Summary:

- Exxon Mobil’s management team has released an update to their ‘Corporate Plan’ outlining their strategy for the future until 2027.

- The plan forecasts generating robust cash flows, rewarding shareholders, and making investments in industries that will be in demand longer than oil.

- The company aims to double its earnings potential by 2027 and expects operating cash flows to expand significantly in the process.

JHVEPhoto

A firm doesn’t become one of the world’s largest publicly traded companies by winging it. No, instead, it requires significant amounts of hard work, appropriate risk taking, and planning. Some of the best companies that I have ever looked at are those that plan several years out. To be perfectly honest, plans more than 12 months out often get changed significantly. But it’s not so much about having the concrete plan as it is about taking charge of your destiny and doing your best to follow a road map that involves value creation. And that is precisely what the management team at Exxon Mobil (NYSE:XOM) has embraced in recent years.

On December 6, the management team at one of the largest integrated energy companies on the planet announced an update to their ‘Corporate Plan’ that attempts to show what management is aiming for between now and 2027. The data provided in this update is incredibly insightful and, even if the company can get half way there, the value creation for shareholders should be significant. This illustrates yet again why the company is an appealing prospect and why I have decided to keep it rated a solid ‘buy’ at this point in time.

Expect big changes moving forward

If you ask the average person what Exxon Mobil does, they would likely describe the company as a player in the oil and gas space. If this were all that the company engaged in, I would be incredibly worried for its future. Even though oil prices are quite elevated (by historical standards) at the moment, and the next few years will probably see a tight market for crude, there is no denying that sometime in the not-too-distant future we will see global oil demand start a permanent decline. Natural gas will probably remain relevant a bit longer. But someday, even it will dwindle.

The good news for shareholders is that management is not content to let the company go the way of the dinosaurs. Their strategy for the future can really be boiled down into three different things. First, they are planning to make use of attractive economics in the energy and chemical markets in order to generate robust cash flows for as long as possible. Second, they are going to be using some of that cash flow to reward shareholders directly, both by paying out distributions and buying back stock. And finally, they are going to be making tremendous investments in industries or market segments that will be in demand far longer than oil will be.

ExxonMobil

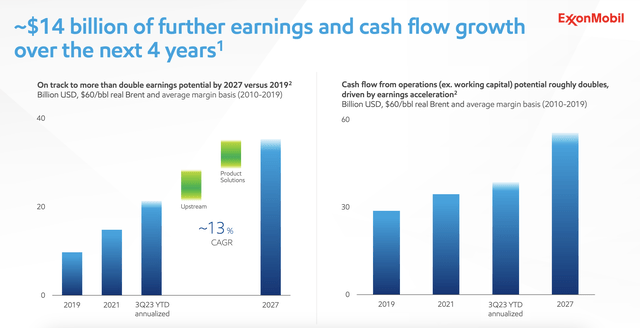

If all goes according to plan, the end result should be quite positive. Take, for instance, their current forecasts. Compared to 2019, management’s goal is to more than double the company’s earnings potential by 2027. That implies about $14 billion of additional earnings and cash flow potential over the next four years. That $14 billion figure represents the increase over annualized results seen as of the third quarter of this year. That number comes out to $21.3 billion, meaning that the company expects 2027 profits to be around $35.3 billion. Meanwhile, operating cash flows are expected to expand from $36.8 billion on an annualized basis this year to $50.8 billion by 2027.

ExxonMobil

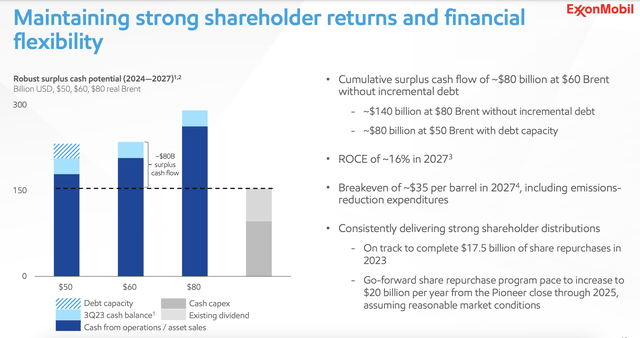

Anybody who follows the energy markets closely knows that pricing fluctuations make any sort of forecast for any meaningful window of time in the future irrelevant. Management knows this all too well, which is why they have set a stipulation on this. That stipulation is that Brent crude prices average $60 per barrel between now and the end of 2027. Naturally, there is no guarantee that this will be the case. But the good news is that management believes that, even with emissions reduction expenditures in play, breakeven pricing for Brent crude for the company by 2027 will be $35 per barrel. And in the event that guidance does come to fruition, it would mean $80 billion of excess cash flow, cumulatively speaking, that can be used for share buybacks, dividends, and other things.

To put this in perspective, this year alone, Exxon Mobil is on track to repurchase $17.5 billion worth of stock. Once it closes its acquisition of Pioneer Natural Resources (PXD), and extending through 2025, the current expectation is for those repurchases to be closer to $20 billion per annum. But again, we will see what happens with energy pricing. Management did say that the $80 billion in excess cash flows could still be possible if the company decides to take on some additional debt. Alternatively, if Brent crude prices average $80 per barrel instead, excess cash flows would be closer to $140 billion.

ExxonMobil

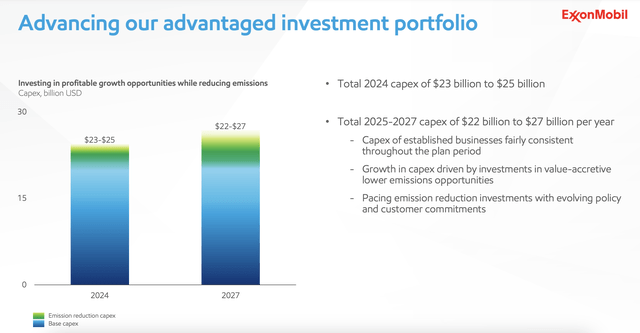

Of course, none of this will come cheap. In 2024, management is forecasting capital expenditures of between $23 billion and $25 billion. But from 2025 through 2027, capital expenditures will range between $22 billion and $27 billion each year. Interestingly, the firms established operations should see capital expenditures remain fairly flat. This means that substantially all of the growth in capital expenditures will be driven by investments in opportunities that result in lower greenhouse gas emissions. As I wrote about previously, Exxon Mobil has plans to invest in not only lowering its own emissions, but also to invest in various initiatives that will go on to generate revenue for it from other clients.

ExxonMobil

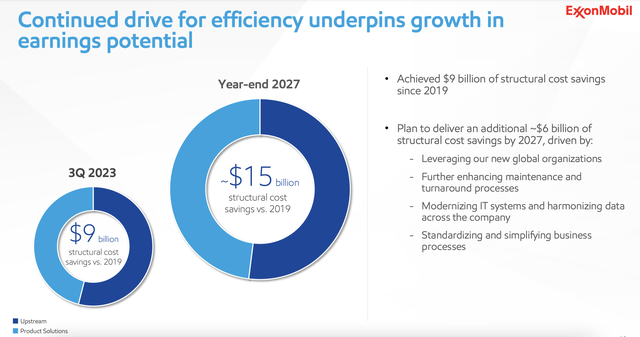

This does not mean that the company is going to spend recklessly. Management has made very clear that its goal is also to cut costs by as much as possible. From 2019 through today, the firm has succeeded in reducing structural expenses by around $9 billion on an annualized basis. The expectation is to capture another $6 billion in annualized savings by 2027. If this comes to fruition, it would mean $15 billion in structural cost savings.

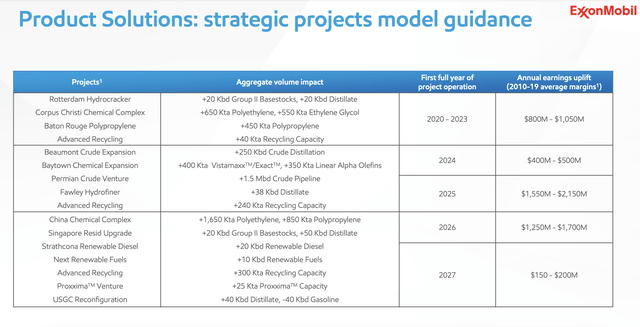

I mentioned that many of the investments the company would be making that result in additional capital expenditures would involve non-core activities. Some of these activities also include certain strategic projects that the company has been working on. An example of these can be seen in the image below. Once each of them comes on to the market, management is expecting additional earnings. At the low end, these projects should bring in a combined $4.15 billion in extra earnings each year. At the high end, the forecast is for $5.60 billion. The largest of these involves some advanced recycling initiatives, a hydrofiner, and its Permian Crude Venture operations.

ExxonMobil

Earlier this year, management also announced that the company would be getting into the lithium mining business. I was a little surprised by this, especially since the firm made some big claims but did not back it up with a separate investor presentation. Management did, in the updated corporate plan, talk about this a bit more. Add on top of this some additional digging that I did, and I am most certainly intrigued by the potential that it offers. You see, management has decided to move forward with extracting lithium from the Smackover Formation that’s located in Arkansas. Earlier this year, the company acquired rights to 120,000 gross acres of that formation in southern Arkansas. Historically speaking, the US is not a major player in the lithium industry. But as a premier market for the adoption of electric vehicles over the next couple of decades, it stands to reason that any company with a natural resource presence here at home would have an advantage over foreign players.

The current objective is for the company to start extracting its first lithium by 2027. And by 2030, management claims that it will be producing enough of the resource to meet the demands of one million electric vehicles each year. That works out to approximately 48,000 tonnes of lithium hydroxide annually. In terms of what economic impact this will have on the company, that is something that only time will tell. Management has not provided any detailed guidance of cost. In addition to this, lithium prices have been all over the map in recent years. Back in December of 2022, for instance, prices were as high as $81,375 per ton. More recently, Citigroup (C) estimated that long term pricing for the resource would be around $22,000 per ton, which is very close to what it is today.

Of course, the purity of the lithium is also very important. The management team at Exxon Mobil made clear that they are focused on battery quality lithium hydroxide, which has a purity of at least 99%. By comparison, standard grade lithium hydroxide is about 55% pure. Add on top of this certain unknown factors like concerns right now over too much of the resource being extracted and concerns about there being a massive shortage of the resource by 2030, and you might as well throw a dart on a dart board in order to guess what price it might ultimately be. If we do take the estimate provided by Citigroup as an example, it would translate to around $1.06 billion of additional annual revenue for Exxon Mobil. But if all goes according to plan, it wouldn’t be difficult to imagine management making further investments in these types of initiatives.

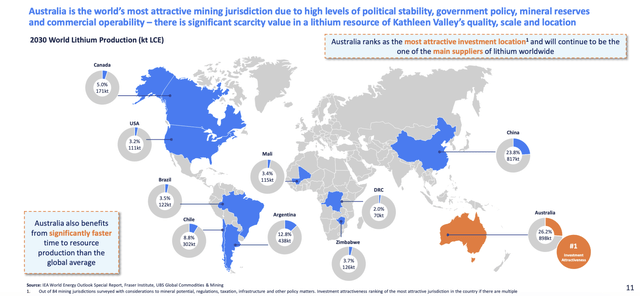

Liontown

One fantastic advantage that Exxon Mobil would have is that it already has tremendous experience when it comes to operating internationally. Earlier in this article, I mentioned that the US is not really a major player in the lithium market. This is true. I say this because, according to current forecasts, by 2030, only about 3.2% of all lithium production will come from here at home. Australia is slated to be the largest market, accounting for roughly 26.2% of all production. This should be followed closely by China at 23.8%. This bodes well for Exxon Mobil because, as of the end of its 2022 fiscal year, about 6.1% of all of its energy reserves were located in the Australia/Oceania region. It boasts 1.2 million net offshore acres and 10,000 onshore acres in Australia alone as of the end of last year. And in total, about $11.4 billion, or 5.6% of its long-lived assets, are located there.

Takeaway

As things stand right now, I must say that I am quite optimistic regarding Exxon Mobil and its potential. Management is making some significant moves aimed at preparing the company for the long haul. Personally, I would prefer that they spend less on dividends and share buybacks and instead allocate more capital toward long term growth initiatives. But by doing all of these things at once, the company is reassuring investors that it deserves their confidence. Even if these plans don’t come to fruition entirely, there is plenty of capital that can be generated from the firm’s efforts. And because of that, I still believe that a ‘buy’ rating is appropriate at this time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is on cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!