Summary:

- Exxon Mobil’s management highlighted their commitment to avoiding past stagnation.

- The company aims to maintain superior performance with consistent cost monitoring and maximum value disposals of non-core units.

- Management’s focus on new goals after achieving current ones signals a proactive approach to sustaining business growth and sustaining dividend growth.

- The outlined goals aim to lower XOM’s breakeven point, enhancing long-term performance compared to previous years.

- Pursuing a growth-and-income strategy is often less risky for the investor (and requires less monitoring) than a strictly income strategy.

bjdlzx

Exxon Mobil (NYSE:XOM) had their investor day to note what is going to happen. But management also took a victory lap based upon what has happened.

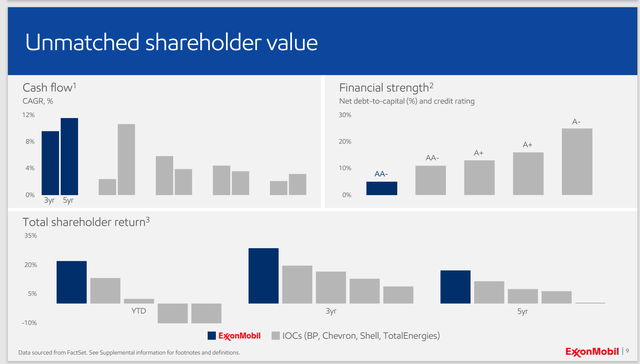

Exxon Mobil Shareholder Returns And Cash Flow Comparison To Other Majors (Exxon Mobil Investor Day Presentation December 2024)

This management has long been acutely aware that before they arrived on the scene, this stock had been “dead in the water” for a long time. It takes a very long time from the start of a new strategy for a large company like Exxon Mobil to show results. Finally, those results are beginning to become apparent to the market.

Another purpose of the slide above is to serve notice to shareholders that management is focused upon not sliding back to the “good old days” that really were not all that good for shareholders.

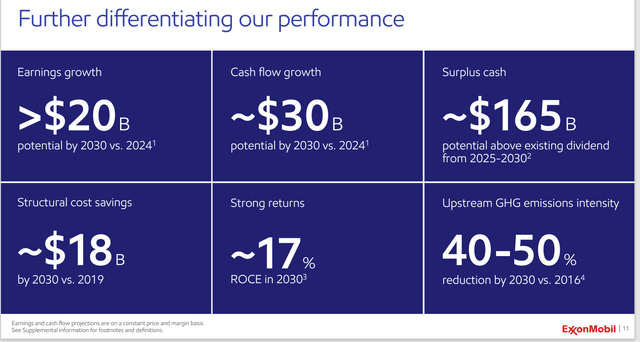

Exxon Mobil Measurable (By Shareholders) Long-Term Goals (Exxon Mobil Investor Day Presentation December 2024)

The first thing that comes to mind is that it was often mentioned that when a goal is met, a new goal is designed. This shows that the company intends to remain competitive while avoiding the stagnancy that many believe pervaded the stock performance for roughly a decade or more.

The other consideration is that the volatility of commodity prices may make the end point hard to measure. But what will happen along the way is the same commodity prices for roughly a reporting period. At that point, an investor should see superior performance compared with when this goal was first mentioned.

Things like more cash flow at the same (roughly) commodity price level should become apparent. A dropping company breakeven is strongly implied by the ROCE goal. That means that lower commodity prices are needed before the company reports losses. It was not that long ago that the company reported a full year of losses for the first time in ages. The goals shown above should make it a long time before it happens again.

The ‘Stagnant’ Effect

One of the reasons that a growth and income strategy is often superior to an income strategy is that an income strategy often implies that “earnings are not going anywhere” any time soon.

But what many investors find to their dismay is that an objective of just income when it comes to stocks often has a surprise ending, and that surprise is not pleasant.

The net result is that the income strategy often involves more trading and more portfolio supervision than many imagined for such a strategy.

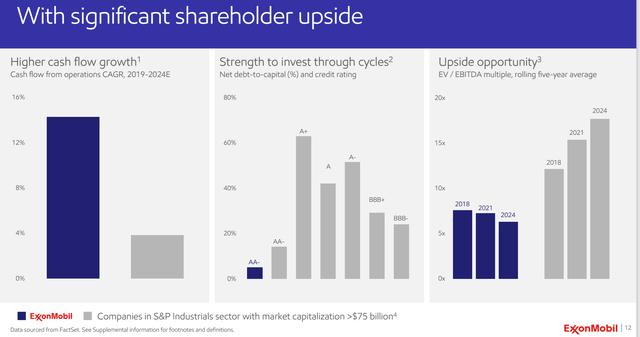

Exxon Mobil Valuation Opportunity (Exxon Mobil Investor Day Presentation December 2024)

On the other hand, an income and growth strategy often means that the management cannot be satisfied with the status quo. The implied complacency usually means that the company falls behind in competitiveness to bring a sad end to the income strategy. It seems almost to be part of human nature.

On the other hand, to grow a company means that the competitive position is at least maintained, and costs are constantly monitored. As the industry moves forward, a management following a growth and income strategy will need to “keep up”. That eliminates the complacency part that often plagues the income strategy. The part that investors like is the growing dividend that usually results.

Sometimes, shareholders are bailed out before things go too awry, as was the case when Exxon Mobil acquired Pioneer. After the acquisition, the now former Pioneer shareholders got a taste of what could have been theirs alone when Exxon Mobil announced what it thought could be accomplished with that same acreage. References to parts of this are in the investor day presentation, in addition to what was stated after the acquisition was announced (and nearly every quarter after that).

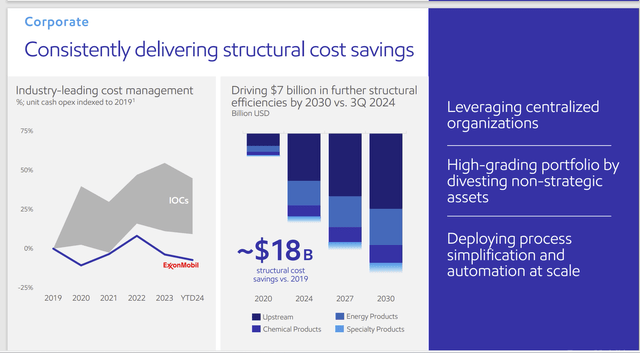

Differentiated Cost Savings

Exxon Mobil has long had a different view of when to get rid of products that are not going to be sufficient contributors to future profitability.

Exxon Mobil Structural Cost Savings Guidance (Exxon Mobil Investor Day Presentation December 2024)

The company has long looked for a good market situation for products that are past their prime. Generally, the company gets darn good money for divested products and divisions as a result.

What I typically see (and write about) is companies that wait for a bad year and then “dump everything” to “clear the decks”. But this leaves money on the table that should be shareholder money.

A good example of this was when Chevron (CVX) wrote down its Appalachian natural gas assets and then sold them in 2020 (which had horrible sale market conditions) to EQT (EQT) “for a song”. For EQT this had to be “the bargain of the century”.

Meanwhile, Exxon Mobil likewise wrote down its natural gas assets but waited a year or two to sell those assets into a far more friendly market. To a casual observer, the difference appeared to be worth a whole lot of money (probably billions).

Being cost-effective means throughout the product cycle the company gets the most money it can for shareholders. There are far too many companies that literally “dump” assets at market bottoms because they are non-core (and who cares what they get for the assets as long as it is something). But generally, integration only works when there is attention to all the details that are inherent with integration and inherent to the business cycle.

Summary

Exxon Mobil remains a strong buy consideration. In fact, the stock has pulled back somewhat from the new high’s that the stock was hitting for a while. That may make the current price a consideration for investors or any shareholders that want to add to their position.

As long as management intends to earn more money at the same level of commodity prices, then this stock is going to be worth more at those same prices. The idea that the stock price would back down or go lower implies that something external would happen to drive earnings below the now lower cost operations (were really designed to prevent). Meanwhile, the company has a goal to be more profitable at the same commodity price level while being as profitable at lower commodity price levels.

Management makes clear that oil and gas have a bright future, despite some drives to eliminate oil and gas. A simple example is to imagine your house, your computer, and cell phone (for example) without all the oil and gas-based products. Yet, those three products are considered growing areas that use oil and gas products. There are a whole lot more products where those came from.

The company is also in the process of transferring its technology to a possible venture into the lithium business. That would provide an avenue of growth into a very “green” area that may at some point positively affect the company’s market valuation.

Risks

Exxon Mobil has one of the highest debt ratings in the industry (if not the highest). The financial risk is therefore extremely low. That risk is lowered more by the integration of the company. The worldwide nature of the company’s businesses also serves to lower the business risk in any one area.

The volatile and low visibility nature of future commodity prices do affect this company somewhat, despite the vertical integration. This risk is lowered by the value-added nature of products produced.

The main risk would be the failure to add enough value-added products in the future that the exposure to commodity price risks increases. A sustained and severe commodity price downturn could really affect the future of the company. A constant influx of value-added products provides (usually) extra margin that limits this danger.

Integration only works if every single part of the integration “pulls its weight”. Otherwise, the spinoffs of divisions or even companies that split into pieces have to do this because management is not paying attention to all the parts. The result of that is that the market values the parts more than the whole company. This usually happens more than the market misvalues a company.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM EQT HES either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation for the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits its own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I analyze oil and gas companies like Exxon Mobil and related companies in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies—the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first, and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.