Summary:

- Exxon Mobil Corporation missed analyst estimates for Q3 ’23 after a major deal announcement, confirming a bearish outlook.

- The acquisition of Pioneer Natural Resources raises concerns about focusing on non-organic growth and shifts focus away from the energy transition.

- Exxon Mobil stock is expensive at 12x EPS run rate, with the risk of lower oil prices apparently not factored into the stock price.

marekuliasz

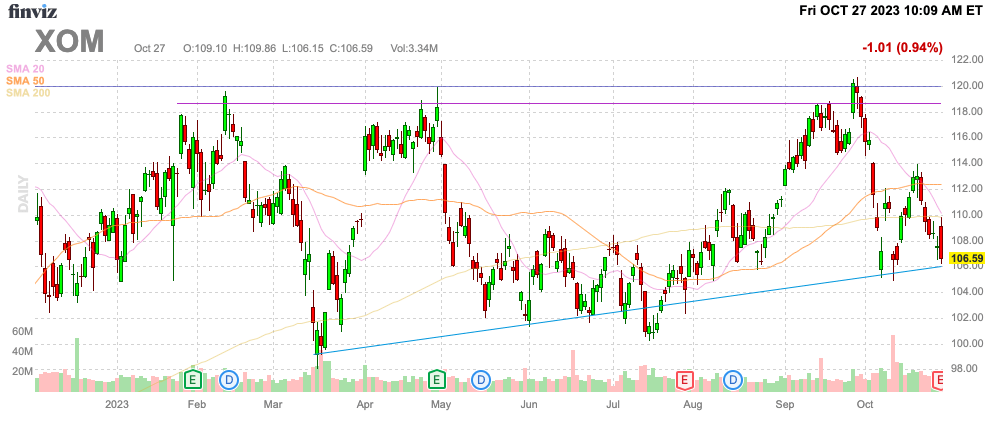

Investors probably shouldn’t be surprised that Exxon Mobil Corporation (NYSE:XOM) missed analyst estimates in Q3 for the first time after announcing a major acquisition. The energy giant has now seen energy prices return to normal levels and investors face the typical risk of cyclical dips after oil has spent several years now above normal ranges. My investment thesis remains Bearish on the stock after the empire-building acquisition of Pioneer Natural Resources Company (PXD).

Source: Finviz

Back To Normal

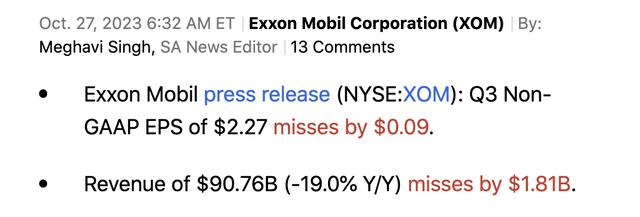

Before the market open on Friday, Exxon Mobil reported Q3’23 numbers as follows:

The bad news is that the energy giant missed both EPS and revenue targets. The good news is that Exxon Mobil produced $9.1 billion in earnings and $16.0 billion in cash flow from operations during the quarter.

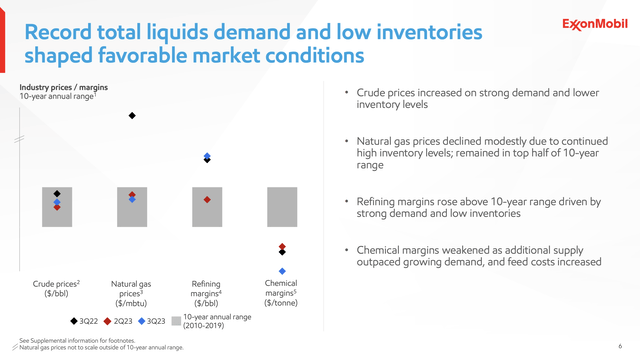

The company is now reporting margins (blue diamonds) in the crude and natural gas prices back into the 10-year annual range. In essence, Exxon Mobil is now generating the typical profit margins in these key sectors, with refining margins still above normal levels offset by weak chemical margins.

Source: Exxon Mobil Q3’23 presentation

Exxon Mobil is now producing an annual EPS of $9, and investors have to question whether energy prices go higher or lower. The ultimate risk is that WTI now heads lower again from trading currently around $83.

Over the prior 10 years, WTI traded below $75 from late 2014 until late 2021. The current higher oil prices (CL1:COM) are not the norm, so anyone buying Exxon Mobil at a current price of $107 has to consider the reality that the stock is slightly expensive at 12x normalized EPS with the risk of much lower prices. Even with multiple wars ongoing now, oil prices don’t appear headed higher.

Exxon Mobil initially jumped due to the BoD approving a 4.4% dividend hike to $0.95 a share. Investors should be cautioned against overreacting to dividend hikes in the midst of a company missing financial targets and watching EPS plunge over 50% YoY.

Exxon Mobil now offers a 3.5% dividend yield, but the energy giant was already paying out $3.66 billion in dividends quarterly. The company has a capital expenditures requirement this year trending towards $25 billion, calling into question the wisdom of focusing too much on more payouts.

The energy giant will now pay over $15 billion in annual dividend payouts. Along with the $25 billion in capex expenses this year, Exxon Mobil has $40 billion in financial commitments.

The company has mostly maintained oil production at around 3.7 Moebd despite some small divestments. The fear here is that Exxon Mobil is spending billions of dollars to buy non-organic growth.

Buying Non-Organic Growth

A few weeks back, Exxon Mobil announced the mega-deal to acquire Pioneer Natural Resources (PXD) for ~$60 billion in an all-stock deal. The deal was consumed at an 18% premium and was quickly followed by Chevron (CVX) agreeing to acquire Hess Corporation (HES) for a nearly similar $53 billion valuation.

The historical energy sector deals typically top-tick the market. Though energy prices aren’t necessarily elevated here, Exxon Mobil had nearly 7 years to acquire companies when prices were depressed, and now the energy giants are acquiring assets for premium deals when profits are falling.

Exxon Mobil was reporting an EPS topping $4 per share and now the quarterly profits are down around $2. The market should question the logic of the energy giants suddenly finding Pioneer appealing near all-time highs.

The $253 stock price values Pioneer at ~12x EPS targets for 2023. Exxon Mobil forecasts extracting ~$2 billion in pre-tax synergies, mostly from drilling efficiencies. The deal valuation isn’t horrible compared to the valuation of Exxon Mobil’s stock, but the company now has to spend years integrating the business and additional drilling efficiencies only amount to higher oil production leading ultimately to lower energy prices.

Shareholders wanted Exxon Mobil to focus on the energy transition and capital returns while this deal shifts the focus right back to energy production, especially short-cycle projects in the Permian Basin.

Takeaway

The key investor takeaway is that current profit trends and the Pioneer Natural Resources deal leave us bearish on Exxon Mobil stock. The risk is that energy prices head lower in the next year while these energy stocks trade around all-time highs already.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.