Summary:

- Exxon Mobil demonstrates a significant decline in revenue this year as compared to last year’s spike in oil prices due to the start of the war in Ukraine.

- But the company demonstrates solid results from cost-optimization initiatives, and profitability metrics are still very strong.

- According to my valuation analysis, the stock is substantially overvalued and the forward dividend yield of 3.5% looks very attractive as well.

JHVEPhoto

Investment thesis

My February bullish thesis about Exxon Mobil’s (NYSE:XOM) stock did not age well yet. The stock price significantly underperformed the broad market and declined by more than 7%. But strong fundamentals and secular favorable trends for the oil and gas industry are still in place. The crude oil price plunged this year due to high recession fears, but many macroeconomic indicators, like the labor market, suggest that the economy is still strong. The recent weakness in stock price performance also made the forward dividend yield much more attractive, now at 3.5%. The valuation is also very attractive, and I like the proactive way the management addresses secular shifts related to decarbonization. Therefore, I reiterate my “Strong Buy” rating for XOM.

Recent developments

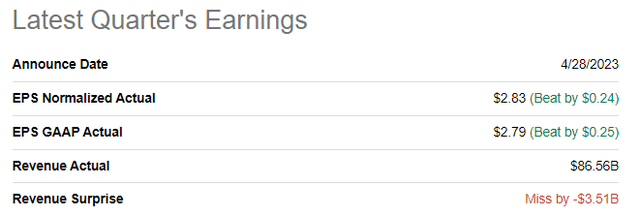

On April 28, the company released its latest quarterly earnings, missing consensus revenue estimates but smashing EPS estimates. The revenue declined by 4.4% YoY, but the EPS expanded notably from $2.07 to $2.83.

The company notably expanded its profitability metrics. The gross margin increased from 29% to 34%, while the operating margin improved to a bigger extent from 10% to 17%. As a result, the cash flow from operations increased by 10% to $16.3 billion. The improvement in profitability was thanks to the higher production levels with the improved product mix, which contributed to the revenue side. From the costs side, the management also was efficient in the execution of cost savings measures. The Upstream segment significantly improved the operating profit, which increased YoY from $4.5 billion to $6.6 billion. The strength was mainly driven by the substantial increase in production volumes, which offset a dramatic 23% decrease in average realized crude oil prices. I like that the company continues taking action to improve its revenue mix long-term. For example, during Q1, XOM finalized the ramp-up of its Beaumont Refinery facility, with the new unit adding 250,000 barrels per day to the refinery capacity. During the earnings call, the management reiterated its priorities related to the balance sheet improvement and continuing to increase operating efficiency. It is a very positive sign for me as an investor.

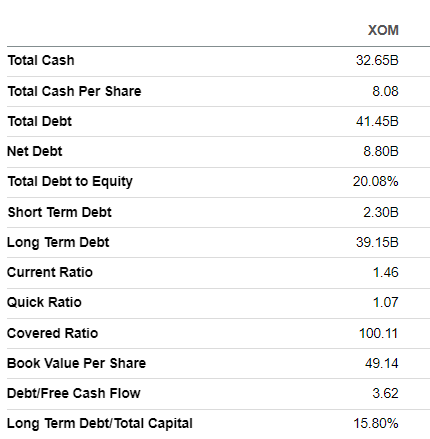

XOM’s balance sheet is still a fortress with more than $32 billion in cash, making it capable of making acquisitions, financing new exploration projects, or investing in improving internal processes, leading to profitability metrics expansion. The leverage ratio is low, and liquidity metrics are sound.

Seeking Alpha

The upcoming quarter’s earnings release is planned on July 28. Revenue is expected to increase sequentially, but a sharp 22% decline is projected on a YoY basis. Unsurprisingly, the spike in oil prices during Q2 of calendar 2022, which started after the inception of the war in Ukraine in late February 2024, resulted in economic sanctions against Russian oil. The adjusted EPS is expected to be more than half YoY.

I have no panic about the double-digit revenue decline. Last year, the company enjoyed a favorable speculative spike in oil prices, and comps are now impossible to sustain. The important part here is that management understands that it is impossible to create long-term value for shareholders without a close eye on costs and product mix improvement. The management understands the secular shift to clean energy and takes proactive steps. For example, the company is ready to move out of the comfort oil and gas zone and will build a lithium processing facility in Arkansas.

The company also continues to invest in its five-year $17 billion plan to reduce emissions with the recent acquisition of Denbury (DEN). Denbury is a developer of carbon capture, utilization, storage solutions, and enhanced oil recovery. This acquisition will provide XOM with the largest CO2 pipeline in the U.S. The transaction is valued at $4.9 billion and will be all-stock, meaning that Denbury shareholders will receive XOM’s shares instead of cash. I think that an all-stock clause is a good deal for XOM because the company will not need to either raise debt capital or reduce its cash balance. I like the consistency of the management and its strict commitment to stick to long-term action plans addressed to adapt to the evolving environment. I think that XOM’s mega-scale and deep experience in managing sophisticated capital projects gives the company a vast competitive advantage to lead in driving decarbonization in the Energy sector.

Valuation update

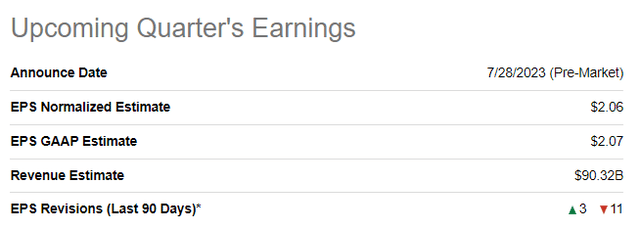

The stock demonstrated a 1% decline in its year-to-date price, significantly lagging the broader stock market and slightly underperforming the energy sector (XLE). Seeking Alpha Quant assigns the stock a “C-” valuation grade, meaning the stock is fairly valued. Indeed, multiples demonstrate mixed discrepancies when compared to the sector median and historical averages.

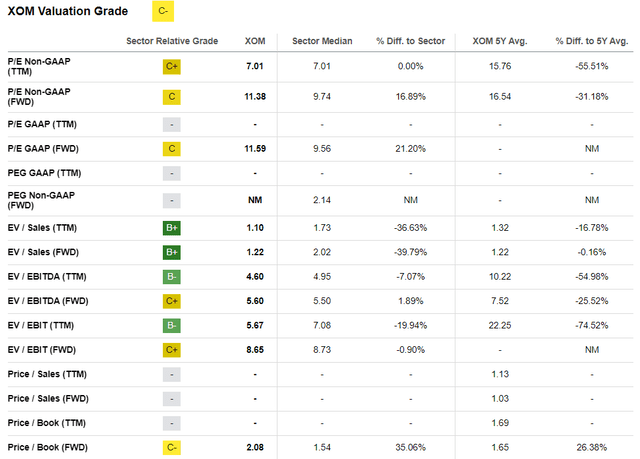

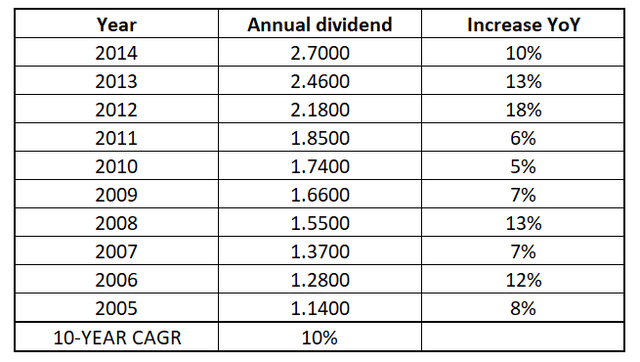

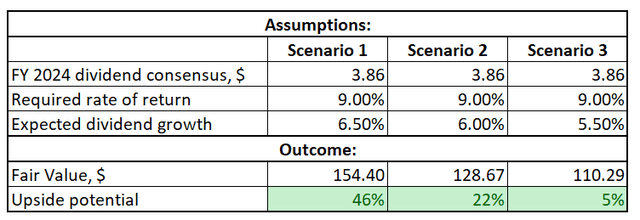

Exxon has a stellar dividend history and currently offers a 3.5% dividend yield, which is very attractive. That said, I want to proceed with my valuation analysis with the discounted dividend model (DDM) approach. Valueinvesting.io suggests that XOM’s WACC is close to 9%, which I consider fair. Consensus dividend estimates expect a $3.86 dividend payout in FY 2024. The dividend growth might be tricky because the past decade or past five years CAGR would not be appropriate because of many unfavorable stocks for commodity prices over the last 10 years. We are currently in the era of accumulated underinvestment in the oil and gas CAPEX, and I believe that currently, commodity prices are at their local lows before a new bull run. Therefore, I think looking at XOM’s dividend hikes history during the previous oil and gas supercycle between 2005 and 2014 for dividend growth estimation is better.

As you see, on average, between 2005 and 2014, XOM’s annual dividend payouts compounded at a 10% CAGR. We are currently in a harsh environment with high recession fears, so I need a haircut for this CAGR before I implement it into my DDM formula. The model is very susceptible to changes in dividend growth assumptions; therefore, I simulate three scenarios below. Each of them is conservative compared to the last oil and gas supercycle XOM’s dividend hikes pace.

As you can see, the stock is attractively valued even under the most conservative dividend growth scenario. Let us also remember that DDM ignores such factors as unmatched profitability and strong business diversification, i.e., companies like XOM are usually traded with a substantial premium to the fair value. Therefore, I think the current share price can be an excellent entry point, but let me discuss the risks before making the final decision.

Risks update

The most obvious risk inherent to investing in XOM is the nature of the oil and gas industry. The company’s earnings are vulnerable to fluctuations in commodity prices, and the company has almost no control over the prices. Apart from affecting earnings, fluctuations in oil and gas prices significantly affect investors’ opinions about the stock. Even if the company takes action to significantly mitigate the adverse effect of unfavorable fluctuations in the oil prices on earnings, investors are still highly likely to sell off the stock.

Another major risk for investors is Exxon’s global operations. The company operates in different countries with varying levels of political stability. Some of these countries have a history of scandals related to corruption linked to the highest governmental officers, and many of these countries are prone to political uncertainties. On the other hand, Exxon’s broad geographical presence ensures that country-specific risks are diversified.

Bottom line

To conclude, XOM became an even stronger buy after its recent weakness in terms of stock price. The upside potential is very attractive amid the current secular favorable cycle for oil and gas caused by the long-term global underinvestment in CAPEX during the past decade when commodity prices were primarily low and experienced the COVID-19 shock. I like the way XOM uses this favorable time to invest in project diversification and the management’s solid track record of success, it is highly likely that these investments will pay off over the long term. Moreover, the stock currently offers a very decent 3.5% forward dividend yield. That said, I reiterate my “Strong Buy” rating for XOM.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.