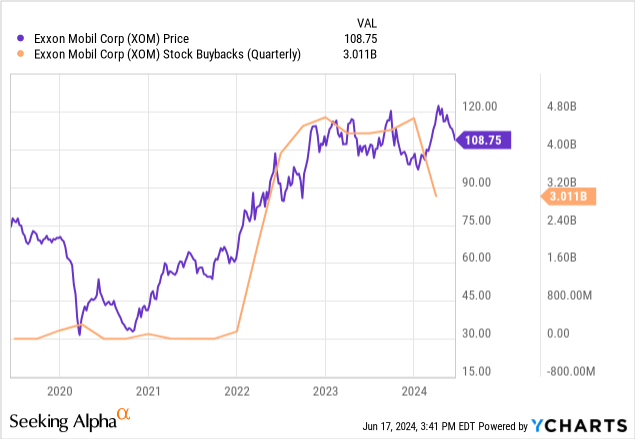

The BoD announced a $20 billion buyback for a company with a $460 billion market cap. The plan increases annual stock buybacks from $17.5 billion in 2023 and provides no context on buying shares at cheap or discounted prices versus the stock recently trading at all-time highs.

The BoD aggressively bought $3 billion worth of shares during Q1 when prices were higher. Exxon Mobil has a neutral balance sheet, with debt and cash virtually equal.

What the energy giant needs to incorporate into the plan is a strong enough balance sheet to repurchase shares on weakness when oil prices inevitably slump again.

Even under the better operations after stripping out $10 billion worth of annual cost, Exxon Mobil has continued its history in the last years of buying shares when the business is strong and terminating the buyback plan on weakness. The company should build up a cash hoard to protect future downside risk by repurchasing shares on weakness.

Takeaway

The key investor takeaway is that Exxon Mobil has recently enjoyed the fruits of elevated oil prices. The company has improved operating efficiency, but the energy giant appears headed down the same path of making deals and repurchasing shares at elevated prices versus building up the balance sheet for a rainy day.

Investors should avoid the stock until the ultimately rainy day occurs and oil prices dip, which appears inevitable with the OPEC+ group holding on to spare capacity.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market in June, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.