Summary:

- Exxon Mobil Corporation is a strong play among oil and gas majors due to positive quarterly results and cheap stock prices. Let me explain why.

- The company’s core earnings remained strong despite challenges, and it aims to achieve cumulative cost savings of $15 billion by the end of FY2027.

- Exxon Mobil’s refining utilization rates are expected to remain high, indicating operational efficiency and strong demand for its products.

- Looking ahead, the consensus expectation of generating around $74.04 billion in EBITDA for FY2025, coupled with a projected EV/EBITDA multiple of 8x, indicates a potential upside of 43% by the end of 2025.

- Despite multiple risks, I rate XOM stock as a ‘Buy’ today.

David McNew

My Thesis

Exxon Mobil Corporation (NYSE:XOM) (NEOE:XOM:CA), one of the largest integrated oil and gas companies in the world, seems to me to be the best play among the O&G majors due to the combination of positive factors we can see from the latest quarterly results, as well as how cheaply XOM stock is trading today.

My Reasoning

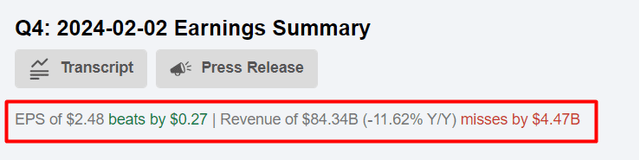

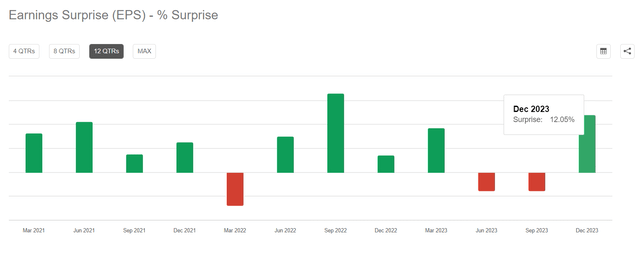

Exxon Mobil posted Q4 FY2023 earnings of $7.6 billion, equivalent to $1.91 per diluted share. However, these figures included some bumps, with $2.3 billion in identified items, notably a $2.0 billion impairment due to regulatory hurdles in California affecting production and distribution assets. Despite these challenges, the core earnings, excluding identified items, stood strong at $10.0 billion or $2.48 per diluted share. For the entire FY2023, Exxon Mobil reported earnings of $36.0 billion, translating to $8.89 per share. While the fourth-quarter earnings dipped compared to the third quarter, primarily due to identified items, core earnings excluding these items actually saw a $0.8 billion increase.

Despite the large revenue miss of ~$4.45 billion, XOM significantly beat the consensus earnings per share estimate, breaking the streak of earnings misses that began 2 quarters ago:

Seeking Alpha, Oakoff’s notes Seeking Alpha Premium, XOM

Exxon’s $36.0 billion in net profit translated to a return on capital employed of ~15%, which looks quite solid. Structural cost savings for the year hit $9.7 billion, surpassing the $9 billion target. Looking ahead, Exxon Mobil’s executives have their sights set on achieving cumulative savings of $15 billion by the end of FY2027.

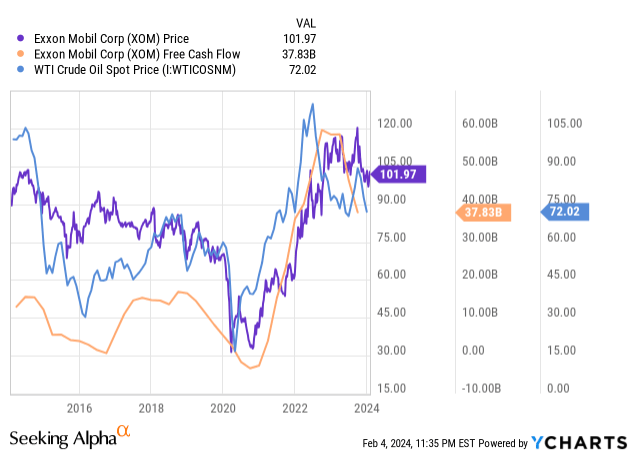

The Q4 saw robust cash flow from operations, hitting $13.7 billion, coupled with a free cash flow of $8.0 billion. Shareholder distributions for 2023, totaling $32.4 billion, comprised $14.9 billion in dividends and $17.4 billion in share repurchases, which is around 7.9% of the whole market cap (as of February 2, 2024).

The way I see it, Exxon’s management is doing a good job of maintaining cash flow generation for investors as oil prices change. That is, when the commodities fall, XOM’s FCF doesn’t fall too much, which provides some stability for predicting future periods.

As we all saw, in January 2024, Brent crude showed a positive 7.5% return, breaking a four-month downtrend. Factors such as escalating tensions in the Middle East, potential demand growth in China, and significant drawdowns in US inventories contributed to the recent upswing. Geopolitical events, including US-Iranian tension and attacks on merchant vessels, raised concerns about potential disruptions in the Middle East’s oil supply. Despite this, the broader OPEC+ group, along with increased production from countries like the US and Brazil, is expected to keep the market well-supplied, preventing a sustained surge in oil prices. The International Energy Agency (IEA) predicts a global supply surplus, contingent on stable production and the absence of major disruptions. The Red Sea crisis adds a marginal premium to oil prices, but overall, the risk premium remains moderate due to ample spare capacity. Based on the above, MUFG’s outlook maintains a cautious stance on the oil market, anticipating OPEC+ market management to aim for a $80-100 per barrel oil corridor, with a floor at $80 and a ceiling at $100. But even with this relatively moderate outlook, I think XOM’s FCF generation already looks solid, suggesting that oil prices will remain within the corridor indicated by MUFG in the coming months.

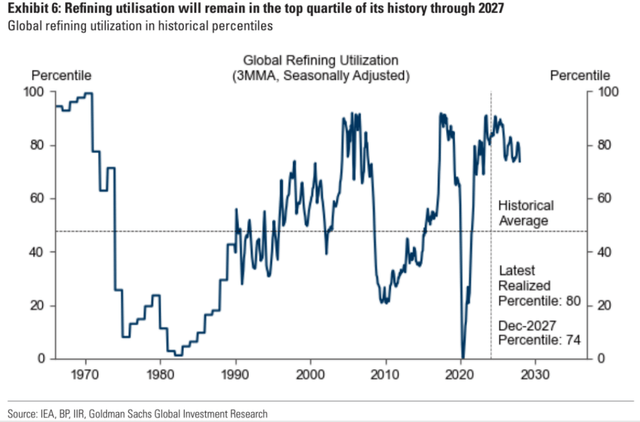

Another major investment bank, Goldman Sachs, predicts higher-than-average utilization rates in the refining industry through FY2027 (January 2024, proprietary source), driven by a balance between robust refined product demand and a notable deceleration in demand growth over 2026-27. The analysis indicates that despite a potential slowdown in demand growth and a significant fall in net refining additions, utilization rates are expected to remain elevated at 85.4%, nearly 3 percentage points above mid-cycle averages.

GS (January 31, 2024, proprietary source)

Goldman Sachs analysts attribute this projection to factors such as estimating higher pandemic closures, removing disrupted capacity, and identifying substantial project slippage, leading to a lower increase in operational capacity compared to consensus figures. The key implication of this forecast is that refining margins are likely to stay supported until EV penetration scales significantly in the late 2020s. Even under alternative scenarios like EV hyper-adoption or no slippage of greenfield projects, Goldman Sachs anticipates utilization rates to be 1.5-2 percentage points above normal in 2027, highlighting the industry’s historical tightness.

If Exxon Mobil keeps its refining utilization in the top quartile through 2027, that’s a good sign. It means they’re running their refining operations super efficiently, getting the most out of their facilities. This not only helps them save on production costs but also suggests they’re meeting strong demand for their products, which can boost overall revenues. Plus, it keeps them competitive in the energy market. Of course, they still need to navigate challenges like changing oil prices and regulations, but high refining utilization generally points to a well-performing and adaptable company.

In Q4 Exxon Mobil outlined plans for continued growth in the Permian Basin, targeting ~650,000 barrels per day in FY2024 and scaling up to nearly a million barrels per day by FY2027. The company aims to optimize production using a manufacturing approach and strategically managing drilled but uncompleted wells (DUCs) to navigate complexities and uphold operational efficiency. Also as you might already know, in October 2023, Exxon Mobil unveiled a $59.5 billion all-stock merger agreement with Pioneer Natural Resources, emphasizing its aim to enhance resource recovery efficiency and expedite emissions reduction efforts. The proposed combination anticipates double-digit returns and is slated to conclude in the second quarter of 2024, subject to regulatory approvals and the agreement of Pioneer shareholders.

During the recent earnings call, Exxon Mobil emphasized its commitment to climate action. Progress toward achieving net-zero greenhouse gas emissions in the Permian Basin by 2030 was evident, with steps such as electrifying drilling fleets and deploying electric fracturing units. The company ventured into the lithium business, announcing plans for the first phase of production in 2027, aiming to supply lithium for about one million electric vehicles annually by 2030. The acquisition of Denbury, Inc. further bolstered Exxon Mobil’s position in carbon capture and storage, boasting the largest owned and operated CO2 pipeline network in the United States, covering 1,300 miles, including over 925 miles in key states like Louisiana, Texas, and Mississippi.

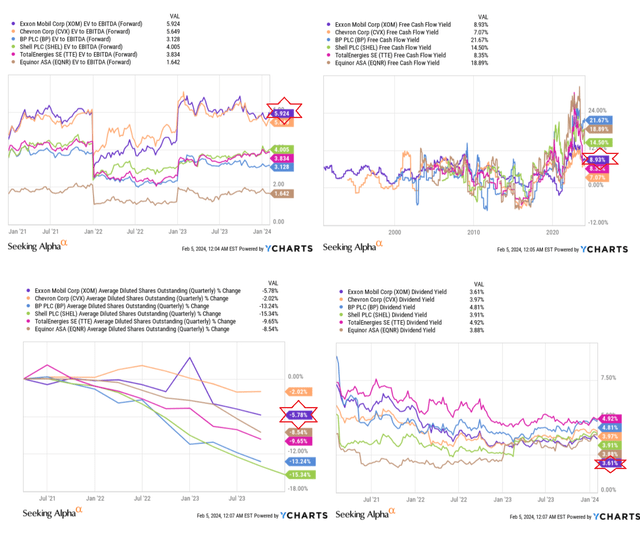

Compared to its peers, Exxon Mobil does not look very attractive in terms of its valuation levels: Its EV/EBITDA for next year of ~5.9x is the highest among the other international majors, and its dividend yield of 3.61% is many basis points behind its peers.

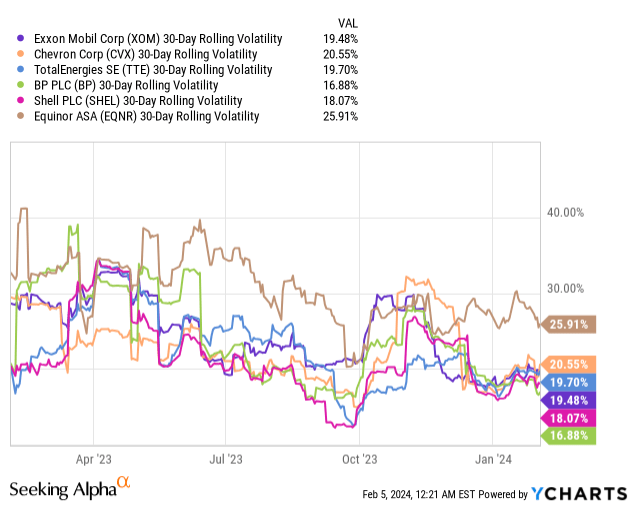

However, much of the resulting premium on the company valuation is explained by the company’s resilience to a possible cycle reversal and its volatility. As we have already seen above, XOM appears to be very resilient in the event of a commodity price reversal, which cannot be said for most other companies. In addition, developments in carbon capture and storage provide Exxon with a sort of margin of safety going forward, in my opinion.

As I see it, XOM stays the best pick among the majors and offers investors one of the lowest volatilities among its competitors.

Today’s consensus expects Exxon to generate ~$74.04 billion in EBITDA for FY2025 (-1.5% compared to FY2024, based on YCharts data). At the same time, it seems to me that the EV/EBITDA multiple for FY2025 should be around 8x. Why? First, this is explained by a return to the average level of the company’s valuation (the historical perspective). Second, this widening of the multiple should occur thanks to the higher dividend yield (based on analysts’ estimates), as more income-seeking investors will look for more profitable companies when the Fed cuts rates.

In recent quarters, XOM has actively deleveraged its balance sheet so that net debt now stands at around $10.34 billion. If we assume an EBITDA of $74.04bn and EV/EBITDA of 8x, this gives an implied equity value of ~$584.1bn after adjusting for the net debt. From this, I calculate an upside potential of ~43% to the current market capitalization by the end of 2025.

Risks To Consider

Investing in Exxon Mobil comes with its share of challenges and uncertainties. One significant concern is the unpredictable nature of the commodities market, where Exxon has limited control over product prices, making it susceptible to market volatility.

There are transaction risks tied to Exxon’s recent acquisitions of Pioneer and Denbury, and ongoing capital projects might encounter delays or budget overruns, potentially impacting the stock. The company’s shift in focus to sustainable energy markets in response to changing demand patterns could be crucial, especially considering competition from lower-priced Russian oil and gas.

Moreover, the regulatory landscape in the U.S. energy sector, particularly under the Biden administration, poses uncertainties. Geopolitical tensions in various regions, such as military threats in Guyana or events in Ukraine, the Middle East, and Taiwan, add another layer of unpredictability. As the climate change debate intensifies during an election year, there’s a risk of reputational damage or activist policies affecting the financial outlook of US oil majors.

Your Takeaway

Despite all the risks listed above, I like XOM as a long-term holding for an income-seeking value portfolio. Amid all the challenges in the energy markets, Exxon was able to show a return on capital employed of ~15% in Q4 with cumulative structural cost savings exceeding targets. The company’s focus on efficient cash flow generation, with a strong FCF of $8.0 billion in Q4, is noteworthy, as evidenced by significant shareholder distributions totaling $32.4 billion in 2023. Strategic moves like the merger agreement with Pioneer Natural Resources and advancements in climate solutions, including progress towards net-zero emissions in the Permian Basin and entry into the lithium business, position Exxon Mobil for future growth and sustainability, in my view.

Looking ahead, the consensus expectation of generating around $74.04 billion in EBITDA for FY2025, coupled with a projected EV/EBITDA multiple of 8x, indicates a potential upside of 43% by the end of 2025. Based on this finding, I rate XOM as a ‘Buy’ today.

Good luck with your investments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in XOM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.