Summary:

- Exxon Mobil has achieved substantial cost reductions and strong earnings growth, positioning it well in a lower oil price environment.

- The transition to renewables may be hindered by practical limitations and potential supply shortages of essential minerals. These costs could slow the adoption of renewables.

- Exxon Mobil’s investments in lower carbon initiatives and carbon capture and storage demonstrate its adaptability and readiness for a changing energy landscape.

Vanit Janthra

Exxon Mobil (NYSE:XOM) is one of the world’s largest oil and gas producers and has achieved a substantial economy of scale, enabling it to achieve substantial return on equity. The company has also achieved major cost reductions in recent years, positioning it to make substantial profits even in a lower oil price environment. However, the company’s operations in the oil and gas sector have attracted criticism from some over the high carbon emissions generated by its operations. These critics express concern over the long-term viability of oil and gas and consequentially over the viability of Exxon Mobil itself.

This article considers some of these challenges and acknowledges that governments’ policies pushing the increased adoption of renewables can have a negative impact on Exxon Mobil’s business. However, it is argued that oil and gas will continue to be relevant for several more years and is unlikely to be replaced entirely by renewables any time soon. Furthermore, Exxon Mobil has already made substantial investments in lower carbon initiatives, which should shield it somewhat from a shift in energy usage towards more renewable energy.

The skepticism over oil and gas

In a recent article published by The Long View Investor here on Seeking Alpha, it was argued that the reduction in the cost of renewable energy is likely to play a key role in the decline of oil and gas. The Long View Investor argues that the primary objective behind advancements in renewable technologies was to maximize their efficiency in terms of energy production and storage, extending their operational lifespan while minimizing the use of materials and resources. An unforeseen benefit of these innovations was the significant reduction in their cost. The Long View Investor draws parallels with the transformation of computer technology, which evolved from bulky, billion-dollar room-sized computers to compact, hundred-dollar handheld devices. Similarly, innovations in renewable technologies have shifted them from being inefficient and expensive energy generation concepts to efficient, cost-effective, and viable energy sources for the mass market.

The Long View Investor suggests that as the cost of renewables continues to decline, they will become the preferred energy source for individuals and entities falling within their price range. A major reason for this shift is that renewable energy generation devices are compact and highly efficient, enabling smaller industrial firms, factories, power plants, businesses, and even individual households to generate ample free power as needed. Competitive pricing, combined with high efficiency and scalability, positions renewable power generation for widespread decentralization and rapid adoption. In my view, these arguments are not without merit as the cost of renewable energy has certainly declined quite substantially over the course of the past few years.

Nevertheless, the world still depends on oil and gas for quite a substantial portion of the total global energy supply and will likely continue to do so in the foreseeable future. While the decrease in the price of renewables coupled with pro-renewable energy policies by governments would certainly encourage further adoption of renewables, there are also practical limitations on the scale at which renewable energy applications can be expanded. In particular, the transition to renewables requires access to various minerals, of which, there would not currently be adequate supply to be able to meet this growth in demand. In a recent report by the Energy Transitions Commission, it was noted that:

for some materials current estimated ‘reserves’ would be insufficient to meet cumulative demand from the energy transition (in a situation where demand rose rapidly but there was limited progress in technology and materials efficiency and recycling) together with other sectors. Under such a scenario reserves might need to expand by up to 30% for copper, 70% for nickel, and 90% for silver to meet total expected demand between 2022-50.

While the Energy Transitions Commission suggests that these challenges can easily be addressed through increased investment in the mining of these minerals, this possible supply issue presents a clear challenge to the cost advantage of renewable energy. McKinsey, in reflecting on these same projected supply shortages, observed that these shortages have the potential to impede the global acceleration of decarbonization efforts, as customers would be unable to transition to more environmentally friendly alternatives. Furthermore, these scarcities are expected to result in significant price fluctuations and instability in the materials market. Consequently, this would lead to increased costs for the technologies reliant on these materials and slow down their adoption rates. Therefore, I remain of the view that a full transition away from oil and gas would not be possible and that should renewables be adopted too rapidly the lower cost of recent years might become a thing of the past as material shortages increase the price of renewables.

Exxon Mobil as a company has also made significant strides in reducing its carbon footprint in recent years. The company has met its own carbon footprint reduction targets at least four years in advance and continues to invest in new energy sources. Investments such as the investment in hydrogen could provide future avenues for revenue generation by Exxon Mobil even as demand for oil and gas declines. Furthermore, gas is often seen as a transition source itself in many instances where it still offers a cleaner source of energy than coal-fired power. This transition source status for gas could still provide Exxon with several more years to capitalize on its projects in the Permian basin.

The company’s recent acquisition of Denbury also offers further opportunities for Exxon Mobil to benefit from the push for a more carbon-neutral world. As Ironside Research recently noted, this purchase includes a company with 1,300 miles of carbon capture and storage pipelines, which benefits Exxon by positioning the company to take full advantage of significant tax incentives provided by the Inflation Reduction Act for companies involved in carbon capture and storage. Ironside Research has observed that:

The incentive here for Exxon and its shareholders is quite large. Under the Inflation Reduction Act, the 45Q tax credit (which covers incentives for carbon sequestration) raises the incentive to store carbon in saline geographic formations (aka, underground) from $50 per tonne to $85 per tonne.

In my view, these moves and investments indicate a forward-looking management who is well-positioned to steer the company through a changing energy environment.

Earnings drivers

Exxon Mobil has achieved substantial cost reduction in recent years and continues to invest quite strategically in higher-margin projects. In its most recent earnings call, management observed that:

We delivered earnings of almost $8 billion, two times higher than what we earned in the second quarter of 2018, under comparable industry commodity prices. That doubling of earnings reflects our work in the intervening years to reshape our portfolio of businesses, invest in advantaged projects, and drive a higher level of efficiency and effectiveness in everything we do.

These improvements in earnings were largely driven by Exxon’s ongoing success in reducing costs, with the company reporting cumulative structural cost savings of $8.3 billion in the second quarter of 2023 compared to the same period in 2019. Management has indicated that it expects the total cumulative structural cost savings since 2019 to reach $9 billion by the end of the current fiscal year. In my view, the ongoing success of its drive for structural cost savings positions Exxon well to deliver strong earnings even in periods where oil prices are lower.

Oil refinery operations continue to see elevated profit margins in the aftermath of the Russian invasion of Ukraine. Exxon has been particularly well positioned to benefit from this period of higher margins, given the large scale of its oil refinery operations relative to its peers. These elevated margins also seem likely to persist in the near term, given that net supply additions have been lower than the growth in demand. S&P Global also expects these higher margins to remain for some time but then to start dissipating. Dan Evans, Vice President of Refinery Consulting at S&P Global, has observed that:

I think really the overall narrative on refining side is really that we’re going to start slowly stepping down from the very high cracks and margins we have seen over the past 18 months over the next 18 months.

Investors should accordingly be prepared for some gradual reduction in margins within this business. However, it is hoped that as margins in this part of the business cool down, margins in the chemical operations could start recovering. Margins in the chemical operations of most oil majors have been depressed in recent months, with no clear indication of a turnaround yet. Nevertheless, these margins might remain somewhat depressed for a while as the decline has largely been attributed to sluggish demand from consumers for products that use plastics and rubber.

Management also expects the margins within this business to remain somewhat lower in the near future and has observed that:

… it’ll take some time is my expectation for demand to kind of take us out of the supply, the excess supply that we’ve got on the marketplace, but I would just add that, we’ve made a lot of investment in chemicals over the last five years, fairly significant investments. And one of the things that frankly I’m quite pleased with is, if you look at all those chemical investments that we brought online, even in the depths of what is a pretty low bottom of cycle condition for our chemical business, all of those brand new projects are earnings positive and cash positive, which I think really bodes well for when the market comes back up and we’re at top of cycle.

Therefore, I am still confident in the long-term ability of Exxon to improve its margins in this business.

Valuation

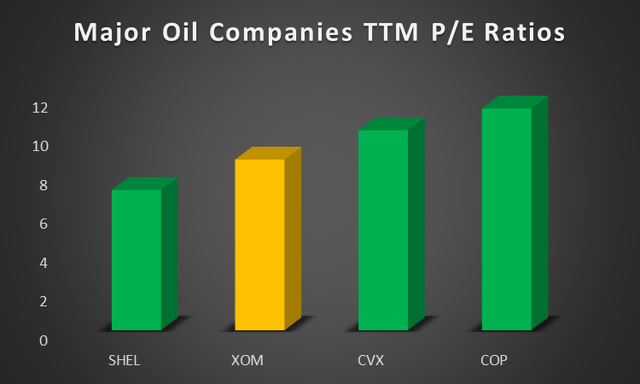

Exxon trades at an undemanding P/E ratio of around 8.79 which compares well to its peers considered in the peer comp chart below. This is also broadly in line with its 5-year average P/E ratio of around 8.9 which indicates that the stock is not particularly pricey on a 5-year average basis.

Major Oil Companies TTM P/E Ratios (Author created based on data from EquityRT)

Given these reasonable valuation levels coupled with the potential for decent growth opportunities as chemical margins improve, the stock appears to be attractively valued for long-term investors.

Conclusion

Exxon Mobil has made substantial strides in reducing costs and investing in initiatives that position it well for the evolving energy landscape. Nevertheless, some investors might remain concerned over the future of oil and gas, with renewable energy gaining momentum due to cost efficiency and environmental considerations. However, practical limitations and potential supply shortages of essential minerals for renewables could slow down their adoption rate. Furthermore, Exxon’s investments in lower carbon initiatives, hydrogen, and carbon capture and storage demonstrate its adaptability and readiness to navigate a changing energy environment.

From an earnings perspective, the company’s cost-reduction efforts and strategic investments have driven substantial earnings growth. Exxon Mobil’s ability to achieve structural cost savings and its strong position in oil refinery operations have contributed to robust financial performance. While refinery margins may gradually decrease, there is hope for recovery in chemical operations as demand for products rebounds. With a reasonable valuation and potential growth opportunities, Exxon Mobil appears to be an attractive choice for long-term investors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.