Summary:

- Exxon Mobil generated $5.0B in free cash flow in Q2 and plans to spend $20B in annual stock buybacks next year.

- Acquisition of Pioneer Resources is already boosting U.S. liquids production, leading to 55% Q/Q growth.

- Shares are priced at reasonable P/E ratio of 12.8X, making Exxon Mobil an attractive investment for income investors.

JHVEPhoto

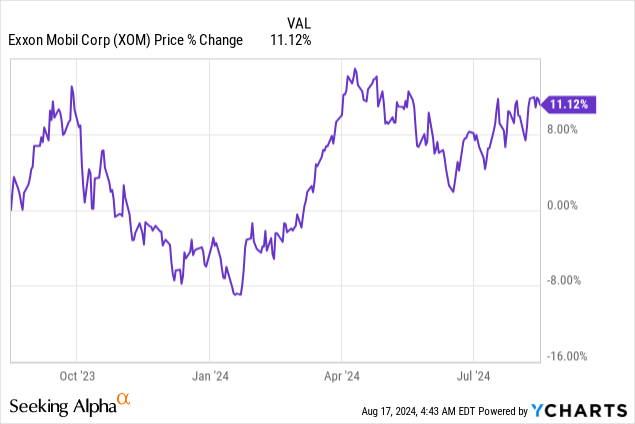

Exxon Mobil (NYSE:XOM) generated a considerable amount of free cash flow from its operations in the second-quarter and guided for $20B of annual stock buybacks until the end of next year. ExxonMobil still benefits from petroleum prices in the $70s price range and will likely continue to generate a lot of free cash flow from its production assets going forward, especially after the company’s $60B acquisition of Pioneer Resources, which has already started to make a positive production impact. In my opinion, ExxonMobil continues to be an attractive investment for income investors especially and shares are priced at a very reasonable P/E ratio of 12.6X.

Previous rating

I rated shares of ExxonMobil a strong buy in June after OPEC+ announced the extension of supply limitations which provided crucial support to petroleum prices: OPEC+ Driving Earnings Upside. I believe the completed Pioneer Resources acquisition will be a boost to the company’s production volumes which in turn should be a positive catalyst for free cash flow growth. With $20B in stock buybacks this year and next year, I believe ExxonMobil is doing the right thing.

Production gains reflected in Exxon Mobil’s Q2, solid free cash flow

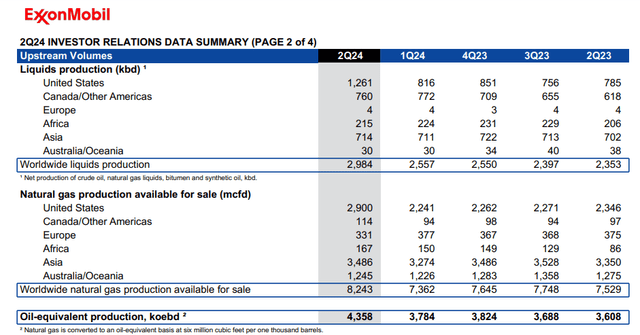

ExxonMobil announced the acquisition of Pioneer Resources last year for $60B in an all-stock transaction. The acquisition was meant to chiefly boost ExxonMobil’s U.S. production, especially in the high potential Permian basin. Following the close of the transaction, ExxonMobil expects to double its production to 1.3M barrels of oil equivalent per day in the Permian. ExxonMobil is already seeing a considerable boost to its U.S. liquids production as well as total worldwide production in Q2’24. In the second-quarter, ExxonMobil’s U.S. operations produced 1.26M barrels of oil equivalent per day, showing 55% quarter-over-quarter growth. ExxonMobil’s total worldwide liquids production didn’t climb nearly as significantly as U.S. production, but it was still up 17% quarter-over-quarter.

ExxonMobil

The main reason to buy ExxonMobil, in my opinion, is that the petroleum company derives a considerable amount of recurring free cash flow from its strategic production assets, especially in the U.S. ExxonMobil generated $5.0B in free cash flow in the second-quarter (after the completion of asset sales) which means that the company did not see any free cash flow growth at all on a year-over-year basis. However, ExxonMobil’s completed Pioneer Resources acquisition is set to be a major free cash flow catalyst going forward as the company has guided to double its Permian production after the close of the transaction.

Additionally, OPEC+ has proven to be highly accommodating this year in terms of extending supply cuts. By limiting production in key production countries, especially Russia and Saudi Arabia, OPEC+ has helped stabilize and support petroleum prices which benefits large producers like ExxonMobil.

|

Exxon Mobil |

FY 2024 |

FY 2023 |

||||

|

$B |

Quarter 2 |

Quarter 1 |

Quarter 4 |

Quarter 3 |

Quarter 2 |

Y/Y Growth |

|

Cash Flow from Operating Activities |

$10.6 |

$14.7 |

$13.7 |

$16.0 |

$9.4 |

12.8% |

|

Proceeds from Asset Sales |

$0.9 |

$0.7 |

$1.0 |

$0.9 |

$1.3 |

-30.8% |

|

Cash Flow from Operations and Asset Sales |

$11.5 |

$15.4 |

$14.7 |

$16.9 |

$10.7 |

7.5% |

|

PP&E Adds / Investments & Advances |

($6.5) |

($5.3) |

($6.7) |

($5.2) |

($5.7) |

14.0% |

|

Free Cash Flow |

$5.0 |

$10.1 |

$8.0 |

$11.7 |

$5.0 |

0.0% |

(Source: Author)

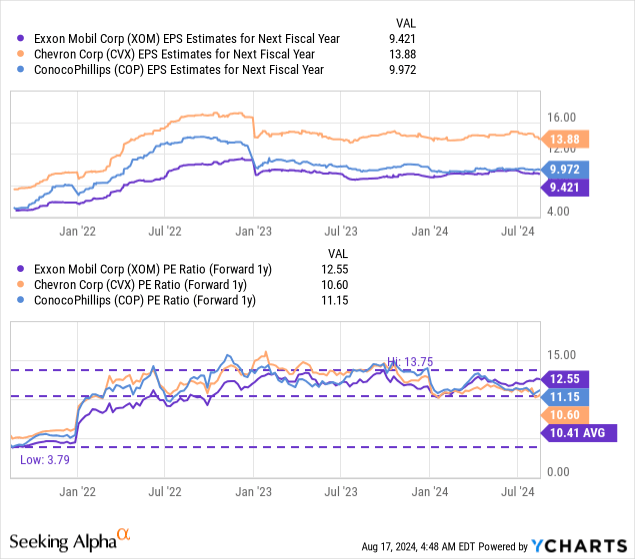

Exxon Mobil’s valuation

Shares of ExxonMobil are currently valued at a price-to-earnings ratio of 12.6X which is about 20% higher than the longer term P/E average of 10.4X. Chevron, ExxonMobil’s biggest rival in the U.S. energy market, is trading at a price-to-earnings ratio of 10.6X and ConocoPhillips (COP), which is a pure-play upstream company, has a P/E ratio of 11.2X.

Due to ExxonMobil’s strong free cash flow, large size and robust capital return plan, I believe ExxonMobil could trade at 13-14X FY 2025 earnings which, assuming a consensus earnings estimate of $9.42, implies a fair value range between $122 and $132 per-share.

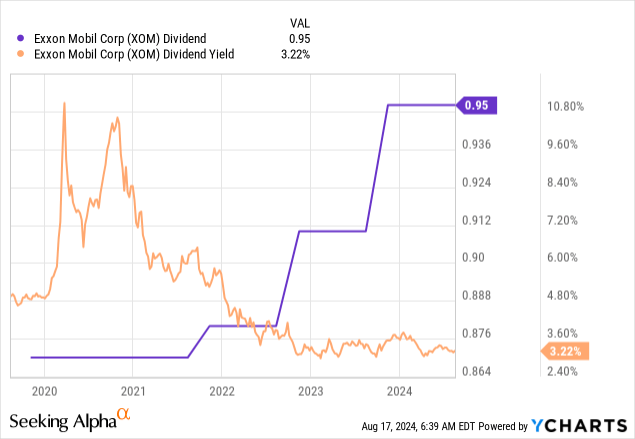

The best reason to own shares of ExxonMobil, in my opinion, relates to the company’s capital return potential. The petroleum company guided for more than $19B in stock buybacks this year and ~$20B next year. Additionally, ExxonMobil pays a growing dividend that is backed by the company’s considerable production assets, both in the U.S. and abroad. ExxonMobil provides a solid 3%+ dividend yield and the company’s dividend has been growing, indicating that the company could be an attractive capital return play for investors going forward.

Risks with Exxon Mobil

ExxonMobil is and will remain dependent on high petroleum prices which is both a strength and a weakness. So far, OPEC+ has provided considerable support for markets by extending supply cuts until the end of FY 2025. However, there are risks to production growth in ExxonMobil’s portfolio, especially as it relates to fossil fuel investments. Any kind of regulations limiting investments in the fossil fuel industry would likely also limit ExxonMobil’s earnings and free cash flow potential. What would change my mind about XOM is if the company were to see a drastic decrease in its free cash flows and a cut-back in stock buybacks.

Final thoughts

I still like ExxonMobil: the petroleum company closed the Pioneer Resources acquisition in the second-quarter which is now already making a positive contribution to ExxonMobil’s liquids production. Further, the company is looking to double Permian production which bodes well for the company’s organic free cash flow growth… especially with petroleum prices holding steady in the mid-seventies. Additionally, I like that ExxonMobil can be bought for what I believe is a very reasonable price-to-earnings ratio. The risk profile, in my opinion, is still very much skewed to the upside here and income investors with a long term investment focus are likely going to benefit from growing dividend income over time.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM, CVX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.