Summary:

- Exxon Mobil is the second largest publicly traded oil company with a market capitalization of over $400 billion.

- The company had a strong financial performance in 2023, with $36 billion in earnings and $55 billion in cash flow from operations.

- Exxon Mobil has a strong portfolio of growth opportunities, including offshore projects in Guyana and Brazil, and plans to hit net-zero emissions by 2030.

JHVEPhoto

Exxon Mobil (NYSE:XOM) is the second largest publicly traded oil company in the world, with a market capitalization of more than $400 billion, behind Saudi Aramco. The company is unique in its continued execution and focus on growth, at a time when the market is changing. However, its scale enables it to maintain strong margins and, as we’ll see throughout this article, makes it a valuable long-term investment.

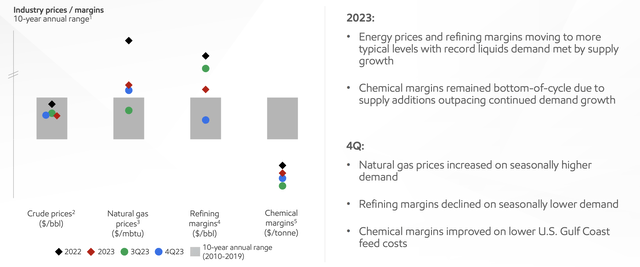

2023 Energy Market Pricing

2022 was a tough year for energy prices as the market returned towards normal from what was an incredibly profitable 2023.

Exxon Mobil Investor Presentation

Crude oil prices sat within their 10-year annual range but came down from 2022, and natural gas, where Exxon Mobil is a major player, declined massively from 2022. Similarly as post-COVID-19 demand became more predictable, refining margins declined as well going into the end of the year. Across the entire year chemical margins remained weak.

While the company puts the 10-year annual range as through the last decade, removing the impact of COVID-19, we’d argue the market has fundamentally changed some. As a result, eventually the company will need to update its historic pricing graphs. Still, it’s worth noting the impact of the negative impacts on some of these margins.

Exxon Mobil Financial Results

The company had a strong 2023 financially, with a P/E of ~11 and strong cash flow.

Exxon Mobil Investor Presentation

The company had $36 billion in earnings for the year, strong growth as new projects continue to be expected on. Cash flow from operations was a staggering $55 billion, as the company has continued to find structural cost savings. That $55 billion has enabled both strong capital spending along with strong repurchases and dividends.

The company’s shareholder returns for the year were $32.5 billion, an 8% yield, with a dividend yield of almost 4%. These financial results aren’t the double-digit shareholder yields we like to chase, but there’s reliability and growth in Exxon Mobil’s earnings that make it an appealing investment at the present time.

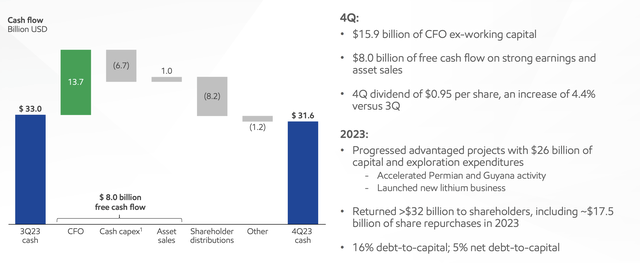

Exxon Mobil Cash Positioning

Exxon Mobil’s cash positioning remains strong.

Exxon Mobil Investor Presentation

The company finished 4Q 2023 with $33 billion in cash. FCF (CFO – capex) was $7 billion, or annualized at almost $30 billion. That’s despite the company’s continued annualized capex of more than $25 billion, an investment in growth, that we expect will continue. Post shareholder returns, the company’s cash will be $31.6 billion, a modest decrease after an annualized yield of >8%.

The company maintains an incredibly modest net debt-to-capital ratio, one of the strongest in the industry, at a mere 5%. The net debt that the company has is a mere $10 billion, an amount the company can easily afford and pay-off. That cash positioning shows that the company can afford both growth and returns.

Exxon Mobil Growth

The company has a strong an exciting portfolio of growth opportunities.

Exxon Mobil Investor Presentation

The company has some major offshore projects as it continues its Guyana plans and is adding in offshore developments in Brazil. The recent halt on LNG approval helps the company, given that it already has all necessary permits and wraps up the Golden Pass LNG terminal. The company is also building a variety of new more complex renewable products around the world.

This growth will enable the company to increase margins and potential earnings. Many of these projects, such as the Yellowtail development, are incredibly profitable. We expect the company to continue its expansions with complex projects only the company has the financial capital and scale to comfortably handle.

Our View

Exxon Mobil is a great company with a great portfolio of assets. The company has some of the most impressive assets in the industry. These include new LNG production it’s building up, and the company’s Guyana and Brazil assets. The company is also continuing to drill in the Permian Basin, already one of the largest oil fields in the world.

The company is electrifying its fleet here, and plans to hit net-zero by 2030. This shows the company understands the impact of the drive to zero emissions. The company is at 610k barrels / day in the Permian Basin, one of the largest sources of low cost production for the company. The company is still targeting 1 million barrels / day by 2027.

This continued growth means the company will be able to continue paying its dividend of almost 4%. The company is aggressively repurchasing shares, which will enable it to increase its dividend while keeping its dividend paid fairly constant. Capital expenditures growing production on top of that will enable long-term shareholder returns.

Thesis Risk

The largest risk to our thesis is two-fold.

The first is that the company remains reliant on oil and natural gas prices. The company’s all-stock acquisition of Pioneer Natural Resources enforces the company’s reliance on this even more. Prices have been incredibly volatile, with global instability, and a major downturn could hurt the company’s ability to drive returns when it’s sitting at a higher valuation.

The second is the vast majority of the company’s capital expenditures remains focused on oil and natural gas. Demand is expected to change over the long-term as governments work to handle pollution. At the same time, renewable advancements mean that renewable energy is getting cheaper. That makes it more competitive and could hurt Exxon Mobil’s long-term potential.

Conclusion

Exxon Mobil has an impressive portfolio of assets as the company continues to sit near its all-time highs for its valuation. The company has a market capitalization of more than $400 billion. The company also remains committed to shareholder returns with a strong dividend and continued aggressive share repurchases.

The company doesn’t have the valuation of some of its peers. However, it’s continuing to invest in growth. Capital expenditures are roughly 6-7% of its market cap annualized, and the company has numerous growth assets such as LNG, Guyana, and more. The company also has a strong and growing dividend and share repurchases.

That combination, we expect, will enable the company to provide growing high single-digit shareholder returns, making it a valuable investment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.